When you’re looking at a Portfolio Management Service (PMS), you’re not just investing money — you’re trusting someone to manage it responsibly. And trust, in finance, is everything.

Scient Capital is one such SEBI-registered PMS firm operating in India. On the surface, it appears like many other regulated investment managers, structured, compliant, and operating within the financial system.

But recently, its name started appearing in regulatory discussions. That’s where questions begin.

What exactly happened? Was it a minor compliance gap or something bigger? Is it still safe to invest?

If you’ve searched for “Scient Capital review” or “Is Scient Capital safe?”, chances are you’re looking for clarity, not noise.

Let’s begin with understanding what Scient Capital is and how it operates.

Scient Capital Review

Scient Capital is a SEBI-registered Portfolio Management Service (PMS) firm based in India.

In simple terms, a PMS firm manages investments on behalf of clients, usually high-net-worth individuals, under a regulated framework.

Unlike mutual funds, where money is pooled together, PMS portfolios are managed individually in the client’s name, and the strategy can be more tailored.

Scient Capital operates under the SEBI (Portfolio Managers) Regulations.

This registration means the firm is authorized to offer portfolio management services and is required to follow strict regulatory standards, including:

- Maintaining a minimum net worth

- Filing periodic compliance reports

- Ensuring qualified and certified personnel manage portfolios

- Adhering to investor protection norms

So on paper, Scient Capital is part of the regulated financial system, not an unregistered or informal investment setup.

However, as with any regulated entity, registration is only one part of the story. Ongoing compliance with those regulations is equally important.

And that’s where the recent developments become relevant.

Scient Capital SEBI Order

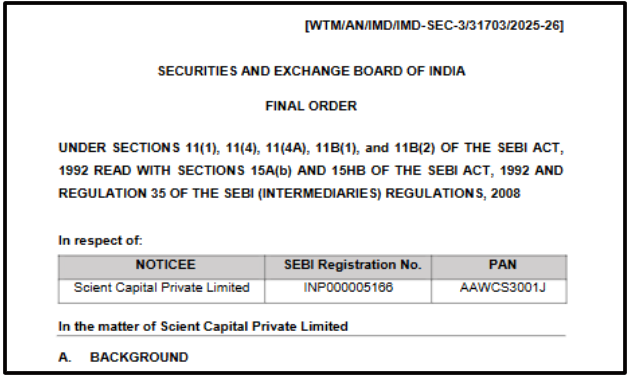

In October 2025, SEBI passed a formal enforcement order in the matter of Scient Capital Private Limited after examining its compliance position for a specific period.

This was not a media allegation or a third-party complaint. It was an official regulatory order issued by the Securities and Exchange Board of India after reviewing filings, financial disclosures, and compliance requirements under the Portfolio Managers Regulations.

Before we break down what SEBI found, here is the first page of the official order:

The order outlines the observations made by SEBI, the regulatory provisions involved, and the final directions imposed on the company.

Now, let’s understand, in simple terms, what exactly the regulator recorded in this order.

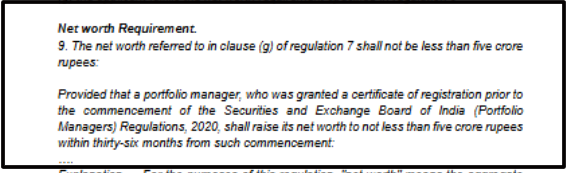

1. Net Worth Requirement Not Met

SEBI regulations require every Portfolio Manager to maintain a minimum net worth of ₹5 crore at all times. This requirement exists for a reason.

Net worth acts as a financial cushion. It ensures that the firm managing investor money has adequate financial strength and stability.

According to the order, Scient Capital’s net worth during the examined period was below the mandated threshold.

Now, does this automatically mean investor money was lost? No.

But it does raise an important concern.

When a portfolio manager does not meet the minimum capital requirement, it signals financial strain or insufficient internal capital strength. For existing investors, this can create uncertainty about the firm’s stability.

