For many investors, trading is built on routine and trust. Orders appear on the screen, confirmation messages arrive, and transactions settle without much thought. Problems begin when investors notice trades they don’t recall placing or approving.

Such moments often lead to confusion, anxiety, and a troubling question: How did these trades happen? In the Indian securities market, situations like these are commonly referred to as unauthorised trading.

There have been instances where investors have raised concerns related to Kotak Securities’ unauthorized trading through formal channels. These disputes don’t automatically imply wrongdoing, but they do highlight gaps in communication, consent, or oversight that can seriously affect investor confidence.

When such issues arise, they are often examined through the arbitration process. Arbitration goes beyond assigning blame—it carefully reviews trading records, client–broker agreements, call logs, authorisation methods, and account activity to determine whether trades were genuinely approved or executed without proper consent.

Understanding how Kotak Securities unauthorised trading disputes emerge, how arbitration evaluates them, and what early warning signs investors should watch for can make a meaningful difference.

Awareness empowers investors to monitor their accounts more closely, ask timely questions, and take responsibility for safeguarding their participation in the market.

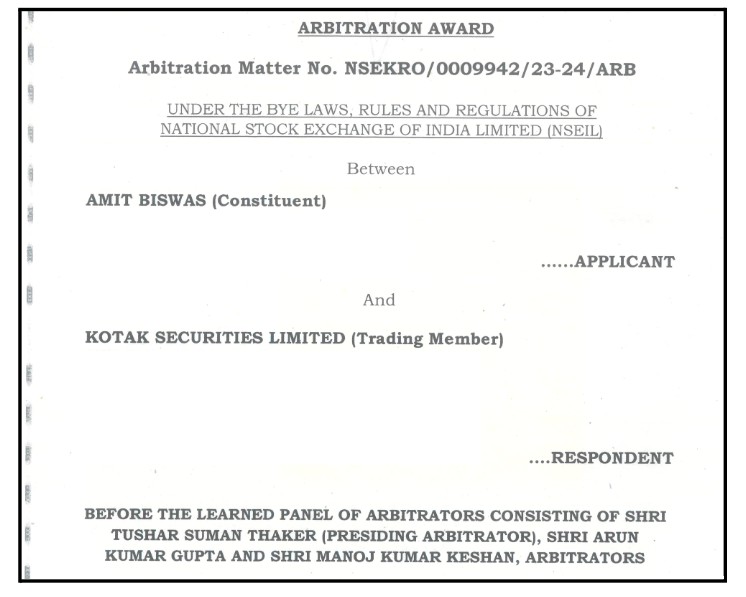

Kotak Securities Unauthorised Trading Case Study

The disagreement began when the trader (complainant) altered his trading arrangements in March 2018, based on promises of active support, margin assistance, and controlled risk.

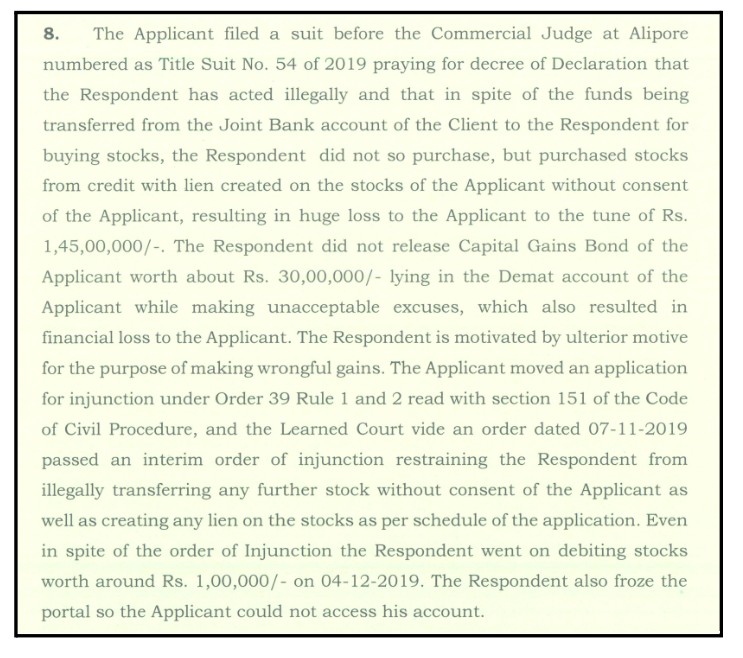

At first, he invested between Rs. 7,00,000 and Rs. 9,00,000, and later moved most of his existing shares into a Demat account held with the trading member. He depended on statements that trading would only happen with his permission and that losses would be limited to the difference in prices.

