You trust a broker because you believe they understand the markets better than you do.

A trading account is opened and hard-earned money is deposited, with assurances that brokerage charges will be minimal.

Then come the projections—large, attention-grabbing projections—showing ₹50,000 turning into ₹8,40,000 in just three months.

It sounds ambitious. But when someone speaks confidently and claims experience, it’s easy to believe.

Now imagine this: after paying service fees, registration charges, and adding additional funds as advised, your capital is suddenly wiped out within days.

The same person who promised high returns now asks you to add more money to “recover” the losses.

This article examines one such complaint involving Profitmart Securities Pvt Ltd, where concerns of alleged unauthorized trading, high service charges, and risky position execution have been raised by an investor.

Let’s look at what the complaint says, and more importantly, what investors should understand from it.

Profitmart Securities Unauthorised Trading Claims

Profitmart Securities Pvt Ltd presents itself as a SEBI-registered stockbroker offering trading services in equity, derivatives, commodities and other market segments.

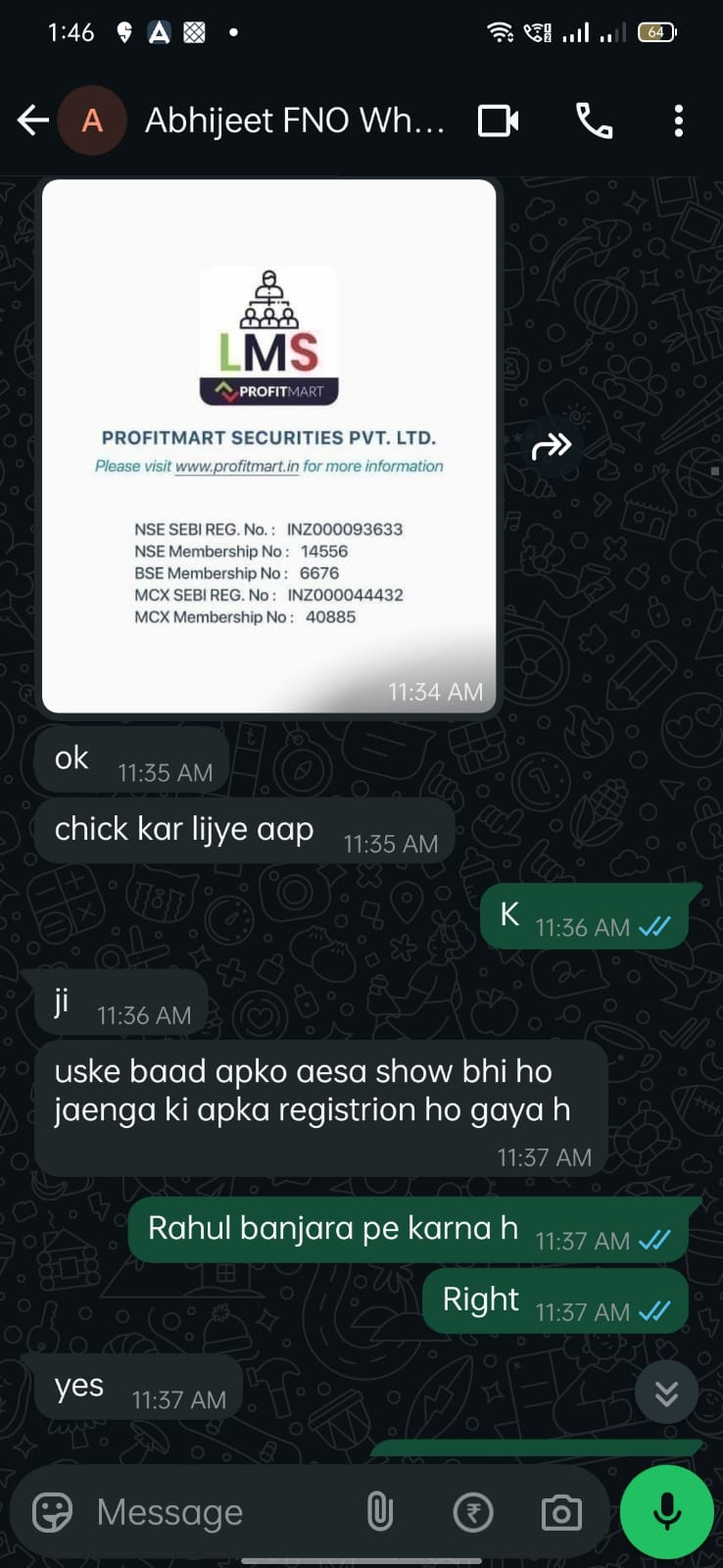

During communication with the investor, the following registration details were shared:

- NSE SEBI Reg No: INZ000093633

- NSE Membership No: 14556

- BSE Membership No: 6676

- MCX Membership No: 40885

These numbers indicate that the company operates as a registered intermediary. Investors can independently verify such details on SEBI and exchange websites.

