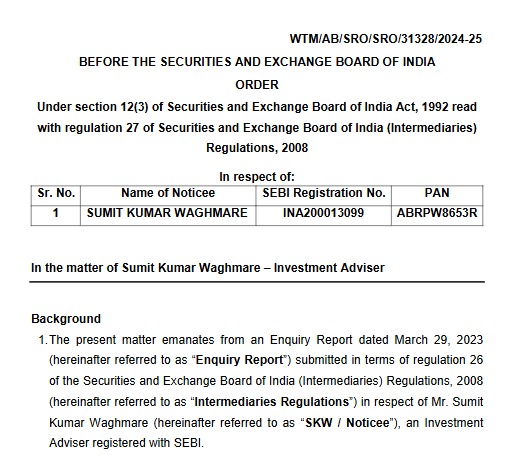

Imagine trusting someone with your hard-earned money, only to discover they were operating outside the rules meant to protect you.

This is exactly what happened with Sumit Kumar Waghmare, a SEBI-registered investment adviser whose actions led to a six-month suspension.

The story begins with a simple question: Can a registered adviser operate through unregistered firms?

SEBI’s answer was clear: Absolutely not.

Who is Sumit Kumar Waghmare?

Sumit Kumar Waghmare seemed like the perfect investment adviser.

He had a SEBI registration number: INA200013099. He was officially registered on April 23, 2019. His credentials were checked out.

But here’s what investors didn’t know:

While showing you his registration, he was operating through completely unregistered firms.

Two firms, to be exact:

- F3 Financials (February 2019 – June 2019)

- Garuda Finance (July 2019 – March 2021)

Neither had SEBI registration. Neither followed the rules meant to protect you.

And together, they collected nearly ₹3.5 crore from investors like you.

The Complaints That Exposed the Operations

- Continuous operation through unregistered entities (over 2 years)

- Significant money collection (nearly ₹3.5 crore combined)

- Lack of transparency about the true nature of operations

- Failure to update SEBI about any of these activities

The complaints weren’t just about poor service; they exposed a fundamental violation of regulatory requirements designed to protect investors.

Major Regulatory Actions on Sumit Waghmare

SEBI doesn’t act on complaints alone. They conduct thorough investigations. Here’s how the case unfolded.

The Inspection (February 2022)

SEBI conducted a detailed inspection of Waghmare’s operations covering April 2020 to March 2021.

Key findings:

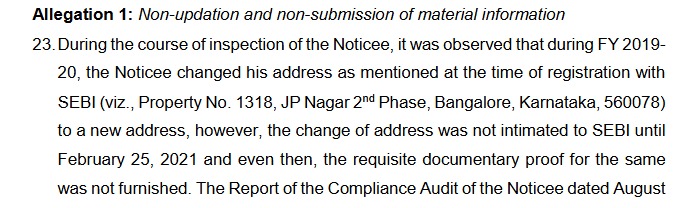

- Office address had changed during FY 2019-20 but wasn’t updated with SEBI until February 2021

- Even then, no documentary proof was submitted

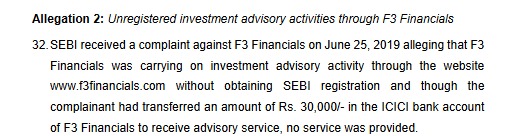

- Unregistered investment advisory activities through F3 Financials were discovered

- Similar activities through Garuda Finance came to light

Violations By Sumit Kumar Waghmare

Let us break down the violations in simple terms that affect you directly as an investor.

Violation 1: Operating Through Unregistered Entities

What the rule says: If you want to provide investment advice for a fee, you must be SEBI-registered. Period.

What Waghmare did: He operated through F3 Financials and Garuda Finance, neither registered with SEBI.

Your protection disappeared the moment you dealt with an unregistered firm, even if there was a registered individual hiding behind it.

Violation 2: Not Informing SEBI About Material Changes

What the rule says: Investment advisers must “forthwith” (immediately) inform SEBI about any material changes, including change of address.

What Waghmare did: Changed his office address in FY 2019-20 but only informed SEBI in February 2021. Even then, provided no documentary proof.

This isn’t a “technical” violation, it directly impacts your ability to hold your adviser accountable.

SEBI’s inspections also get affected. If SEBI can’t find the adviser at the registered address, they can’t:

- Check compliance with regulations

- Verify client records

- Ensure your data is being protected

- Take timely action on complaints

When your adviser hides their real location, you’re the one who suffers.

