Have you been scrolling through your social media feed and suddenly stumbled upon ads promising insane cashbacks from an app called SD Pay?

Maybe a friend forwarded a reel showing daily earnings just by depositing money and referring others, making it sound like free money raining down on you.

What if this hyper-local discovery app with bill payments and discounts is legit, or worse, what if it’s luring you into a deposit-heavy scam?

In this article, we’ll take a closer look at SD Pay company details, how the app works, and whether the promises you see online really match the reality.

Stick around, because your hard-earned money deserves better than false promises.

SD Pay Review

You might be wondering, what is this SD Pay app all about, and where can you even find it?

SD Pay, developed by SD HUB (OPC) Private Limited, based in Mehsana, Gujarat, positions itself as India’s first hyper-local online platform.

It helps connect customers with nearby merchants for shopping, dining, entertainment, and more.

It is available for download on both the Google Play Store, with over 5 million downloads, and Apple’s App Store, making it accessible across Android and iOS devices in India.

Curious about what it actually does and how it supposedly gives you money?

The app lets users discover local shops, get discounts, recharge mobiles, pay utility bills like electricity and gas, and even offers an SD Pay card that functions like a credit card for payments at partnered vendors with extra discounts.

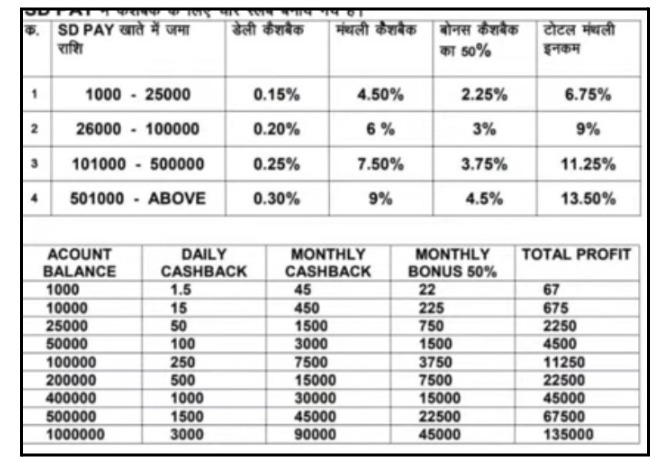

Right now, trending cashbacks include daily cashback income from depositing funds into your wallet, with rates like:

- 0.15% to 0.30% daily, depending on your balance

- A 50% monthly bonus on top

- Referral programs where you earn by inviting friends

- Promises of 1-2% cashback on purchases.

For example, deposit 10,000 rupees and supposedly earn 15 rupees daily plus bonuses, scaling up to massive returns on higher amounts like 1 million rupees, yielding thousands monthly, all promoted heavily on Instagram reels.

Is SD Pay Safe or Not?

The big question on everyone’s lips is whether SD Pay is safe, especially when it comes to your personal data and privacy.

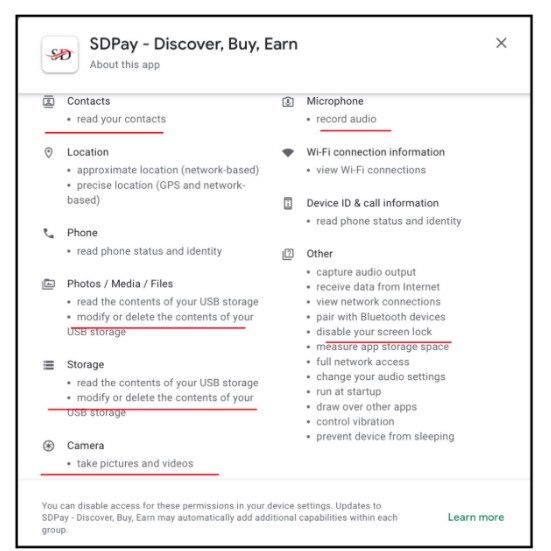

While the app claims data is encrypted in transit and you can request deletion, a closer look reveals troubling inconsistencies in its data practices.

On the Google Play Store, it admits to collecting huge data, which seems excessive for a simple discovery and payment app. Thus, raising eyebrows about why such personal info is needed beyond basic transactions.

Have a look!

This app collects unnecessary information that you should really think about before downloading this app. Imagine an app that has access to modify or delete your USB storage as well!

Not only this, it can record any audio and listen to your conversations, take pictures and videos on its own. Well, this is not at all what legitimate apps look like.

India’s Digital Personal Data Protection (DPDP) Act 2023 strictly prohibits collecting unnecessary personal data without clear consent and purpose, emphasizing data minimization to protect users from misuse.

Yet, SD Pay’s Google Play listing shows it gathers more than what’s essential, while shockingly claiming “no data collected” on the App Store.

