Prop trading has become a buzzword among Indian traders over the last few years. The idea sounds attractive: trade with a firm’s capital, keep most of the profits, and limit personal risk.

Social media ads, Telegram channels, and YouTube videos often portray prop trading as a shortcut to professional trading.

This popularity has also created space for misuse. Several operators now use the prop trading label to run unregulated money-collection schemes, targeting traders who are eager to scale quickly but lack regulatory awareness.

Understanding how these frauds work is the first step toward avoiding them.

What a Prop Trading Frauds Looks Like?

A prop trading fraud is not always obvious. It rarely looks like a “scam” at the start.

Typically, a platform or group claims to offer funded trading accounts.

Traders are asked to pay an evaluation fee or deposit. They are shown dashboards, profit numbers, and rulebooks that appear professional.

The real problem emerges when traders try to withdraw money or question how funds are actually being managed.

How do these Frauds usually Operate Step by Step?

Most prop trading frauds follow a predictable pattern.

First, traders are recruited through Instagram ads, WhatsApp groups, Telegram channels, or local “trading mentors.” The messaging focuses on high-leverage, funded accounts, and the idea that traders can earn without risking much.

Next, traders are asked to pay fees. Sometimes this happens through websites. In many cases, money is collected by agents offline or routed to personal bank accounts.

Once inside, traders receive access to a trading dashboard. Profits may appear initially, creating confidence. This phase is critical because it lowers suspicion.

Trouble starts when withdrawals are requested. Excuses follow rule violations, verification delays, tax deductions, or demands for additional payments. Eventually, communication slows or stops, platforms go offline, or offices shut down.

By the time traders realize something is wrong, there is often no contract, no regulator, and no clear entity to pursue.

Prop Trading Frauds Real Cases

Real incidents from India show how prop trading frauds operate in practice and the real-world consequences for traders.

The ₹150-Crore Prop Trading Scam

One of the clearest examples of prop trading misuse in India involved an unregulated operation that reportedly caused losses of around ₹150 crore. The operation had offices, agents, and what appeared to be professional trading infrastructure.

Traders from multiple cities were recruited and asked to deposit money in exchange for access to funded accounts and high leverage.

What later emerged was that the setup had no proper regulatory registration, no transparent trading linkage, and no enforceable agreements.

When traders attempted withdrawals, systems stopped responding, and payouts were denied. Many victims were left without documentation or clarity on where their money went.

This case showed how easily the appearance of institutional trading can be manufactured to gain trust.

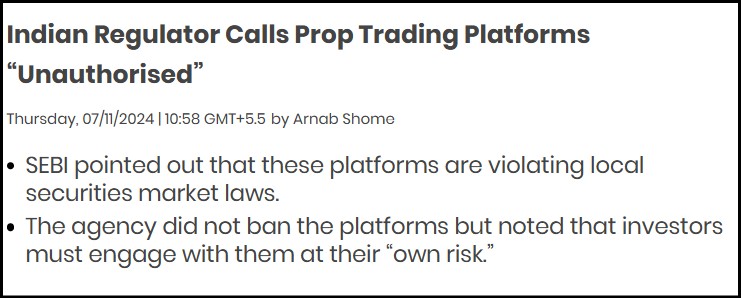

SEBI’s Warning on Unauthorized Trading Platforms

India’s market regulator has publicly cautioned that many platforms offering trading-related services operate without authorization or registration.

While these warnings are not specific bans, they make one thing clear: if a platform is not registered with SEBI or connected to a regulated broker, users participate entirely at their own risk.

This regulatory stance matters because most retail-facing prop trading firms in India do not fall under SEBI supervision. That means there are no guaranteed safeguards for dispute resolution or fund protection.

Trading Dashboard Scams Using Fake Profits

Separate from formal “prop trading” labels, Indian media have reported multiple cases where traders were shown fake profits on manipulated dashboards. Victims believed they were trading successfully, only to find withdrawals blocked later.

