Imagine logging into your SBICAP trading account one morning, excited about your investments. You start planning to achieve your bucket list goals.

But then, you discover unauthorised trades, payout delays, or charges you never agreed to. Your stomach drops as you realise the broker you trusted, who was part of India’s biggest bank, might be the source of the problem.

In the high-stakes world of trading, where every rupee counts, SBICAP complaints aren’t just numbers on a report. They represent real investors losing sleep, time, and hard-earned money over service failures and disputes.

Even giants like SBI Capital Markets can falter, turning market risks into broker headaches.

This blog dives deep into SBICAP Securities Limited (SBICAP), uncovers the most common SBICAP complaints, and examines arbitration battles and regulatory orders.

By the end, you will be able to learn steps to fight back if you’re facing the same nightmare.

What is SBICAP Securities Limited?

SBICAP Securities Limited, a wholly-owned subsidiary of State Bank of India (SBI). It stands as one of India’s prominent full-service brokerage firms since its incorporation in 1998.

It uses SBI’s vast network that serves millions of retail, HNI, and institutional clients with equity trading, derivatives (F&O), commodities, currency segments, mutual funds, IPOs, and wealth management services.

Registered with NSE, BSE, MCX, and NCDEX, SBICAP emphasises digital platforms like its user-friendly app and web terminal for seamless trading.

According to NSE data, it has over 1083151 active clients, with 162 complaints received. SBICAP has already resolved 145 complaints, and its success rate is 90%.

On paper, these figures suggest reliability backed by a banking giant. But, for the affected investor, even one unresolved SBICAP complaint means 100% frustration.

Behind the stats lie stories of trust eroded by operational slips, reminding us that no broker, however established, is immune to accountability demands.

SBICAP Complaint Details

Seeing the NSE data, it is clear that most of the SBICAP complaints are grouped under:

- Type I: Non-receipt / delay in payment, such as delay in payments, non-receipt of payment, Delay in refund of margin payment and non-settlement of accounts.

- Type II: Non-receipt/ delay in securities, such as delay in delivery, non-receipt of delivery, delay in refund of margin deposit and non-settlement of accounts.

- Type III: Non-receipt of documents such as contract notes, bills, account statements and agreement copies.

- Type IV: Unauthorised trades/misappropriation, such as unauthorised trades in client accounts and misappropriation of clients’ funds/securities.

- Type V: Service-related issues such as excess brokerage, non-execution of order, wrong execution of order, connectivity/system-related problem and non-receipt of corporate benefits.

- Type VI: Closing out / squaring up, like closing off / squaring up a position without consent and dispute in Auction value / close out value

- Type IX: Others / miscellaneous

Even a small set of SBICAP complaints in these buckets can hit investors in real ways.

There have also been a few arbitration cases filed against SBICAP Securities Ltd., a reminder that even regulated brokers can face disputes when things don’t go as expected.

Let’s take a closer look at the issues raised by clients and what led them to seek arbitration in the first place.

SBICap Arbitrations

With respect to SBICap Securities, like with any large brokerage firm, some clients may occasionally run into issues that don’t get resolved through regular customer support.

In such cases, arbitration becomes the next formal step to address the concern. The arbitrations listed below relate to disputes where SBICap Securities was involved.

- Arbitration on Blocked E-Margin to Cash Conversion (PNB Shares)

