Have you ever received a call promising easy money through data entry jobs or high-return investments, only to wonder if it’s too good to be true?

Picture this: a smooth-talking professional from Mohali reaches out, dangles dreams of quick profits, and before you know it, your hard-earned savings vanish into thin air.

Stories like these are popping up more often, especially with companies like Sarwave Solutions grabbing attention online.

What makes this outfit stand out in a sea of questionable ventures? Is it a legitimate opportunity or a cleverly disguised trap waiting for the next victim?

Readers often ask these questions when they stumble upon flashy promises of wealth without effort.

This blog dives deep into Sarwave Solutions, uncovers troubling red flags in their survey solutions pitch, shares a chilling real-life scam story, and arms you with steps to report such fraud.

By the end, you will feel empowered to question every offer that sounds perfect.

Sarwave Solutions Review

What exactly does Sarwave Solutions claim to offer, and can you trust their setup?

This company, based in Mohali, Punjab, presents itself as a provider of the following services:

- data entry jobs

- PDF conversion projects from hard books

- BPO services

- franchise opportunities for those looking to earn from home.

They are often seen talking about the following:

- financial planning

- investment management

- retirement solutions

- business growth services

This often raises eyebrows since it mixes work-from-home gigs with investment lures.

If we talk about their social media presence, it can be seen on the following platforms:

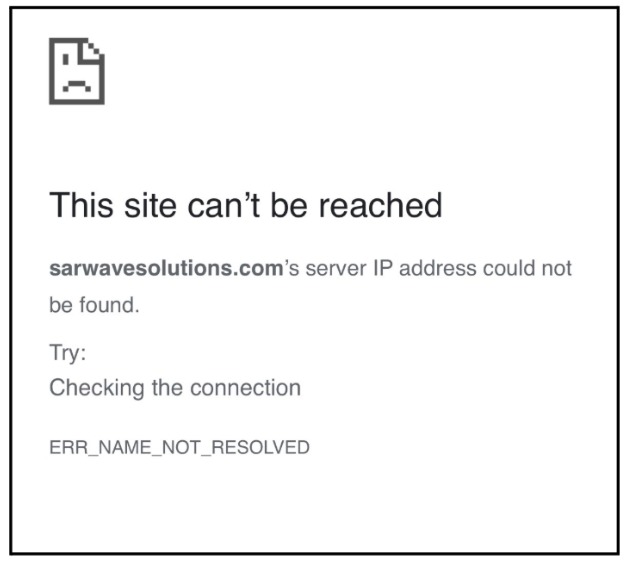

- Website (not working)

Other important info includes their push for “country head” logins and operations head roles, which sound ambitious for a very new entity incorporated just over a year ago.

Overall, while registration exists, the blend of services from data jobs to investments feels mismatched and warrants caution.

Sarwave Solutions Real Or Fake

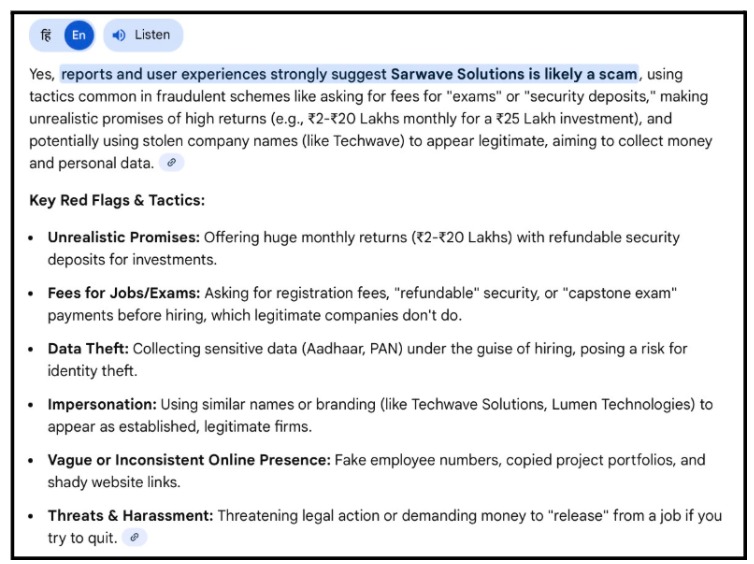

Why do survey solutions from companies like Sarwave Solutions often scream trouble before you even sign up?

Many people jump in thinking these are harmless side hustles, but hidden dangers lurk that can cost you dearly.

