In the fast-moving world of stock market investing, the difference between “expert advice” and “subtle inducement” can be razor-thin. And when that line gets crossed, investors are often left wondering: Was I misled? And if yes, what can I do about it?

Until recently, seeking justice against a registered market professional felt intimidating, with complex procedures, long timelines, and unequal power dynamics. But that’s changing. With SEBI’s Online Dispute Resolution (ODR) mechanism, investors now have a clearer, faster, and far more accessible path to accountability.

In a recent high-stakes conciliation matter, our team stepped in as the Authorised Representative for an investor locked in a dispute with a SEBI-registered Research Analyst (RA).

What followed was a compelling example of how the right strategy, sharp legal understanding, and investor-centric representation can truly shift the balance.

In this blog, we take you inside the case, breaking down what went wrong, how the ODR process unfolded, and most importantly, how informed representation can turn the tide in the investor’s favour.

Arbitration Filed Against White Horse Research

In June 2023, Mr. Rahul Shindhe, a retail investor, signed up for research services offered by Somnath Dey, the proprietor of White Horse Research. Trusting the expertise on offer, Mr. Shindhe paid a hefty subscription fee of ₹1.80 lakh, hoping it would guide him toward profitable trades.

However, the story took a sharp turn over the next three months. Acting on the Research Analyst’s recommendations, Mr. Shindhe actively traded in the Futures & Options (F&O) segment, only to watch his capital steadily erode. Instead of gains, he was left grappling with significant and painful losses.

With frustration mounting, the matter was taken up as a file case in the SMART ODR Portal, an online dispute resolution mechanism introduced under a SEBI Master Circular to ensure faster and more transparent resolution of investor grievances. What followed was a digital conciliation process aimed at untangling responsibility, accountability, and the fine line between research advice and risky trading outcomes.

This case serves as a stark reminder that in the high-stakes world of F&O trading, even paid “expert” advice can come with unexpected consequences.

How White Horse Research Misleading Advice Led to Loss of ₹9 Lakh?

Mr. Shindhe’s story reads like a cautionary tale many investors can relate to.

According to him, the journey began with bold promises. The Research Analyst (RA) allegedly lured him into the high-risk F&O (Futures and Options) segment by showcasing eye-catching profit demonstrations and painting a picture of “assured, lucrative returns.” Trusting these claims, Mr. Shindhe decided to invest—expecting expertise, strategy, and professional hand-holding.

But once the money was in, the guidance he expected never really showed up.

Despite paying a premium fee, Mr. Shindhe claimed he was left without the basics of responsible trading. There were no stop-loss levels, no clear target prices, and no structured risk management, critical elements for anyone trading in the volatile F&O market. The result? A painful loss of ₹7.50 lakh.

Feeling misled and short-changed, Mr Shindhe didn’t just count his trading losses. He also factored in the fees paid for the service that, according to him, failed to deliver. Putting it all together, he sought a total recovery of ₹9.30 lakh, covering both his financial losses and the cost of the advisory services.

In essence, his complaint boils down to this: big promises upfront, little professional support afterwards, and a heavy price paid by the investor.

How We Assisted Victim in Reprsenting the Case?

-

Aggressively soliciting business, and

-

Assuring recovery of all losses , a promise that goes far beyond the legal scope and ethical limits of a registered Research Analyst.

By spotlighting these serious regulatory breaches, we effectively shifted the narrative away from the investor’s bookkeeping lapses and onto the RA’s professional misconduct.

Even though the Conciliator raised questions about the authenticity of the Excel sheet submitted by the applicant, our team stepped in to bridge the evidentiary gaps. We assisted in collating and presenting crucial supporting material, including verified WhatsApp logs and telephonic conversation records, ensuring that the applicant’s case remained strong and credible.

In the end, it wasn’t just about documents; it was about accountability, regulatory compliance, and investor protection. And that’s exactly where we ensured the spotlight stayed.

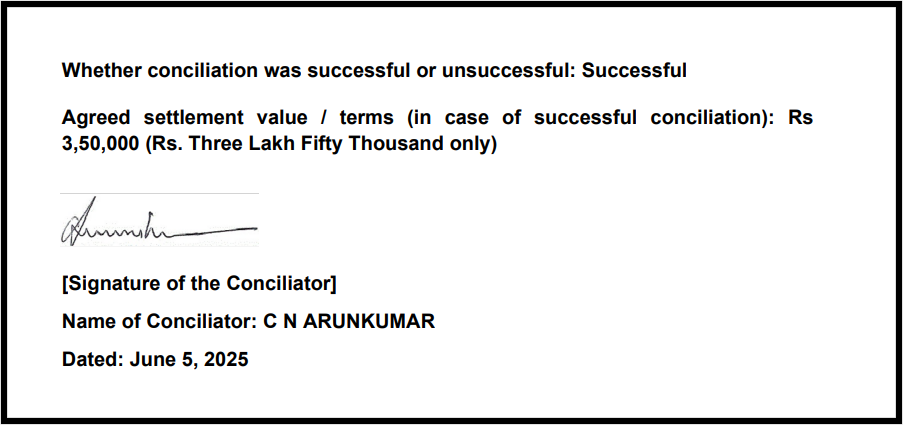

Through professional guidance and strategic presentation of the facts, we ensured that the client’s case was handled with the necessary expertise, culminating in a successful outcome and financial recovery for Mr. Shindhe. Our representation helped facilitate the “via media financial settlement” where both parties agreed to a final compromise of Rs 3.50 Lacs, thus ensuring a resolution without the need for further, potentially lengthy, legal proceedings.