In 2021, the crypto world saw the emergence of a mobile app called “HPZ Token”, promising investors the kind of returns that make most people’s eyes widen.

The pitch was simple: deposit money, and the app would supposedly buy “mining machines” for Bitcoin and other cryptocurrencies on your behalf.

Every day, you would see returns reflected in the app dashboard, and as trust was built, the app encouraged users to “upgrade” to higher tiers for even bigger earnings.

At first glance, it seemed like a golden opportunity, especially for small investors eager to make their money work harder.

But behind the sleek interface and enticing numbers, there was a much darker story unfolding, a well-coordinated, transnational fraud operation that would eventually catch the attention of India’s top investigative agencies.

HPZ Token Scam

HPZ Token’s modus operandi followed a pattern common in sophisticated investment scams. Early investors were shown small withdrawals to build confidence.

Once users believed the returns were genuine, the operators began delaying payouts and asking for additional “fees” or “upgrades” to unlock the promised profits.

Money flowed through a complex network of shell companies, overseas-linked entities, and mule accounts, making it extremely difficult to trace or recover.

By August 15, 2021, the app and related websites vanished entirely, leaving thousands of investors in shock.

People who had trusted the platform with their savings suddenly found themselves locked out, with no way to access their funds.

Red Flags of HPZ Token Scam

What made HPZ Token particularly dangerous was its psychological and operational design.

The app leveraged a few classic fraud patterns:

- Guaranteed daily returns: A hallmark of scams, real investments rarely promise precise daily payouts.

- Small early withdrawals: Users were lulled into trust when initial small returns were delivered, only for larger withdrawals to be blocked later.

- Shift to untraceable channels: Support and fund transfers moved to Telegram or WhatsApp, often involving unknown wallets or UPI IDs.

- Complex fund layering: Money was routed through multiple shell companies and merchant accounts, making tracing and recovery extremely difficult.

These tactics worked in tandem, giving the illusion of legitimacy while creating a labyrinth of transactions that hid the fraudulent core.

HPZ Scam Investigation

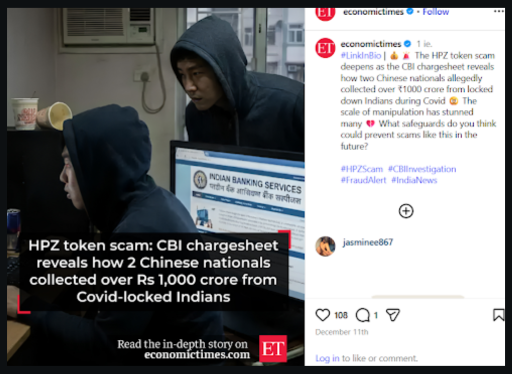

The disappearance of HPZ Token didn’t go unnoticed. Indian authorities, including the Enforcement Directorate (ED) and the Central Bureau of Investigation (CBI), launched detailed investigations spanning multiple cities and years.

Here’s a look at some of the key milestones:

- 2022: The first nationwide searches and account freezes were carried out. The ED identified assets worth approximately ₹56.49 crore linked to HPZ entities.

A CBI FIR documented the app’s operations and the conspiracy to collect public funds through “HPZ Tokens.” - 2023: Investigators dug deeper, scrutinising transactions, payment gateways, and the shell company networks. The ED highlighted the scam’s typical promise: invest ₹57,000 and earn ₹4,000 per day, a classic lure designed to seem too good to ignore.

- May 2024: The CBI released a press note detailing the scale of the operation and its modus operandi, emphasising astronomical promised returns and the layering of funds through multiple accounts.

- August 2024: The ED’s press release revealed the depth of fund layering via shell companies and merchant IDs. Provisional attachments were made under the Prevention of Money Laundering Act (PMLA).

- January 2025: Further media coverage highlighted ED scrutiny, additional asset freezes, and the complex web of funds across the country. Investigators also noted the cooperation and denials from some payment firms involved.

- October 2025: In one of the biggest updates, the CBI, under Operation Chakra-V, conducted pan-India searches and made five arrests, seizing critical digital and financial evidence.

Their press release described the case as a large, transnational cyber fraud operation, run by foreign nationals with Indian associates, using shell companies, payment gateways, and app relabeling to target unsuspecting investors.

How to File a Crypto Fraud Complaint in India?

If you invested in HPZ Token or similar platforms:

- Document everything: Screenshots of the app, chats, payment receipts, UPI IDs, and bank statements.

- File a Cyber Crime complaint: The faster you report, the better the chances of freezing suspect accounts.

- Inform your bank: Flag transactions, request holds or recalls, and disable any automatic mandates.

- Do not pay additional “unlock/TDS” fees: This is a classic extortion technique that only escalates the scam.

Need Help?

In case you end up losing money in HPZ or any such scam, then register with us now, and we will guide you with the process to report such issues and to get a recovery of losses.

Conclusion

HPZ Token was never a legitimate investment. Its disappearance, combined with a multi-year investigation by the CBI and ED, demonstrates the scale and sophistication of modern crypto frauds.

If you encounter HPZ-branded apps or similar “mining/task” platforms promising daily payouts, treat them as high-risk and verify everything independently before parting with your money.

Frauds like HPZ serve as a wake-up call: in crypto, promises are cheap, but caution is priceless.