In today’s hyper-digital finance world, the lure of “quick money” and “guaranteed profits” can feel almost irresistible. After all, who wouldn’t want their money to multiply while they sleep?

But just like a catchy tune that hides a dangerous message, these promises often come with risks most investors don’t see until it’s too late.

One name that’s been quietly making its way into online discussions, complaint forums, and warning posts is TradeNow.

Let’s be honest. Our screens are crowded with trading apps claiming they can transform ordinary people into overnight millionaires. Flashy dashboards, persuasive marketing, and confident “success stories” make everything look legit.

But here’s the uncomfortable truth.

Many such platforms operate in regulatory grey zones, well outside the watchful eye of authorities meant to protect investors like you.

So, where does TradeNow really stand? Is it a genuine trading opportunity or just another digital mirage?

If you’re even remotely thinking about putting your hard-earned money into this platform, pause right here.

This blog takes you behind the scenes, breaks down the claims, and explains why seasoned market watchers and experts are raising red flags.

By the end, you’ll have a much clearer picture and hopefully avoid learning a costly lesson the hard way.

TradeNow Review

At first glance, TradeNow looks like it has all the right ingredients to win your trust.

A sleek interface, bold promises of fast trades, and the allure of attractive profits, everything a beginner or even a seasoned trader might want seems neatly packaged on the surface.

But dig a little deeper, and the story takes a sharp turn.

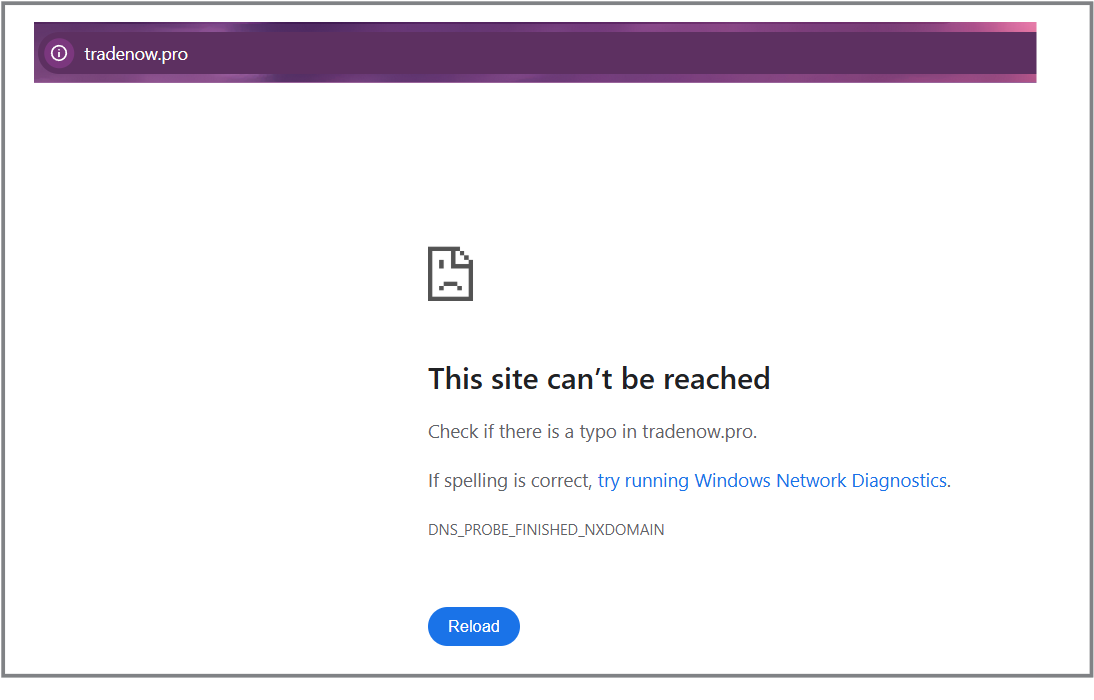

The polished image quickly starts to crack when you try to trace the platform’s real presence. Instead of a clear, functional website, you’re met with dead links, vanished pages, and an unsettling lack of verifiable information.

What should have been a transparent digital storefront feels more like a ghost trail scattered across the internet.

This stark contrast between promise and reality raises an obvious question: if a platform can’t maintain something as basic as a working website, how reliable can it really be when it comes to handling your money?

If a trader is unable to give you details of its services, then how can it be authentic?

TradeNow’s online footprint doesn’t inspire confidence; it leaves users searching, guessing, and ultimately doubting whether there’s anything solid behind the glossy claims.

