What if one glitchy trade during a market crash erased ₹5 lakhs from your Nirmal Bang account? This nightmare struck real traders in 2025, sparking a flood of Nirmal Bang complaints that revealed cracks in this brokerage firm.

From Mumbai offices to online forums, investors are sharing tales of frozen funds and ignored pleas, urging everyone to pause before clicking “buy.”

These aren’t anonymous rants, but they’re documented disputes piling up on NSE trackers and SEBI radars, affecting salaried folks like you building wealth through F&O or IPOs.

Spotting Nirmal Bang complaints early isn’t paranoia. It’s smart investing in India’s cutthroat markets.

Let’s unpack the broker’s story, dissect the drama, and hand you the roadmap to fight back and win.

Nirmal Bang Review

Founded in 1986, Nirmal Bang is a well-known full-service stockbroker that has been around for decades.

It offers a wide range of financial services like equity trading, commodity trading, currency futures, mutual funds, IPOs, and research-backed investment advisory.

The broker operates under Nirmal Bang Securities Pvt. Ltd., a registered member of the NSE, BSE, MCX, and NCDEX, and is regulated by SEBI.

With more than 2,000 branches and franchises across India, Nirmal Bang has built a strong brand presence.

Yet, despite its long-standing reputation, a rising number of investors have voiced their dissatisfaction online.

Issues such as delayed withdrawals, poor customer response, and hidden charges have become frequent topics of discussion on investor forums.

The interesting part?

These problems often start small but can escalate quickly when brokers fail to respond on time, leading investors straight toward filing official complaints.

Nirmal Bang User Complaints

Like any large broker, Nirmal Bang complaints vary from minor service delays to serious disputes involving losses due to technical glitches or unauthorised trades.

Nirmal Bang currently has 138,511 active clients, out of which 27 complaints were officially recorded. This amount accounts for only 0.019% of their active user base that raised an issue.

The complaint resolution rate is 70.37% which indicates that most concerns were addressed by the broker.

Types of Complaints Against the Broker:

- Type IV: Unauthorised Trading

These account handling by Nirmal Bang have complaints involving trades executed without the client’s permission or misuse of client funds/securities. It usually indicates a breach of trust or improper access to the client’s account.

- Type V: Service-related

These issues arise from delays, poor customer support, wrong information, or system/platform problems. They mostly relate to the broker’s overall service quality and responsiveness.

- Type VI: Closing out / Squaring up

This happens when the broker closes a client’s positions due to margin shortfall or risk policies. Complaints arise if the client feels the action was premature, incorrect, or not properly communicated.

- Type VIII: IPO related

These complaints involve problems in IPO application, allotment status, mandate issues, or delays in refunds. They stem from miscommunication or operational errors during IPO processing.

- Type IX: Others

This category covers all issues that don’t fit into specific complaint types, technical glitches, account update delays, settlement mismatches, or any miscellaneous concerns raised by clients.

If you’ve experienced Nirmal Bang unauthorized trading or any such issue, don’t panic, as you are not alone. The process to raise and resolve these complaints is actually clear and structured, thanks to SEBI’s grievance redressal mechanisms.

Nirmal Bang Arbitrations

There have also been a few arbitration cases filed against Nirmal Bang, which is a reminder that even regulated brokers can face disputes when things don’t go as expected.

Let’s take a closer look at the issues raised by clients and what led them to seek arbitration in the first place.

