Before investing ₹40,000 in a stock market course, wouldn’t you want to hear from people who’ve already taken that leap?

Ruchir Gupta User Complaints

Ruchir Gupta positions himself as a stock market educator with over 17 years of experience, running the Ruchir Gupta Training Academy.

He sells courses like the GCD Calculator (₹40,000) and GCD BSE Scanner (₹99,999), claiming to provide stock market training and predictions.

However, a closer look at user complaints reveals a troubling pattern.

Here’s what real users are saying about their experiences with Ruchir Gupta courses and services:

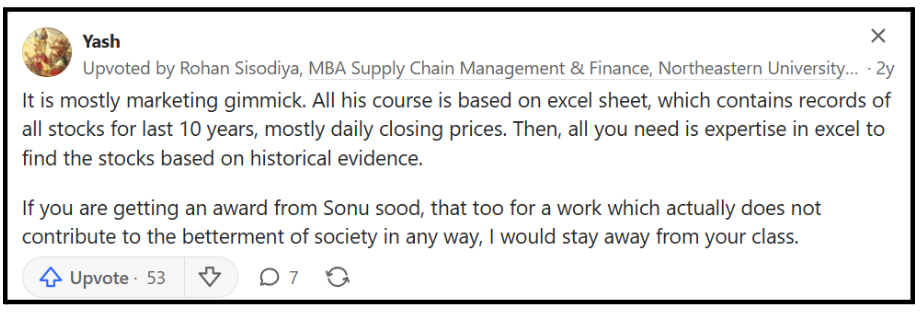

- Marketing Gimmick with Excel-Based Course

The course foundation itself appears questionable to many users.

User Yash discovered that the entire course revolves around an Excel sheet containing historical stock data from the past 10 years, mostly daily closing prices.

The “expertise” being sold is simply pattern recognition in historical data, not any proprietary method or insight.

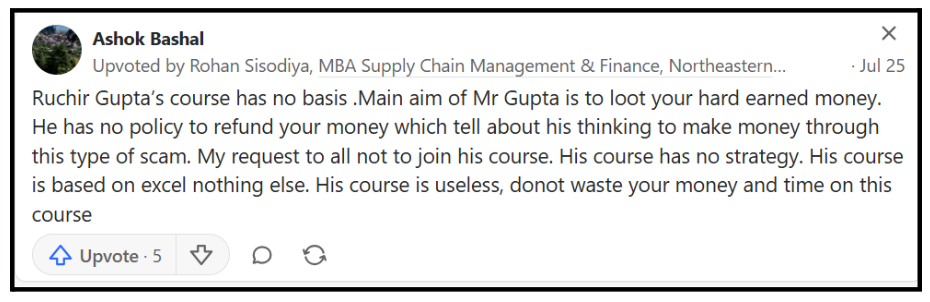

- Zero Course Value and Refund Issues

Multiple users report that the course lacks substance entirely.

Ashok Bashal faced a significant issue: Ruchir Gupta has no refund policy whatsoever, which raises concerns about his confidence in the product’s value.

Ashok warns potential buyers that the course contains no actual strategy, just Excel sheets with no practical application.

He explicitly states the course is “useless” and advises others not to waste money and time.

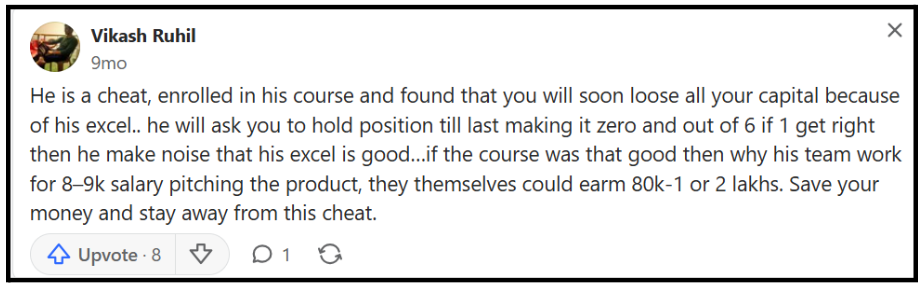

- Fraudulent Claims Leading to Capital Loss

The most serious complaints involve actual financial losses.

