Stock exchange issues don’t announce themselves.

There’s no warning banner. No countdown. No official update at the start.

One moment, you’re trading normally. Next, orders are stuck, charts freeze, or prices stop updating.

These are issues, not complaints. They happen during live markets, often without clarity, and sometimes without immediate accountability.

This blog examines what stock exchange issues are, how traders experience them in real-time, and what users themselves have documented on X and Reddit when things go wrong.

Common Types of Stock Exchange Issues

Stock exchange issues refer to technical or infrastructure-level disruptions that impact the functioning of markets.

They usually originate from:

- exchange connectivity layers

- order-routing systems

- data dissemination feeds

- core market infrastructure under load

Unlike broker-specific problems, these issues:

- appear across multiple brokers at the same time

- surface during high volume or volatile sessions

- resolve suddenly, without user action

By the time official clarification arrives, the market has already moved.

From repeated market incidents and trader discussions, these issues usually fall into clear patterns:

- Orders stuck or rejected

- delayed or frozen executions

- charts and index values not updating

- data feed lags

- partial platform functionality

What makes them difficult is not just the failure but the uncertainty around what’s actually happening.

Stock Exchange Complaints

Let’s look at actual user experiences shared during live market disruptions.

These are not summaries.

These are real words from real traders, posted while markets were open.

Issue 1: Orders Executed Late, Causing Heavy Losses

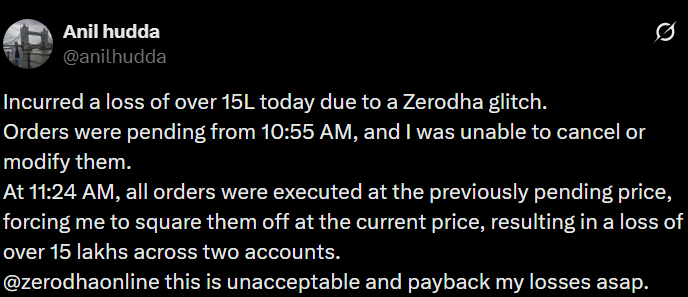

Anil Hudda posted on X during live market hours (July 2024):

“Incurred a loss of over 15L today due to a Zerodha glitch. Orders were pending from 10:55 AM, and I was unable to cancel or modify them. At 11:24 AM, all orders were executed at the previously pending price, forcing me to square them off at the current price, resulting in a loss of over 15 lakhs across two accounts. @zerodhaonline this is unacceptable and pay back my losses asap.”

This post shows how delayed execution during live markets can turn manageable positions into irreversible losses.

The key issue isn’t just the loss, it’s the inability to cancel or modify orders while the market kept moving.

When such behaviour appears suddenly, it often points to exchange-side order routing or connectivity failure, not a user error.

Issue 2: Exchange Connection Not Accepting Orders

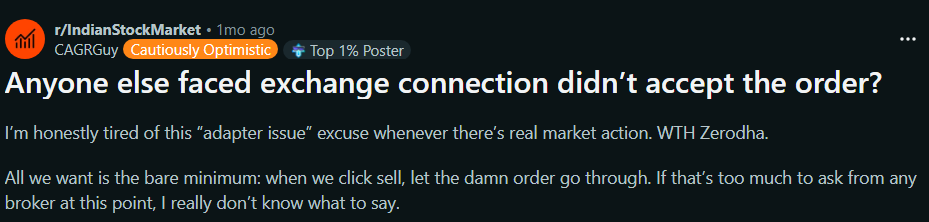

A trader posted on Reddit’s r/IndianStockMarket:

“Anyone else faced ‘exchange connection didn’t accept the order’ today? Getting this error repeatedly.”

Other users replied, saying they faced the same error across different brokers.

When identical exchange-related errors appear across platforms, it usually indicates a systemic issue in how the exchange is receiving or processing orders, rather than a broker-specific malfunction.

