You open your trading app during market hours. Positions are live. Volatility is high.

- Then the Shoonya App is not working.

- Orders don’t go through.

- You try logging in again.

Unfortunately, nothing works.

For many Finvasia (Shoonya) users, this wasn’t a hypothetical situation.

It happened, and it caused real losses.

This blog breaks down the Finvasia technical glitch, what traders experienced, how the broker responded, and what the exchange grievance and arbitration system ultimately decided.

Finvasia Technical Glitch Details

On 13 April 2023, Finvasia’s Shoonya trading platform faced a major technical glitch reporting during live stock market hours.

Traders reported:

- Inability to square off open positions

- Orders are getting rejected or not reflecting correctly

- Incorrect positions appearing on the screen

- The platform freezes or becomes unresponsive

- Difficulty reaching customer support

Finvasia later acknowledged that a technical glitch had occurred and reported it to the exchange and regulator.

What Traders Actually Faced (Real User Impact)

Across forums and professional platforms, traders described similar experiences:

- Positions visible but not actionable

- Repeated login failures

- Password reset is not working on the glitch day

- call-and-trade lines unreachable

- delayed or no response from support during market hours

For intraday and F&O traders, even a short disruption translates into losses.

These are first-hand user discussions, not summaries.

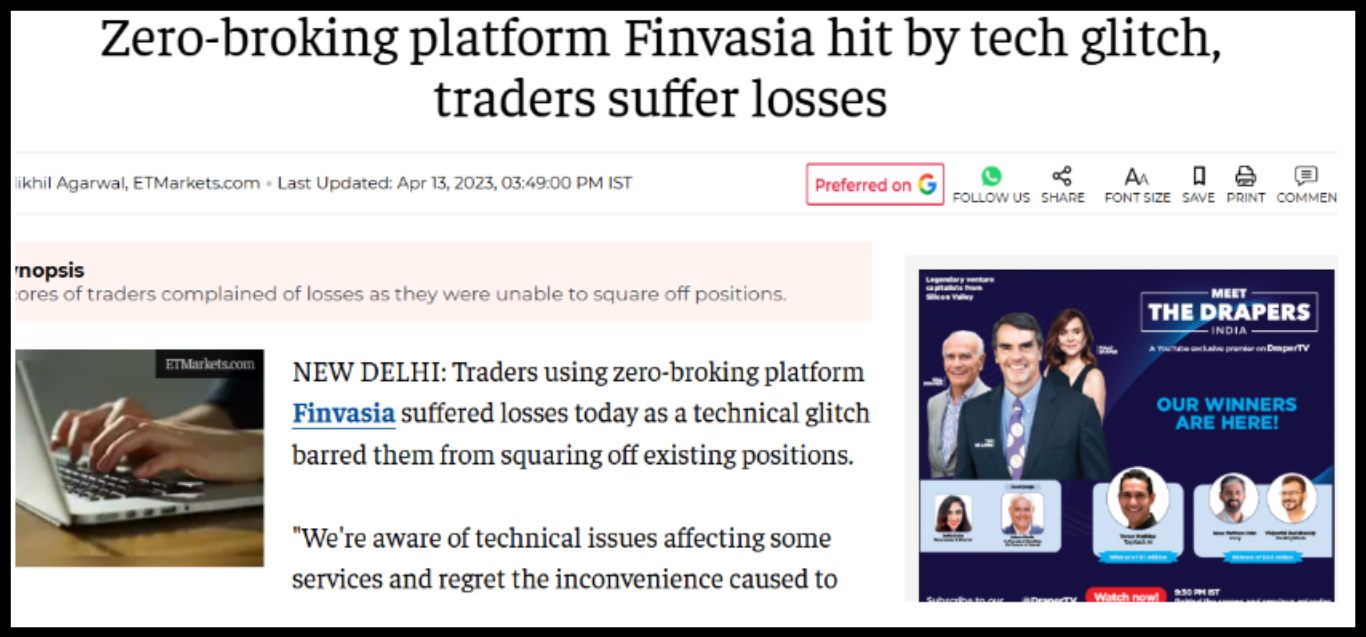

Finvaisa Technical Glitch: Impact of News Report

Financial media reported a technical glitch in the stock market, its impact, & how to recover losses:

