Groww is one of the top stock brokers in India, known for its simple interface and strong presence among retail investors.

However, like many fast-growing platforms, it has faced certain regulatory penalties.

Here we have listed two major case studies where Groww ended up paying a significant settlement amount to SEBI (Securities and Exchange Board of India).

In this blog, we break down what happened, why it matters for investors, and what steps you can take if you ever face similar issues with your broker.

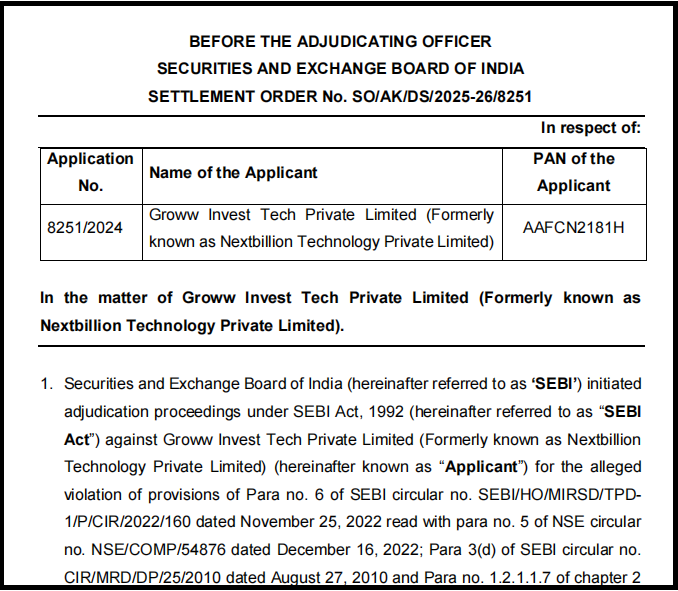

SEBI Complaint Against Groww

Despite Groww’s reputation as a well-known and trusted broker, there are indeed several dispute cases pending.

Here are some of them, let’s take a look:

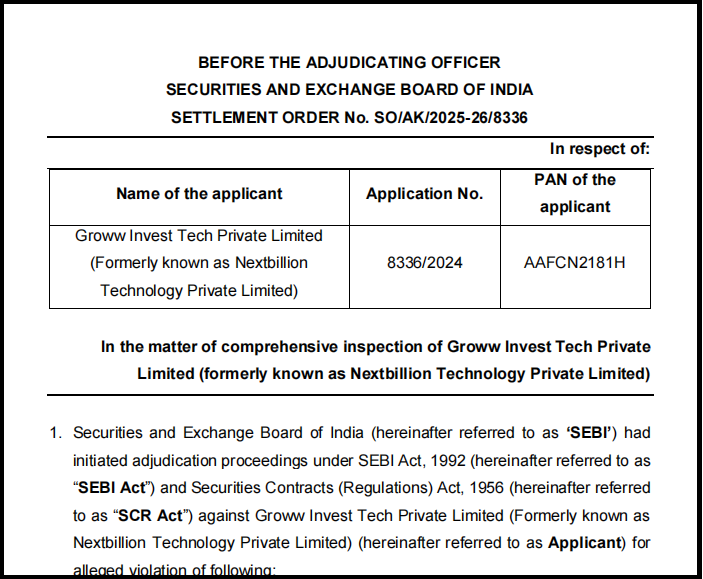

Groww has recently settled two major legal cases with SEBI. They paid a total of ₹82,97,500 (around ₹82.98 lakhs) to settle these cases.

This shows that SEBI found serious problems in how Groww was operating and protecting its investors. The company settled without admitting it was guilty, which is a common legal step.

A. SEBI ₹83 Lakh Settlement for Investor Safety Lapses

This case came from a detailed SEBI inspection. It found many big failures:

1. Giving Wrong Account Information to Clients

The Problem:

Groww sent monthly account statements to clients that had mistakes. The balance shown and the margin money required did not match in 38 cases.

Investors Impact:

People make trading decisions based on their account statements.

If the information is wrong, they might trade more than they can afford, get penalised for margin shortage, or have their positions forcibly closed by the broker.

They are basically trading blind.

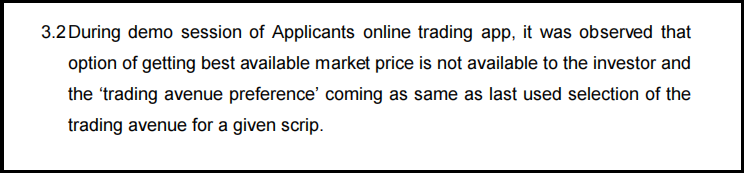

2. Faulty App Design & No Choice in Trading

- The demo version of the trading app did not show the “best available market price” option clearly.

