You don’t begin by doubting a platform like Streetgains. Most investors came there after weeks of watching the market move without knowing, missing trades, second-guessing decisions, and feeling the quiet pressure.

Maybe it’s time to seek expert guidance.

A platform that appears professional, well-structured, and regulated can feel reassuring.

As you explore subscription plans and read about past performance, an important question naturally arises: Is Streetgains SEBI registered? What does that actually mean for my money?

Because once advice begins to influence your trades, and those trades begin to affect your savings, you’re no longer looking for excitement.

You’re looking for confidence, accountability, and a way to trust the guidance without surrendering control.

Is Streetgains Safe?

Streetgains provides stock market research and advice. Its official name is Streetgains Technologies Private Limited, and it was started in 2016 by Santhosh Kumar V.

The company has registered with the SEBI as a Research Analyst, with the registration number INH000017082.

This means it is allowed to give independent market analysis and recommendations under SEBI rules.

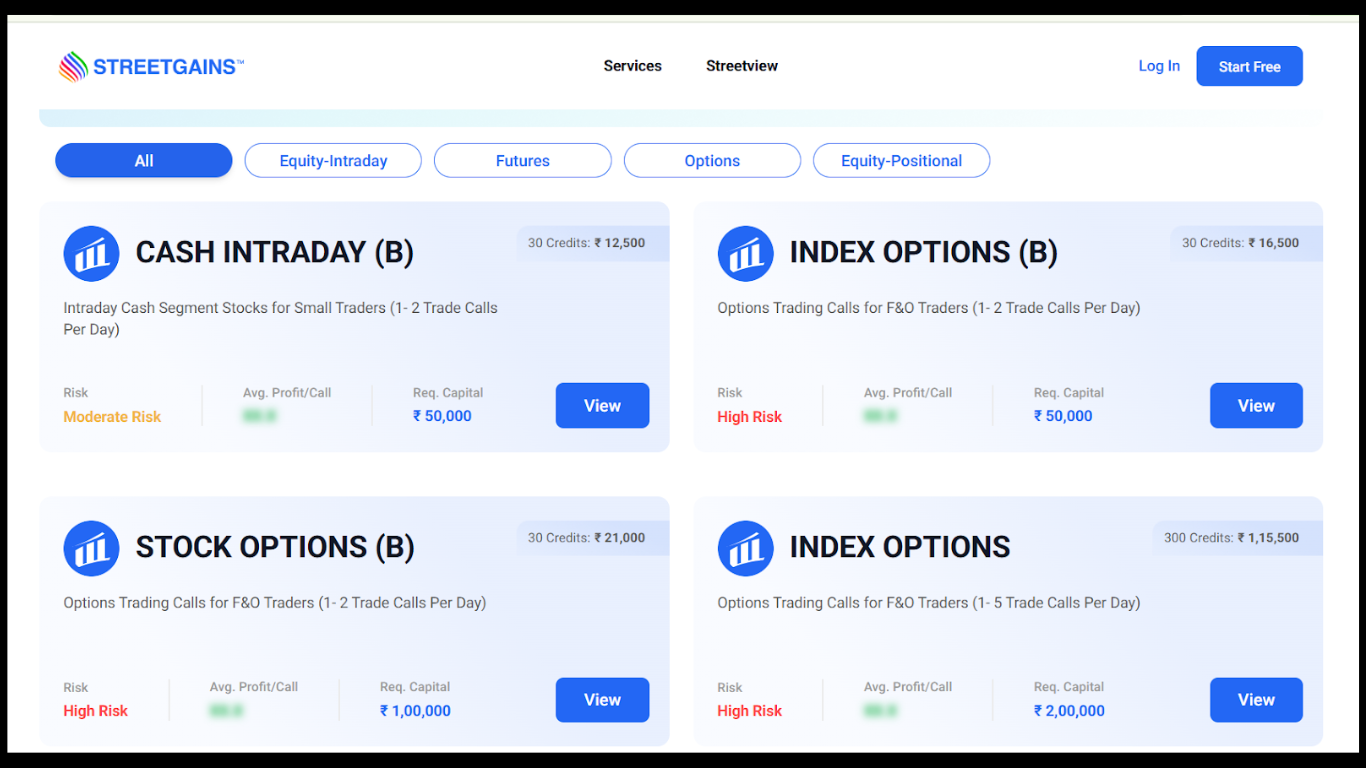

It offers real-time trade suggestions, stock research, model portfolios, and market analysis for different types of trading, like intraday, swing trading, options, and long-term equity.