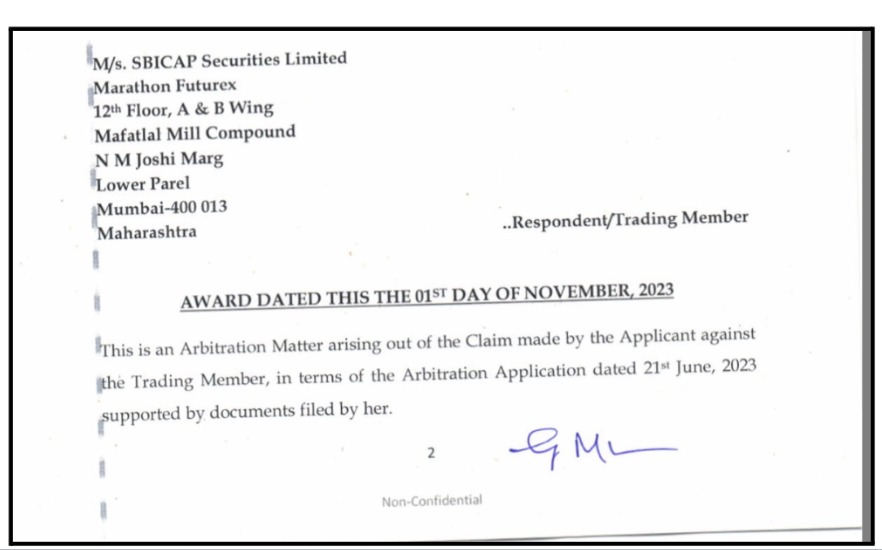

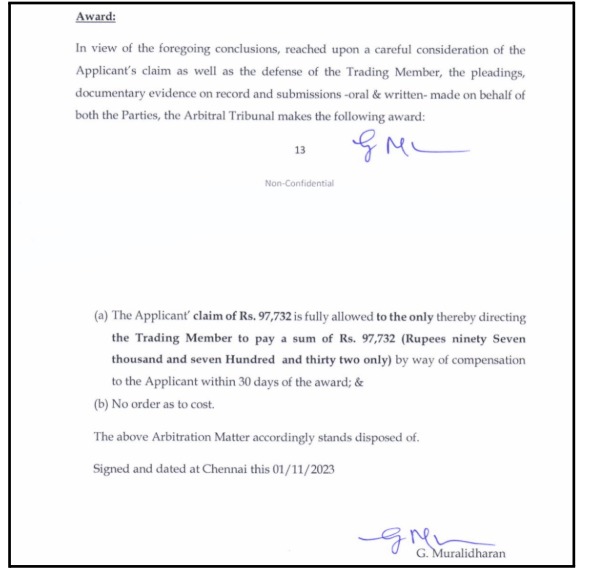

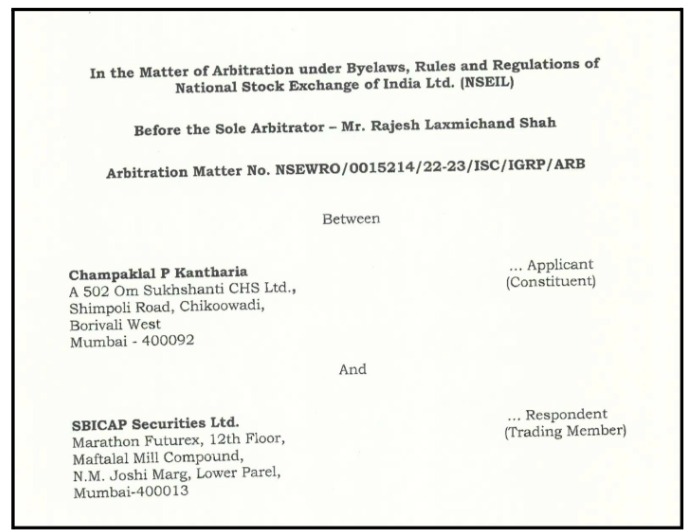

SBICAP Securities Limited faced NSE arbitration from investor Mrs Sutha Renganadane.

She bought 10,000 Punjab National Bank shares on December 16, 2022, under the Margin Trading Facility at Rs. 22 per share.

The position could be converted to delivery within T+30 days.

What Went Wrong?

The investor tried to convert her e-margin position to cash delivery on January 26, 2023. The broker had blocked e-margin to cash conversions from January 23, 2023, due to SEBI block mechanism rules.

She received no proper notice through email, SMS or website updates. Her screenshots showed old rules allowing T+30 delivery even on January 29, 2023.

This forced her to square off shares on January 30, 2023, at Rs. 59.80 average price, causing a loss. The broker violated MTF terms requiring clear communication of policy changes.

