In the Indian stock market, grand promises are often more common than genuine profits. “Guaranteed returns,” “sure-shot tips,” and self-proclaimed “SEBI-registered experts” flood your screen daily, all claiming they can double your money with ease. If you’ve ever paused, felt tempted, or even taken the bait, this story is meant for you.

Today, we’re pulling back the curtain on a landmark arbitration in a stock market case that every retail trader should know about. It’s not just another legal file buried in paperwork; it’s a powerful reminder that investors are not as helpless as they are made to believe. This case exposes how misleading assurances can crumble under scrutiny and how accountability can finally catch up with unethical advisors.

More importantly, this isn’t just about winning a dispute. It’s about reclaiming confidence in a market where trust is often exploited. This case stands as a clear message to shady operators and a ray of hope for investors who feel wronged. Consider it a real-world playbook for standing your ground, asking the right questions, and fighting back when the system is misused.

So, if you’ve ever wondered whether it’s possible to challenge false promises and come out stronger on the other side, keep reading, because this recovery from Capital Craft Research case proves that it absolutely is.

When Capital Craft Research Promised ₹2,00,000 Monthly Returns

What began as a promising investment journey quickly turned into a cautionary tale for a retail investor in Bihar.

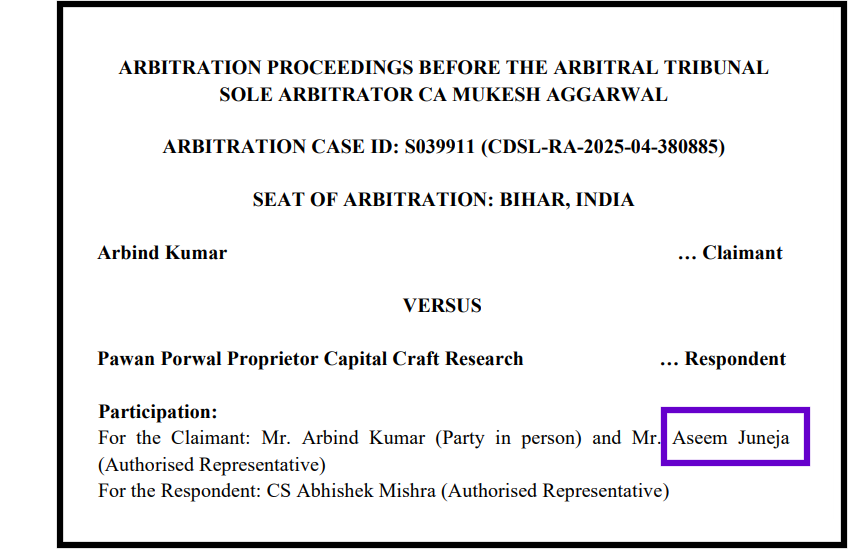

The dispute unfolded before an Arbitral Tribunal presided over by Sole Arbitrator CA Mukesh Aggarwal.

At the heart of the case was Arbind Kumar, a retail investor who was contacted by a representative of recovery from Capital Craft Research, a SEBI-registered Research Analyst firm. The pitch sounded almost too good to ignore. The representative allegedly promised profits of ₹10,000 every single day and a whopping ₹2,00,000 in monthly returns.

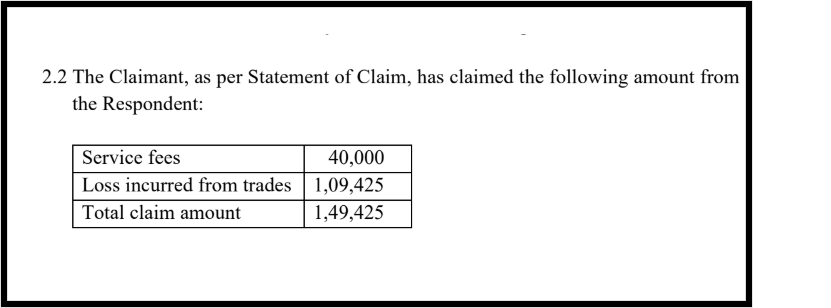

Like many first-time investors, Arbind took comfort in one powerful phrase: “SEBI-registered.” Trusting that this tag guaranteed credibility and protection, he paid a service fee of ₹40,000 between November and December 2024 and began trading based on the firm’s recommendations.