- The app automatically selected the same stock exchange (NSE/BSE) the client used last time, instead of asking each time.

- Did not allow “interoperability”, meaning clients couldn’t easily move their stocks or money between different clearing houses.

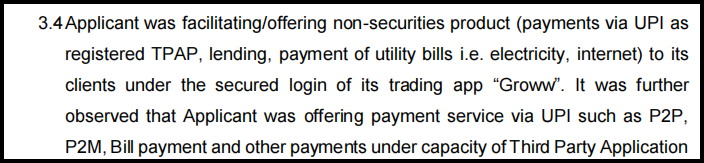

3. Mixing Stock Trading with Banking & Payments

The Problem:

Groww offered non-stock market services like UPI payments, loans, and bill payments inside the same logged-in section of its main trading app “Groww”.

Investors Impact:

This is very risky and confusing. If there is a problem with a UPI payment done through Groww’s app, it could create a legal mess.

This dispute might even affect the safety of the investor’s main trading account and money. Stock trading and payments should be kept separate for safety.

4. Poor Backup Systems & Tech Failure Plans

The Problem:

- Groww had no backup method (like a desktop website or phone line) for clients to trade if the mobile app or website crashed.

- Their “Disaster Recovery Plan” (called BCP) was checked only once a year, not twice as required.

Investors Impact:

If the app stops working, investors are completely stuck. They cannot buy, sell, or exit their existing trades.

If the market moves fast during this time, they can suffer huge, unavoidable losses. A weak disaster plan means these outages can last longer.

5. Weak Checks for Illegal Activity & Client Risk

The Problem:

- No automatic alert system to flag when a client’s trading size or margin requirement was too big compared to their known income.

- Failed to update income and financial details for 83 cases involving 41 clients.

Investors Impact:

This makes the platform weak against money laundering or fake trading.

For honest investors, it means Groww is not stopping them from taking dangerous, excessive risks that could wipe out their savings.

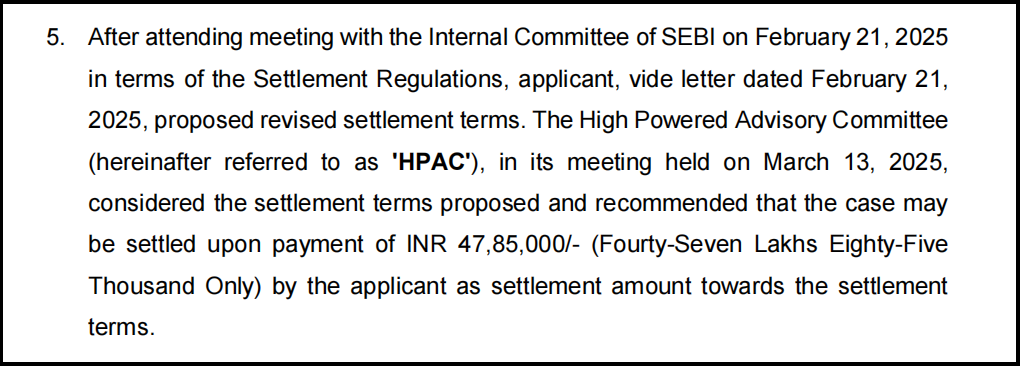

The Final Settlement

The company submitted revised settlement terms on February 21, 2025.

These terms were then reviewed and accepted by SEBI’s High Powered Advisory Committee, which recommended a final settlement payment of ₹47,85,000.

B. SEBI Settlement For Tech Failure & Lapse

This case was specifically about a major technical failure and how poorly Groww handled it.

1. Not Sharing Important Data with the Exchange

The Problem:

Did not send the required trading data to the stock exchange’s monitoring system on a particular day.

Market Impact:

This makes it harder for SEBI and the exchange to watch the market and catch illegal activities in real time.

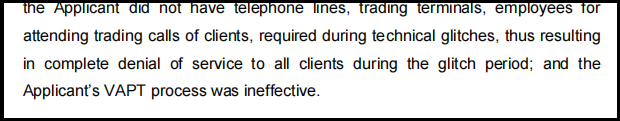

2. Total Shutdown During a Tech Glitch

The Problem:

During a platform failure, Groww had absolutely no backup. No phone support, no alternative terminal, no staff to take orders over the phone call.