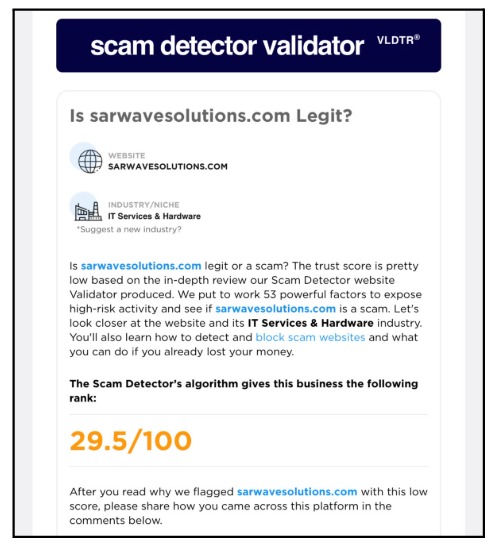

- Low Trust Score

Before we break it down, consider this: even a shiny score on review sites cannot hide deeper issues. Here are the key red flags that should make you pause and think twice.

Multiple negative points persist, like limited transparency on ownership and the site’s newness, low traffic, which algorithms overlook but savvy users spot.

If you look at the scam detector score, you see a low-rated score. This score tells us that this website is a scam.

Always dig beyond the number for real proof.

- No Professionally Complete Website

Does a professional company really lack a fully functional website?

Sarwavesolutions.com exists but feels barebones, with pages like countryhead/login that lead to vague login prompts instead of clear service details.

Visitors report glitches or incomplete sections, making it hard to verify legitimacy.

Without a robust online hub, how can you trust them with your data or money?

- Guaranteed Returns Promise

Who would not love guaranteed profits on surveys or investments?

Sarwave pitches assured high returns, a classic hook that regulators like SEBI warn against, as no ethical business can promise fixed gains without risk.

This tactic preys on hope, often masking losses down the line.

Real opportunities never come with such ironclad assurances.

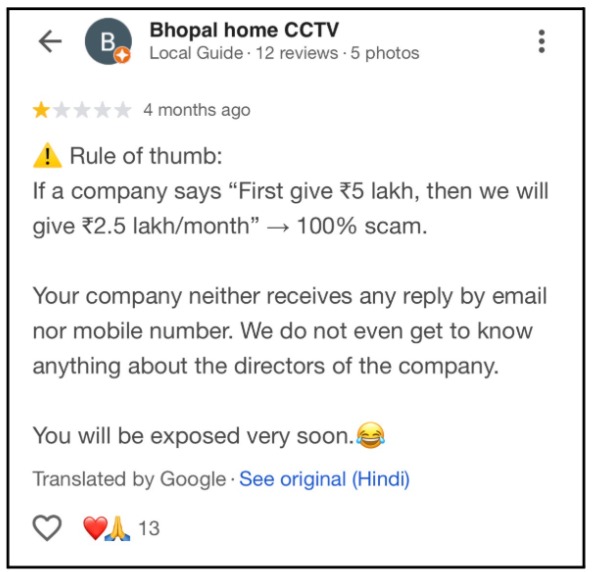

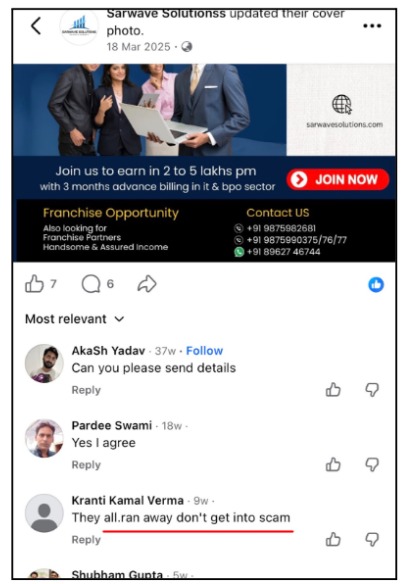

- Negative Reviews on Google and Facebook

Have you checked what others say about Sarwave on Google and Facebook?

Negative feedback piles up, with users calling out unfulfilled promises and poor communication after payments. These platforms show patterns of dissatisfaction that outweigh any positives.

In this review, you can see that the company first asks you to pay money and then promises to give you money.

This model is highly suspicious and screams SCAM!

Ignoring them could land you in the same boat.

- No Pictures Available on Google

Why does Googling Sarwave Solutions yield zero real office photos or team images?

Legitimate firms flaunt their workspace to build trust, but here you get nothing tangible.

This absence fuels doubts about their physical presence and operations. Visual proof matters in verifying claims.