- Unauthorised Trades

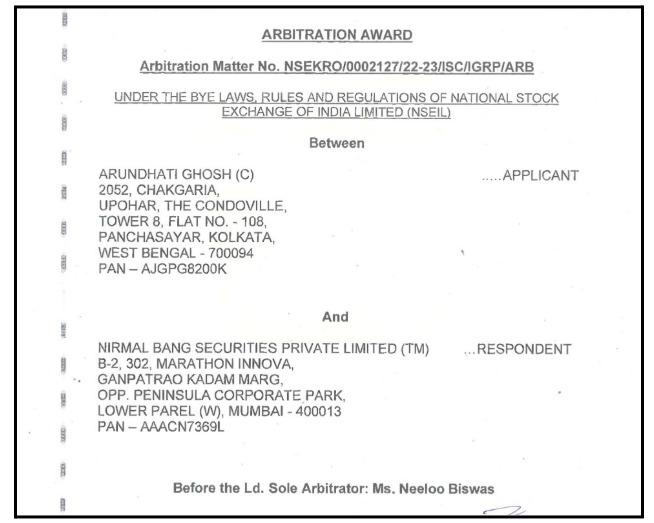

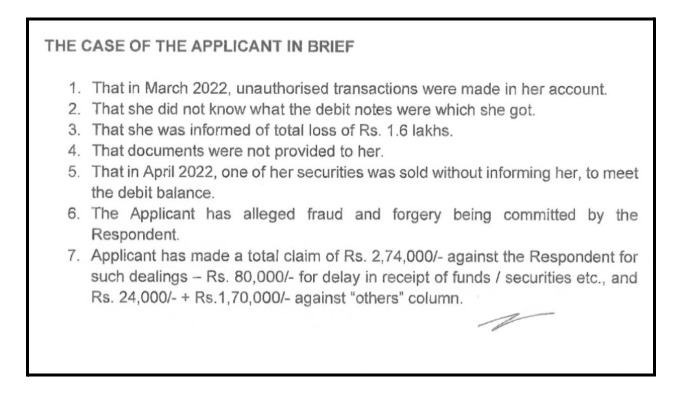

Arundhati Ghosh filed the arbitration claim against Nirmal Bang Securities Private Limited.

She alleged them for unauthorised trades in March and April 2022, fraud, forgery, and delays in fund/securities delivery.

It resulted in a Rs. 1.6 lakh loss and a total claim of Rs. 2.74 lakh. She claimed ignorance of debit notes and an unapproved sale of securities to cover dues.

Penalty Imposed

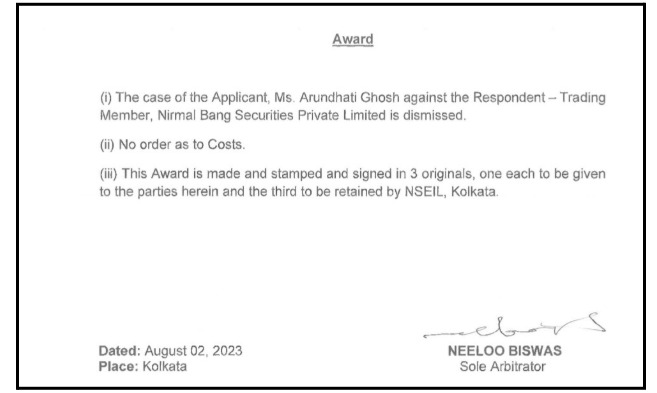

The sole arbitrator, Ms. Neeloo Biswas, dismissed the entire claim after Ghosh failed to appear at hearings on June 9 and 19, 2023, despite notices and adjournments.

The broker proved trades were authorised via emails, calls, and statements. Thus, no costs were awarded.

Learning for Investors

Always attend arbitration hearings or risk claim dismissal, as excuses like medical issues or counsel unavailability without formal applications fail.

Verify trade authorisations through contract notes and SMS alerts promptly, and note that prior Grievance Redressal Committee rejections limit appeals.

- Currency Trade Dispute

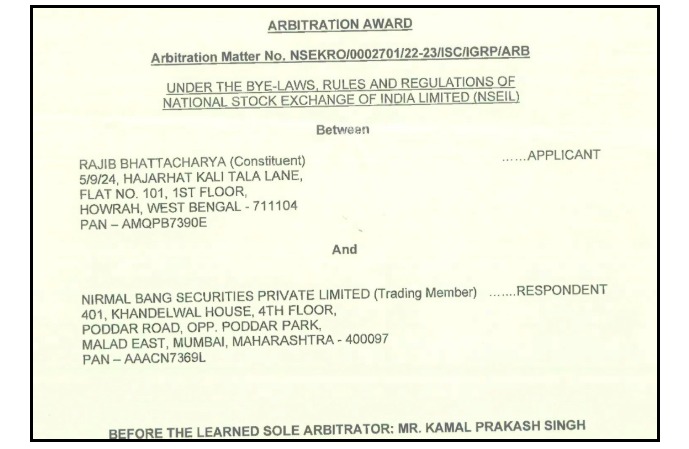

Rajib Bhattacharya filed against Nirmal Bang Securities, claiming an unauthorised currency derivative trade on December 30, 2021.