The company uses a credits-based system where customers buy credits to access research calls. It also interacts with users by sharing content, daily market updates, and research reports.

The company makes sure to show its SEBI registration and claims of using data-driven insights to build trust.

However, even if a firm is registered with SEBI and has a professional online presence, investors should still be cautious.

SEBI registration just means the firm follows rules to run as a research analyst; it doesn’t mean their predictions are always correct, that you’ll make safe profits, or that all their marketing is honest.

In fact, SEBI has already taken action against Streetgains for breaking rules, like making false promises or suggesting guaranteed returns.

This shows that overstatement in promotional messages can lead to real problems.

Also, online reviews show mixed opinions, with some users unhappy with the quality of service, accuracy of their predictions, and how customer support handled their issues.

This highlights a main message from both SEBI and Streetgains’ own warnings: investing in the market always has risks, past results don’t guarantee future success, and even SEBI-registered research can’t stop you from losing money.

If you’re thinking about using such services, make sure to read all the information carefully, understand the risks involved, and don’t think that being registered means there’s no risk at all.

Streetgains SEBI Order

Order – SEBI Imposes Monetary Penalty on Streetgains Over Compliance Breaches and Misleading Practices

- Claims of Assured Returns and Loss Recovery – SEBI said Streetgains’ sales team told clients they could get guaranteed returns and recover losses via WhatsApp.These promises were seen as wrong and could have affected how clients made decisions.

- Violations Under PFUTP Regulations – The actions were checked against Rules 3(a), (b), (c), (d), 4(1), 4(2)(k), (o), and (s) of the SEBI (Prohibition of Fraudulent and Unfair Trade Practices relating to Securities Market) Regulations, 2003, along with Sections 12A(a), (b), and (c) of the SEBI Act, 1992.

- Mis-selling Through Employees – SEBI found that Streetgains didn’t control its employees well, allowing sales staff to share messages that might have led to mis-selling of services and mistakenly influencing clients.

- Referencing Past Performance on Social Media – The order said Streetgains posted research calls that performed well with ROI percentages and gains on the platform “X”. This was seen as referring to past results, which is not allowed under Clause 1(c)(xii) of SEBI Circular dated April 5, 2023, and Clause 8.1(c)(xii) of SEBI Master Circular dated May 21, 2024.

- Incentive Structure for Sales Executives – SEBI found that Streetgains gave sales staff incentives for high sales, which may have pushed them to sell products not right for clients’ risk levels, breaking Clause 4(xi) of SEBI Circular dated August 27, 2013, and Clause 12.4(xi) of the SEBI Master Circular dated May 21, 2024.

- Failure to Keep Proper Research Rationale – Streetgains did not keep clear, specific reasons for each research suggestion. Instead, they used the same general documents again and again, which is not allowed under Regulation 25(1)(i) and 25(1)(iii) of the RA Regulations.

- Not Following Digital Signing Rules – Even though they kept research records digitally, they didn’t use digital signatures, failing Regulation 25(2) of the SEBI (Research Analysts) Regulations, 2014.

- Nature of SEBI Proceedings – The order said SEBI’s process is like a court case, and the WhatsApp messages used during the check were allowed as part of the evidence.SEBI also stressed that having a registration doesn’t mean you’ll make money, and not following rules can lead to penalties.

- Monetary Penalty Imposed by SEBI – The Adjudicating Officer decided to fine Streetgains Research Services a total amount of ₹8,00,000 (Rupees Eight Lakh only). This fine was given based on the violations found and the rules in Section 15J of the SEBI Act. Part of the fine, ₹5,00,000, was for breaking rules about unfair and dishonest business practices. Another part, ₹3,00,000, was for not following the rules for Research Analysts, as stated in Section 15EB.

