Trust matters in investing. Especially when you’re following someone’s advice with your hard-earned money.

But what happens when a SEBI-registered Research Analyst breaks every rule in the book?

From fake experience certificates to misleading YouTube videos promising daily profits, this case has it all.

Who is Prerna Sharma?

Prerna Sharma operates as a SEBI-registered Research Analyst with registration number INH000006819.

She runs a service called “Algologic”, an algorithm-based trading recommendation system.

Her primary business? Providing stock market recommendations to clients through software. She also runs a YouTube channel called “Algologic Live” with thousands of subscribers.

Sounds professional, right? Wait until you hear what SEBI discovered.

Why SEBI Took Action on Research Analyst Prerna Sharma?

According to SEBI’s Adjudication Order No. Order/SM/SM/2025-26/31941 dated December 30, 2025.

The inspection covered the period from April 01, 2021, to March 22, 2023. What they found shocked everyone.

Multiple violations. Fake documents. Misleading promotions. Poor client service.

The penalty? ₹15 lakh, one of the highest for a Research Analyst.

Identified Violations by Prerna Sharma

Here are some key violations highlighted by SEBI in its order:

-

The Fake Experience Certificate Scandal

This is where things get serious.

To become a Research Analyst, you need specific qualifications. According to Regulation 7(iv), you need either proper certification or five years of relevant work experience.

Prerna Sharma submitted an experience letter from Motilal Oswal Financial Services Limited. The letter claimed she worked there and gained the required experience.

But there was a Motilal Oswal Complaints.

SEBI contacted Motilal Oswal on March 14, 2023. They asked one simple question: “Did Prerna Sharma work for you?”

The answer was NO.

Motilal Oswal checked their employee records thoroughly. They couldn’t find Prerna Sharma anywhere.

The letter was fake. The seal was forged. The entire document was fabricated.

Impact on Investors

This isn’t just about paperwork. When someone gets registration through fake documents, they bypass the entire qualification system.

Investors trust SEBI-registered analysts. They believe these people have proper experience and knowledge.

Unqualified individuals giving investment advice can lead to massive losses. Market risks multiply when advisors lack proper training and experience.

-

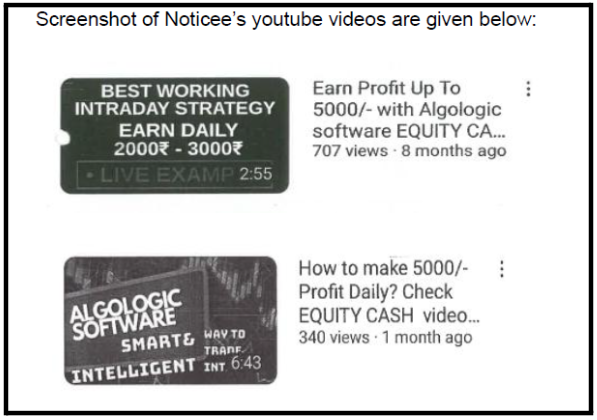

The “Earn ₹5000 Daily” YouTube Deception

Prerna Sharma ran a YouTube channel called “Algologic Live.” She posted videos promoting her algorithm-based trading system.

But the video titles crossed every ethical line.

Notice something? These titles promise specific profit amounts. They suggest guaranteed returns. They make stock trading sound like a fixed deposit.

Anyone with basic market knowledge knows this is impossible. Stock market returns depend entirely on market conditions. Nobody can guarantee daily profits of ₹5000.

But hundreds of people watched these videos. Many probably invested based on these misleading claims.

She said these were just “educational” videos.

But SEBI didn’t buy it.

The titles were designed to lure investors. They created false expectations. They concealed the basic truth: all stock investments carry market risk.

The YouTube channel description even displayed her SEBI registration number: INH000006819.

This meant she was acting as a Research Analyst. Not an educator. Not a casual YouTuber.

Impact on Investors

Promising specific daily returns is the oldest trick in the investment fraud playbook.

Misleading promotions cause real harm. Investors see these videos and believe trading is easy money.

-

Missing Disclosures in Trading Recommendations

Prerna Sharma sent trading recommendations through her Algologic software. Clients received buy and sell signals based on the algorithm.

But here’s what was missing: every mandatory disclosure required by law.

SEBI regulations are clear. Every research report must include:

- Potential conflicts of interest

- Whether the analyst owns shares in recommended companies

- Compensation received from companies

- Past relationships with companies

- All material information affecting investment decisions

Prerna Sharma’s algorithmic recommendations included NONE of this.

She argued her “recommendations” weren’t “research reports.” She claimed the algorithm was just a medium, like WhatsApp or SMS.

SEBI disagreed completely.

According to SEBI guidelines for Research Analysts, a research report means “any written or electronic communication that includes research analysis or research recommendation or an opinion concerning securities… providing a basis for investment decisions.”

Impact on Investors

Hidden conflicts create severe trust issues. Imagine receiving a “buy” recommendation for a stock. You invest ₹50,000 based on that advice.

Later, you discover the analyst held large positions in that stock. Or had undisclosed business ties with the company. Would you have invested if you knew?

Disclosure requirements exist to prevent such situations. When analysts skip these disclosures, investors make decisions with incomplete information.

-

No Research Rationale Maintained

Here’s another serious violation.

Research Analysts must maintain a detailed rationale for every recommendation.

Why did you recommend this stock? What analysis supported your advice? Which factors influenced your decision?

Prerna Sharma maintained NONE of this.