Vikash Ruhil enrolled in the course and experienced devastating results; he lost all his capital following Ruchir’s Excel-based recommendations.

According to him, users are asked to hold positions until they reach zero, and only 1 out of 6 predictions turns out correct.

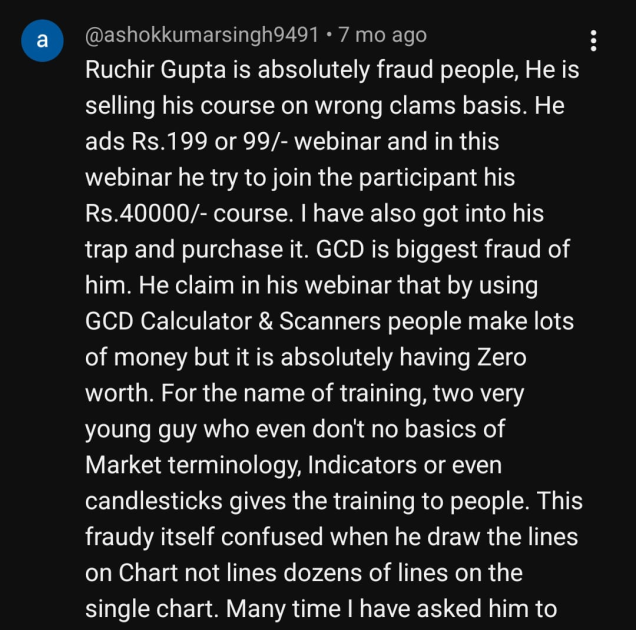

- False Promises in Webinars

A user shared his experience seven months ago, calling Ruchir Gupta “absolutely a fraud.”

He describes how Ruchir advertises webinars for ₹199 or ₹99, then uses these sessions to pressure participants into purchasing his ₹40,000 course based on false claims.

He notes that trainers conducting the sessions are “very young guys who don’t even know the basics of market terminology, indicators, or even candlesticks.”

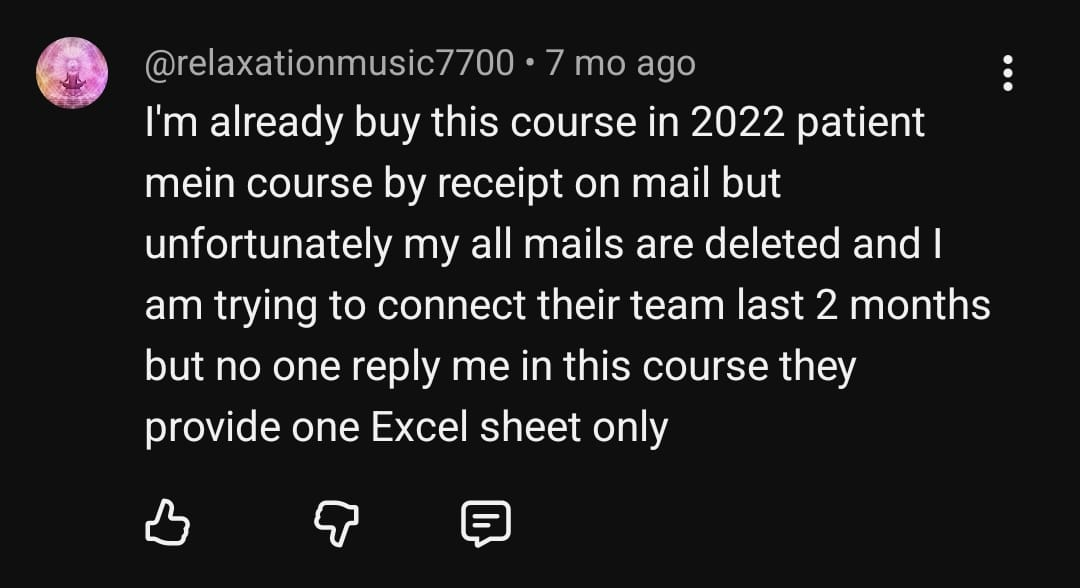

- Poor Customer Support and Accessibility Issues

Customer service appears non-existent. A user purchased the course in 2022 but lost access when their emails were deleted.