Violation 3: Misleading Clients About Registration Status

What the rule says: Advisers must make “adequate disclosures of relevant material information” and act “honestly and fairly.”

What Waghmare did: Garuda Finance displayed a SEBI registration number on their website and communications, but the firm itself wasn’t registered.

Client agreements, bank accounts, and services were all in the firm’s name.

You had no reason to doubt anything.

Impact of Sumit Waghmare Violations on You?

Let’s talk about what this actually meant for people who trusted these firms with their hard-earned money.

- You Paid for Services You Never Received

You see a professional website for F3 Financials. It offers investment advisory services. You’re looking for guidance with your investments, so you decide to sign up.

You transfer ₹30,000 to their ICICI bank account. You’re excited to start receiving professional advice.

But then, nothing. No services. No advice. No response.

You try to reach out. The communication stops. Your money is gone.

The impact on you: You have no legal protection because the firm isn’t SEBI-registered

And you’re not alone. SEBI’s investigation found that F3 Financials collected ₹10.91 lakh from investors between February and June 2019. That’s dozens of people who faced similar situations.

- You Were Misled About Who You Were Dealing With

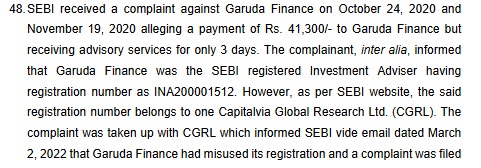

The Garuda Finance deception:

Imagine this is you:

You’re looking for investment advice. You come across Garuda Finance. Their website looks professional. They offer different packages for different investor needs.

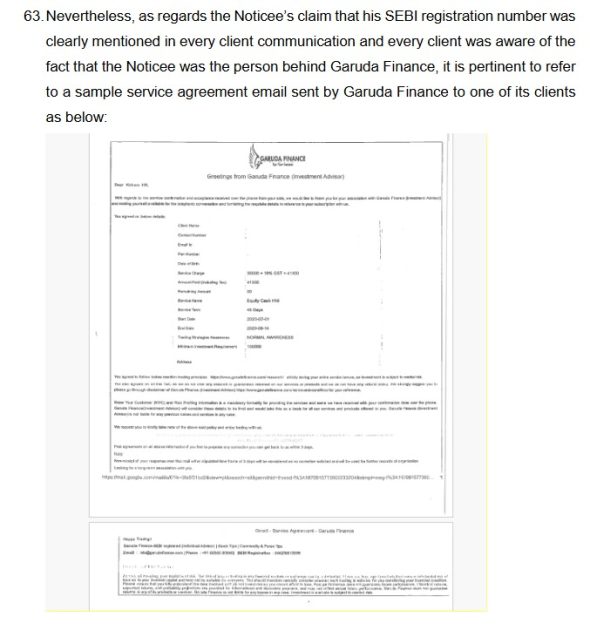

You pay ₹41,300 for their advisory package. You’re happy to invest in professional guidance.

But after just 3 days, the service quality drops dramatically. Or worse, services stop altogether.

You try to complain. That’s when you discover the shocking truth:

The SEBI registration number they showed you (INA200001512) didn’t belong to Garuda Finance at all. It belonged to a completely different company, Capitalvia Global Research Ltd.

The impact on you:

- You were deceived into thinking you were dealing with an SEBI-registered firm

- The registration protections you thought you had? They don’t exist

Over ₹2.51 crore was collected from investors like you through Garuda Finance alone.

Think about that number. At ₹41,300 per client, that’s potentially 600+ investors who were affected. 600+ people who trusted a SEBI registration number they saw on a website.

What Made the Sumit Kumar Waghmare Case Worse?

Here’s what really hurt investors:

Waghmare started F3 Financials in February 2019, BEFORE he even got his SEBI registration in April 2019.

Then, immediately after F3 Financials faced complaints, Garuda Finance started in July 2019.

This wasn’t a mistake. This was a pattern.

For over 2 years, investors kept putting money into unregistered entities. By the time SEBI took action in 2022, the damage was done.

What SEBI Investigation Found?

SEBI’s investigation uncovered facts that should concern every investor.