These cases share the same mechanics used by prop trading frauds: fake interfaces, psychological trust-building, and withdrawal obstruction.

How to Identify a Prop Trading Frauds Early?

Before committing any money, it’s critical to recognize the common red flags that repeatedly appear in prop trading scams.

These warning signs often surface early, but understanding how trading frauds work is the only way to spot them before your capital is at risk.

1. Lack of Proper KYC and Documentation

Certain warning signs repeat across many prop trading scams. If a firm avoids proper KYC but quickly asks for money, that is a major red flag.

Legitimate firms verify identity and provide clear documentation before handling any funds.

2. No Written Contract or Unclear Withdrawal Rules

Another warning sign is the absence of a written contract or vague withdrawal terms. If payout rules suddenly change when you request a withdrawal, it usually indicates manipulation rather than a genuine operational issue.

3. Guaranteed Profits and Pressure Tactics

Guaranteed profit claims or aggressive pressure to upgrade accounts are common tactics used to push users into depositing more money. Real trading firms never promise fixed or assured returns.

4. Untraceable or Informal Payment Methods

Be cautious if payments are collected through cash, personal bank accounts, or informal agents. Legitimate trading firms rely on transparent, traceable banking channels for all transactions.

5. Repeated Online Complaints and Account Freezing

If online searches reveal repeated complaints about blocked withdrawals or frozen accounts, take them seriously. Genuine trading businesses do not depend on secrecy, urgency, or unrealistic promises.

How to Stay Safe Before Joining Any Prop Trading?

Before joining any prop trading platform, you must prioritize due diligence.

Always verify the entity’s history, check for physical registration details, and confirm whether they are linked to a regulated broker or exchange.

However, for Indian investors, the first question to resolve is: is Prop Trading legal in India?

The answer is complex. In India, proprietary trading is perfectly legal for established financial institutions that use their own capital.

However, the “evaluation-based” model popular with retail traders, where you pay a fee to access a “funded account” on international platforms, exists in a regulatory grey zone.

Under RBI’s 2026 guidelines and FEMA rules, sending money abroad to trade non-INR currency pairs or to fund speculative offshore accounts can lead to severe legal penalties.

Remember that as an Indian resident, trading global pairs like EUR/USD through offshore platforms is restricted. Legal prop trading in India is typically restricted to SEBI-authorized exchanges and INR-based pairs.

How to Report Trading Frauds?

If you suspect a prop trading fraud, acting quickly is crucial. Timely action can limit losses, preserve evidence, and improve the chances of recovery.

1. Stop All Payments Immediately

If you suspect a prop trading fraud, stop sending money immediately. Do not make additional deposits, upgrades, or “recovery” payments under any circumstances.

2. Preserve All Evidence

Preserve all available evidence, including payment records, chat histories, emails, screenshots, call logs, and platform details. Proper documentation strengthens your complaint and helps investigators act faster.

3. Inform Your Bank Without Delay

Notify your bank about the suspicious transactions as soon as possible. Banks may be able to flag accounts, block further debits, or initiate internal reviews if the report is made early.

4. Report the Fraud Cyber Crime Authorities

File a complaint on the National Cyber Crime Reporting Portal and approach your local cybercrime cell or police station with complete documentation. Early reporting improves the likelihood of formal action.

Need Help?

If you have lost money through a prop trading scheme or are facing blocked withdrawals with no response, structured guidance can help.

We assist affected individuals by helping organize evidence, guiding complaint filing, and supporting escalation through proper legal channels.

Register with us. Taking informed steps early makes a real difference.

Conclusion

Prop trading frauds thrive in grey areas where regulation is unclear, and traders rely on promises rather than verification. Real cases in India show that professional branding, offices, and dashboards do not guarantee legitimacy.

For Indian traders, the safest approach is awareness. Understanding how these schemes operate, recognizing warning signs early, and knowing how to act when problems arise can prevent serious financial and emotional harm.

In trading, caution is not a weakness; it is a skill.