This creates a massive red flag for potential privacy risks and makes it far from safe for cautious users like you.

Is SD Pay Regulated by RBI?

You are probably thinking, does SD Pay have the official green light from RBI since it deals with money and deposits?

The app and its promoters claim RBI approval and regulation, often touting it as a secure wallet for financial transactions like bill payments and cashback earnings.

But here’s the reality check: a scan of RBI’s official lists of authorized payment aggregators and prepaid payment instruments shows no trace of SD Pay anywhere, not even in the latest updates, which include big names like Amazon Pay, Razorpay, and Pine Labs.

This absence from official RBI sources is a huge red flag, as legitimate fintechs proudly display their certificate numbers and links to RBI pages.

Thus, SD Pay’s claims might just be empty promises to trick you into depositing funds, potentially leading down a scam path.

Is SD Pay Real or Fake?

SD pay is very much real as an application, downloadable from both Google Play and App Store with active listings, and user ratings around 4.4 on iOS. It features, like merchant discovery, that seem functional at first glance.

However, the practices it follows scream suspicion, mimicking classic scam tactics dressed up as rewards.

So, let’s dive into these key points that should make you pause:

- High daily cashbacks are promised, like 0.15-0.30% on deposits plus 50% bonuses, sounding too good to sustain without new user money.

- The referral program aggressively pushes inviting friends for earnings, fueling growth like a Ponzi scheme.

- It has been reported as fraud in reviews and YouTube exposures, with no RBI regulation despite claims.

- Customer care is unresponsive, as per user complaints about withdrawal issues. Also, if you try to contact their customer care number it says switched off.

- On App Store, it declares no data collected, but Google Play reveals excessive collection of location and media, a blatant inconsistency.

- Overall, the structure relies on deposits for “passive income,” echoing Ponzi models where early users profit from later ones until it collapses.

- Various promotional YouTube videos with comments, highlighting referral codes, and pushing users to download the app.

SD Pay Complaints

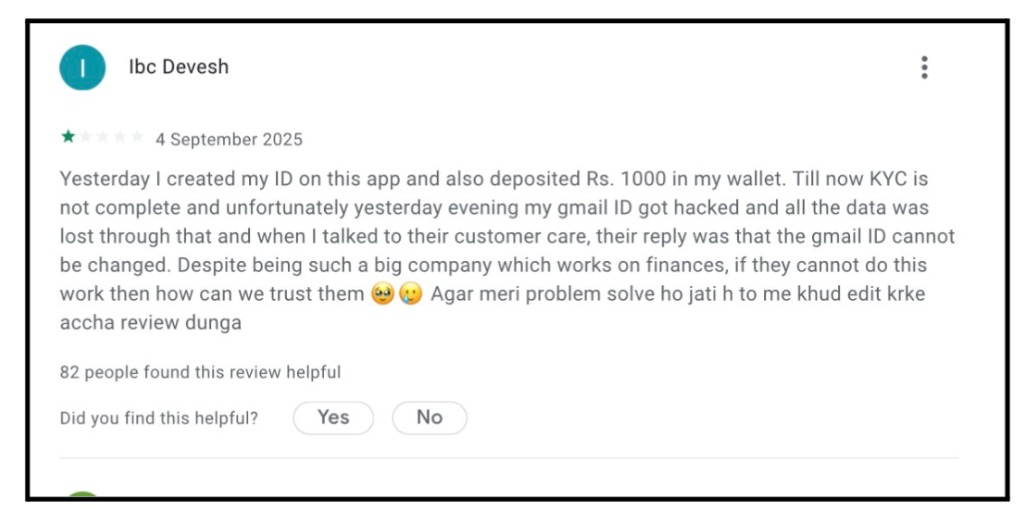

The promotion of the app is done in such a way that it seems nearly impossible to figure out if there is a complaint or not. But users frequently report difficulties with the application.