This image shows the company name along with its SEBI registration and exchange membership numbers. Investors need to verify such details independently before investing.

What Should a SEBI-Registered Broker Do?

A registered stockbroker is expected to:

- Execute trades only with proper client authorisation

- Clearly explain risks, especially in derivatives (F&O)

- Disclose margin requirements

- Maintain a transparent brokerage structure

- Avoid mis-selling or unrealistic return promises

- Collect payments through official and documented channels

In simple words, transparency and consent are not optional. They are mandatory.

Unauthorised Trading?

Unauthorised trading may involve:

- Trades placed without clear consent

- Larger quantities executed than instructed

- Risk exposure not explained

- Excessive trading to generate brokerage (churning in Stock market)

- Misuse of dealer access

It is not about whether a profit or a loss occurred. It is about whether the client understood and approved the trade.

Profitmart Securities Unauthorised Trading Complaint

Understanding the details of this complaint helps investors recognise potential warning signs and regulatory issues.

The Investment Offer: ₹50,000 to ₹8,40,000 in 3 Months

According to the complaint, the investor was contacted in July 2025, and the broker told them that ₹50,000 could be converted into ₹8,40,000 within three months.

A 22% service fee was charged on the expected return, amounting to ₹1,84,000, with ₹37,000 demanded upfront.

The investor states that he ultimately paid:

- ₹47,000 as service charges

- ₹5,000 as registration fee

Here’s where regulatory questions begin.

Under SEBI norms:

- Brokers cannot guarantee or assure fixed returns.

- Percentage-based profit commitments tied to projected returns are considered misleading if presented as certain.

- Risk disclosure must accompany any performance projection.

Markets can move in any direction. No registered intermediary is permitted to assure specific profit multiplication.