It resulted in buying 1200 lots of USD-INR put options (expiry Jan 27, 2022, strike 72) that caused Rs. 65,643 loss without his consent.

He alleged coercion by relationship manager Deep Das and others to confirm the trade via phone and the Beyond app to meet targets, after prior losses.

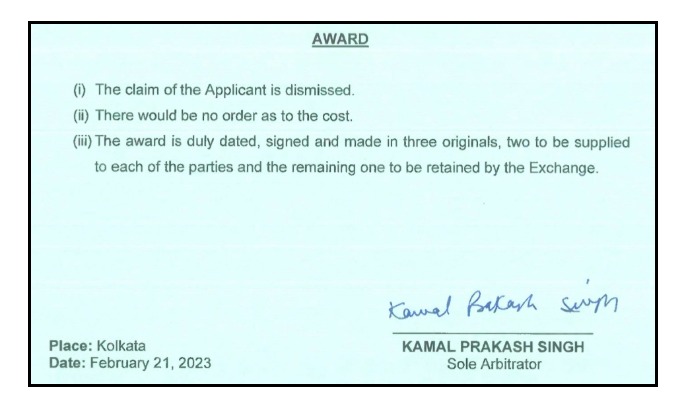

Penalty Imposed

Sole arbitrator Mr. Kamal Prakash Singh dismissed the claim entirely on February 21, 2023, after hearings on January 6.

Evidence showed the applicant executed the trade himself via the Beyond app (IP logs, call recording admission), received timely contract notes, SMS, and emails. Thus, no costs awarded.

Learning for Investors

Confirm trades immediately upon receiving contract notes, SMS, and emails, as delays weaken unauthorised claims.

Secure app logins personally, as prior trade experience and call confirmations undermine ignorance pleas, as GRC rejections often stand.

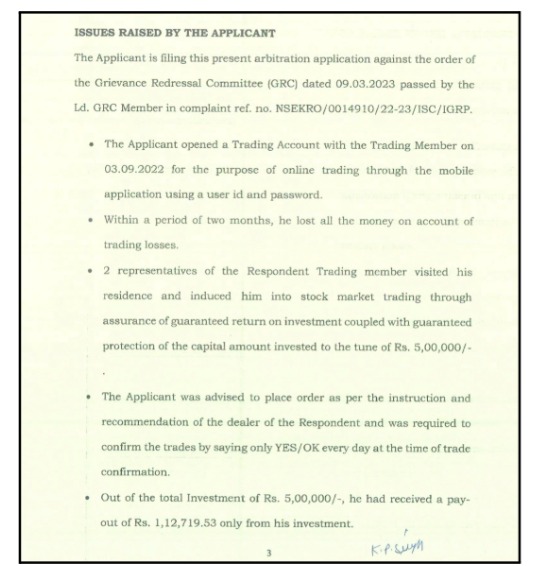

- Fixed Return Promise Claim

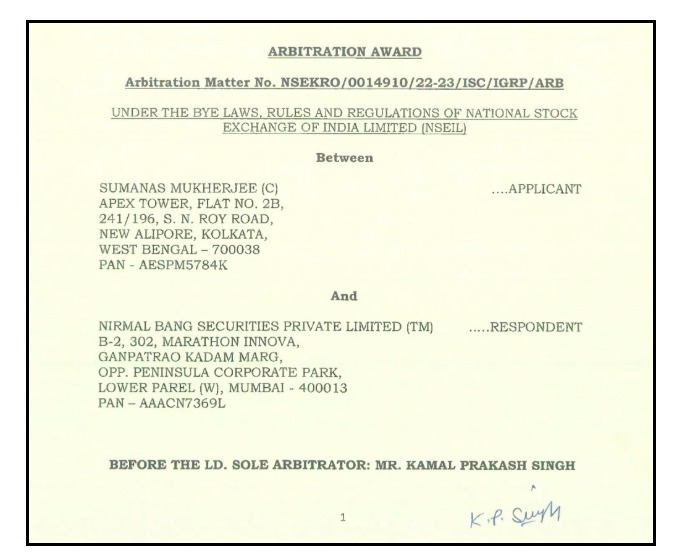

Sumanas Mukherjee filed a case against Nirmal Bang Securities Private Limited.

