Imagine you are scrolling through your phone late at night, and a flashy ad pops up promising quick cashback or high-interest deposits through a shiny new UPI app.

Your finger hovers over the download button, heart racing at the thought of easy money.

But what if that simple tap drains your bank account overnight?

In India, where UPI handles over 15 billion transactions monthly, fake UPI app scams have exploded, leaving thousands penniless and paranoid about every ping.

Have you ever wondered if that “too good to be true” app is a ticking time bomb?

What is Fake UPI App Scam?

Fake UPI app scams occur when fraudsters create counterfeit mobile applications that mimic legitimate payment platforms like Google Pay, PhonePe, or Paytm. They trick users into downloading them and handing over sensitive banking details.

Once installed, these apps capture your UPI PIN, bank credentials, or even grant remote access to your phone, allowing scammers to siphon off funds in real time.

The operation typically starts with aggressive marketing on social media, WhatsApp groups, or fake Google Play listings, where they lure you with irresistible offers like instant loans, high-yield savings, or cashback rewards that sound legitimate in our fast-paced digital economy.

Scammers operate through several devious types, each designed to exploit different vulnerabilities in our daily routines.

One common variant involves deposit schemes, like the notorious “SD Pay” app, where fraudsters promise juicy returns if you put your savings there for a fixed period.

But victims soon discover their money is locked or vanished. There are various complaints flooding forums about impossible withdrawals.

Another type uses phishing within the app, prompting you to enter OTPs or PINs for “verification,” which actually authorizes silent transfers to the scammer’s accounts.

Fake QR code scams embedded in these apps generate fake codes that debit your balance instead of crediting it when scanned.

Then there are collect request traps, where the app sends bogus payment requests disguised as refunds or prizes, urging you to approve them hastily.

Social engineering rounds it out, with fake customer support chats inside the app pressuring you to share more details under the guise of resolving “account issues.”

Why do these work so well?

Because they blend seamlessly with real UPI flows, making you question every transaction alert that buzzes your phone.

Fake UPI App Scam: Real Stories

Real-life nightmares from fake UPI app victims hit hardest, showing how these scams shatter lives in seconds and why awareness saves wallets.

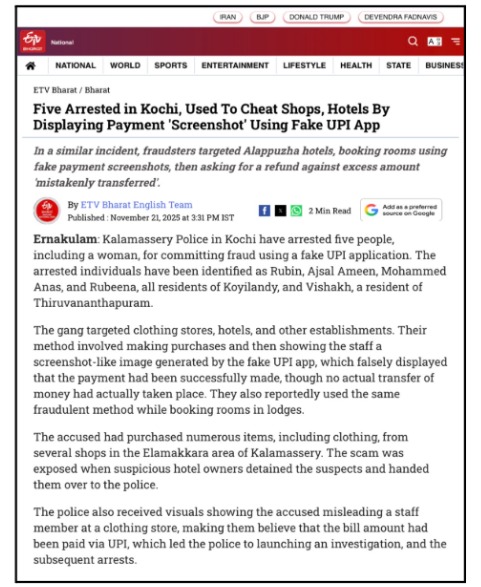

- In Kochi, five individuals faced arrest in November 2025 for running a sophisticated UPI fraud using a fake app that generated deceptive screenshots.

This helped in tricking merchants into handing over goods like electronics without actual payments being processed.

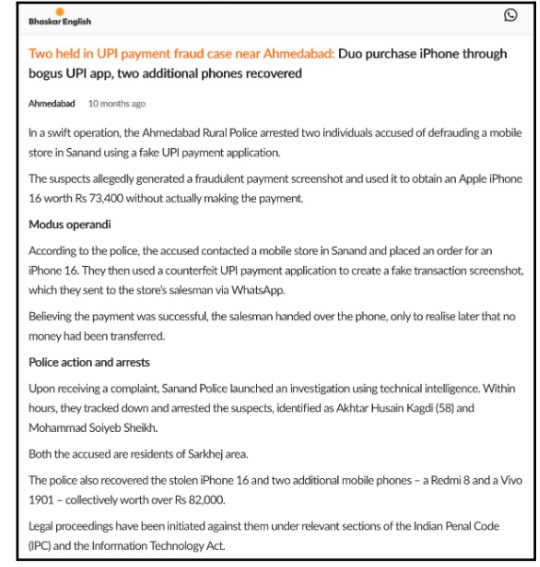

- Another striking case unfolded in Ahmedabad’s Sanand area.