However, over time, trading increased a lot without proper approvals being documented. The applicant later found out he had a total loss of Rs. 1,45,00,000 in his account.

The records also show that a lien was placed on his existing securities, and his account access was restricted, which stopped him from keeping track of or stopping the trades during important times.

The financial loss went beyond just trading losses. The applicant mentioned that Capital Gains Bonds worth Rs. 29,40,000 were not released and that stocks were sold even though there were court orders telling them to stop.

The records also show that stocks worth about Rs. 1,00,000 were debited even after an injunction was issued. To calculate the total claim, the applicant asked for the return of shares valued at Rs. 1,01,11,230, Capital Bonds worth Rs. 29,40,000, and cash of Rs. 9,10,000, making the total amount claimed Rs. 1,39,61,230.

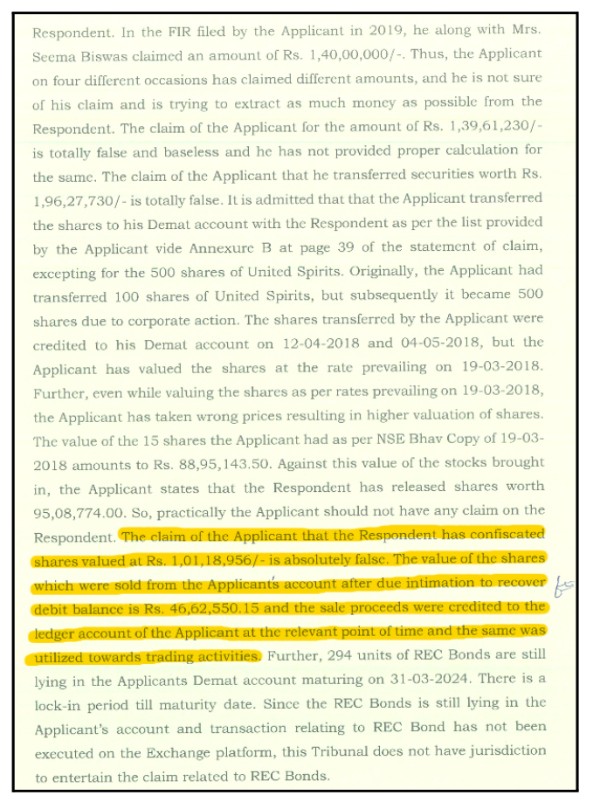

The respondent disagreed and said that some shares worth Rs. 95,08,774 had already been released, and sales of Rs. 46,62,550.15 were used to settle the debit balances.

The final decision does not include any order for financial recovery or returning the claimed amount to the applicant.

The process found several issues related to the following rules, based on documents, phone calls, and written submissions.

The records show that trades were carried out without proper written permission, a contested Power of Attorney was used for Demat account activities, and securities were sold even when trading was not allowed.

The documents also show that people advised on calls and recordings, even though rules say that traders can’t give advice or influence clients.

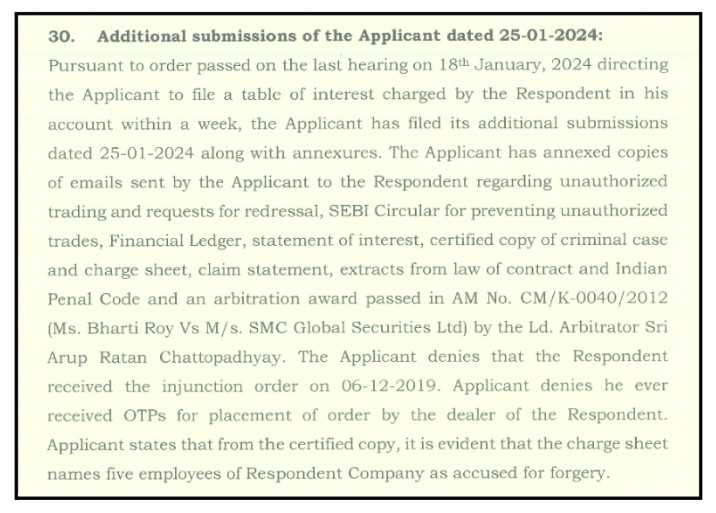

The case also includes information about interest charges on loans, selling assets because of a lack of funds, and late disclosures. All these points were used as the main reasons for the claims made during the arbitration.