What followed was nothing short of disastrous. Instead of steady profits, the so-called “expert advice” pushed Arbind into a string of damaging trades. In a matter of weeks, his capital eroded, leaving him staring at losses totaling ₹1,09,625.

The promised returns never came. The confidence he had placed in the research advice vanished just as quickly.

Realizing that the assurances were hollow, Arbind stopped trading and decided not to suffer in silence. He approached us and we guided him to register a complaint on the SMART ODR Platform seeking redressal, where we represented him in pursuing justice against the Respondent.

The case serves as a stark reminder that flashy profit promises, even when backed by a “registered” label, should always be questioned, and that investors do have a forum to fight back when trust is misplaced.

Violations Done by Capital Craft Research

The Tribunal pulled no punches in its findings. It held that the Respondent, despite being a SEBI-registered Research Analyst, fell seriously short of the standards expected under the SEBI (Research Analysts) Regulations, 2014.

- False Assurance of Guaranteed Returns: The most glaring violation? Guaranteed returns. The Respondent boldly promised eye-catching profits, ₹10,000 every single day and a whopping ₹2,00,000 per month. The Arbitrator was crystal clear: these were “false assurances of guaranteed returns”, something strictly forbidden for any Research Analyst.

- Failure to Act as an Unbiased Advisor: SEBI regulations require Research Analysts to act as objective, unbiased professionals, offering advice backed by research and market realities. However, the Tribunal found that the Respondent failed to deliver services in the manner envisaged by SEBI. Instead of an informed analysis, the approach appeared more promotional than professional.

- Misleading Conduct: While the Respondent claimed to comply with all rules and provided disclaimers about market risks, the Arbitrator found these defenses insufficient given the specific promises of profit made to the Claimant.

When We Represented Victim’s Case in Arbitration?

As the Authorised Representative for the Claimant, we didn’t just participate in the arbitration; we steered it strategically from start to finish, navigating every procedural and legal twist to ultimately secure an award of ₹1,20,061 in the Claimant’s favour.

Here’s how we made the difference:

1. Turning Evidence into Impact

We helped the Claimant build a compelling and well-structured evidence trail, from WhatsApp conversations and detailed trade records to crucial email exchanges.

These weren’t just documents; they were clear contradictions to the Respondent’s claim that no “guaranteed profits” were ever promised.

The Respondent argued that the WhatsApp chats were “selective and unclear”. Our representative helped present a robust trail of WhatsApp logs, emails, and trade details that clearly showed the regulatory violations.

2. Regulatory Advocacy

During the oral hearings on July 28 and August 6, 2025, we anchored our arguments firmly in the SEBI (Research Analysts) Regulations.

By breaking down how the advisor’s conduct crossed legal boundaries, we ensured the Tribunal clearly understood where and how the law was breached.

3. Countering Defense Arguments

When the Respondent tried to dilute the case, calling the evidence “selective,” “unclear,” or technically defective due to the absence of a Section 65B certificate, we cut through the noise.

Our focus remained on the core substance of the misconduct, ensuring technical objections didn’t overshadow the truth.

4. Strategic Guidance

From filing the Statement of Claim (SOC) within strict timelines to navigating the journey from conciliation to final arbitration on the SMART ODR Platform, we stood shoulder-to-shoulder with the Claimant, who also appeared in person, providing constant legal and strategic support.

We carefully handled the “heavy lifting” of the legal arguments, communications with the arbitrator, and arguing points with proof to demonstrate that the respondent had violated regulations by promising guaranteed returns.

This professional representation ensured that the claimant, who was also present as a party in person, had a structured and effective presentation of their case, which is vital for navigating the formal arbitration process.

Final Order and Penalty

What Traders Can Learn from This Case?

- Always ensure you are dealing with a genuinely SEBI-registered research analyst and verify their registration number on the official SEBI website.

- Be extremely cautious of any advisor or analyst promising “sure-shot” or “100% profit” returns, as this is a direct violation of SEBI norms.

- Carefully review all terms and conditions, disclosures, and risk assessments before making any payments or acting on advice.

- Always pay through traceable banking channels and keep records of all communications, agreements, and payment receipts.

- If an RA offers guaranteed returns, you should inform SEBI about the misconduct.

Have you ever encountered a situation with an advisor promising guaranteed profits, and would you like to know how to officially file a complaint with SEBI? You can register with us, and we can help you, too.