In the stock market, the most expensive mistake isn’t losing a trade; it’s believing the wrong person at the right time.

Every day, thousands of traders search for one simple thing before they subscribe, pay, or follow a call: “Is this analyst genuine, and what do real users say?”

Options King Research Analyst is one of those names people actively look up. The firm is operated by Sunil Suklal Pawar, a SEBI-registered research analyst, and is also widely discussed on social platforms.

So, if you’re here to understand who he is, what registration details exist in public view, and what complaints/reviews typically claim, this blog is built exactly for that purpose.

Options King Research Analyst

Options King Research Analyst, a SEBI-registered advisory operated by Mr. Sunil Suklal Pawar, successfully completed the qualification process to be a SEBI-registered research Analyst on 31 July 2016.

His SEBI Research Analyst registration number is stated as INH000003325 on his website and related public posts.

The business model is simple. Users pay for stock market tips and research alerts. The service focuses heavily on options trading.

Service Channels:

- Telegram channel

- Website subscriptions

Payment Structure:

- Paid subscription packages

- Demo calls available

- Multiple service tiers

According to their Telegram channel, users can chat on WhatsApp.

The platform shares intraday levels. Users receive “high risk trade” alerts.

But here’s the catch: The Research Analyst never guarantees returns on recommendations, and investment/trading in stocks or other securities is always subject to market risk.

Red Flag Alert: However, many users report pressure tactics like adding more capital, increasing quantities and keep averaging down.

Sounds concerning, right? Well, let us dig into the complaints section to make things clearer.

Options King Research Analyst SEBI Order

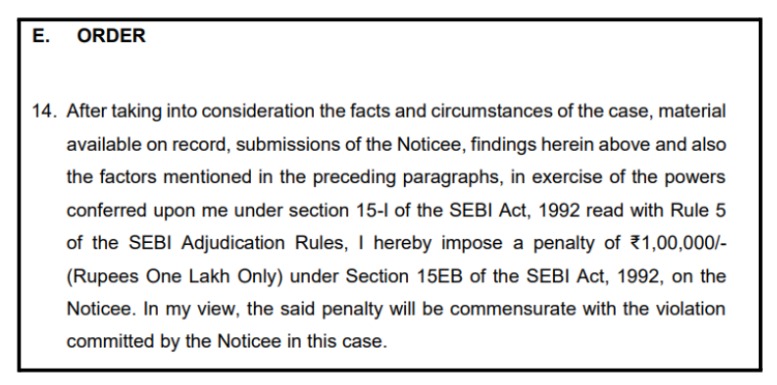

In a significant regulatory action, SEBI has imposed a penalty of ₹1,00,000 (One Lakh Rupees) on Options King Research Analyst, a SEBI-registered entity, for operating without a valid mandatory certification for over five years.

The case highlights the critical importance of continuous compliance for financial intermediaries, even in the face of genuine misunderstandings.

Background of the Case

- Entity: Options King Research Analyst (Proprietor: Sunil Suklal Pawar)

- Violation Period: June 07, 2019, to December 30, 2024 (Over 5 years)

- Key Allegation: Failure to hold a valid NISM (National Institute of Securities Markets) Research Analyst Certificate, a mandatory requirement under SEBI regulations.

- Legal Provisions Violated: Regulation 7(2) of the SEBI (Research Analysts) Regulations, 2014, and Section 15EB of the SEBI Act, 1992.

What Went Wrong?

The Core of the Violation

SEBI’s thematic inspection for the period April 2023 to September 2024 revealed a critical lapse:

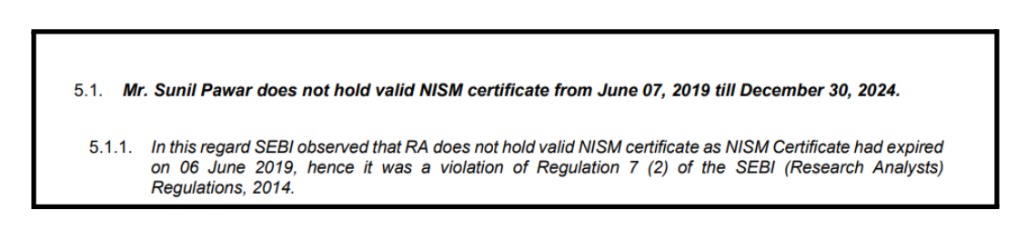

- The proprietor, Mr. Sunil Pawar, had allowed his NISM certificate to expire on June 7, 2019.