After considering the material available, the arbitration did not result in any direction for recovery, restitution, or replenishment of the amounts claimed by the applicant. The matter therefore, concluded at the arbitration stage without monetary relief being awarded, leaving the dispute resolved on record rather than through financial compensation.

The case shows the dangers that happen when someone has control over operations, access to credit facilities, and gives advice without proper written protections in place.

It explains how long-running disagreements, multiple court cases happening at the same time, and not resolving things quickly can increase the risk for investors.

The result shows how important it is for investors to have clear permission, proof of trades, and ongoing access to their accounts, especially when they’re using leveraged trading.

The arbitration ended without any compensation being given, so the disagreement was just recorded as settled, not actually fixed with money.

What Can Investors Do in Such Situations?

In many arbitration in stock market cases, there are usual patterns of disagreement that show up before a formal dispute is filed. These signs don’t prove someone did something wrong, but they may suggest it’s a good idea to check things over quickly and get things clear.

Paying attention early on can help investors keep their interests safe and have more control over their accounts.

Common red flags that people often notice in disputes include:

- Trades made without clear or timely confirmation

- Transactions that don’t fit with the stated level of risk

- Contract notes that come in late or are unclear

- Complaints made without getting a written reply

When investors see trades they don’t recognize, they can start by talking to their broker directly. This helps both the investor and the broker look through records and make sure everything was done correctly from the beginning.

If the problem isn’t fixed this way, the investor can report the issue through the stock exchange’s official complaint system. If there’s still a disagreement after that, they can go to arbitration.

Arbitration follows specific rules set by the exchange and lets both sides present their case properly.

Procedural options for investors include:

- Writing to the broker to explain their concern

- Filing a stock exchange complaint on the platform

- Choosing arbitration if the problem isn’t resolved through the earlier steps

How To File a Complaint Against Unauthorised Trading?

When an investor sees trades that weren’t clearly approved, it’s important to report the issue quickly. Taking action early helps keep records safe and allows the problem to be handled properly through the right channels.

The Indian market has rules that give a clear, step-by-step way to bring up such concerns. Here’s how investors can report unauthorized trading in a clear and organized way.

Steps to Register a Complaint:

- Contact the broker first: Tell the broker about the problem through email or the official support channel. Be specific about the trades in question and the dates involved.

- Keep records ready: Make sure you have all the relevant documents ready, like contract notes, trade confirmations, emails, SMS alerts, and account statements related to the issue.

- Register a complaint with the exchange: If the broker doesn’t solve the problem, file a complaint on the NSE or BSE portal of the relevant exchange. Examples include the

- Track the grievance resolution: The exchange will look into the complaint and ask the broker to respond within a set time frame.

- Escalate to arbitration if required: If the issue isn’t resolved through the exchange, investors can apply for arbitration as a formal way to settle the dispute.

- Use SEBI’s SCORES platform: If the problem isn’t resolved, investors can also lodge a complaint to SEBI’s SCORES platform for further review.

Need Help?

Many investors find it tough to handle the complaint and arbitration process by themselves. It involves gathering documents, keeping track of time limits, and working with different platforms.

Register with us, and we help investors go through the right steps from filing a complaint to reaching arbitration, making sure everything is done in a clear and legal way.

Our main job is to support the process, make sure things are clear, and help with proper submissions at each stage.

How we help step by step:

- We look into the issue and check if it qualifies as an unauthorized trading complaint.

- We help write and send a clear written complaint to the broker.

- We assist in filing the grievance on the stock exchange platform or SCORES.

- We guide you in preparing and organizing all the supporting documents and records.

- If things escalate, we help with filing the arbitration application.

- We also help keep track of responses and make sure all submissions are done on time.

Conclusion

Unauthorized trading disagreements show how important it is to have clear consent, good communication, and proper records between investors and brokers.

Arbitration cases show that authorities look closely at documents, trade confirmations, and the order in which actions were taken. Every case is different and depends on the proof each side provides.

For investors, being informed is key to avoiding and solving problems.

Checking trade confirmations regularly, quickly raising any issues, and using official complaint and arbitration channels help keep things fair.

Having a clear plan and keeping records of all communications helps investors protect their rights and feel confident in the regulated market.