Can your stock broker provide you with call tips?

Yes, if the broker is a full-service stock broker then you can easily find call tips, research reports & recommendations on its mobile app & web.

Can my stock broker handle my account?

In some cases, stock brokers can take a position on your behalf, like in case of a technical glitch or other issues after getting a confirmation from you or based on a request placed by you.

A stock broker or sub-broker can handle your account only upon your approval.

So, how many of you were already aware of this?

Not many, right?

And here some of the stock brokers reap the benefit and misguide their clients to earn more brokerage.

Recently, we came across the case of Mr. Sushil (name changed), a skilled trader living abroad who was unaware of certain regulations and ended up losing ₹60,000.

But at the right time, he reached to us. Our team listened and understood his case and finally helped him in recovering 100% of his losses.

Let’s get to the details of how all this started and how he fought to recover from his losses with the help of our team.

How Did the Stock Broker Misguide Sushil?

Sushil was a trader himself; however, despite his expertise, he often missed trading opportunities in the Indian market due to time zone differences.

He then came across the Instagram ad of one of the top stock brokers and entered his details. A few days later, he received a call from the broker’s executive, who added him to the free WhatsApp group where the broker created inducement by showing high-profit screenshots.

Soon, one of the executives contacted Sushil and told him about the low-risk-high-return trading strategies. However, Sushil told him about the issue of time-zone difference. On this, the executive asked him to open the demat account and allow him to trade on his behalf.

In short, the broker’s executive asked for account handling of the client.

A clear violation of SEBI guidelines, but unfortunately, Sushil was not aware of the same.

Now to go ahead, the executive asked him to add ₹50,000 to the account. Sushil found it convenient and agreed to open the account. Later he shared his account details.

Additionally, Sushil was advised to send an email authorizing the individual to take trade positions on his behalf.

Trusting this advice, Sushil followed his instructions, unaware that the person on the other end was not an expert but a sales executive just focusing on meeting targets to earn incentives.

Initially, Sushil made a profit of ₹1000-₹2000, but after 2-3 days, he started losing money.

On this, Sushil instructed the person to square off positions in case the loss reached ₹1000. To avoid overtrading, he added, to cut the positions & stop taking more positions once ₹2000-₹2500 profit is earned.

However, just to meet the brokerage target, the person kept on taking multiple trade positions without any proper risk management. In all, he was not considering Sushil’s instructions.

In 3-4 days, Sushil found that he had already lost ₹27,000. Further, when he checked the brokerage, he found that the broker was charging a brokerage equal to ₹50 per lot. He then withdrew the remaining account.

After a few days, he received a call again, but due to continuous losses and hefty brokerage charges, Sushil refused to continue trading on the same platform.

On this, the executive told him to share the account details of the broker’s platform that charges less brokerage.

Since Sushil had one account with the discount broker too, he shared the login details and added ₹35,000.

Now, think for a second, why did the broker’s executive do so?

Earlier, he did account handling to meet his brokerage charges, but this time, what was his hidden benefit? Well, that is still an unresolved mystery, but again, due to overtrading in the account, Sushil lost another ₹24,000 in one single trade.

He got furious and withdrew his remaining account from that broker’s account, too.

He tried to contact the broker but didn’t get any response. Also, due to a time-zone issue, he was not able to raise his concerns.

A few days back he returned to India and looked for the solution and where to complaint against stock broker.

Luckily, he came across one of our reels on Instagram. He reported his concern there and finally got help from our team.

What Steps Did Our Team Take to help Sushil Recover ₹60,000?

Upon receiving a request on Instagram, the case was assigned to one of our team members. He contacted Mr. Sushil to understand the case.

Soon, he was able to point out a few violations that the broker did, like:

- Created an inducement by displaying P&L.

- Giving assurance of guaranteed returns.

- Handled account.

- Communicated only on WhatsApp.

Now, in such cases, the very first is to reach out to the registered entity only.

Our team collected all the proofs, created a mail draft on behalf of the client, and asked Sushil to send it to the stockbroker. However, the stockbroker didn’t admit its mistake.

- They even said that none of their executives was involved in account handling in stock market. However, the proofs submitted by the client made them change their statement.

- They then pointed towards Sushil by saying that he had approved all the trades. However, Sushil, along with permitting to trade, also asked to manage a proper ris,k which was not followed.

- Later, the broker said that the concerned executive left their office a few months back, hence they are not liable to pay for any losses. On getting such responses from the broker, Sushil was disappointed.

To protect itself, the broker kept changing its statements, which confirmed that it was aware of the situation.

However, our team didn’t stop there and helped Sushil further by filing a complaint.

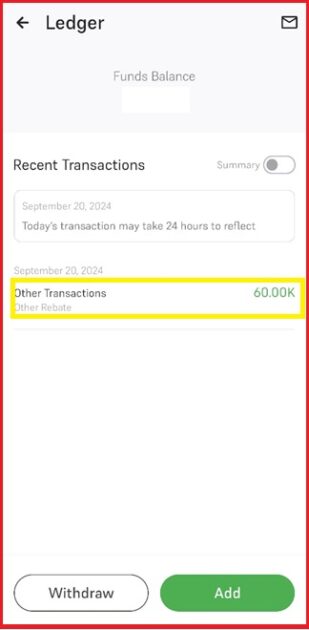

After a day or two of filing a complaint, Sushil received a call from a stockbroker whom he agreed to pay a 100% loss amount plus brokerage.

Finally, he received a credit of ₹60,000 in his trading account. This is how your persistence and continuous efforts help you in getting justice and recovery from losses.

Conclusion

In this case, although Sushil recovered his lost amount, was he entirely right in allowing a broker to handle his account without first gaining complete information?

Certainly not. Before sharing his details, he should have verified what the regulations say about such practices. Had he conducted thorough research and validation, he could have avoided losing his money in the first place.

Recovery is secondary; the key takeaway is to never blindly trust someone and hand over your money to a stranger without proper checks.