1. The F3 Financials Trail

Evidence SEBI found:

- ₹2.27 crore received across 565 transactions in just 9 months

- Transaction descriptions like “stock consult,” “trading fees,” “share tip fee,” “HNI package”

- ₹10.91 lakh specifically identified as investment advisory fees

What Waghmare claimed:

“I was defrauded by my ex-employers. They misused my KYC documents. I had no control over F3 Financials.”

Why SEBI didn’t believe him:

He declared F3 Financials income in his own Income Tax Returns. The police complaint was filed AFTER SEBI started investigating.

2. The Garuda Finance Trail

Evidence SEBI found:

- Partnership deed clearly stated: “business shall be stock market advisory, financial advisory, consultancy”

- Both were authorized signatories and beneficiaries

- ₹2.51 crore collected between July 2019 and February 2021

- Website offered investment advisory packages

What Waghmare claimed:

“Garuda Finance was just a brand name, not a separate entity. I was the one providing all services. My SEBI registration number was clearly displayed.”

Why SEBI rejected this argument: Sample email shown in SEBI’s order: “Garuda Finance is SEBI registered (Individual Advisor)”

SEBI Verdict

Whole Time Member Ashwani Bhatia disagreed with the lenient recommendation.

Aggravating factors that justified suspension:

- Timing: Waghmare provided advisory services through F3 Financials even before getting SEBI registration (showing intent to circumvent rules)

- Duration: Operated through unregistered entities for over 2 years continuously

- Multiple violations: Not just one entity, but two separate operations (F3 Financials and Garuda Finance)

- Significant amounts: Collected nearly ₹3.5 crore through these unregistered channels

- Lack of genuine remorse: The “fraud” defense appeared fabricated after the fact

- Disregard for regulations: Showed “scant regard” for applicable requirements

What does this mean for Retail Traders?

During the suspension period:

- Waghmare cannot provide any investment advisory services

- He cannot take on new clients

- Existing clients must be informed

- He remains subject to all other regulatory requirements

What Can You Do in Such Cases?

If you are a client or investor who faced issues with Sumit Kumar Waghmare, F3 Financials, or Garuda Finance, you are not alone.

Our dedicated team specializes in supporting investors in situations like these.

We provide end-to-end guidance to ensure your grievance is clearly documented and effectively escalated.

- Initial Consultation & Case Assessment

We arrange a confidential discussion with a dedicated Case Manager who will listen carefully to your full experience with Sumit Kumar Waghmare, F3 Financials, or Garuda Finance.

- Professional Case Documentation & Drafting

We help you prepare a structured, persuasive, and legally sound complaint that outlines:

- The misconduct you experienced

- Any financial losses incurred

- Specific SEBI rule violations (such as operating through unregistered entities, failure to disclose material information, or misleading clients about registration status)

- Direct Engagement & Escalation

- Reaching out to Sumit Kumar Waghmare: We guide you in formally communicating your complaint to the advisor, which is often a required step before approaching SEBI.

- Filing on SEBI SCORES: We assist you in filing a complaint on the SCORES portal. We will also help you track its status and respond to SEBI queries.

- Exploring SEBI Smart ODR: If eligible, we can guide you through the SEBI Online Dispute Resolution platform for a faster resolution.

- Advisory & Strategic Counselling

Our experts provide realistic advice on potential outcomes, possible recovery avenues, and expected timelines based on similar cases against investment advisors.

If responses from Sumit Kumar Waghmare or initial SEBI actions are unsatisfactory, we help you explore further options, like filing an arbitration and representing your case.

Take the First Step Today

Register with us today, and let our experienced team guide you toward a fair resolution.

Conclusion

The Sumit Kumar Waghmare case isn’t just about one adviser’s suspension. It’s a wake-up call for every investor in India.

When you deal with an unregistered entity, even if there’s a registered individual behind it, you lose these protections.

The Waghmare case shows that SEBI is watching and willing to act. But they can’t be everywhere. Your vigilance is the first line of defence for your own investments.

Investment advisers play a crucial role in helping people build wealth and secure their futures. But that role comes with responsibility, to clients, to the market, and to the regulatory framework that maintains trust in the system.

When advisers cut corners, everyone suffers. When investors stay alert, everyone benefits.

Remember: A truly trustworthy adviser welcomes your questions, provides clear documentation, and operates fully within SEBI’s framework. If something seems off, it probably is.

Your financial future is too important to leave to chance. Verify. Question. Protect.