Despite attempting to contact the team for two months, they received no response.

The only deliverable they received was a single Excel sheet, nothing more.

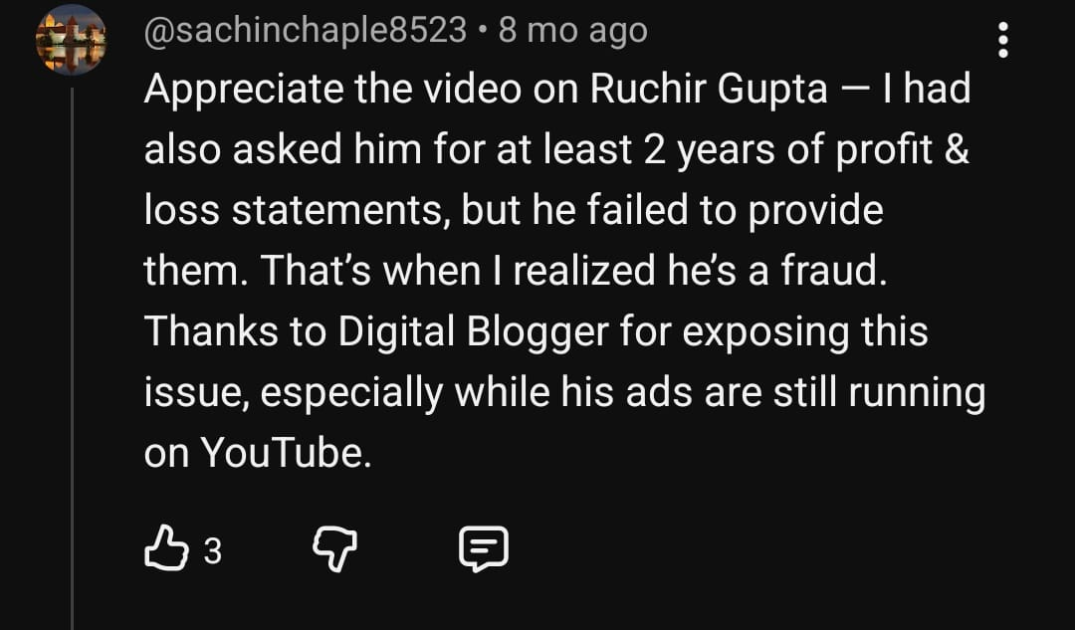

- Lack of Transparency and Proof

Sachin Chaple’s complaint highlights a critical red flag: Ruchir Gupta refuses to provide profit and loss statements.

When Sachin requested at least two years of verified trading results, Ruchir failed to provide them.

- Several Articles Cover His Violations Too

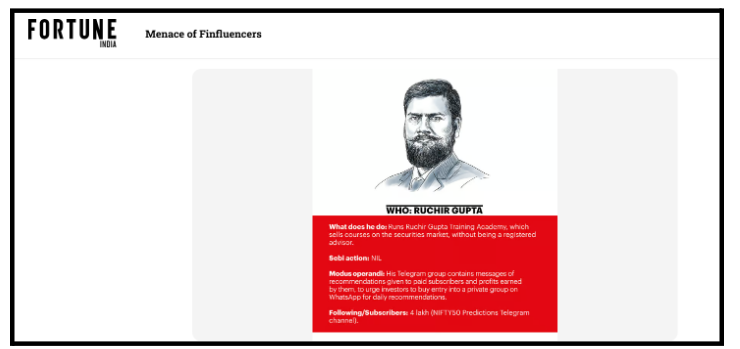

User complaints aren’t the only red flags surrounding Ruchir Gupta.