He alleged inducement into high-risk trades from September 2022 with promises of 10-12.5% monthly fixed returns on Rs. 5 lakh investment.

It led to Rs. 4.36 lakh losses after payouts of only Rs. 1.12 lakh.

He claimed unauthorized trades per staff instructions (confirmed by “YES/OK”), excess brokerage of Rs. 2.91 lakh not disclosed in KYC, forged signatures on documents, and SEBI guideline breaches, challenging the GRC order of March 9, 2023.

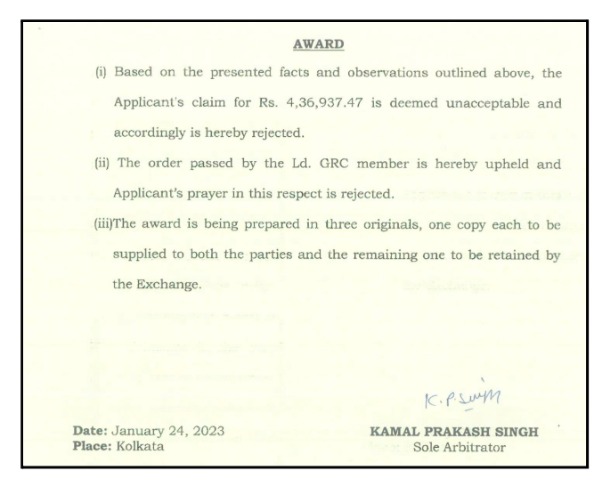

Penalty Imposed

Sole Arbitrator Mr. Kamal Prakash Singh dismissed the full Rs. 4.36 lakh claim plus Rs. 50,000 costs after November 10, 2023, hearing, upholding GRC findings.

Evidence showed the applicants unauthorized trades via instructions, voice recordings, SMS, emails, and branch visits. There was no proof of fixed return assurances or excess brokerage, as KYC warnings were signed and risks acknowledged.

Learning for Investors

Reject promises of guaranteed returns, as SEBI prohibits them, and KYC documents explicitly warn of market risks, as no broker can assure profits.

Actively verify all trades through contract notes, ledgers, and confirmations immediately, since silence implies consent and delays weaken claims.

Demand transparent brokerage rates upfront and retain all signed documents to counter forgery allegations effectively.

SEBI Orders against Nirmal Bang

SEBI is the watchdog of the Indian Stock Market. It regularly keeps a check on its registered brokers to ensure that they are following the guidelines. If they find something unusual, they monitor it.

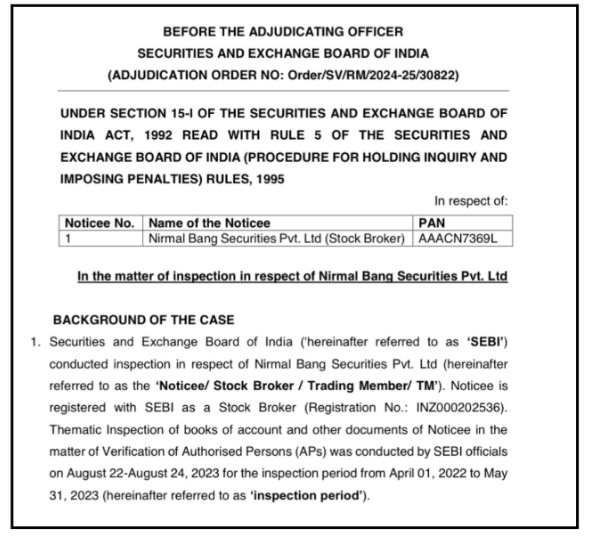

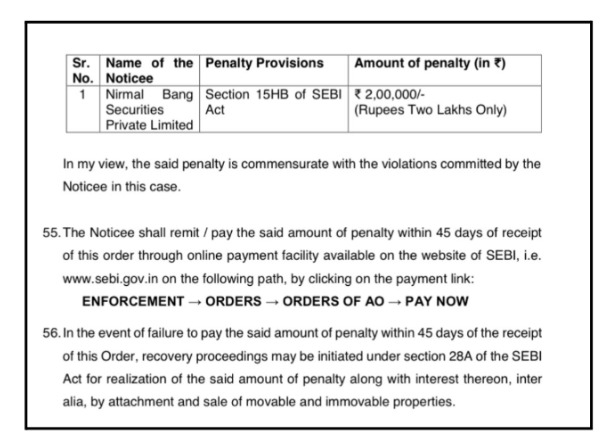

SEBI issued an adjudication order against Nirmal Bang Securities Pvt. Ltd., a registered stock broker, after inspecting its authorised persons (APs) from April 2022 to May 2023.

