Online trading apps promise quick access to global markets, low deposits, and high returns-all from a smartphone.

Olymp Trade positions itself as an international trading platform offering access to over 250 assets, including forex, stocks, crypto, and 24/7 instruments. With a minimum deposit of just $10 and trades starting at $1, it appears beginner-friendly at first glance.

However, before trusting any trading platform with your money, it’s important to look beyond marketing claims.

This blog takes a cautious look at Olymp Trade-whether it’s real or fake, legal or not, and how safe it actually is for users.

Olymp Trade Real or Fake?

Olymp Trade is a real platform in the sense that it exists as a global entity, is available on the Google Play Store, and has millions of registered users worldwide.

However, “real” does not automatically mean safe, regulated, or legal for everyone. In the Indian market, differentiating between a legitimate global business and fake trading app scams is crucial for protecting your capital.

APK Downloads

One of the biggest red flags associated with Olymp Trade is the availability of APK download links from websites and third-party sources.

APK files bypass the security checks of app stores and can expose users to:

- Malware or spyware

- Data theft (banking details, passwords, device access)

- Unauthorised app behaviour

One of the most dangerous trends emerging around the platform is the promotion of a supposed Olymp Trade hack.

Scammers often lure traders with “modified” APKs, automated bots, or “cheat codes” that promise guaranteed wins or the ability to bypass platform restrictions.

In reality, these are almost always traps.

Using or downloading these third-party tools doesn’t just violate the platform’s terms, leading to an immediate account ban, but also exposes your device to severe security breaches.

Olymp Trade Legal or Not?

In India, Olymp Trade does not hold a license from SEBI or any Indian financial regulator. While it may be regulated in other jurisdictions, that regulation does not extend legal protection to Indian users.

This means:

- Trading on the platform operates in a legal grey area

- Indian authorities have limited power to intervene in disputes

- Users have little legal recourse if funds are blocked or lost

Legality depends on local regulation, not global presence.

Olymp Trade Safe or Not?

When it comes to safety, Olymp Trade raises multiple red flags that users should not ignore, especially those new to online trading.

Price Behaviour After Trades

Several users claim that once a trade is placed, the price graph behaves differently than expected.

Sudden spikes or reversals right after entering a position create suspicion that trades may not always reflect real market movement. For beginners, this can quickly lead to losses without a clear understanding of what went wrong.

Deposit Issues and Missing Funds

Another common concern is money being deducted from a bank account or wallet, but not appearing in the Olymp Trade balance immediately.

While delays can happen, repeated reports of such issues create uncertainty around fund handling and transparency.

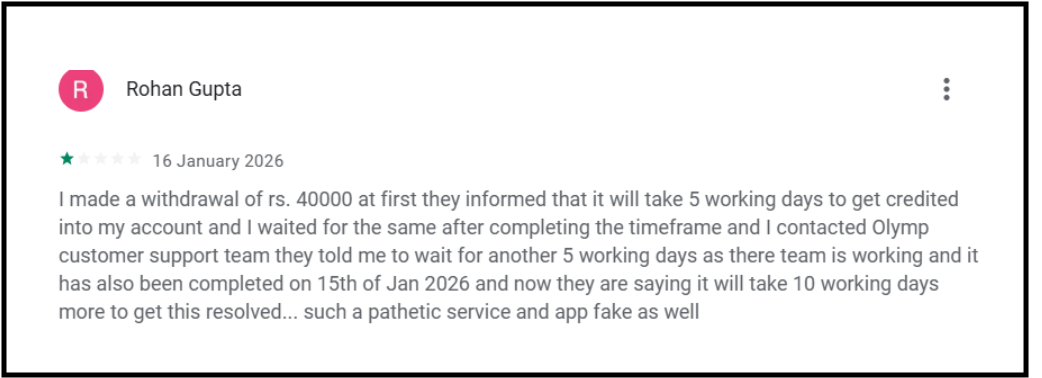

Olymp trade withdrawal Problem

Withdrawals are one of the biggest pain points. Users report long waiting periods, repeated verification requests, or withdrawals getting stuck without clear reasons.

In some cases, accounts are restricted just when users attempt to withdraw profits, which raises serious trust concerns.

