Imagine you’re scrolling through your phone, and you stumble on an ad promising “instant personal loans, no paperwork, get money in minutes”. For someone in need, that sounds ideal.

But what if you’re asked to pay first a processing fee, a launch fee, or an “advance EMI” and then the money never comes?

That’s exactly the kind of scenario many users say they’ve encountered with the “Press Money” app.

Press Money Loan App Review

The Press Money loan app is a borrowing platform based in India. It has positioned itself as a provider of quick personal loans with clear terms.

The Google Play Store mentions that the app is a product of Storrose Vyapaar Private Limited, an NBFC.

Now, this firm is a registered Non-Banking Financial Company (NBFC) operating in accordance with the guidelines set by the Reserve Bank of India (RBI).

However, the app has been involved in a cluster of complaints from users who state that it is a fraud and, therefore, should not be trusted despite its assertions of being a legitimate and RBI-compliant.

On the face of it, it looks like one of many instant-loan apps. The listing touts features like “clear loan terms” and a “paperless process”.

Is Press Money Loan App Real or Fake?

Here’s where things get tricky. On one hand, the app listing gives some details and appears as a legitimate product.

On the other hand, multiple user complaints suggest serious problems.

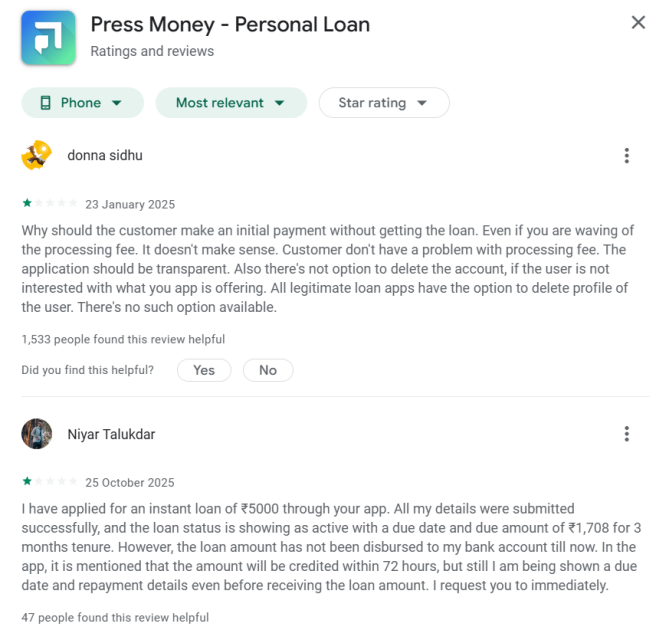

According to reviews on SafeLoan.in, users claim that after paying various fees (including a “processing fee” or even a first EMI), they never received the loan amount in their bank account. On the Google Play support forum, one user wrote:

“The app claims to offer instant personal loans. After downloading it, I was asked to pay ₹1020 through UPI … Once …”

These red flags point to the possibility that the app may be operating with scam-like behaviour (asking for advance fees) even if it presents as “real”.

Is Press Money Loan App RBI Approved?

In India, genuine loan apps must be backed by an entity registered with or regulated by the RBI (for NBFCs, etc).

According to expert advice: “A genuine instant personal-loan app will be registered with the RBI, following all norms.”

The claims of the app being backed by an RBI-registered NBFC suggest it could be real in theory, but the reported user experiences indicate it operates in a fake and fraudulent manner.

How?

Here are several user reviews highlighting issues such as payment requests without actual loan disbursement and other unexpected charges.

Because it asks for money early, which legitimate lenders do not.

So, there is significant doubt about its regulatory status being fully legitimate.

How to Report Loan Frauds in India?

If you or someone you know has applied and paid a fee but not received the loan, you should:

- Stop further payments until you verify legitimacy.

- Take screenshots of the app, ads you saw, payment screenshots, and communications.

- Contact your bank/UPI provider and see if you can stop or trace the transaction.

- File a complaint in Cyber Crime.

- Lodge an FIR with local police under the IT Act or approach the National Consumer Helpline.

- Report the app to Google Play (if Android) for non-compliance / fraudulent behaviour.

- Warn your friends/family: these apps often spread via referrals or aggressive ads.

Need Help?

If you have been a victim of such loan app scams, register with us for step-by-step guidance.

Conclusion

The story of Press Money is a cautionary tale for anyone chasing “easy money” online.

Yes, instant-loan apps can be legitimate, but the difference lies in who is offering, they are regulated, they are asking you to pay upfront, and do you see real disbursement.

In the case of Press Money, the signs strongly point to scam risk: upfront fees, non-disbursal, and changing details.