Streetgains Reviews

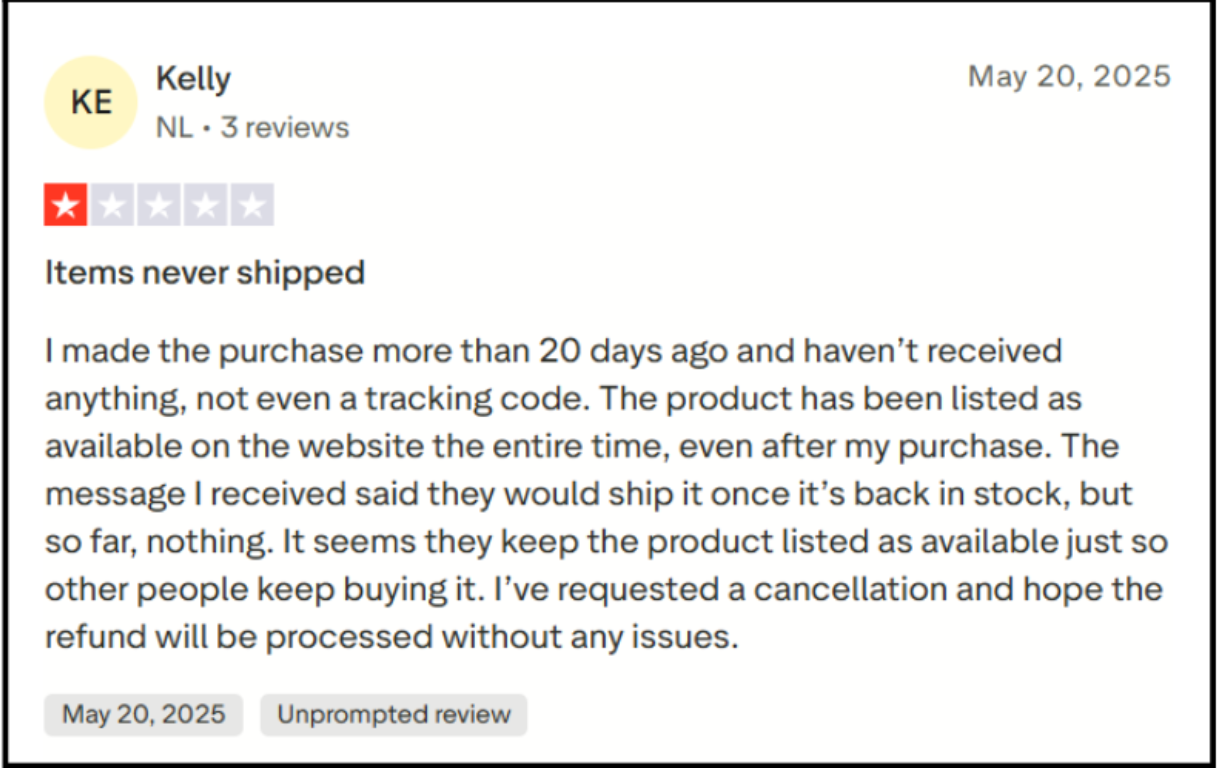

When it comes to platforms like Streetgains, users often expect refunds or withdrawals to go smoothly because the service seems organized, official, and professional.

This expectation can make delays or no response feel worse than actually losing money.

Complaints are usually about slow refunds, unclear communication, or not meeting promised timeframes, which makes users wonder if their request is being handled at all.

Review 1 – Even if refunds are promised, the long wait and no updates can cause frustration and make people doubt the whole process.