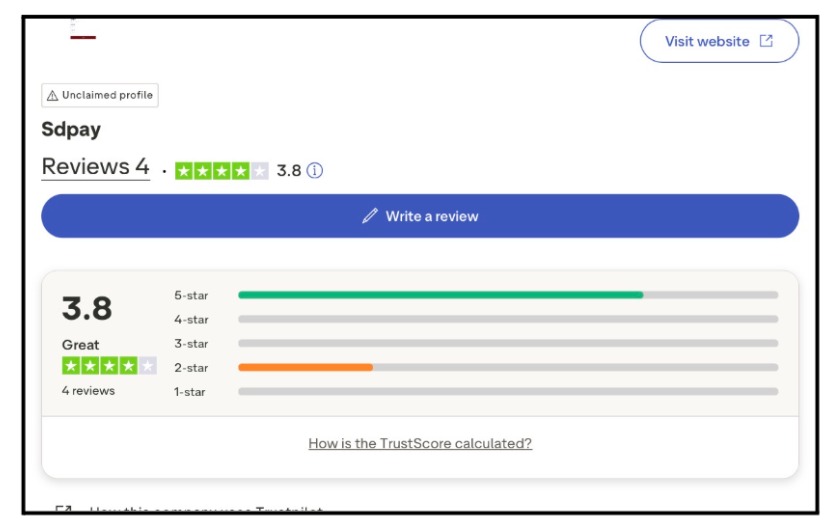

If you check Trustpilot reviews of the app, you can clearly see that it has a rating of 3.8 with only four reviews, out of which only one is negative.

But if you look at the complaints and reviews on other platforms, you will see why you should stay away from this application.

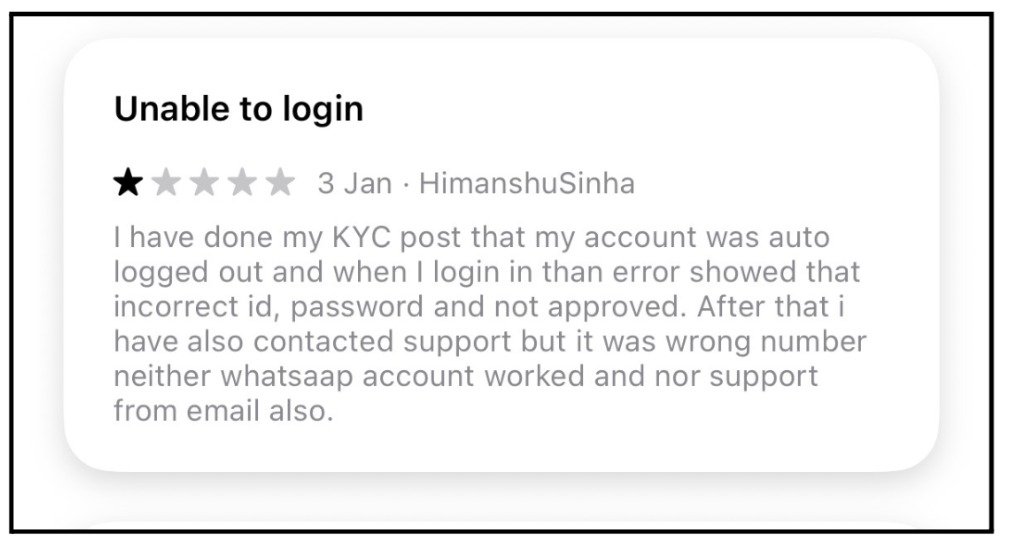

Uses the report after depositing money. If a person loses their ID, then they will have no access to their account and their money.

Another frequent issue that is faced by users is the SD Pay login issue. Thus, before you download this app, be cautious.

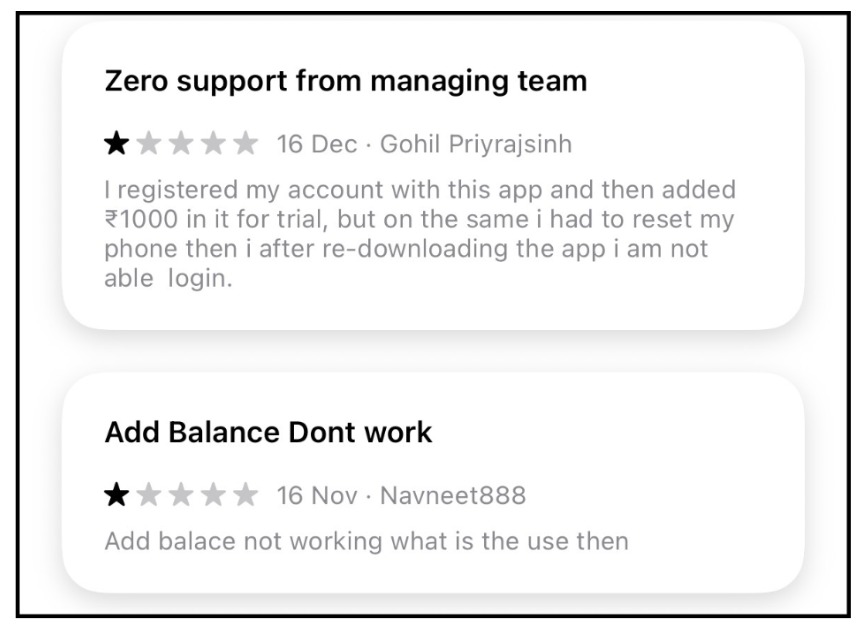

Even the customer care of the application is not trustworthy. If you face any issues, you are on your own, as they won’t help you in any case.