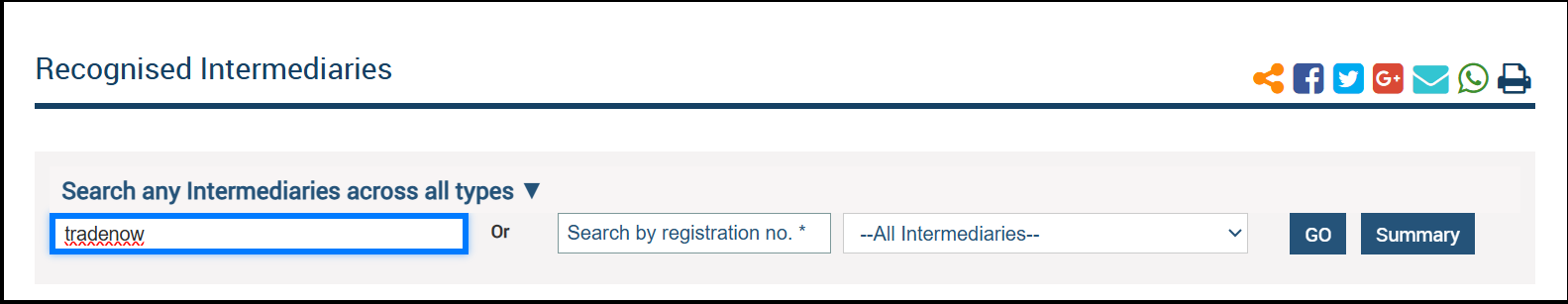

Is TradeNow SEBI Registered?

In India, investing isn’t a free-for-all; it’s governed by strict rules designed to protect you. Any company offering stock broking or investment services must be registered with SEBI.

Now here’s the red flag: TradeNow is NOT SEBI-registered.

So what does that really mean for an investor?

Think of SEBI as a safety net. When you trade through a SEBI-registered broker, you’re covered by regulations, grievance mechanisms, and investor protection norms.

But the moment you step onto an unregistered platform like TradeNow, you step outside that protective umbrella. If something goes wrong, your funds vanish, trades are manipulated, or the app simply stops responding, SEBI cannot step in to recover your money.

In short, trading with TradeNow isn’t just risky. It’s like handing over your hard-earned money with no legal backup.

Before you invest, pause, verify, and make sure the platform is SEBI-registered. In the market, excitement fades fast, but losses can last a lifetime.

TradeNow is Real or Fake?

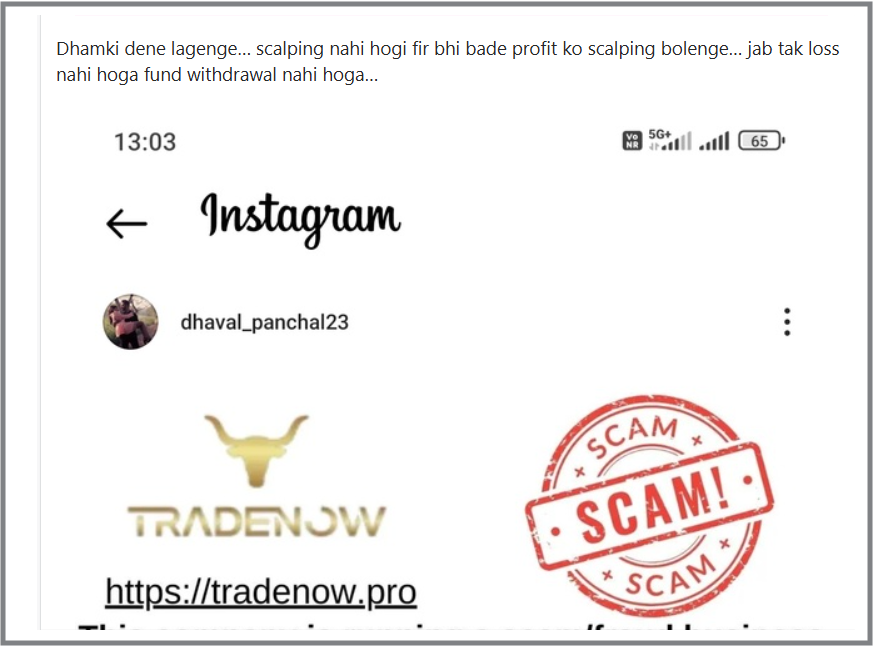

When people ask whether TradeNow is real or fake, the answer isn’t as simple as whether the app once worked. A smooth interface doesn’t equal legitimacy, and this is where TradeNow starts raising serious red flags.

Yes, the app may have looked functional at some point. Buttons worked, screens loaded, and everything appeared “normal.” But in the world of finance, appearances can be dangerously misleading.