- Despite this, he continued to operate as a registered Research Analyst, providing recommendations to over 1,000 clients without the mandated certification for more than five years.

The Noticee’s Defence: A Claim of “Perpetual” Misunderstanding

Mr. Pawar defended himself, stating:

- He held a “perpetual” SEBI registration (granted in August 2016) and believed this status also applied to his NISM certificate.

- He claimed to have contacted SEBI in 2021 during registration renewal and was told that, as a perpetual registrant, only a fee payment was needed, no document submission, including the NISM certificate.

- He argued it was an inadvertent error based on this guidance, not intentional negligence.

- He emphasized that his service quality was never compromised, and no client harm occurred.

- He also cited COVID-19 relaxations and a new SEBI notification in 2025 as evidence of earlier ambiguity.

SEBI’s Firm Rejection & Rationale

The Adjudicating Officer (AO) dismissed these arguments, establishing a clear violation:

- Regulation is Unambiguous: Regulation 7(2) clearly states that a Research Analyst must have a valid NISM certificate “at all times,” and a fresh one must be obtained before the old one expires.

- No Excuse for Ignorance: As a registered intermediary, the Noticee was expected to know and comply with applicable regulations.

- “Perpetual” Registration ≠ “Perpetual” Certification: The AO clarified that SEBI registration and certification requirements are two separate compliance pillars. One does not override the other.

- Post-Violation Correction is Not an Absolution: The fact that Mr. Pawar cleared the NISM exam in December 2024 after the inspection does not erase the past violation.

The Outcome: Penalty Imposed

Considering all factors under Section 15J of the SEBI Act:

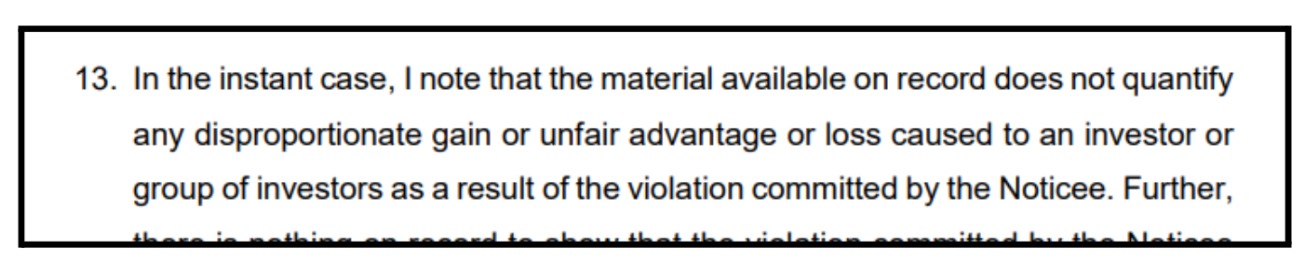

- No quantifiable unfair gain or investor loss was identified.

- The default was not deemed repetitive.

- However, the violation was serious in duration and nature.

Therefore, SEBI imposed a penalty of ₹1,00,000, the minimum prescribed amount under Section 15EB for such failures. This balanced the need for deterrence with the circumstances.

The Order Mandates:

- Payment within 45 days (by ~September 13, 2025).

- Failure to pay will lead to recovery proceedings, including attachment of property.

Options King Complaints

Still, for many traders, it can be hard to believe that complaints may surface even against an SEBI-registered analyst.