Fortune India’s investigation featured him in their “Menace of Finfluencers” report, grouping him with unregistered financial influencers who sell paid recommendations without proper SEBI licensing.

They also highlighted that his Telegram group contains messages of recommendations given to paid subscribers, urging investors to buy entry into a private group on WhatsApp for daily recommendations, all activities that require proper regulatory registration.

Violations Done by Ruchir Gupta

Based on user complaints, investigative reports, and SEBI regulatory guidelines, here are the key violations attributed to Ruchir Gupta’s operations:

- Operating Without SEBI Registration

What it means: Anyone providing paid stock recommendations must be registered with SEBI as either an Investment Adviser (IA) or Research Analyst (RA).

How Ruchir Gupta violated it: According to investigative findings, Ruchir Gupta operates without IA or RA registration while providing specific stock targets, entry/exit dates, and accuracy percentages through paid courses and Telegram groups.

- Inducement Under PFUTP Regulations

What it means: SEBI’s Prohibition of Fraudulent and Unfair Trade Practices forbids making guaranteed return claims or statements like “making money is very easy.”

How Ruchir Gupta violated it: His webinars promise “thick-cream returns,” guaranteed targets (T1, T2, T3), and claims like “God puts ideas into my mind” to emotionally manipulate participants into purchasing expensive courses.

- Making Accuracy Claims

What it means: SEBI’s RA Master Circular explicitly prohibits claiming specific accuracy percentages for stock predictions.

How Ruchir Gupta violated it: His courses and promotional materials claim 90%, 80%, and even 100% success rates for stock recommendations, claims that cannot be legally made without proper registration.

- Cherry-Picking Performance Results

What it means: Financial advisers must present complete and transparent performance data, not selectively showcase only winning trades.

How Ruchir Gupta violated it: According to investigation findings, only successful trades are highlighted on his website and Telegram channels, while losing positions are minimized or completely ignored, creating a false impression of consistent profitability.

How to File a Complaint Against Ruchir Gupta?

If you’ve purchased Ruchir Gupta’s courses and faced losses or issues, you can file complaints through:

- Register and file your complaint against unregistered advisers

- Attach all relevant evidence (payment receipts, course materials, communication records)

- Track your complaint status online

2. File a complaint in Cyber Crime

- Report online financial fraud

- Submit evidence of misleading advertisements and false claims

3. Consumer Forums

- File cases for deficiency in service

- Claim refunds for courses that don’t deliver promised value

- Present evidence of misrepresentation

Need Help?

Have you lost money following Ruchir Gupta’s recommendations? Are you struggling to get a refund? Has your complaint been ignored by his team?

We can assist you with:

- Proper documentation of your complaint for SEBI filing

- Guidance through the SCORES complaint process

- Consumer forum representation for refund claims

- Evidence compilation for legal proceedings

- Connecting you with appropriate regulatory authorities

Don’t let your hard-earned money disappear without taking action. Your complaint matters and could prevent others from facing similar losses.

Conclusion

The complaints against Ruchir Gupta reveal a consistent pattern: expensive courses with minimal value, Excel sheets with historical data presented as proprietary methods, poor customer support, and devastating financial losses for those who follow his recommendations.

What’s particularly concerning is the combination of aggressive marketing tactics, emotional manipulation in webinars, lack of SEBI registration, and complete absence of verifiable trading results.

When an educator refuses to share their own profit and loss statements, that’s a massive red flag.

The question isn’t whether Ruchir Gupta’s courses work, user experiences clearly indicate they don’t.

Before spending ₹40,000 or ₹99,999 on any stock market course, ask yourself: If someone genuinely had a method to consistently make “thick-cream returns,” would they need to sell it? Or would they simply use it themselves?