Investors Impact:

This proves the biggest fear from Order 1 was true. Clients had no way to reach the market. They missed profit chances or, worse, couldn’t sell to stop their losses. This is a basic failure of a broker’s job.

3. Weak Cyber Security Checks

3. Weak Cyber Security Checks

The Problem:

Their process for finding security holes in their app and website (called VAPT) was not effective.

Investors Impact:

This puts every user’s personal data, password, and money at high risk of hacking. A breach could lead to unauthorized trading in Groww or theft.

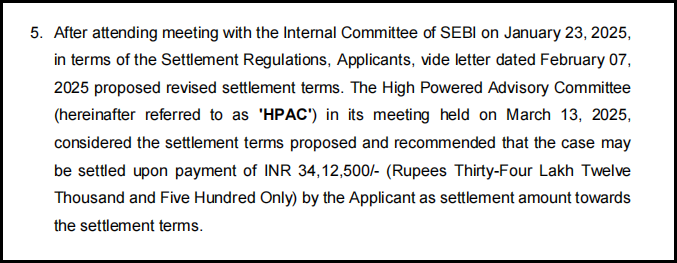

The Final Settlement

The applicant proposed revised settlement terms to SEBI on February 7, 2025.

The advisory committee reviewed them and recommended a final settlement of ₹34,12,500, which was accepted on March 13, 2025.

What Can You Learn From These Cases?

1. A Harsh Reminder of “Fine Print” Risks for Retail Investors

- This case highlights how standard brokerage agreements heavily favour the broker.

- By signing these terms, investors may unknowingly waive their right to claim compensation for most technical failures, even if they result in losses.

2. The “Seconds vs. Hours” Loophole in Tech Glitch Accountability

- The ruling creates a dangerous precedent: if a glitch lasts less than 5 minutes, the broker may bear no liability, regardless of the financial impact.

3. “Stability Guaranteed” – Marketing Hype vs. Legal Reality

- Fintech brokers often use confident, reassuring language in marketing.

- This case shows that such slogans have little legal weight when challenged. They are treated as aspirational messaging, not contractual guarantees.

What Can You Do in Such a Case?

If you have experienced incorrect account statements, platform outages, delayed withdrawals, or technical failures, the most important thing is to act calmly and methodically.

Start by contacting the broker’s customer support team, like Groww in this case. Many issues are resolved at this stage if properly documented. Always preserve screenshots, emails, complaint ticket numbers, trade logs, and timestamps.

If the issue remains unresolved, escalate systematically:

- Approach the broker’s Compliance Officer

- File a formal complaint through SEBI’s SCORES platform

How to Complain Against Groww App?

Handling a financial dispute can feel overwhelming, especially if you are unfamiliar with regulatory procedures.

Professional guidance can significantly improve the clarity and strength of your case.

Our Structured Assistance Includes:

1. Case Evaluation & Onboarding

Once you connect with us, we assign a dedicated case expert to review your issue and guide you on the appropriate legal and regulatory pathway.

2. Complaint Drafting Support

We help you prepare a well-structured and legally sound complaint that includes:

- Proper documentation and supporting evidence

- Clear explanation of the grievance

- Relevant SEBI regulations and compliance references

- Chronological timeline of events

- Accurate calculation of financial losses

3. Broker-Level Escalation Support

We assist in formally communicating with the broker through the appropriate grievance redressal channels to ensure accountability and proper documentation.

4. Filing Complaint on SCORES

If internal resolution fails, we guide you step-by-step in lodging a complaint on SEBI’s SCORES platform, ensuring all regulatory references and attachments are properly submitted.

5. Arbitration in Share Market

If the dispute remains unresolved even after SCORES, the next step may be stock exchange arbitration. We assist with preparing the arbitration application, organising documentary evidence, structuring claims, and understanding the exchange-level dispute resolution mechanism.

Ready to File Your Complaint?

Connect with us today to understand the most effective route to resolve your dispute with Groww or any other registered stockbroker.

Conclusion

Regulatory settlements serve as important reminders that even leading financial platforms must continuously maintain compliance, transparency, and robust risk controls. For investors, awareness is the first line of protection.

Before choosing any broker, it is essential to understand not just its features and marketing claims, but also its compliance history and grievance redressal mechanisms.

In financial markets, informed decision-making is not optional; it is essential.

If you ever face issues, remember that structured documentation, regulatory escalation, and timely action can significantly improve your chances of resolution.