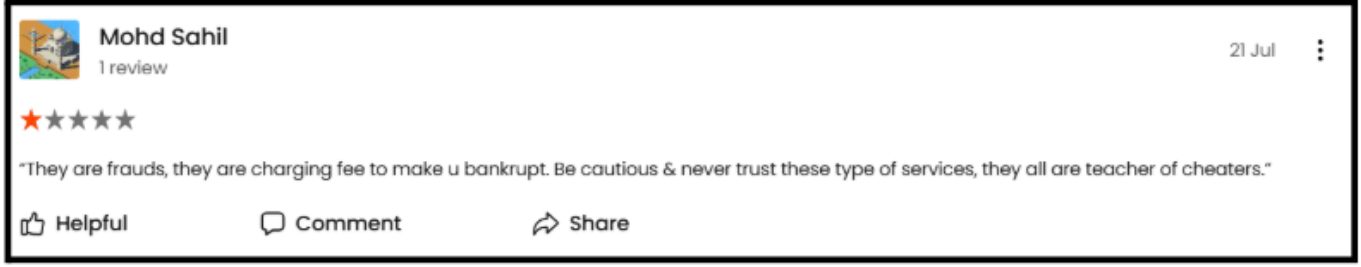

Review 2 – Some complaints include strong emotional words, which usually show how frustrated investors feel when they lose money or don’t get the results they expected.

Review 3 – This complaint reflects intense frustration after financial loss.

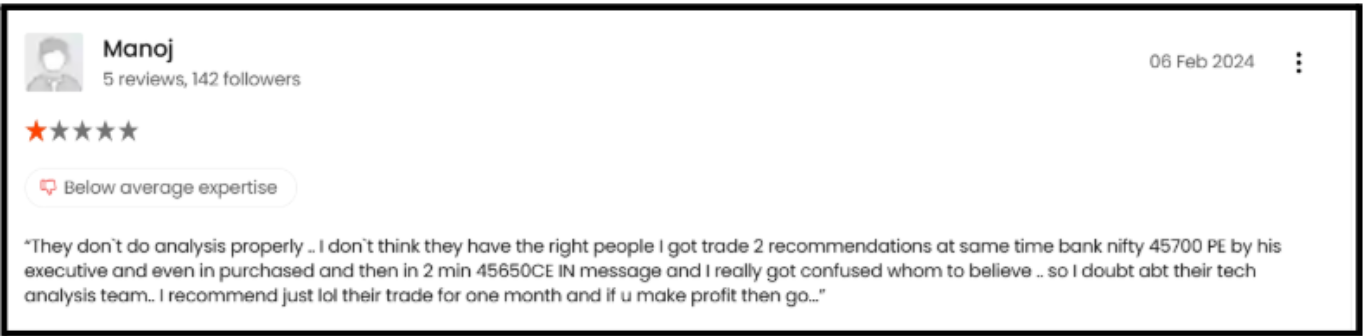

Review 4 – This review suggests that presenting multiple recommendations simultaneously can be confusing, particularly for investors during busy trading periods.

It worries about how well information is shared and how clear it is, saying that confusing instructions can hurt trust, even if the message is meant to be helpful.

How to Lodge a Complaint Against RIA?

When you come across complaints like these, it’s normal to feel confused, stressed, or even helpless.

Losing money or dealing with unclear communication can erode your confidence and leave you unsure about what to do next.

We understand how tough that can be because for many investors, it’s not just about the money; it’s also about trust that feels broken.

If you’re not sure how or where to report your issue, you don’t have to face it alone.

We’re here to help you every step of the way:

Register with us; we are here to help you at every stage:

- Understanding your case clearly: We listen carefully to your experience and help you figure out exactly what went wrong.

- Collecting the right proof: We guide you in gathering emails, chat messages, payment receipts, call records, and screenshots that are needed for your report.

- Drafting your complaint: We help you write a clear and honest complaint without confusion or emotional mistakes.

- Registering the complaint on the right platform: Whether it’s filing a complaint on SEBI SCORES or another correct channel, we help you through the whole process

- End-to-end support: From submitting the complaint to following up, we stay with you and help you understand every update.

Conclusion

Streetgains being SEBI registered might give a feeling of being organized and properly regulated, but it doesn’t mean the service is completely safe or that results are guaranteed.

The complaints, SEBI comments, and different experiences from users show that market advisory services should be treated with care and not taken for granted.

The final choice of when to trade still belongs to the investor.

Even good-quality research can lead to losses if the market behaves unexpectedly or if the information isn’t clear enough.

That’s why it’s important to read through all the necessary documents carefully, think about what you’re expecting, and avoid making decisions based on fear or pressure.

Being careful and well-informed protects you better than any title or registration.

In the end, the aim is not to trade out of fear but to trade with knowledge and understanding of your rights, noticing risks early and taking action if something feels wrong.