If you’ve been scrolling through the Play Store looking for a quick loan, you’ve probably come across Rupee Bazaar Loan App, one of those platforms that promise “Instant loan credit in your account”.

Sounds tempting, right?

But before you hit that Install button, it’s worth taking a closer look.

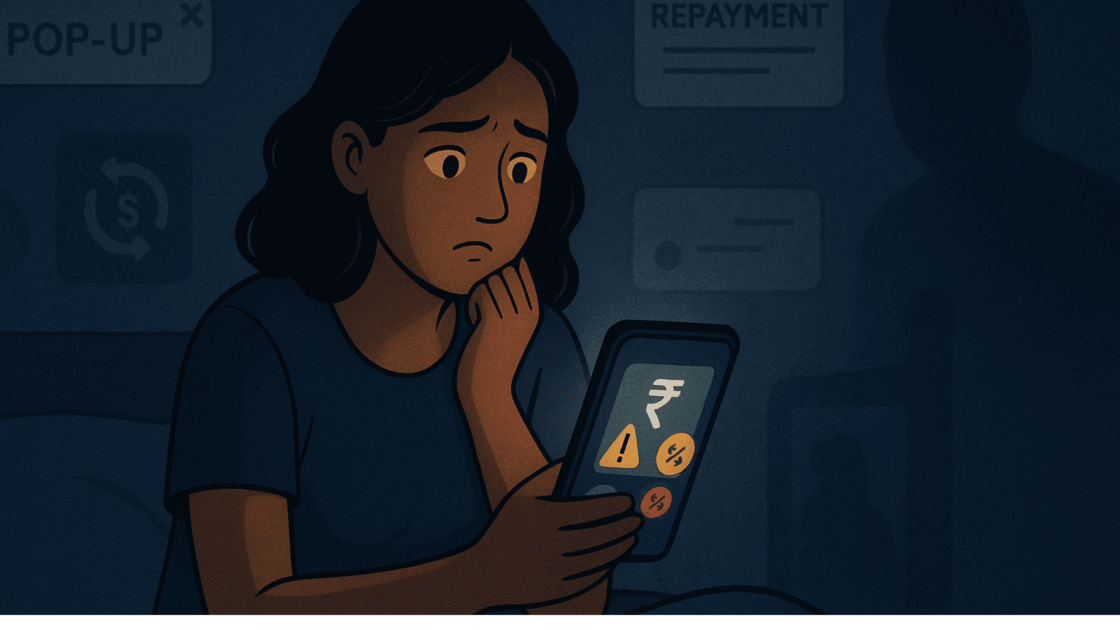

While many digital lending apps look legitimate on the surface, some have been linked to fraud, data misuse, and harassment of borrowers.

This post isn’t just about how Rupee Bazaar claims to work; it’s about helping you understand the risks behind such apps, what users have experienced, and the red flags you should watch out for before sharing your personal or financial details online.

Let’s break down what Rupee Bazaar really is, how it operates, and why caution is more important than convenience when it comes to instant-loan apps.

Rupee Bazaar Loan App Review

Rupee Bazaar was a mobile-based lending platform that offered instant personal loans to users by collecting minimal information, usually an Aadhaar card, PAN, and bank account details.

The process looked simple and enticing:

- Download the app

- Fill in your details

- Upload KYC documents

- Get money directly into your bank account within minutes

For many, especially those who faced rejection from traditional banks or needed quick funds for emergencies, this looked like a lifesaver.

But what lay hidden was a web of privacy invasion, harassment, and mental trauma for several borrowers as one tragic story revealed.

Rupee Bazaar Loan App Scam

Although at first, the app looks harmless but checking its legitimacy raises many questions.

If you get into the details, you will find that the app is neither RBI nor NBFC approved, making it risky for users.

Here, it is important to note that such apps not only steal your money but also your data and use it for multiple operations, including fraud.

Rupee Bazaar Loan App Scam- Real Case

In November 2020, The New Indian Express reported a heartbreaking story that shook many across India.

Sai Aravind, a 23-year-old IT professional from Chennai, had taken a small loan through an app called Rupee Bazaar to meet an urgent expense.

At first, everything seemed normal: instant approval, quick disbursal, and an easy repayment promise. But things took a dark turn when he couldn’t repay the amount on time.

Like many such digital lending platforms, the app had requested access to Aravind’s phone contacts, gallery, and personal information during installation, something most users accept without thinking twice.

When he defaulted, the so-called recovery agents allegedly began calling people from his contact list, creating WhatsApp groups to shame him publicly, and even using his personal photos to humiliate him.

Unable to bear the harassment, Aravind died by suicide, a tragedy that highlighted how unregulated lending apps can cross the line from financial service to psychological torture.

The police investigation that followed revealed that the app operators had been intimidating borrowers through illegal means, tactics that have since been reported in many similar cases across India.

Why This Matters?

Aravind’s case isn’t an isolated story. It’s part of a larger pattern of digital-loan app abuse, where convenience comes at the cost of privacy and dignity.

These apps often:

- Gain unrestricted access to personal data (contacts, photos, messages).

- Use that data to harass or publicly shame defaulters.

- Operate without NBFC licences or RBI oversight.

While authorities have since cracked down on hundreds of such apps, many reappear under new names, continuing the same exploitative practices.

How to Protect Yourself from Loan App Scams?

If you ever plan to take a loan through a digital app, here are some crucial things to remember before you tap “Accept”:

- Check for Legitimacy:

Always verify if the app has a registered partner NBFC or bank. RBI’s official website lists all licensed financial institutions. - Watch App Permissions:

Never give apps access to your contacts, gallery, or messages. Legitimate lenders don’t need that information to process a loan. - Read the Terms Carefully:

Understand the repayment timeline, interest rate, penalties, and fees. Many apps lure users with low initial rates but hide huge processing charges. - Avoid Sharing Sensitive Documents:

Do not share KYC documents through unverified or unauthorized platforms. RBI specifically warns against this. - Report Suspicious Apps:

If you encounter harassment or unethical behavior, report it to law enforcement agencies and the Google Play Store immediately.

How to Complaint Against Online Loan App?

If you believe you’ve been scammed by Rupee Bazar (or any similar entity) in India, you need to follow the given steps:

- File a complaint in Cyber Crime by registering online.

- After filing online, also go to your nearest police station (ideally the cyber-cell) and file an FIR. The acknowledgment from the portal will help here.

Need Help?

In case you failed to identify the fraud and lost your money in any such loan app scams, then take quick action now.

Register with us today to report loan frauds in India to recover your losses.

Conclusion

Rupee Bazaar’s story isn’t just about one tragic incident; it’s a wake-up call.

As financial technology grows, so do the risks that come with convenience. Instant cash might sound tempting, but no loan is worth your peace of mind or privacy.

Before downloading any loan app, verify, think, and act wisely.

Choose transparency over speed, and safety over convenience. Because sometimes, the loan you take to solve your problems could end up creating far bigger ones.