Opening a demat account and being bombarded with calls offering advisory services? This is a common scenario for many new traders. In their eagerness to seek proper guidance, many end up availing of such services without a thorough understanding of the regulations.

Something similar happened to Harsh (name changed), who lost his hard-earned money in one such scam.

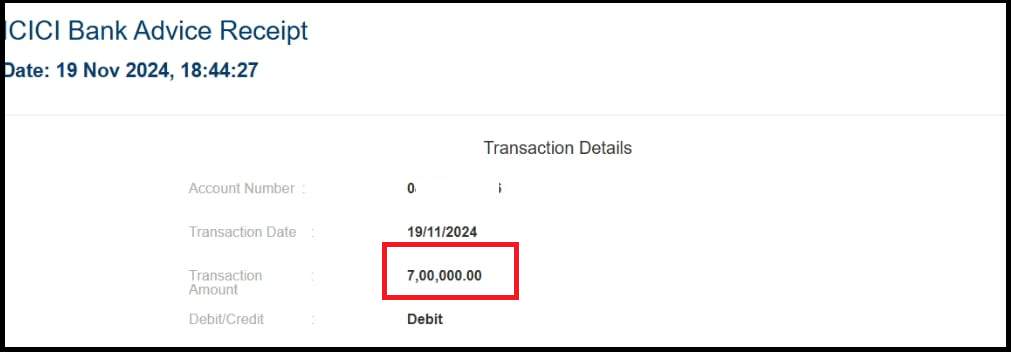

Our team carefully analyzed his case and successfully helped him recover ₹7,00,000. Continue reading to learn how the scam unfolded and how we assisted Harsh in getting his refund.

It Started With Just One Call

“Hello Sir, are you looking forward to guidance on trading in the stock market?”

“Yes, Yes! Please guide me on how to get started?”

“We are a SEBI-registered RA and provide you with trading tips and calls that would help you in making trade decisions. Here are our package details with various benefits.”

Many beginner traders often come across such calls and, with no understanding of market regulations and trading strategies, fall for it, paying hefty fees to such RAs.

Such vulnerabilities of traders become an opportunity for Research Advisors who easily manipulate them to pay heavy fees, account handling in stock market, or profit sharing.

Recently, we came across one case of a victim, Harsh (name changed), who lost around ₹21 lakh in a similar scam. Here is how our team helped him later to get a recovery of ₹7 lakh.

How Harsh Got Trapped in RA’s Fake Offers?

Two years back, Harsh came across trading services through a SEBI-registered RA to avail of the trading services. He offered these services through a platform known as BESTSTOCK Advisor.

Harsh availed their services, and he was directed to a WhatsApp group where daily calls for trading were shared. Based on the recommendations of those calls, he took traders, but he noticed that he faced a loss of 5-6 lakhs in total.

He then received a call from the Advisor’s executive, who convinced him to buy their platinum package worth Rs. 5.75 lakhs. Harsh was already falling losses, so he showed reluctance in buying the package.

But the executive convinced him by saying that initially, he could pay only Rs. 50,000 and assured him a return of ₹1.5 -2.5 lakhs. Harsh found it a good offer and paid ₹ 50,000.

Following the first tip post, he made a profit of around ₹2,000. Immediately after that, he started receiving calls from the company pressuring him to pay the full fees of the plan.

Under pressure, he made the full payment for the package.

To his shock, his package was now auto-upgraded to 25 lakhs without his consent, and he again started receiving calls for the payment. Harsh was now offered a discount of 15 lakhs and was asked to pay 4 lakhs to upgrade his services. Again, he made the payment.

A few days later, the company denied giving the discount and asked him to pay the complete package fees as well as the GST amount. Harsh almost paid 21.50 lakhs to the company.

After payment of the amount, he was not in a situation to pay anymore, and the company said that they would upgrade his account to a 15.75 lakhs package, and he does not need to pay any more amount now.

To his surprise, they again asked him to pay 18% GST on this package. This was the time he realized that he was getting scammed and decided to file a complaint against stock advisory to recover his lost money.

He reached out to the Advisor through calls, emails, etc, but got no response.

How Our Team Helped in Recovering ₹7 Lakh?

After 2 years of the case, when he had almost lost hope of getting his lost amount back, he came across one of the videos on A Digital Blogger. He immediately entered his details on the website.

Our team contacted him and, after understanding the severity of the case, helped him register a complaint with the regulatory body.

However, initially, the RA denied the allegations against Harsh and claimed they were false. However, when our team further escalated the case to higher authorities and other platformers, RA contacted Harsh and agreed to pay ₹14 Lakh in a few installments.

To date, Harsh has successfully received ₹7,00,000 in his account, with the remaining amount expected soon.

What Red Flags Did Harsh Ignore?

Every scam gives warnings before it happens. However, the lack of knowledge or proper validation led victims like Harsh to get trapped in it easily.

Here are some of the red flags that Harsh ignored in his case:

- Offering unrealistic returns of 1.5 to 2.5 lakhs from an investment of 50,000.

- Offering high-value packages for making quick returns.

- Auto-upgrading the packages without the consent of the investor.

- Offering huge discounts on packages.

- Pressure to act quickly to avail of the offer

Conclusion

Harsh’s story is a lesson not to fall trapped in trading services packages. Be skeptical about any false promises of assured returns.

Refrain from too-good-to-be-true schemes offering extensive discounts for availing trading services.

In case you have also fallen victim to any such scam and need assistance with your case, provide your contact details in the form below, and our team will contact you for help.