The stock market can be exciting. But what happens when things go wrong? What if your broker delays withdrawals? Or a research analyst gives you misleading advice?

These aren’t hypothetical scenarios. These are real problems faced by thousands of Indian investors daily.

Stock Market Issues

Ever felt cheated after a trade? You’re not alone.

According to SEBI’s annual report 2023-24, the regulator received over 1.2 lakh complaints from investors. That’s a staggering number. And it’s growing every year.

Here’s what investors struggle with most:

- Unauthorized trading – Brokers executing orders you never placed

- Delayed refunds – Your money stuck for weeks after withdrawal requests

- Hidden charges – Surprise fees that weren’t disclosed upfront

- Platform crashes – Apps failing during crucial trading hours

- Poor customer service – No response to your queries or complaints

Moreover, many investors face issues with contract notes. Some brokers delay sending them. Others modify them later. Both practices are illegal.

Types of Stock Market Complaints

Not all complaints are the same. Understanding the category helps you file correctly.

SEBI has created a structured classification system.

This makes complaint filing more organised and effective.

Complaints Against Brokers

Complaints against brokers typically arise when investors or clients experience issues related to trading practices, financial transactions, or the quality of service.

These complaints may stem from miscommunication, lack of transparency, unethical conduct, or violations of regulatory guidelines.

Understanding and categorising such complaints is essential for identifying patterns, addressing grievances effectively, and ensuring accountability within the financial services ecosystem.

Proper classification also helps regulators, firms, and clients take appropriate corrective and preventive actions.

Category I: Payment-Related Issues

These involve money stuck in the system.

Type I – Non-receipt/Delay in Payment

- Type Ia: Delay in payment – Money credited after the standard timeline

- Type Ib: Non-receipt of payment – No credit even after repeated follow-ups

- Type Ic: Delay in refund of margin payment – Your margin money not returned after position closure

Category II: Securities-Related Issues

Your shares are stuck or missing.

Type II – Non-receipt/Delay in Securities

- Type IIa: Delay in delivery – Shares credited late to your demat account

- Type IIb: Non-receipt of delivery – Shares never arrived

- Type IIc: Delay in refund of margin deposit – Margin securities not released

- Type IId: Non-settlement of accounts – Account balance incorrect

- Type IIe: Non-receipt of documents – Missing contract notes or statements

According to NSE data, Type IIb complaints increased 23% in 2023. That’s concerning.

Category III: Documentation Problems

These are paperwork-related issues.

Type III – Non-receipt of Documents

- Type IIIa: Contract notes – Trade confirmation not received within 24 hours

- Type IIIb: Bills – Billing statements missing or delayed

- Type IIIc: Account statements – Monthly/quarterly statements not provided

- Type IIId: Agreement copies – Account opening forms not given

Category IV: Unauthorized Trading

Someone traded using your account without permission.

Type IV – Unauthorized Trades/Misappropriation

- Type IVa: Unauthorized trades in client account – Trades you never authorized

- Type IVb: Mis-appropriation of client’s funds/securities – Your money or shares used illegally

Category V: Service-Related Complaints

Poor service quality issues fall here.

Type V – Service Related

- Type Va: Excess brokerage – Charged more than agreed rates

- Type Vb: Non-execution of order – Your order wasn’t placed despite confirmation

- Type Vc: Wrong execution of order – Wrong quantity, price, or scrip

- Type Vd: Connectivity/system-related problem – Platform crashes, login issues

- Type Ve: Non-receipt of bonus/rights/other benefits – Corporate actions not processed

- Type Vf: Other service defaults – Anything else service-related

Category VI: Account Closure Issues

Can’t close your account? This category covers it.

Type VI – Closing Out/Squaring Up

- Type VIa: Closing off/squaring up position without consent – Broker closed your position without informing you

- Type VIb: Dispute in auction value/close out value – Disagreement over settlement prices

Category VII: Arbitration Failures

You won arbitration but broker didn’t pay. File this complaint.