Penalty Imposed

A full claim of Rs. 97,732 was awarded on November 1, 2023.

The broker was ordered to pay within 30 days with no costs.

Key Takeaways

- Brokers must prove policy notices with email headers, SMS logs and dated website proof.

- Screenshot broker websites regularly for rule changes.

- MTF clients have delivery rights if dues are paid, despite block mechanisms.

- Poor notice wins cases; ledger statements prove actual losses.

- Full awards are possible when communication gaps are proven.

- Arbitration on One India One Plan Brokerage Scheme Dispute

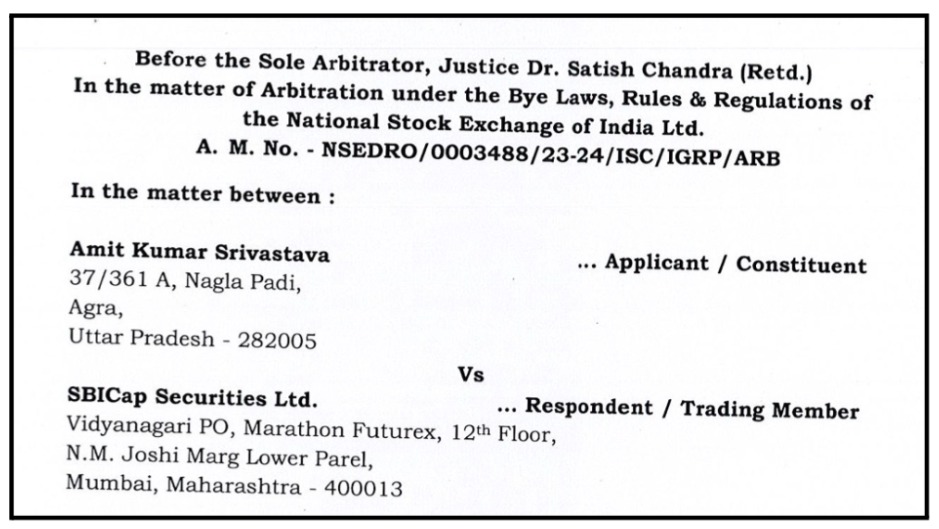

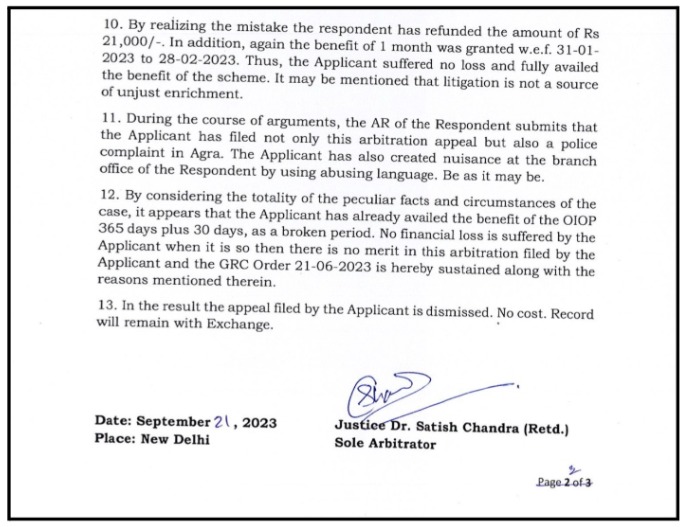

Investor Amit Kumar Srivastava bought SBICAP’s “One India One Plan” (OIOP) scheme for ₹5,900, promising nominal brokerage for 365+30 days from Jan 13, 2022.

Plan expired early Jan 13, 2023 (only 12 months); standard rates charged, leading to ₹21,000 excess.

Broker refunded it and extended 1 month benefit (Jan 31-Feb 28, 2023) due to a technical glitch.

The client claimed an additional ₹65,000 loss.

Penalty Imposed

Appeal was dismissed on Sep 21, 2023. There was no compensation given.