How the Payments Were Collected

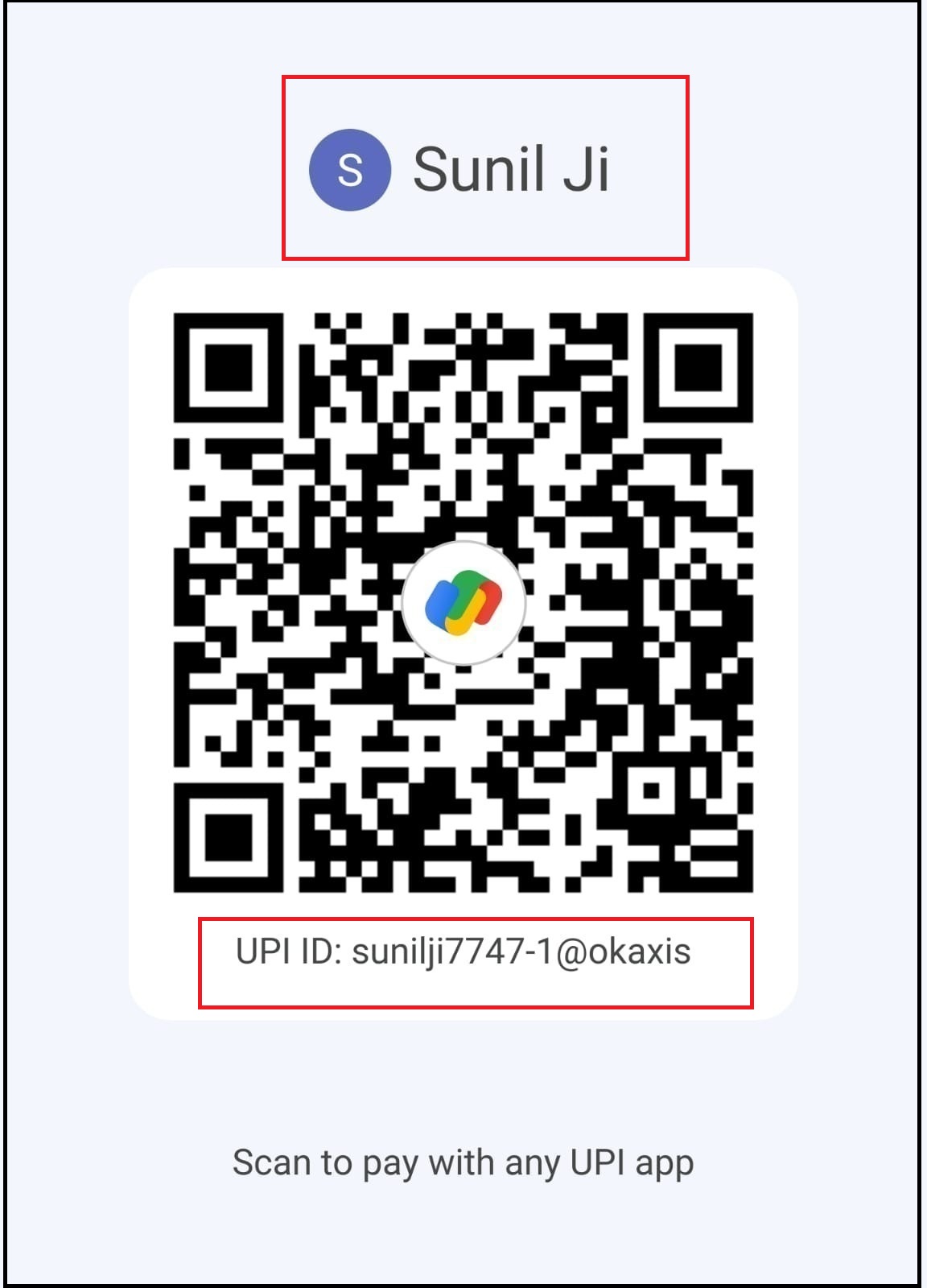

The complaint states that service charges and registration amounts were collected via UPI transfers.

Let’s look at what was shared.

This screenshot shows a QR code with the name “Sunil Ji” and a personal UPI ID.

In simple terms, the payment appears to have been made to an individual account rather than a clearly labelled corporate bank account.

Now here’s what SEBI compliance generally expects:

- Client payments should be routed through official company bank accounts.

- Proper invoices or documented fee structures should exist.

- Payment trails must be transparent and auditable.

When financial service fees are collected through personal UPI handles, it raises documentation and accounting questions.

This does not automatically prove wrongdoing, but it demands clarity.