After all, SEBI registration is often seen as a mark of credibility and regulatory oversight. However, registration alone does not automatically eliminate dissatisfaction or disputes.

To understand the situation better, it’s important to move beyond assumptions and hear directly from users, their experiences, concerns, and feedback shared across public platforms provide valuable insight into what actually happens on the ground.

Review 1: The ₹2.5 Lakh Loss

User Experience: Lost entire capital following the options advice

“They do not even have a basic understanding of the stock market. They will ask you to increase your capital and when you put your hard-earned entire money into their suggested options, the premium value will go on decreasing and finally it will be zero. I have lost 2.5 lacs with them.”

Key Takeaway: Continuous pressure to add money led to total loss.

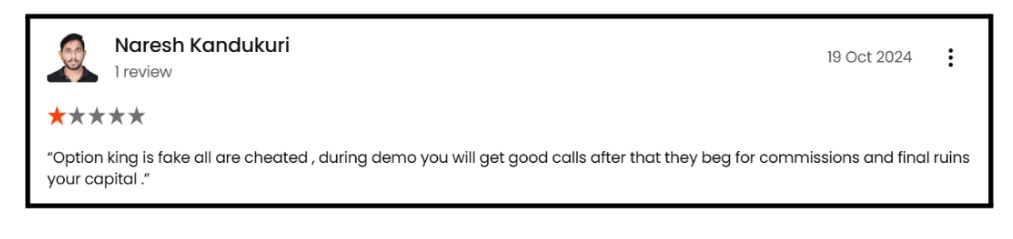

Review 2: The Fraud Accusation

User Experience: Felt cheated by misleading calls

According to Justdial, users accused the company of making false promises and pressuring them to buy expensive packages.

Key Takeaway: High-pressure sales tactics and unmet expectations.

A negative user review accuses the service of being fake and ruining capital after a deceptive demo.

How to Report Options King Research Analyst?

Lost money?

Here’s your action plan.

Whether the lapse is intentional or due to a “genuine misunderstanding,” the impact on investors remains the same. And if you’ve faced similar issues, you should never have to handle them alone.

Our team is here to support you through every stage of the grievance process, ensuring your concerns are documented clearly and addressed effectively.

Start by gathering solid proof right away.

- Collect All Evidence

Document everything thoroughly, including emails, chat logs, recommendation reports, portfolio statements, screenshots of misleading advice, and call recordings if available. Strong evidence forms the backbone of any successful claim against faulty research or investment tips.

- Register Your Complaint

File your grievance through the analyst’s official support channels to create a clear record. This ensures all facts are captured accurately without missing key details.

- Assistance with Documentation and Drafting

Seek expert help to craft a polished formal complaint that outlines the issue precisely and attaches all proof. A structured submission boosts the odds of quick and fair handling.

SCORES (SEBI Complaints Redress System): File your Research Analyst complaint online via SEBI’s portal for official intervention.

For lingering disputes, move to the Online Dispute Resolution platform, which speeds up mediation between investors and analysts.

- Representation in Counselling and Arbitration

Expert support guides you through counselling meetings and arbitration hearings, presenting your case effectively to defend your financial interests.

These actions empower you to handle the matter confidently, making sure authorities view your Research Analyst complaint seriously for better results.

Don’t navigate this alone.

Register with us today, and let our experienced team help you move toward resolution, accountability, and peace of mind.

Conclusion

Multiple users report losses of lakhs of rupees, with complaints about poor risk management and pressure to add more capital.

Registration doesn’t equal reliability. Numerous Indian traders report substantial losses. The patterns are clear. Capital erosion. Pressure tactics. Poor guidance.

Approach any research analyst with extreme caution.

Follow these rules: invest only what you can afford to lose, question “guaranteed” returns, verify past performance independently, start small, and keep your own stop-loss discipline.

Remember: Research Analysts are not liable for your losses. You bear the risk alone, but if you suspect misconduct, you don’t have to fight for justice alone.

SEBI and legal channels exist to hold non-compliant advisors accountable.