Client already availed the full 365+30 days benefit via refund/extension, and no financial loss was proven.

Key Takeaways

- Track scheme expiry dates; query extensions in writing.

- Tribunals reject inflated claims without proof; litigation isn’t for enrichment.

- File complaints promptly with proper documentation as proof.

- Arbitration on Excess E-Margin Brokerage and Unauthorised Debits

Senior citizen Champaklal P Kantharia (75) opened an SBICAP account in March 2021, lured by RM for trading guidance.

He deposited ₹29.9 lakh over 2 years and suffered a ₹25 lakh loss (₹13 lakh brokerage). Through this, he claimed unauthorised auto-debits (₹5.9 lakh), higher E-margin brokerage (1% vs agreed 0.01%/0.10%), and double charges on intraday/delivery.

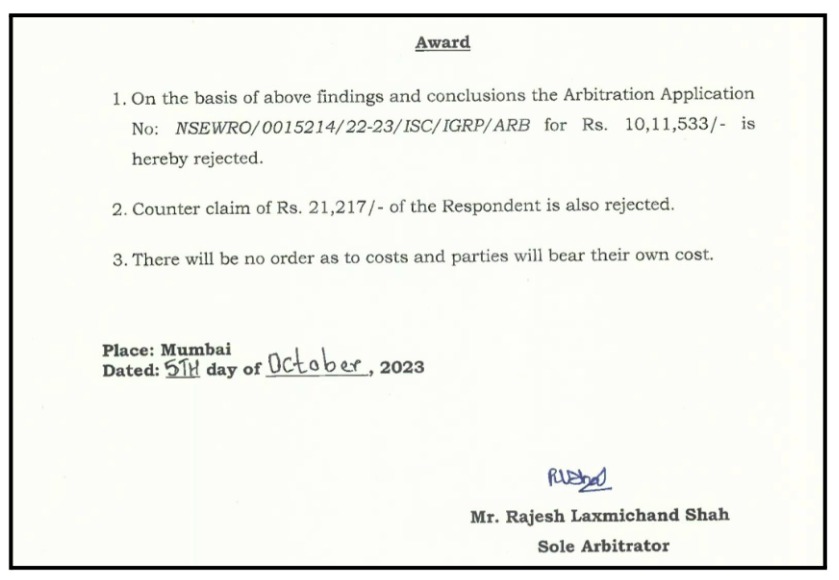

Penalty Imposed

Claim for ₹10.11 lakh was rejected on Oct 5, 2023.

Broker’s ₹21k counter-claim (short brokerage) was also dismissed.

Applicant consented to E-margin/MTF rates online, placed trades himself, and marked liens for debits. Thus, there was no proof of excess.

Key Takeaways

- You should always get written clarifications on rates/E-margin before high-volume trades.

- Check brokerage schedules in KYC because online consent binds you.

- Dispute debits/charges immediately with timestamps, as delays weaken cases.

- Voice logs/contract notes prove implied consent as tribunals prioritise evidence over “mercy.”

- Brokers can’t claim shortfalls from their calculation errors.

- Arbitration on Blocked E-Margin to Cash Conversion

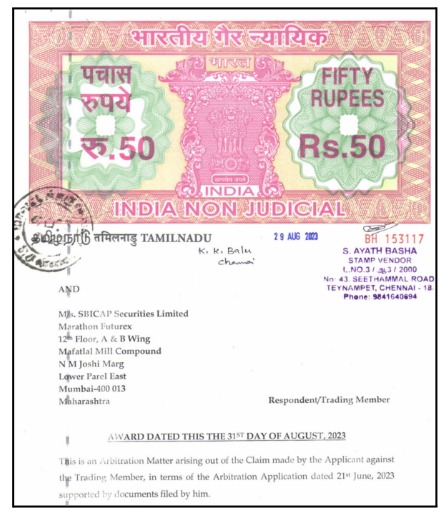

SBICAP Securities Limited faced NSE arbitration from investor R. Srinivasan over the blocked conversion of e-margin shares to cash delivery, forcing premature sale.