Issue 3: Market Data and Index Feed Delays

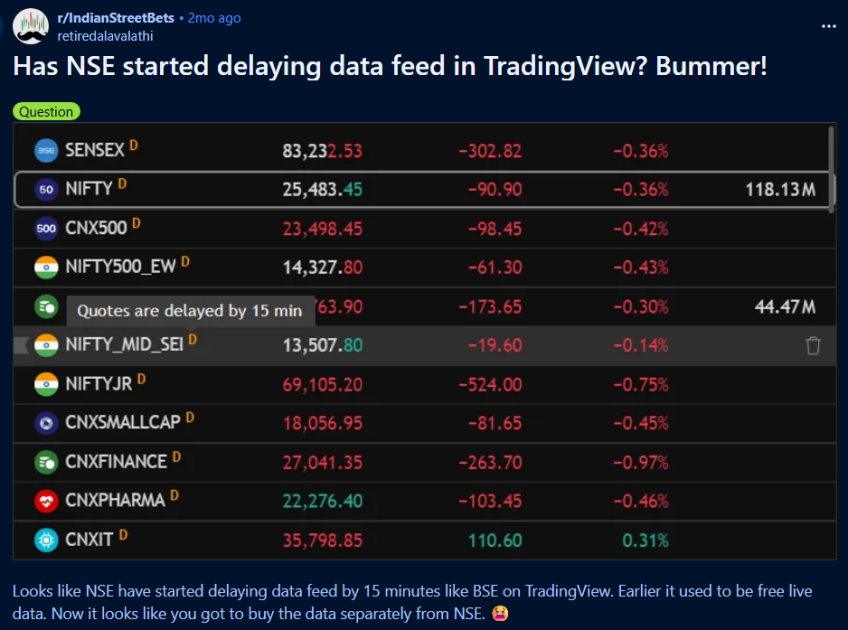

A user on r/IndianStreetBets wrote:

“Has NSE started delaying data feed in TradingView? Charts are 15 minutes behind unless I refresh or change settings.”

Several users confirmed noticing similar delays.

Data lag is dangerous because traders may act on outdated prices without realising it.

When multiple users report the same delay across platforms, the issue is often linked to exchange data dissemination, not individual charting tools.

Issue 4: Issues Appearing Across Multiple Brokers at Once

In another Reddit discussion, a trader commented:

“Same issue on multiple platforms. Charts frozen, orders delayed. Switching brokers didn’t help.”

This is a classic sign of an exchange-level issue. When switching brokers doesn’t solve the problem, the failure is usually upstream, at the market infrastructure level.

Across X and Reddit, the pattern is consistent:

- Issues start suddenly

- Multiple brokers are affected at the same time

- traders realise it’s systemic only after comparing notes

- problems are resolved without user intervention

These are market infrastructure issues, not isolated app bugs or trader mistakes.

What Traders Can Do During Stock Exchange Issues?

When something feels off across platforms:

- Avoid placing new trades based on frozen data.

- Don’t assume reinstalling apps will fix it.

- Check multiple sources before acting.

- Avoid panic exits if execution is uncertain.

- Lodge a complaint in SCORES.

Most exchange issues resolve on their own. Acting on partial information often makes losses worse.

Need Help?

Stock exchange issues don’t always end when systems come back online.

If an issue led to:

- forced exits

- delayed executions

- unexpected losses

And you’re unsure whether it was broker-side or exchange-side, structured review matters.

We help traders:

- understand where the issue originated

- document what happened during the disruption

- decide whether escalation is valid

- Follow the right path if losses were caused by a system failure

- Filing a complaint

- Escalation of the case

- Filing and representing a case in arbitration in the stock market.

So, if you have faced any kind of technical or non-technical issue with the stock exchange that led to losses, register with us now.

Conclusion

Stock exchange issues are part of modern, high-speed markets, but they’re not rare, and they’re not imaginary.

They surface during volatility. They affect multiple brokers at once.

And traders usually detect them before official confirmation arrives.

Understanding these issues helps you stay calm, avoid bad decisions, and act correctly when the market itself misbehaves.

When systems fail, clarity matters more than speed.