She also violated SEBI regulation, which requires annual compliance audits by chartered accountants or company secretaries. She never conducted any such audit.

Impact on Investors

Investors believe Research Analysts conduct thorough analysis before making recommendations.

They trust these aren’t casual opinions but informed judgments backed by research.

When no rationale exists, that entire trust framework collapses. Clients paid for professional analysis.

If losses occur, investors have no way to understand what went wrong. Was the analysis flawed? These questions remain unanswered.

-

Delayed Complaint Resolution

SEBI regulations mandate quick complaint resolution. Regulation 13(1) of the Intermediaries Regulations requires grievance redressal within 45 days.

SEBI’s circular for Research Analysts is even stricter, 30 days maximum.

During the inspection period, Prerna Sharma received 5 complaints from clients. She resolved 3 within time limits.

But two complaints took shockingly long.

That’s more than five months for one complaint. Imagine being a client with money stuck or facing issues.

You file a complaint. Weeks pass. Months pass. No resolution.

-

Not Using “Research Analyst” Designation

This seems minor, but reveals unprofessional conduct.

Research Analysts must use the term “Research Analyst” in all correspondence with clients.

SEBI found random sample emails where Prerna Sharma used “PS Invest” instead. Some emails from October and November 2022 showed this clearly.

-

The Terms Nobody Understood

As per SEBI regulation, an RA must define technical terms used in recommendations. If you use industry jargon or specific terminology, explain it clearly.

Prerna Sharma’s algorithmic recommendations used various terms and indicators. But definitions? Nowhere to be found.

She claimed everything was in “layman’s language” that any investor could understand. According to her, no terms needed explanation.

SEBI disagreed. The regulation makes defining terms mandatory, regardless of language simplicity.

Impact on Investors

Undefined technical terms leave investors confused. They follow recommendations without fully understanding the basis.

This creates blind following, the opposite of informed investing. Clients should comprehend the reasoning behind advice.

Penalty on Research Analyst Prerna Sharma

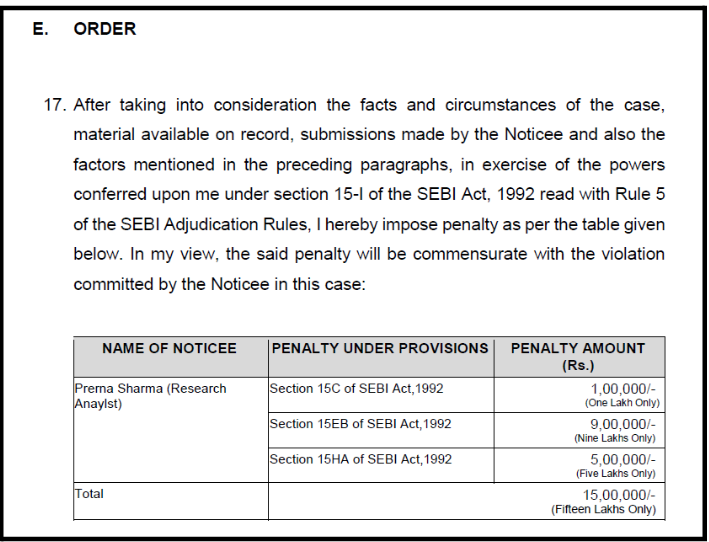

After reviewing all evidence and hearing Prerna Sharma’s defense, SEBI issued the final order on December 30, 2025.

Total Penalty Imposed: ₹15,00,000 (Fifteen Lakh Rupees)

Breakdown:

- Under Section 15C (Complaint redressal failure): ₹1,00,000

- Under Section 15EB (Research Analyst violations): ₹9,00,000

- Under Section 15HA (Fraudulent practices): ₹5,00,000

The order noted no quantifiable investor losses could be established from records. No evidence showed repetitive violations.

However, the serious nature of violations, especially the fake certificate, warranted a substantial penalty.

Prerna Sharma must pay within 45 days. Failure triggers recovery proceedings, including property attachment.

How to File a Complaint Against Research Analyst?

Facing problems with your Research Analyst? Report immediately through these channels:

Primary Reporting:

- Lodge a complaint in SCORES.

- SEBI Office of Investor Assistance and Education (OIAE)

Stock Exchange Mechanisms:

Always maintain complete documentation, emails, transaction records, recommendation screenshots, payment receipts, and all communication with the analyst.

Need Help?

Are you facing issues with your Research Analyst? Unauthorized recommendations? Delayed refunds? Misleading advice causing losses?

Register with us for expert guidance in filing complaints and pursuing recovery.

Our team specializes in investor grievance redressal and regulatory complaint processes.

Your investment matters. Your complaint matters. Don’t let violations go unreported.

Conclusion

The Prerna Sharma case represents a complete breakdown of professional ethics in research analysis. From the foundational fraud of fake credentials to ongoing violations in client service, this case had everything wrong.

The ₹15 lakh penalty sends a strong message. SEBI won’t tolerate Research Analysts who mislead investors, skip mandatory disclosures, or obtain registration fraudulently.

If recommendations seem too good to be true, they probably are. The YouTube videos promise daily profits; run the other way. If an analyst won’t provide proper disclosures, find someone who will.

Your financial future deserves better than algorithmic recommendations without a research rationale. Better than fake experience certificates. Better than delayed complaint resolution.

Stay informed. Stay vigilant. Choose advisors carefully. And always remember, in investing, if something sounds too easy, it’s probably too risky.