You received a stock tip on WhatsApp. The sender claims to be SEBI registered. Should you trust them immediately? Absolutely not.

Don’t become another statistic. Let us show you exactly how to verify SEBI registration yourself.

Why To Check SEBI Research Analyst Registration

Fake advisors are everywhere now. Telegram groups, Instagram pages, YouTube channels.

Can a Research Analyst handle an account in India? According to SEBI’s enforcement data, unregistered advisory is the biggest source of investor fraud in India.

These fraudsters often display fake SEBI numbers. They promise guaranteed returns. Then they disappear with your money.

The Hard Truth – Screenshots can be faked. Certificates can be forged. Claims mean nothing without verification.

Only one thing matters: Does their name appear in official SEBI databases?

Every legitimate research analyst has a unique registration number.

- Format of Registration Number – Always starts with “INH” (for individual and non-individual research analysts). This is followed by 9 digits. Example: INH000017550 or INH200009193.

2. Registration Status Types – Active/Perpetual (currently valid), Expired (validity period ended), Suspended (temporarily barred by SEBI), Cancelled (permanently revoked). Only work with analysts showing Active or Perpetual status.

Ways to Check SEBI-Registered Research Analysts

Here are the straightforward methods that help you check and verify details of Research Analysts:

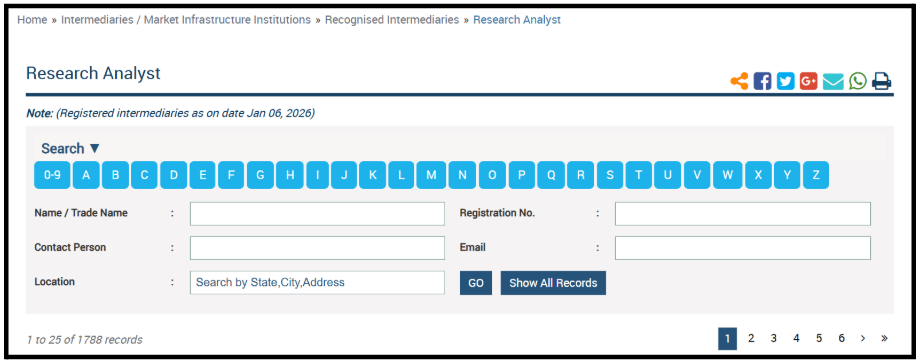

Method 1: Check SEBI Official Website – The Primary Method

This is your most reliable verification source. SEBI maintains a comprehensive database of all registered research analysts.

Step 1: Open Official SEBI Portal

Go to SEBI official website.

Never use any other website claiming to verify SEBI registration. This is the only official portal.

Step 2: Choose Your Search Method

The portal offers multiple search options. You can search by:

- Name/Trade Name of the analyst

- Registration Number

- Contact Person name

- Email address

- Location (City/State)

Step 3: Enter Search Details

Let’s say someone claims their registration number is INH000017550. Enter this exact number in the “Registration No.” field.

Step 4: Click “GO” Button

The system will search the database. Takes 2-3 seconds.

Step 5: Review the Results

If registered, you’ll see complete details:

- Official name/trade name

- Registration number

- Email address

- Phone number

- Complete registered address

- Contact person name

- Validity period (From date – To date)

- Current status

What If Nothing Appears?

If your search returns zero results, that person is NOT registered. Don’t proceed further.

Some fraudsters provide slightly modified numbers. They change one digit hoping you won’t verify. Always check carefully.

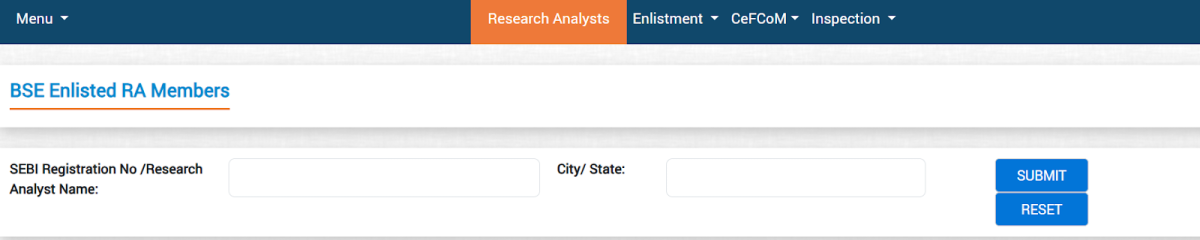

Method 2: BSE Verification Portal

BSE (Bombay Stock Exchange) also maintains a verification database. This provides an additional layer of confirmation.

Step 1: Visit BSE Website

Step 2: Search Options

BSE portal has simpler search functionality. You can search by:

- SEBI Registration Number

- Research Analyst Name

- City/State

Step 3: Enter Details and Search

Enter the registration number or name. Click search.

Step 4: Cross-Verify Information

Compare BSE results with SEBI portal data. Both should match exactly:

- Registration number

- Full name

- Location

- Contact details

Method 3: Ask for Official Registration Certificate

Every registered analyst receives an official certificate from SEBI. This is physical proof of registration.

Verify Certificate Authenticity

Once you receive the certificate:

- Match Registration Number – Copy the number from the certificate. Search on SEBI portal. Verify exact match.

- Check Name Consistency – Certificate name should match SEBI database name exactly. Even slight spelling differences are red flags.

- Verify Validity Dates – Ensure the validity period covers the current date.

- Cross-Check Contact Details – Certificate should show the same address and contact info as SEBI portal.