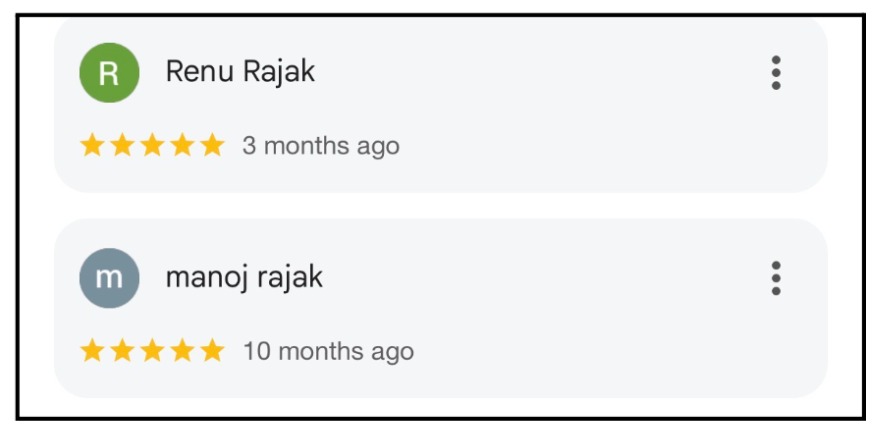

- Fake Positive Reviews on Google

If you look at their Google reviews, you will find that 2 reviews have rated the website as 5 stars.

But if you take tea in two reviews, you will find that they have only given five stars and no comments added. Also, these reviews have one thing in common, which is the surname!

Could it be some internal team reviewing itself? Cross-check with multiple sources before buying in.

- Risky Business Model

What happens when data entry morphs into investment demands?

Sarwave’s model shifts from simple surveys to high-stakes funds, exposing you to unregulated risks.

This pivot often hides unsustainable practices that collapse, leaving investors high and dry. Stability comes from clear, proven paths, not shape-shifting offers.

- Mimics Ponzi Scam

Does Sarwave echo infamous Ponzi schemes?

Their reliance on new money for promised returns, without visible revenue streams, mirrors classics like those banned by law.

Early players might see small wins, but the house always crumbles. Spot this cycle early to stay safe.

Sarwave Solutions Scam: Real Case

What if a trusted-sounding CEO approached you with a life-changing investment talk?

One investor faced exactly that nightmare with Sarwave Solutions.

A victim was contacted by Mr. Abhinav Bhatnagar, who claimed to be the CEO of Sarwave Solutions Private Limited, along with his associate Palak.

They posed as legitimate professionals, promising high returns, business expansion perks, and safe profit models from a supposedly strong company.

Trusting their persistent assurances, the investor agreed to pour in funds.

Between August 2025 and October 2025, large sums totaling around ₹21,00,000 moved via Axis Bank internet banking to accounts tied to Sar Wave Solutions Pvt Ltd and Akanksha Sharma.

Specific transfers included:

- ₹6,00,000 on 10/10/2025

- ₹4,95,000 on 10/10/2025

- ₹2,08,000 on 27/09/2025

- ₹3,88,000 on 25/08/2025

- ₹3,00,000 on 16/09/2025

- ₹1,00,000 on 24/08/2025

At first, the accused kept in touch, assuring imminent returns, but delays turned into excuses, then silence after collecting everything.

No refunds, returns, or services ever materialized.

This case screams Ponzi scheme, where fresh victim cash props up illusions for earlier ones, all built on a fake business model designed to cheat honest people.

How to Report a Ponzi Scam?

If you have been a victim of Sarwave Solutions or any other scam, you don’t need to worry. Reporting swiftly not only seeks justice but also warns others.

Act fast with these straightforward steps to build a case and alert authorities.

- Collect all the evidence, like screenshots of chats, amount transfers, contact numbers, promises made, etc.

- File a complaint in Cyber Crime.

- Lodge an FIR at your local police station with all transaction proofs and communications.

- File a complaint with SEBI if investment promises violate regulations.

- Notify your bank immediately to flag and potentially reverse suspicious transfers.

- Share details on consumer forums like ConsumerComplaints.in and social media for community awareness.

Need Help?

We understand that losing your money can be difficult and heartbreaking. But there is still a way out to get justice.

If you want to earn your money back, register with us now!

We are a team that specialises in recovering money lost to scams or fraud. Our team will help you in every way possible, from gathering evidence to finding your complaint the right way.

Conclusion

Ever thought one call could wipe out years of savings, as it almost did for that investor?

Sarwave Solutions started with shiny promises of jobs and returns, but unraveled into red flags, fake assurances, and a real Ponzi trap that cost someone ₹21 lakhs.

Questions like “Is this legit?” or “Should I invest?” demand you pause, verify registrations, and hunt for proof beyond words.

Next time a deal sounds irresistible, remember this story and those steps to report. Stay vigilant, share with friends, and turn suspicion into safety.