₹4,636 crore and counting! That’s how much Indian investors have lost in stock market scams in 2024.

From fake trading apps to algorithmic fraud, scammers are getting smarter, while investors are paying the price.

If you think scams target the unaware or rural areas, think again—cities like Karnataka, Maharashtra, Delhi, and Gujarat top the list of reported fraud cases.

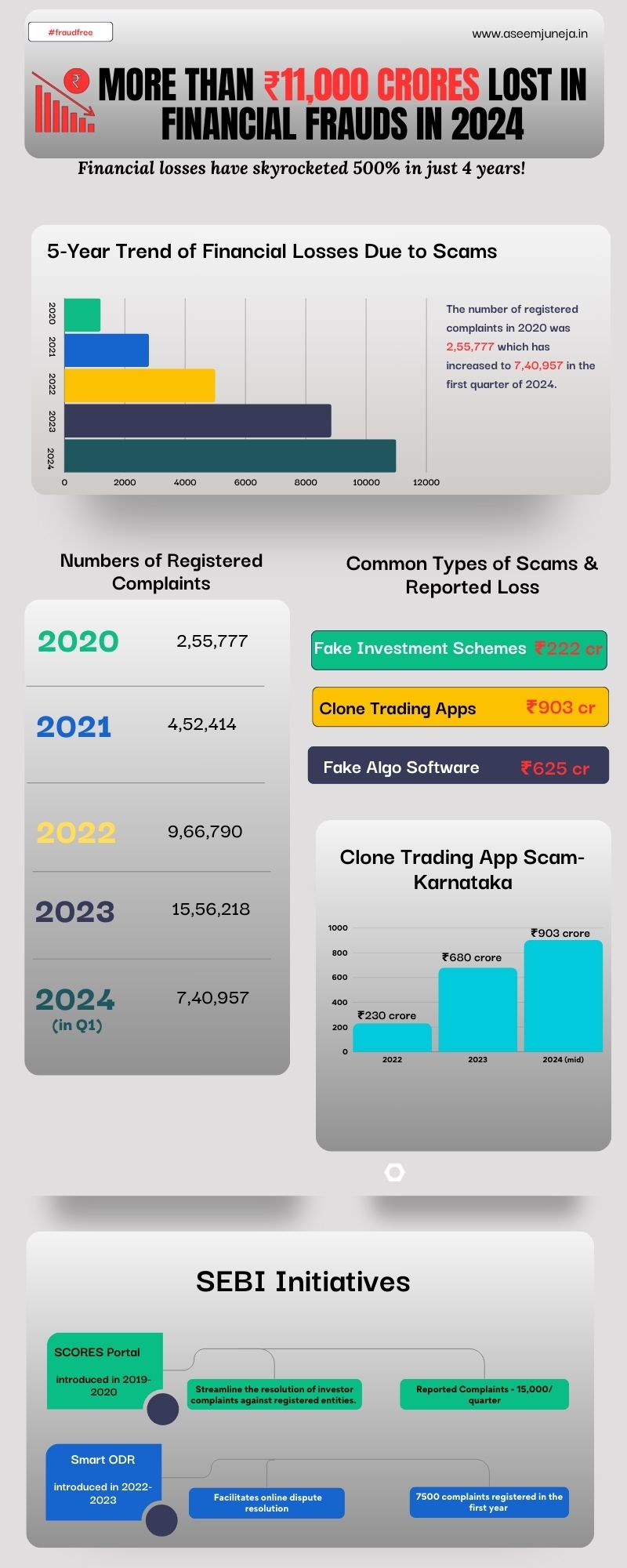

Now looking at the financial loss value in 2019 it was around ₹530 crores which has increased to ₹1,750 crores by April 2024.

The data is alarming, but awareness is key. Let’s dive into the numbers, explore the evolving nature of scams, and see how regulators like SEBI are stepping up the fight.

Common Types of Scams Reported in India

The execution of scams has evolved with time. Scammers are using sophisticated methods making it difficult for a newbie to identify red flags.

Here are some of the major categories under which investors are losing substantial capital:

1. Investment Scheme Scams

- Fraudsters lure investors with promises of high returns through fake investment schemes.

- Looking at the data, around 62,687 complaints have been registered for investment scheme scams, amounting to a total loss of approximately ₹222 crores.

2. Fake Algorithmic Software Manipulation

- Many platforms promise AI-based trading software that guarantees consistent profits, only to deceive investors after collecting hefty fees.

3. Clone Trading Apps

- These clone apps target unsuspecting investors with fake advertisements and irresistible offers.

- Scammers create apps that mimic genuine trading platforms to steal funds.

- Here if look at the clone trading app scam in the state of Karnataka, the total loss amount was ₹230 crores in 2022 which has increased to ₹680 crore in 2023. The value reached ₹903 crores by mid-2024, signaling the exponential growth.

- Authorized Push Payments (APP) scams encompassing clone trading apps resulted in a loss of around ₹3.7 crores in 2023 and the projected loss at a Compounded Annual Growth Rate of 6% is ₹4.9 crores by 2028.

Targetted Cities: Myth vs Fact

There is a prevalent myth that most of the scams occur in people living in rural areas giving a reason for less awareness of digital payment and technology.

However, looking at the data of the reported cases, most of the scams are reported from the states:

- Karnataka

- Maharashtra

- Gujarat

- Delhi

In Karnataka alone, the clone trading app scams and the loss amount has increased significantly in the last three years. In 2022, when the state reported a loss of ₹203 crores, the value rose by 195% to 630 crores in 2023.

The trend is alarming in 2024 where by the middle of this year, the loss amount reached ₹903 crores.

SEBI’s Efforts to Combat Scams

To tackle the rising number of trading scams and investor grievances, SEBI has introduced several initiatives:

1. SCORES Platform (2019-2020)

The SEBI introduced the Complaints Redress System (SCORES) to streamline the resolution of investor complaints against registered entities.

- As per the data in 2022-2023, 34,752 complaints were registered on the SCORES portal in this period.

- Around 15,000 complaints are registered every quarter on SCORES.

2. SMART ODR Platform (2022-2023)

Later the regulatory body introduced the SMART ODR platform facilitates online dispute resolution in the securities market.

- In the first year, around 7500 complaints were reported in the system.

- The platform has been instrumental in offering faster and more transparent dispute resolution.

Conclusion

The numbers reveal a worrying trend in stock market frauds across India. As scams become more sophisticated, losses are skyrocketing, particularly in the urban cities of Karnataka, Maharashtra, Delhi, and Gujarat.

With the significant increase in several clone trading apps and investment schemes, it become important for investors to remain vigilant and rely only on trusted, SEBI-registered platforms.

SEBI’s proactive measures, such as the launch of SCORES and SMART ODR, are significant steps toward protecting investors and ensuring timely grievance redressal.

However, combating the rising fraud requires collective awareness, stricter regulations, and increased adoption of technological safeguards.

To stay safe, investors must:

- Verify platforms on SEBI’s official website.

- Avoid unauthorized trading apps or schemes.

- Register to file a SEBI SCORES complaint immediately.

- In the case of an unregistered entity, one must file a complaint in Cybercrime.

By staying informed and cautious, investors can play a crucial role in minimizing the impact of trading scams in India.