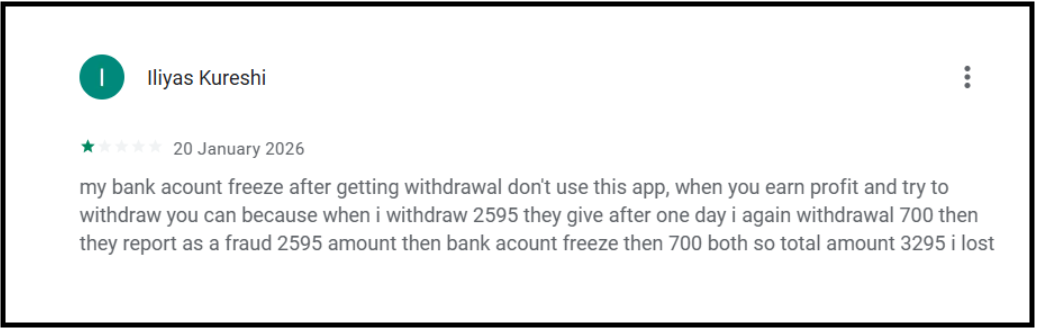

Account Freezing Without a Clear Explanation

There are complaints of accounts being frozen suddenly, often after profitable trades or withdrawal attempts. When this happens, access to funds becomes uncertain, and customer support responses are often slow or generic.

Inactivity Fees That Drain Balances

Olymp Trade reportedly charges inactivity fees if no deposits or trades are made for a certain period. Many users are unaware of this until their balance reduces automatically, which feels unfair to casual or cautious traders.

Aggressive Bonus and Profit Claims

Promises such as “bonus up to 100%” or “profitability up to 93%” can be misleading. Bonuses often come with strict conditions that make withdrawals difficult, and high-profit claims may encourage risky trading behavior.

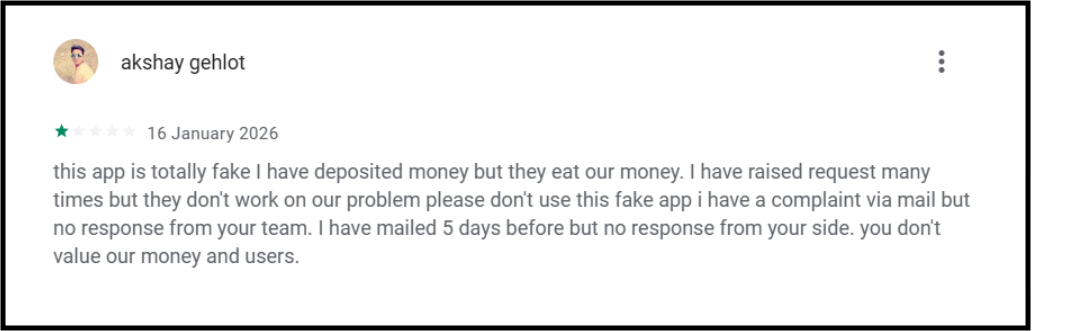

Olymp Trade User Complaints

A large number of user complaints around Olymp Trade follow a similar pattern. Many users report difficulty withdrawing funds, even after completing verification requirements.

Some complain that accounts are suddenly restricted or frozen, especially after profitable trades or when a withdrawal is initiated.

Others mention unexpected balance deductions, delayed deposits, or poor responses from customer support when issues arise.

Customer Support Concerns

Many users report that Olymp Trade’s customer support is:

- Slow to respond

- Limited to automated replies

- Unhelpful during withdrawal or account freeze issues

For a trading platform handling real money, active and accountable support is essential, and its absence increases risk.

While not every user has a negative experience, the consistency of these complaints highlights a lack of transparency and accountability, factors that are critical when real money is involved.

For Indian users in particular, the absence of local regulatory oversight makes resolving such complaints even more challenging.

How to Report Trading Scams

If you face issues such as blocked withdrawals, sudden account restrictions, or suspect unfair or deceptive practices, it’s important to act quickly and carefully.

- The first step is to stop depositing any additional money into the platform.

- Next, file a complaint on the Cyber Crime Reporting Portal. This creates a formal record of the issue and helps authorities track patterns across similar platforms.

- You can also call the National Cyber Crime Helpline, especially if financial transactions are involved, as early reporting improves the chances of timely action.

- If you have made payments or deposits, inform your bank or payment provider immediately. Ask them to flag the transactions and the receiving account for suspected fraud or dispute, as this can sometimes prevent further misuse.

- Finally, preserve all evidence carefully. Keep screenshots of the app, transaction IDs, bank statements, emails, chat conversations, and any error messages or account notifications.

Need Help?

If you are unsure about an app’s legitimacy or have already suffered a loss, structured guidance can make a difference. Register with us.

We assist users by:

-

Reviewing evidence and payment records

-

Guiding complaint drafting and escalation

-

Helping navigate legal and consumer channels

Early action and good documentation improve the chances of accountability and recovery.

Conclusion

Olymp Trade may look appealing with its modern interface, low entry barriers, and promises of high returns, but several red flags remain hard to ignore.

Unofficial APK downloads, lack of SEBI regulation in India, recurring user complaints about withdrawals and account freezes, and aggressive bonus promotions all point to a higher risk than the platform initially suggests.

In trading, appearance means very little without regulation and accountability.

Platforms that highlight easy profits or minimal risk should always be approached with caution.

If you choose to use apps like Olymp Trade, do so carefully, invest only what you can afford to lose, and step away immediately if something doesn’t feel right.