Why the Action?

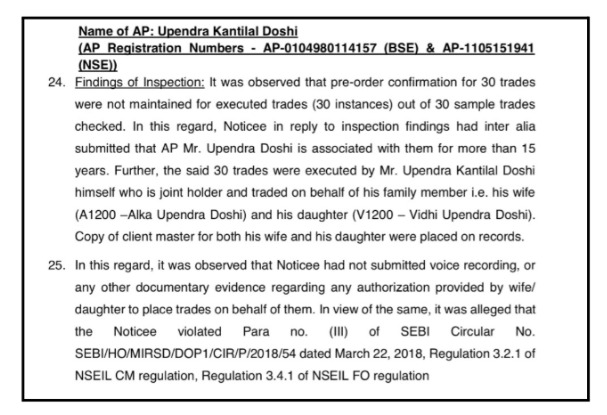

SEBI found issues with three APs not following rules on client order confirmations and office displays.

One AP failed to keep records for 30 client trades and did not display mandatory notices like risk warnings, SEBI certificates, and complaint registers at its Bhandup office during inspection.

These broken rules are meant to prevent unauthorised trades and ensure transparency.

Other cases involved family trades without full proof, but SEBI dropped those for lack of clear violation.

What SEBI Did?

SEBI conducted a thematic inspection in August 2023, issued a show cause notice in April 2024, and held a hearing.

On September 30, 2024, it imposed a penalty of Rs 2 lakh under Section 15HB for the confirmed lapses, holding the broker responsible for its APs’ errors.

No investor losses or gains were quantified, and the penalty was considered a corrective step taken by the broker.

Key Learnings for Investors

Always check if your broker’s sub-brokers (APs) display risk warnings and maintain complaint books at their offices.

Insist on clear proof of your trade orders, like call recordings or signed sheets, to avoid disputes.

Report issues directly to SEBI if you spot missing disclosures, as brokers must oversee APs strictly.

What to Do If You Have an Issue with Broker?

If you’re facing issues with Nirmal Bang and feel stuck, you don’t have to handle it alone.

Register with us, and we’ll help you turn your problem into a proper, trackable complaint.

Here’s How We Help with Nirmal Bang Issues:

- Collecting Proofs

We help you gather trade statements, ledgers, contract notes, emails, chats, and screenshots, so your case has strong evidence. Because SEBI inspections demand clear records for trades.

- Writing Your Complaint

We draft clear complaints in the correct format for NSE, BSE, SEBI SCORES, and SMART ODR, so they are not ignored or rejected over wording or formatting.

- Filing on the Right Platform

We guide you step by step while submitting to SCORES or SMART ODR and ensure all details and documents are filled in properly.

- Escalation and Follow-Up

If Nirmal Bang doesn’t solve the issue, we will show you how to escalate to the exchange or next level, as SEBI did after finding AP lapses and help you reply to any queries.

- Support in Counselling/Arbitration

If your case goes to counselling or arbitration, we help you prepare your statements and documents so you feel ready and confident.

In short, you focus on telling your story and tracking your money, and we handle the drafting, filing, and procedure against Nirmal Bang.

Conclusion

Brokers like Nirmal Bang have played a big role in helping millions of investors access the market. However, no brokerage is immune to complaints. The only thing that matters is how efficiently those issues are resolved.

As an investor, don’t overlook red flags such as delayed responses, incorrect account statements, or hidden charges.

Document every conversation, raise complaints in writing, and escalate them through proper channels if needed.

Remember, SEBI and the exchanges have built a strong framework to protect retail investors, and you just need to use it wisely.

Your trades are your hard-earned money at work, so treat every transaction with the seriousness it deserves.

By staying aware of complaint procedures, tracking official SEBI orders, and learning from others’ experiences with Nirmal Bang, you’ll be better equipped to trade safely and confidently in India’s financial markets.