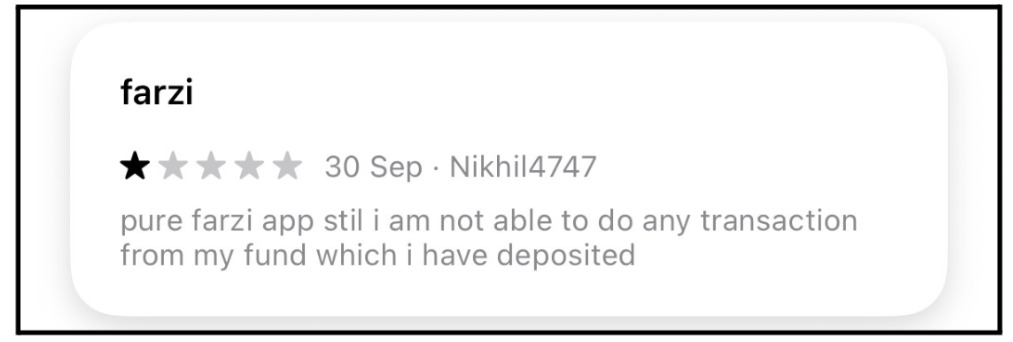

People often call this app a scam. They also complained about not being able to do transactions from the fund that have been deposited into the SD pay app.

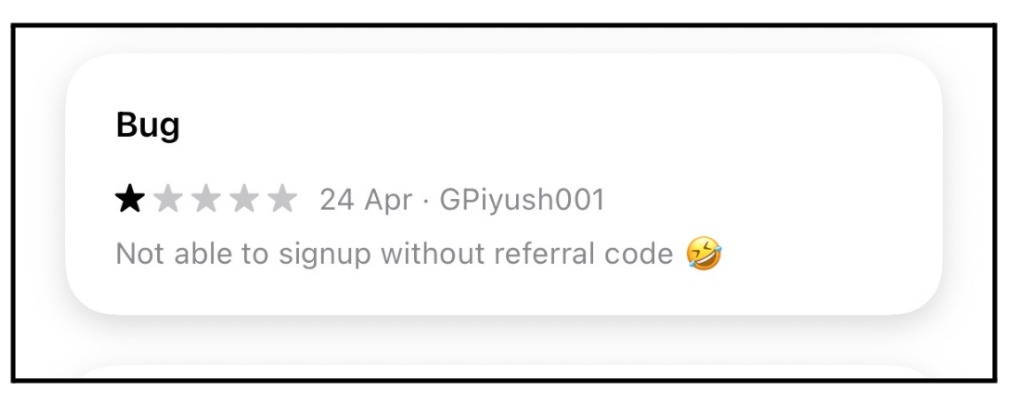

Another user reports that without a referral code, signup is not possible. This shows heavy reliance on ponzi scam structure.

Seeing all these reviews, it can be concluded that the app is not safe to use, and that you should definitely think twice before you download this app.

What to do if Online Fraud Happens?

If something feels off with SD Pay, how exactly do you report it to protect yourself and others? If you follow these steps, you can report this app and get your money back.

- Start by gathering evidence like screenshots of ads, app listings, transaction records, and communications, then act swiftly through official channels in India.

- File a complaint in Cyber Crime, selecting “financial fraud” for quick police action.

- Contact Google Play or App Store support to flag the app as fraudulent, potentially leading to removal.

- Share your experience on consumer forums or Trustpilot to warn others.

- If money is lost, approach your bank immediately for a chargeback and lodge a FIR at your local police station.

These steps empower you to fight back and contribute to shutting down risky apps.

Need Help?

If you have lost your money to any scam or fraud, you can still fight back for your rights. All you need to do is register with us.

A team of dedicated professionals will help you in every step of filing your complaint and getting a resolution that is satisfactory for you.

Conclusion

Have you spotted those irresistible SD Pay ads yet, or maybe even downloaded it chasing quick cash?

This blog has peeled back the layers to reveal an app that’s real on the surface but loaded with red flags like:

- unchecked data grabs

- missing RBI oversight

- Ponzi-like rewards

- mounting complaints that could spell trouble for your wallet and privacy

Reviewing the SD Pay company details shows that the platform claims RBI approval and regulation, but it does not appear on the RBI’s official lists of authorized prepaid wallet issuers or payment aggregators, which raises serious concerns.

Don’t let the hook of daily cashbacks blind you to the risks, especially under DPDP rules and RBI guidelines meant to shield folks like us in India.

Pause, verify independently, and steer clear until proven legit, because true financial apps build trust with transparency, not hype.