Here, scammers contacted Moje Motabhai Electronics Showroom posing as buyers for an iPhone 16 worth ₹73,400, and sent a phony payment confirmation via the “Fake Paytm” app over WhatsApp.

Then they collected the device and vanished before the showroom realized no money had arrived, leading to quick police action and recovery of the phone.

These stories raise a tough question: If educated professionals fall prey, how can everyday users stay one step ahead without constant paranoia?

How to Identify Fake UPI App?

Spotting a fake UPI app before it bites can save you a fortune, especially when scammers make them look identical to trusted ones at first glance.

Always pause and verify instead of rushing into downloads prompted by urgent ads or messages.

Here are clear, one-line checks to unmask these frauds quickly:

- Apps not listed on official NPCI-approved UPI platforms or major stores like Google Play with verified developer badges are immediate red flags.

- Promises of unrealistic rewards, such as 20% daily interest on deposits or guaranteed cashback without conditions, scream scam since genuine UPI apps stick to RBI-regulated rates.

- Requests for UPI PIN, OTP, or bank details during signup or “KYC” processes violate basic security rules, as no legitimate app asks for these upfront.

- Poor grammar, blurry logos, or mismatched app icons compared to official versions indicate hasty knockoffs built to deceive.

- Lack of two-factor authentication or biometric locks, plus pressure to grant excessive permissions like full phone access, exposes their true intent.

- Absence of clear privacy policies, customer support contacts, or Grievance Officer details means no accountability when things go wrong.

- Fake reviews dominated by generic five-star praise or sudden spikes without a history point to paid bots inflating credibility.[myjar]

Next time an app demands too much too soon, ask yourself: Does this feel off, or is it just excitement clouding your judgment?

What to do if Online Fraud Happens?

Acting fast after a fake UPI app scam maximizes recovery chances, as time-sensitive cyber laws in India prioritize swift reporting.

Start by securing your accounts, then follow structured channels for official action without delay. Key steps ensure authorities trace and penalize the crooks effectively.

- Preserve all digital footprints, like call recordings or messages, as they strengthen your case during investigations.

- Block your UPI ID and reset your PIN immediately through your genuine bank’s app to halt further damage.

- Contact your bank helpline or visit the branch in person, providing transaction IDs, app details, and screenshots of interactions for a formal fraud report.

- File a Cyber Crime complaint on the National Cyber Crime Reporting Portal, selecting “financial fraud” and uploading all evidence, like app download links or chat logs.

- Lodge a separate grievance via RBI’s Sachet portal or your bank’s nodal officer within 30 days, quoting previous complaint references for escalation.

- Approach your local police station with a written FIR under the IT Act sections for cyber fraud, carrying bank statements as proof.

- Track progress using the complaint acknowledgment number emailed to you, following up weekly if no updates arrive within 7-10 days.

Need Help?

If you have lost your money to a fake upi app scam or any such online banking scam, you don’t need to worry at all.

Just register with us.

We are a team of dedicated professionals who will help you in every step of recovering your money. Don’t waste your time and reach out to us now!

Conclusion

Fake UPI app scams thrive because we rush into digital promises without a second thought. But, armed with this knowledge, you hold the power to flip the script on fraudsters.

Always double-check the app you download, as spotting the red flags and walking away can save your money.

Regulators like NPCI and RBI tighten rules yearly, but real change starts with you questioning every shiny offer.

Stay curious, stay safe, and remember: True wealth builds slowly, not through overnight app miracles.

Your vigilance today keeps the scammers at bay tomorrow.