Category VIII: IPO-Related Issues

Covers public issue problems:

- Application rejection without valid reason

- Refund delays

- Allotment disputes

- Wrong demat credit

Complaints Against Research Analysts

Think you got burned by bad stock tips? Here’s what to watch for:

- Misleading research reports with inflated price targets

- Pump-and-dump schemes disguised as recommendations

- Conflict of interest not disclosed properly

- Unregistered analysts operating illegally

According to SEBI guidelines, all research analysts must be registered. They must disclose any conflicts of interest. Many don’t follow these rules.

Complaints Against Companies

Sometimes, the listed company itself is the problem:

- Non-payment of dividends – Your entitled dividend never arrives

- Rights issue problems – Application rejected or shares not allotted

- Buyback issues – Tender process irregularities

- Corporate governance violations – Management misconduct affecting shareholders

Who Handles Stock Market Complaints?

Confused about where to complain? Let’s break it down.

SEBI SCORES

SEBI is the apex regulator. Think of it as the guardian of investor interests.

What SEBI does:

- Registers and monitors brokers, analysts, and other intermediaries

- Frames the rules and regulations for market conduct

- Investigates serious violations and market manipulation

- Imposes penalties and can even cancel licenses

- Runs the SCORES platform for complaint resolution

According to SEBI’s investor charter, they aim to resolve complaints within 30 days. In practice, complex cases take longer.

Stock Exchange

These are self-regulatory organizations. They handle operational complaints about trading.

Their responsibilities include:

- Monitoring broker compliance with exchange rules

- Investigating trading irregularities

- Running investor grievance cells

- Imposing penalties on member brokers

- Referring serious cases to SEBI

NSE’s Investor Grievance Redressal System (IGRS) and BSE’s Investor Services Cell are your first stop for exchange-level issues.

CDSL and NSDL (Depositories)

These handle demat account-related complaints.

According to RTA (Registrar and Transfer Agent) data, most demat issues get resolved at the DP level itself. However, unresolved cases escalate here.

They manage:

- DP performance monitoring

- Resolution of beneficiary account problems

- Coordination with stock exchanges

- Processing investor complaints against DPs

Stock Market User Complaints

Let’s look at actual complaints. These reveal recurring patterns.

Complaint 1: Unauthorized Trading

Rajesh Kumar from Mumbai shared on a popular investment forum:

“My broker executed 50 trades in a single day without my permission. I lost ₹2.3 lakhs. When I complained, they said it was ‘system error.’ Three months later, still no refund.”

This indicates a serious breach of trust. Moreover, it shows how brokers sometimes exploit technical excuses.