For future investors, this becomes a lesson:

Always check whether the PMS firm you are investing in is consistently meeting regulatory capital requirements — not just registered on paper.

Registration is the starting point. Ongoing compliance is what builds trust.

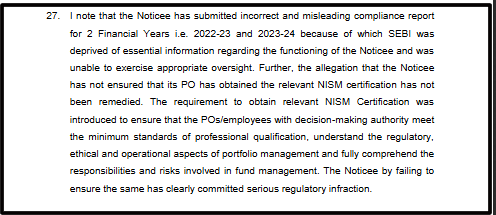

2. Compliance Reporting Issue

The order further notes that compliance certificates were submitted to SEBI stating that regulatory requirements were being met.

However, at the same time, the net worth requirement was not fulfilled.

This is where governance becomes important.

In financial services, regulators rely heavily on accurate disclosures. When compliance reporting does not fully reflect the actual position, it weakens transparency.

For investors, transparency is everything.

Even if there is no fraud allegation, inaccurate reporting can shake confidence. It makes investors question whether internal controls and oversight mechanisms are strong enough.

The lesson here is simple:

Before investing, look at the firm’s track record of regulatory compliance, not just performance numbers.

Returns attract investors. Compliance protects them.

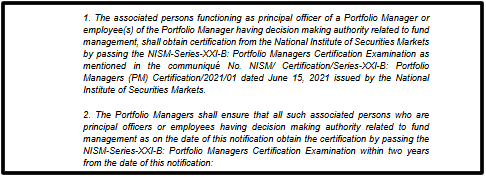

3. NISM Certification Lapse

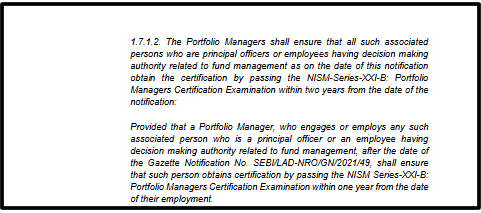

SEBI also observed that the Principal Officer, the individual responsible for managing portfolio activities, did not obtain the required NISM certification within the prescribed deadline.

The Principal Officer is the person responsible for overseeing portfolio management activities. SEBI mandates specific certifications to ensure competence and regulatory knowledge.

When such certification requirements are delayed or missed, it suggests gaps in compliance monitoring.

For existing investors, this may raise questions about whether regulatory standards were being closely followed.

For future investors, this is a reminder:

Don’t just look at branding or strategy. Check whether key management personnel meet regulatory qualifications.

Professional qualifications in regulated financial services are not optional; they are mandatory safeguards.

4. Monetary Penalty

Finally, SEBI imposed a monetary penalty and restricted the firm from onboarding new clients until compliance is restored.

Operational restrictions are not symbolic. They signal that the regulator expects corrective action before normal business expansion can continue.

For investors, this reinforces a larger principle:

Regulatory action may not always mean fraud, but it does highlight risk management and governance weaknesses during that period.

And governance is what separates a sustainable investment manager from a risky one.

So when we step back and look at the overall picture, the order highlights:

- A capital requirement gap

- Inaccurate compliance reporting

- A certification lapse

- Operational restrictions and penalty

This does not automatically classify the company as fraudulent.

But it does show that regulatory standards were not fully met during the examined period.

And for investors, that distinction is important.

Now the real question becomes, what does this mean for someone considering investing with Scient Capital?

Is Scient Capital Safe?

Now let’s pause for a moment.

Reading a SEBI order can sound technical. But what really matters is, how should an investor interpret this?

First, let’s be clear about one thing.

This is not a case where SEBI accused Scient Capital of fraud, fund diversion, or investor misappropriation. There is no publicly reported criminal case linked to this order.

What SEBI has recorded are compliance lapses.

But in the financial world, compliance is not a small matter.

What should investors understand?

1. Regulatory Action Signals Governance Gaps

When a regulator restricts the onboarding of new clients and imposes penalties, it means the issues were serious enough to require intervention.