- Warning: Fake certificates look very professional now. Always cross-verify with official portals. Screenshots can be easily doctored.

Method 4: Direct Contact with SEBI

When in serious doubt, contact SEBI directly. They have dedicated helplines for investor assistance.

Provide the analyst’s name and claimed registration number. SEBI officials will check their system and confirm.

Method 5: Check SCORES Complaint History

SCORES (SEBI Complaints Redress System) shows complaint history against registered intermediaries.

Step 1: Visit SCORES Portal

Step 2: Register as Investor

You need to register first. Requires:

- PAN card details

- Email address

- Mobile number

- Basic personal information

Registration is free and takes 5-10 minutes.

Step 3: Search for Research Analyst

After logging in, use the search function. Look up the analyst by name or registration number.

Step 4: Review Complaint History

According to SEBI guidlines for Resurch Analysts must resolve investor complaints within 30 days. Repeated failures show poor conduct.

Method 6: Verify NISM Certification

SEBI registration requires valid NISM certification. Every research analyst must pass the NISM Series XV: Research Analyst Certification Examination.

How to Check for Fake SEBI Research Analyst Registration

Understanding common tricks helps you stay alert on SEBI Registered Account Handling. Here are patterns observed from recent cases.

Pattern 1: Fake Registration Numbers

How It Works: Fraudsters create registration numbers that look genuine. They use the correct format (INH + 9 digits) but with random numbers.

Example: Real number INH000017550 becomes INH000017551 (just one digit changed).

Protection: Always verify on the official portal. Don’t just check if the format looks correct.

Pattern 2: Expired Registration Claims

How It Works: They show genuine registration numbers. But registration has expired or been cancelled.

Real Case: In 2024-2025 cases, several operators used credentials of analysts whose registrations had lapsed.

Protection: Always check validity dates. “Expired” status means they cannot legally operate now.

Pattern 3: Using Someone Else’s Registration

How It Works: They display a real, active registration number. But it belongs to someone else entirely.

Protection: Verify name matches exactly. Cross-check contact details. Ask for a certificate with the same name.

Pattern 4: Claiming SEBI Approval Without Registration

How It Works: They say “SEBI approved” or “SEBI certified” instead of “SEBI registered”. These sound similar but mean nothing.

Warning: Only “SEBI Registered Research Analyst” with valid INH number matters.

Protection: Ask specifically: “What is your SEBI Research Analyst registration number?” Not approval, not certification – registration.

Pattern 5: WhatsApp Group Schemes

How It Works: You’re added to groups with impressive names like “SEBI Advisory Group” or “Official Stock Tips”. The group description shows fake credentials.

Recent Cases: Ahmedabad IT professional case (December 2025). Fake SEBI authorization claims in WhatsApp groups.

Protection: Never trust credentials shared in messages. Independently verify on official websites.

Can We Trust SEBI Registered Research Analyst?

SEBI-registered Research Analysts (RAs) are authorized professionals, but trust in any financial service should be built gradually through transparency, consistency, and ethical conduct.

Even if a person or company claims to be SEBI registered, investors must stay alert and avoid services that make unrealistic or misleading promises. Many frauds operate under the disguise of registration while violating regulatory rules.

A genuine advisor provides research and guidance, not false guarantees or direct control over your funds.

- Do not trust anyone who promises guaranteed or fixed returns, as no stock market investment can be guaranteed.

- Never allow any advisor or service provider to handle your trading account, as this is illegal and extremely risky.

- Avoid services that offer or demand a profit-sharing model, as SEBI strictly prohibits such arrangements for Research Analysts.

- Always verify SEBI registration on the official SEBI website and check the advisor’s compliance history.

- Remember that real advisors give advice, not assurances.

How to Report Fake SEBI Registration Claims

You verified someone. Found inconsistencies. Now what?

- Stop All Engagement – Don’t proceed with any subscriptions, payments, or following advice.

- Document Everything – Take screenshots of their claims (messages, websites, advertisements).

- Lodge a Complaint in SCORES

- Login with your registered account.

- Click “Lodge Complaint”

- Select category: “Unregistered Intermediary” or “Research Analyst”

- Provide all details and attach documentation

- Submit complaint.

4. File a Report to Cyber Crime: File complaint under “Financial Fraud” category. Provide all evidence.

5. File an FIR to the Local Police: For cases involving money lost, file FIR at your local police station under relevant IPC sections for fraud.

Need Help?

Are you facing issues with an unregistered advisor? Have you already paid fees or subscribed to services? Lost money following fraudulent recommendations?

You’re not alone. Many Indian investors face these situations daily.

Register your complaint with us. We help victims of investment fraud navigate the complaint process. We assist with:

- Proper complaint documentation

- Filing with appropriate authorities

- Following up on complaint status

- Understanding your legal options

Don’t let fraudsters get away. Don’t suffer in silence.

Contact us today to register your grievance and get the guidance you need to take action.

Your complaint matters. It protects you and warns others.

Conclusion

Checking SEBI research analyst registration isn’t complicated. Visit the official SEBI portal, enter the registration number, and verify the details match exactly.

Cross-check on BSE portal for additional confirmation. Ask for certificates and verify NISM certification validity. The entire process takes just 10-15 minutes but can save you from losing lakhs of rupees to fraudsters who use fake credentials.

The investment advisory industry has both genuine professionals and sophisticated scammers. Don’t trust screenshots, don’t believe claims without proof, and don’t skip verification because someone seems professional.

Remember that verification is not a one-time task. Registrations can expire, get cancelled, or be misused by others.Your financial security depends on this simple habit of independent verification through official channels only.