- Multiple traders were affected simultaneously

- Some users saw “ghost orders” or mismatched order states

- Finvasia described the issue largely as a front-end display problem

- aggregate claims from traders ran into several crores

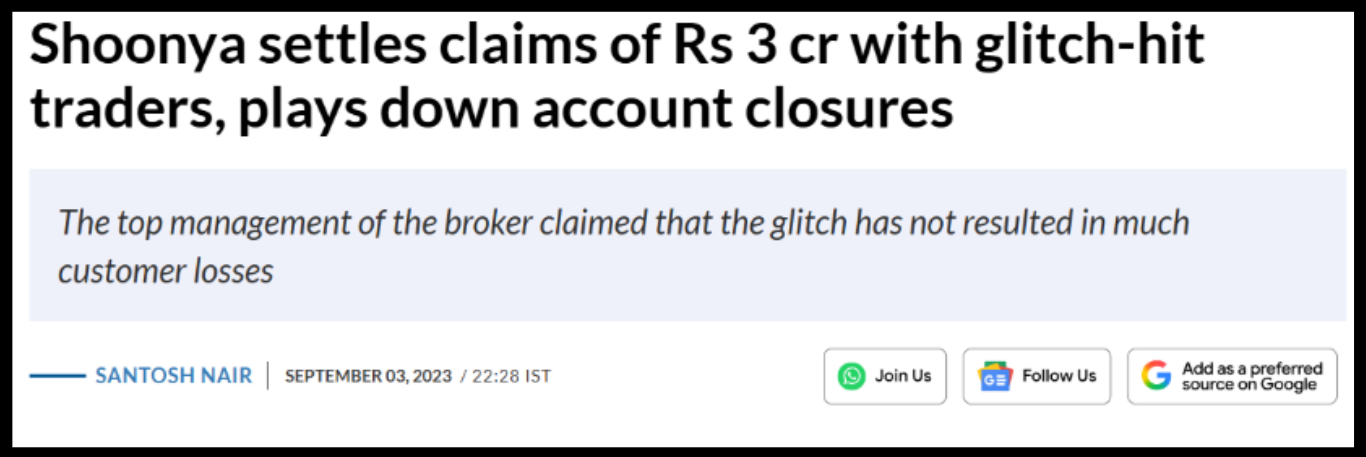

Finvasia later stated that it had settled approximately ₹2.7–3 crore worth of claims with affected traders.

Client Claims Losses Due to a Technical Glitch at Finvasia

Some disputes were not resolved at the broker level and moved through the exchange grievance and arbitration framework.

One such case was filed for arbitration back in 2024, where, due to a Finvasia technical glitch, one of the clients faced a loss of ₹85,539.

During the arbitration, the client proved:

Repeated failed login attempts on the glitch day

- Inability to reset password on 13 April 2023

- attempts to contact Finvasia via email, SMS, and call-and-trade

- Inability to square off positions due to login failure

The sole arbitrator held that:

- A technical glitch in Fenvista did occur on the Shoonya platform

- Finvasia had agreed in principle to compensate glitch-related losses

- The Shoonya Login Issue was genuine, even if the backend logs did not capture it

- The inability to log in directly prevented the client from squaring off positions

Based on findings and argument:

- Finvasia is directed to pay ₹85,539 in full

- appeal dismissed

- award dated 19 January 2024

What This Case Means for Traders

This arbitration in stock market establishes that:

- Technical glitches are not dismissed as “client-side issues” by default

- Login failures can be compensable when supported by evidence

- emails, screenshots, and timelines matter

- Escalation beyond broker support can succeed

It also shows that the grievance framework is functional when used correctly.

What To Do If You Face a Similar Technical Glitch

- Document immediately – screenshots, error messages, timestamps, order book

- Raise a written complaint with the broker – email + ticket; avoid relying only on chat

- Escalate to the Exchange (IGRP)

- Proceed to Arbitration if required

- File a complaint on SCORES / ODR where applicable – under the Securities and Exchange Board of India framework

Written records decide outcomes.

Need Help?

Technical glitch cases often fail not because the loss isn’t real, but because:

- The evidence is incomplete

- Escalation is done at the wrong stage

- claims are poorly structured

Register with us, we help traders with:

- assessing whether losses qualify for compensation

- organising evidence correctly

- drafting complaints for brokers, exchanges, and arbitration

- guiding escalation via IGRP, arbitration, SCORES, and ODR

- tracking timelines so cases don’t stall

The focus is accountability and resolution.

Conclusion

The Finvasia technical glitch was not just a temporary outage.

It caused real losses, and more importantly, it tested the grievance system.

The NSE arbitration award confirms that:

- Genuine trader losses are recognised

- Login failures during glitches are not automatically rejected

- persistence, documentation, and correct escalation work

Technical failures happen.

Unresolved losses don’t have to.