Even if client money was not directly misused, it reflects that internal systems were not fully aligned with regulatory standards during that period.

For some investors, that may be a red flag. For others, it may simply be something to monitor.

2. Operational Restrictions Matter

The restriction on onboarding new clients is not symbolic.

It affects business growth and signals that SEBI expects corrective action before allowing expansion.

As an investor, you should always ask:

- Has the company restored its net worth to the required level?

- Have all compliance gaps been rectified?

- Has the Principal Officer obtained the required certification now?

Regulatory compliance is dynamic. It can be restored, but investors should verify.

3. Risk Tolerance Differs From Person to Person

Some investors are comfortable investing with firms that have faced regulatory penalties in the past, especially if corrective measures are taken.

Others prefer a completely clean compliance track record.

There is no universal answer.

But transparency matters. And knowing the full picture helps you make an informed decision.

In short:

This SEBI order does not automatically make Scient Capital “unsafe.”

But it does mean investors should exercise due diligence rather than rely only on brand positioning.

Now, if someone does face issues or has concerns, what can they actually do?

How to Report Scient Capital?

If you ever face issues with a PMS firm — whether it’s delayed responses, documentation concerns, or unresolved grievances, there is a proper channel to follow.

Since Scient Capital is a SEBI-registered Portfolio Manager, complaints are handled through regulatory mechanisms, not random forums.

Here’s how the process works:

1. Start With the Company

The first step is always to raise a written complaint directly with Scient Capital.

- Send an email explaining your issue clearly

- Keep records of communication

- Ask for a written acknowledgment

Most regulated entities are required to have a grievance redressal mechanism. Sometimes, issues get resolved at this level itself.

2. File a Complaint on SEBI’s SCORES Portal

If the matter is not resolved satisfactorily, you can file a complaint on SEBI’s SCORES (SEBI Complaints Redress System) platform.

Through SCORES, you can:

- Select the category (Portfolio Manager)

- Submit details of your complaint

- Attach supporting documents

- Track the complaint status using a reference number

This ensures that the complaint is formally recorded with the regulator.

3. Escalation & Further Action

If the issue remains unresolved after regulatory intervention, further escalation mechanisms may include:

- Arbitration processes (where applicable)

- Formal legal remedies

However, these steps are generally considered only after the internal and SCORES processes are exhausted.

The key is documentation.

Keep copies of agreements, portfolio statements, emails, and payment records. Clear documentation makes any grievance process smoother and stronger.

At the end of the day, regulation exists to protect investors. And understanding the correct reporting channels is just as important as understanding the regulatory order itself.

Need Help?

If you’re unsure what this SEBI order means for your investment, you’re not alone.

If you’re facing concerns related to Scient Capital, such as a lack of clarity, delayed responses, or unresolved issues, taking the right steps early makes a difference.

Register with us, and we can assist:

- Help you understand your options

- Organize and review your documents

- Prepare proper evidence if escalation is needed

- We will help in checking SEBI complaint status

- Guide you on filing a complaint through the correct regulatory channel

- Assist you with the preparation of your statements and evidence in the event that your matter goes to counselling or arbitration in stock exchange matters

You don’t have to navigate it alone.

Conclusion

Scient Capital is a SEBI-registered Portfolio Management Service firm operating within India’s regulated financial framework. It holds a valid registration and continues to function as a recognised PMS entity.

At the same time, the October 2025 SEBI order clearly records certain compliance lapses.

These were regulatory in nature related to capital requirements, reporting standards, and certification obligations. The regulator imposed a monetary penalty and restricted the firm from onboarding new clients until compliance is restored.

There is no publicly reported criminal proceeding linked to this matter. The action taken was regulatory enforcement, not a fraud prosecution.

For investors, this situation is not about panic it is about awareness.

Regulatory findings do not automatically make a firm unsafe, but they do highlight areas where governance and compliance fell short during the examined period.

Ultimately, investment decisions should be based on transparency, current compliance status, and personal risk comfort. When it comes to managing money, clarity and due diligence always matter more than assumptions.