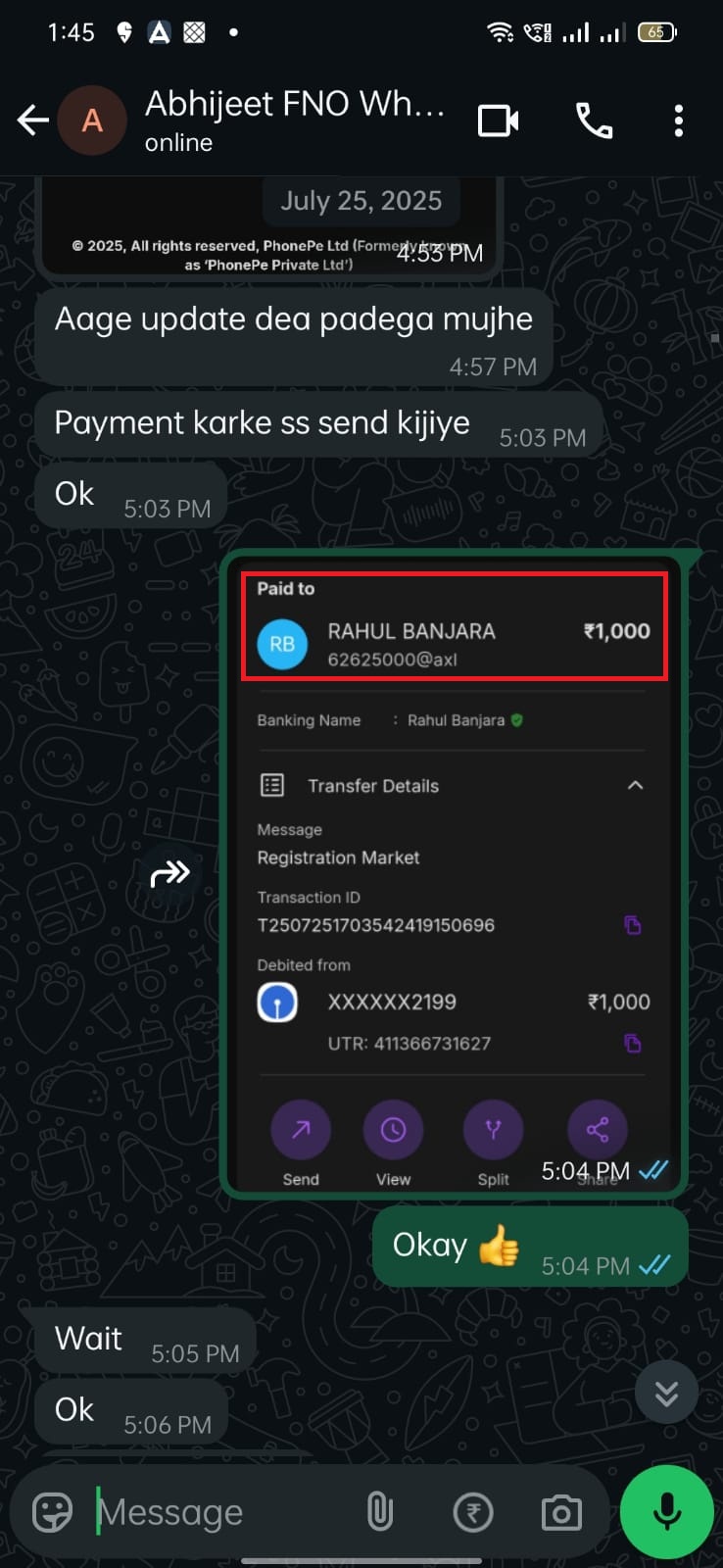

This image shows a transfer made to “Rahul Banjara” through UPI. The message field reads “Registration Market.”

From a compliance perspective, investors should ask:

- Was an official invoice issued?

- Was this amount reflected in a formal brokerage ledger?

- Was the charge disclosed in writing before payment?

SEBI’s fair practice principles require clarity in fee disclosure. Ambiguous charges labelled informally can create confusion.

Hence, transparency is mandatory, not optional.

The Trades That Followed

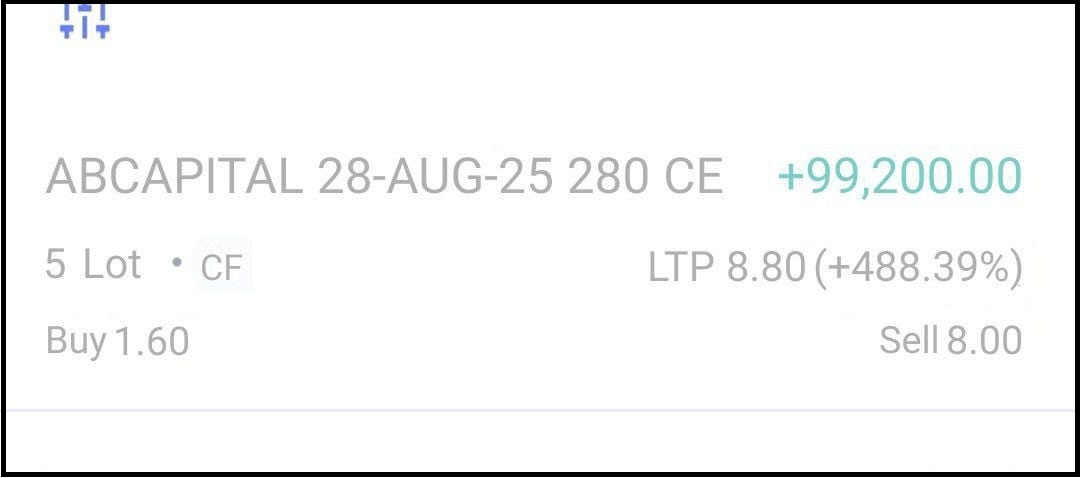

After the payments and deposit of ₹30,000 into the trading account, the complaint alleges that high-risk trades were executed.

The investor states that he instructed limited quantity trading (1–2 lots). However, larger positions were allegedly taken.

This screenshot shows an options contract: ABCAPITAL 28-AUG-25 280 CE, with 5 lots visible.

For readers unfamiliar with derivatives:

Each “lot” represents a fixed number of shares. Increasing the lot size significantly increases risk exposure and margin requirement.

If a client instructs 1–2 lots but 5 lots are executed, that materially increases financial risk.

Under SEBI regulations:

- Brokers must act based on client instructions.

- Trade quantity and product suitability must align with client consent and risk profile.

- Excessive trading to generate brokerage (called churning) is prohibited.

The complaint further states that three trades resulted in losses of approximately ₹33,000, ₹67,000 and ₹55,000; wiping out the capital.

Loss itself is not proof of violation. But loss, combined with the alleged absence of consent and risk disclosure, raises regulatory questions.

Additional Recovery Demand

After the losses, the investor alleges that additional funds of ₹1–2 lakh were requested to “recover” the losses.

This is where investors must be cautious.

SEBI guidelines prohibit:

- Misleading inducement

- Pressure-based deposit escalation

- Assured recovery strategies presented as certainty

Markets do not guarantee recovery through additional deposits.

What To Do In Such Cases?