Srinivasan (client since 2010) used MTF for low-margin positions up to T+30 days.

Broker discontinued e-margin-to-cash conversion Jan 23, 2023, per the SEBI block mechanism, but failed to properly notify via email/SMS/website

The client’s screenshots showed old rules till Jan 29. No clear proof of communication was there, and the client sold at a loss instead of taking delivery after paying dues.

Violated MTF terms requiring advance notice of policy changes.

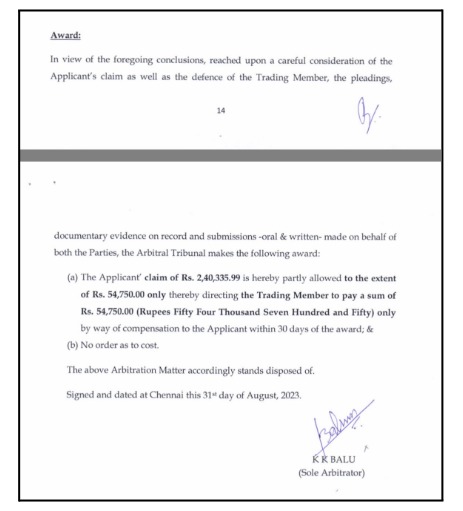

Penalty Imposed

The client’s claim was reduced from ₹2.40 lakh to actual ₹54,750 (Aug 31, 2023).

Broker ordered to pay within 30 days. GRC’s prior rejection was overturned due to poor notice.

Key Takeaways

- Brokers must prove policy change notices (email logs/IP proof essential).

- MTF clients must monitor the T+30 expiry.

- SEBI block rules (2021) bind brokers, but notice gaps favour clients.

- Square-off/sell options exist, but delivery rights prevail with dues paid.

What to Do If You Have an Issue with SBICAP?

There are various arbitrations filed against SBICAP, but most of them are not in favour of investors.

Only the investors who had proper documentation and proof were able to get their money back.

Thus, now it is clear that proper documentation is necessary to get your money back!

You can take help from us if you need to file a case against your broker. We help you in fighting for your money.

If you’re facing issues with your broker and don’t know where to begin, you can register with us, and we’ll guide you through every step of the process.

Here’s what we specifically help you with:

- Documentation Assistance

We help you gather, organise, and structure all the necessary documents, trade statements, ledger reports, contract notes, call logs, screenshots, and emails, so your case is backed with solid evidence. - Drafting Your Complaint

Our team prepares clear, well-formatted complaint drafts that fit the exact requirements of NSE, BSE, SEBI SCORES, and SMART ODR.

This ensures your complaint is understood properly and not rejected due to formatting issues. - Platform Filing Support

Whether it’s SCORES or SMART ODR, we guide you through the submission process and ensure every detail is filled in correctly to avoid delays. - Escalation Guidance

If your complaint needs to be escalated beyond the broker, we show you the right path, whether it’s going to the exchange or preparing for the next stage. - Case Management from Start to Finish

Once you’re registered with us, we track your case, remind you of deadlines, and help you respond to any queries asked by regulators or exchanges. - Support During Counselling & Arbitration

If your case moves to counselling or arbitration, we assist you in preparing your statements and documents so you feel confident and ready.

By registering with us, you don’t have to struggle with complicated procedures, drafting confusion, or paperwork stress.

We make the process smoother, clearer, and faster, so you can focus on recovery while we handle the technical work.

Conclusion

SBICAP Securities is a trusted broker that many investors rely on for their trading needs. But as these real arbitration cases show, even big names face issues that hit hard when you’ve put your savings on the line.

The good news is that valid complaints with proper documentation and proof do lead to refunds and compensation. The first step is always filing that complaint promptly with solid documentation.

If SBICAP or any broker gives you trouble, don’t delay. Act fast to protect your investments while details are fresh.

And if the process feels overwhelming, we’re here to help. Share your story, and we’ll guide you step by step to the resolution you deserve.

You earned that peace of mind.