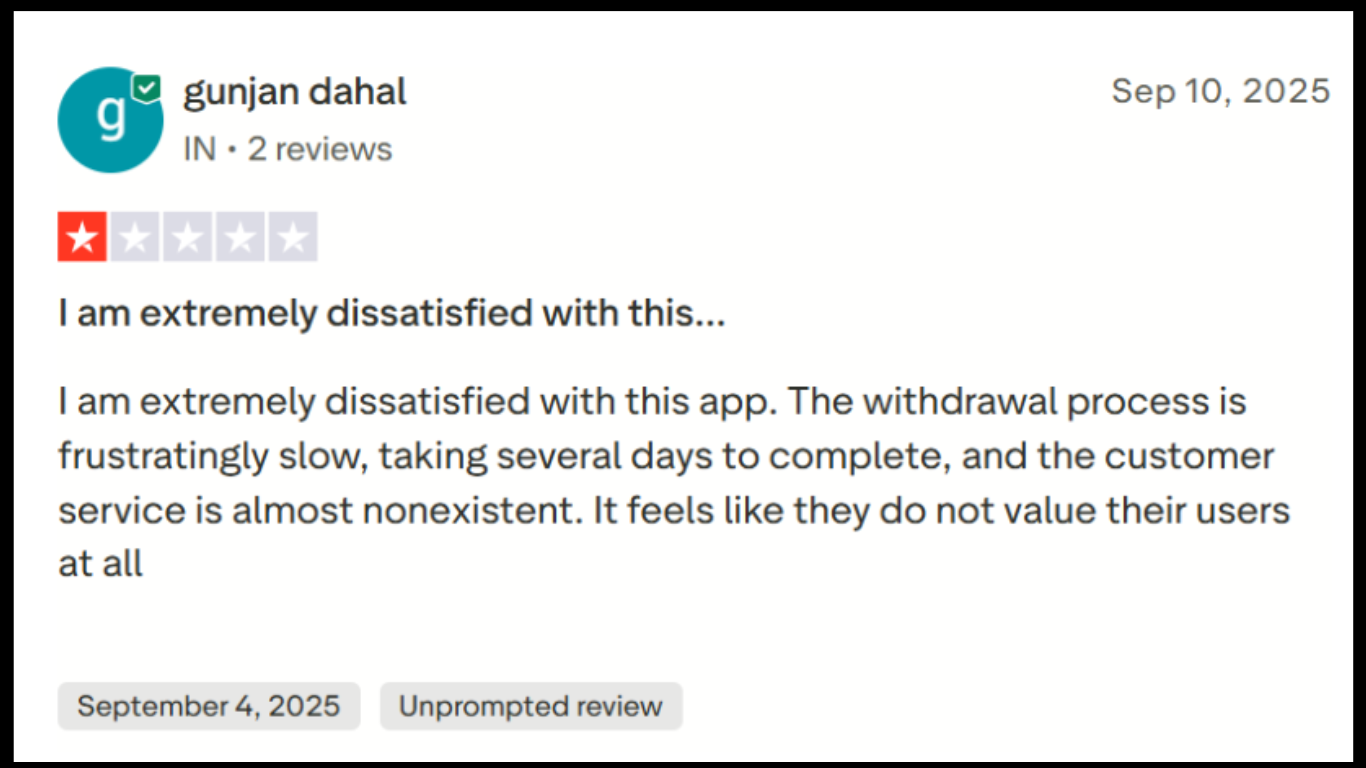

Complaint 2: Withdrawal Delays

Priya Sharma from Delhi posted on Trustpilot:

“Requested withdrawal of ₹5 lakhs on March 15. Today is April 20. Still haven’t received the money. Customer care gives different excuses daily. Extremely frustrated.”

This reveals a common tactic. Some brokers delay refunds to use client money. It’s illegal but happens frequently.

Complaint 3: Hidden Charges

Amit Patel from Ahmedabad complained on Google Reviews:

“They advertised zero brokerage. But charged ₹850 as ‘platform fees’ on every transaction. This wasn’t mentioned anywhere during account opening. Complete fraud.”

Complaint 4: Research Analyst Misconduct

Sunita Reddy from Hyderabad wrote on Quora:

“Paid ₹25,000 for premium stock tips. The analyst recommended 5 stocks. All fell 30-40%. Later discovered he wasn’t even SEBI registered. Lost my savings.”

This shows the danger of unregistered advisors. Always verify SEBI registration before paying anyone.