If you suspect unauthorised trading or improper conduct in your trading account, the first step is not panic; it is documentation.

Market losses can happen. Volatility is part of trading. But if trades were executed without clear consent, or risk was not properly explained, you must act carefully and promptly.

Here is what investors should do:

1. Download All Contract Notes

Every executed trade generates a contract note sent to your registered email. Download all contract notes immediately and review:

- Trade date and time

- Quantity executed

- Order type

- Brokerage charged

Contract notes are official exchange records. They are critical evidence in any dispute.

2. Review Margin and Ledger Statements

Download your:

- Margin statement

- Ledger summary

- Daily transaction report

Examine whether there was:

- A sudden increase in lot size

- High turnover within a short period

- Brokerage that appears disproportionate to capital

Under regulatory norms, brokers must maintain transparent records of margin usage and brokerage. If exposure taken in your account appears higher than what you understood or authorised, it requires clarification.

3. Preserve All Communication

Retain all supporting material, including:

- WhatsApp conversations

- Call recordings

- Payment confirmations

- UPI receipts

- Screenshots of trade positions

4. File a Written Complaint With the Broker

Before escalating the matter to regulators, submit a formal written complaint to the broker’s designated grievance officer.

Clearly state:

- Which trades you dispute

- Whether quantity exceeded your instruction

- Whether risk was explained

- Concerns regarding payment collection

Request the following:

- Order logs

- Dealer ID used

- IP address records

- Proof of recorded authorisation

Under regulatory standards, brokers must be able to demonstrate client consent for executed trades.

How To File a SEBI Complaint Against a Stockbroker?

If your written complaint to the broker does not resolve the issue, the next step is to escalate it formally through regulatory channels.

Here is the structured process.

Step 1: File an Internal Complaint First

Before approaching SEBI, you must raise a written complaint with the broker’s official grievance redressal officer.

Mention clearly:

- Unauthosired trades

- Quantity mismatch (if applicable)

- Lack of risk disclosure

- Concerns regarding service fees or payment collection

- Dates and transaction references

Brokers need to respond within a specified timeframe. Keep a copy of your complaint email and their response.

Step 2: Register a Complaint on SEBI SCORES

If the response is unsatisfactory or not received, you can escalate the matter on the SEBI SCORES (SEBI Complaints Redress System) portal.

On the portal, you will need to:

- Select the broker category

- Enter broker name and registration number

- Clearly describe the issue in chronological order

Attach supporting documents, such as:

- Contract notes

- Ledger statement

- Margin statement

- Payment receipts

- Communication screenshots

- Copy of your internal complaint

SEBI examines compliance violations based on documentation. A structured and factual complaint improves clarity.

Step 3: Approach the Exchange Grievance Cell

If the matter remains unresolved, you may escalate the complaint at BSE or NSE in grievance redressal mechanism.

The exchange may:

- Seek clarification from the broker

- Review trade logs

- Examine whether proper authorisation was recorded

In some cases, disputes may proceed to arbitration through exchange mechanisms.

Step 4: Filling Arbitration in Stock Exchange (If Required)

If regulatory escalation does not resolve the issue, arbitration through the exchange framework may be an option.

Arbitration examines:

- Whether trades were authorised

- Whether brokerage and margin norms were followed

- Whether documentation supports the claim

This process is more formal and may require detailed evidence.

Need Help?

If you are facing similar concerns with your stockbroker, you do not have to navigate the process alone.

Many investors feel confused about whether their case qualifies as unauthorised trading, mis-selling, or simply market loss. The difference matters, especially when preparing a regulatory complaint.

We help investors:

- Understand their available options

- Organise documentation properly

- Structure complaints in a clear, chronological manner

- Identify relevant regulatory provisions

- Prepare submissions for brokers, exchanges, or SEBI

If you believe your case involves improper trading activity, lack of consent, or questionable fee practices, register with us for guidance on the next steps.

Conclusion

In the fast-paced world of Indian stock markets, the line between aggressive advisory and professional misconduct can sometimes blur.

Allegation of unauthorised trading risk are among the most serious charges a broker can face, as they strike at the heart of investor trust.

SEBI registration confirms that a firm is legally authorized to operate. But that license is not a shield against the mandatory responsibilities of obtaining explicit client consent and maintaining absolute transparency in fee structures.

In this specific case, the complaints regarding projected “guaranteed” returns and payments collected through individual UPI accounts, rather than official corporate clearing channels, raise significant red flags.

Executing higher-risk positions without a documented “Opt-In” from the client is a direct violation of regulatory standards.

Whether these incidents constitute a definitive breach of law depends on a forensic review of the digital trail.