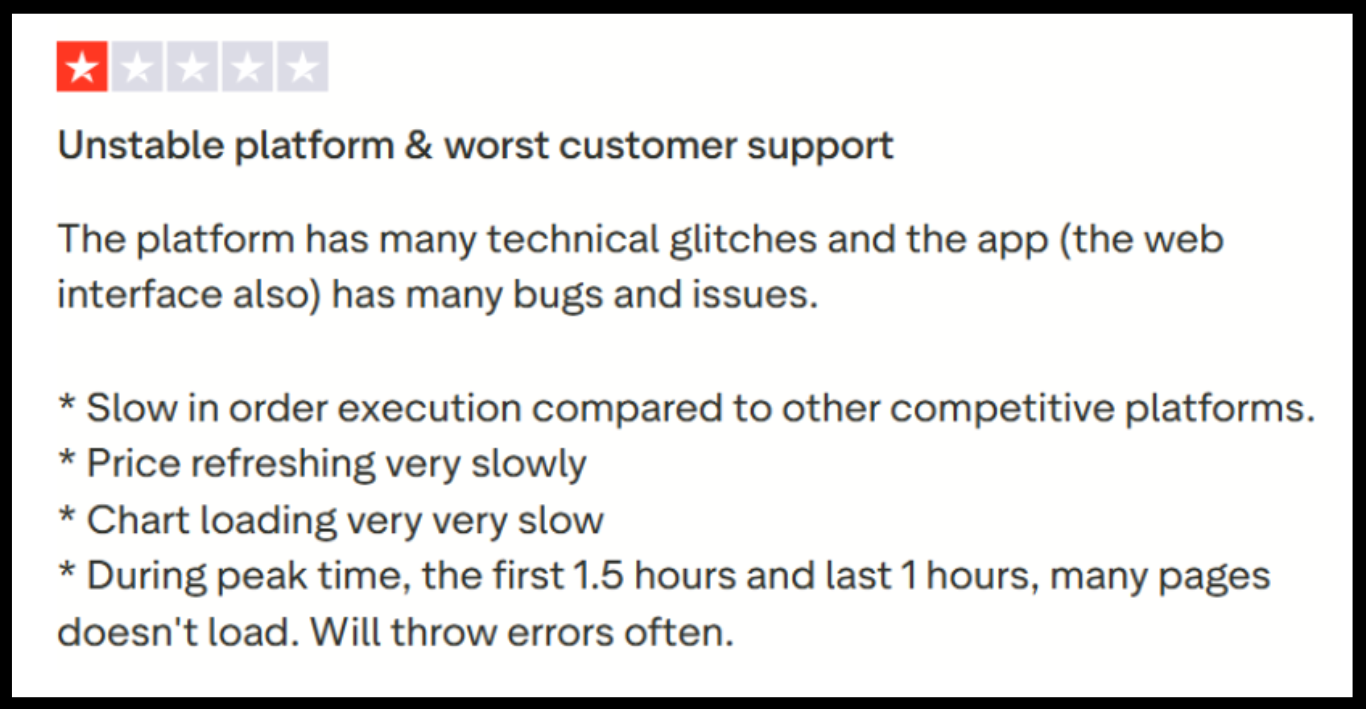

Complaint 5: Platform Crashes

According to multiple complaints on social media, several brokers face this issue:

Technical reliability is crucial. Frequent crashes indicate poor infrastructure. It’s a valid complaint.

How to File a Stock Market Complaint

Ready to complain? Here’s exactly how.

Step 1: Complain to the Intermediary First

Start where the problem originated.

For broker complaints:

- Contact broker’s customer care

- Keep all proof: screenshots, transaction records, communication history

Give them 30 days to respond and resolve.

Step 2: File on Complaint on SCORES Platform

- Register using PAN card and email

- Select complaint category (broker, DP, company, etc.)

- Fill detailed complaint form

- Upload supporting documents (max 2MB per file)

Step 3: Escalate to Exchange Level

If unresolved, move to the exchange.

For NSE complaints:

- Register your complaint with all details

- Attach supporting documents

- Use the Investor Services portal

- Submit a complaint with evidence

Timeline: Exchanges typically respond within 30 days.

Need Help?

Facing difficulties with your stock market complaint? Feeling overwhelmed by the process?

We can help.

Our team specializes in investor grievance redressal. We understand SEBI regulations inside out. We’ve successfully resolved hundreds of cases.

Our services include:

- Complaint Assessment – We analyze your case and connect to a case manager

- Documentation Support – We help gather, organize, and present evidence effectively

- Complaint Drafting – We prepare professionally worded complaints that get attention

- SCORES Filing Assistance – We guide you through the portal step-by-step

- Arbitration Representation – We represent you in ODR proceedings

Don’t let your complaint get ignored. Register with us today and get expert assistance in recovering your funds.

Conclusion

Stock market complaints aren’t just frustrations. They’re serious violations of investor rights.

The key takeaway? You have multiple layers of protection. SEBI, exchanges, depositories – all work to safeguard your interests.

However, protection only works when you act. Don’t ignore issues. Don’t delay complaints. Every day counts.

According to recent statistics, investors who complain promptly recover funds in 80% of cases. Those who delay? Success rate drops below 40%.

The stock market rewards the prepared and punishes the complacent. This applies to investing. And it applies to protecting your investments.

Be prepared. Know the complaint process. Document issues immediately. Act promptly.

And if you need support, reach out. Professional help can make the difference between losing ₹5 lakhs and recovering it with compensation.

Your money matters. Your rights matter. Your complaint matters.

File it. Fight for it. Win it.