What truly matters is trust, transparency, and regulatory compliance, and this is where TradeNow’s credibility begins to crumble.

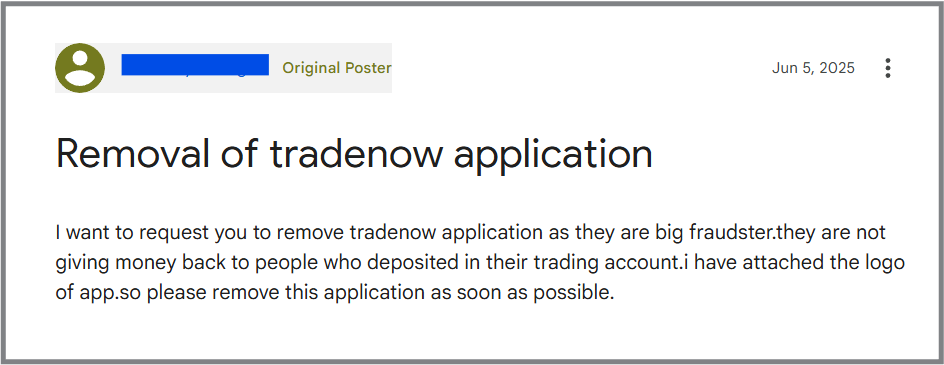

Here’s the most alarming part: TradeNow has vanished from the Google Play Store. That’s not a minor technical hiccup. Google doesn’t casually remove financial apps unless there are serious policy violations involved.

Especially those linked to deceptive practices or potential fraud. In fact, users themselves reportedly flagged the app, urging Google to take action and calling it a “big fraud.”

A legitimate business wants to be found. TradeNow, however, has no reachable website and no official social media presence for customer support.

So, while TradeNow may once have looked real, its disappearance from official platforms tells a much darker story. In the financial world, silence and disappearance often speak louder than flashy promises.

Is TradeNow Safe?

When it comes to choosing a financial platform, nothing matters more than safety.

Before trusting any app with your hard-earned money, a simple question must be answered: Can this platform be held accountable if something goes wrong?

That’s where TradeNow immediately raises alarm bells.

A genuinely safe platform is open about who runs it, where it operates from, and how it protects user data. TradeNow, unfortunately, checks none of these boxes.

Its website is currently unreachable, there’s no clarity about the company behind the app, no identifiable founders, and no verifiable office address. In the financial world, this kind of anonymity isn’t mysterious; it’s dangerous.

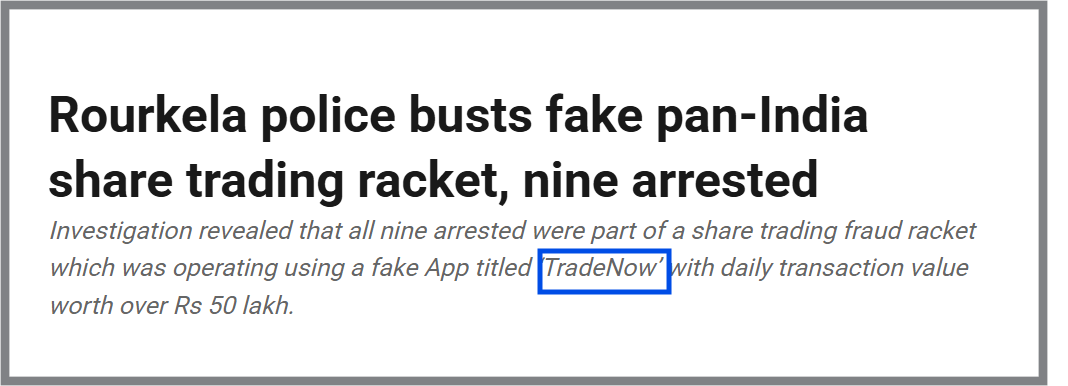

What makes the situation even more serious is the involvement of law enforcement. The so-called “TradeNow” app has been flagged as part of an international organised crime and fraud network.

In fact, Rourkela police uncovered a pan-India share trading scam that was operating through a fake app named ‘TradeNow’, exposing it as a front for defrauding investors.

Think about it: if a platform refuses to tell you who they are or where they’re based, who do you turn to when your money disappears? In finance, secrecy isn’t a feature.

It’s a major red flag. And with TradeNow, the lack of transparency combined with confirmed police action makes one thing clear: this is not a platform you can trust with your money.

TradeNow Complaints

Pinning down official, verifiable complaints is tough, and that’s largely because the platform operates in the shadows, leaving behind little permanent evidence.

But step into online forums, comment sections, or discussion groups, and a clear pattern starts to emerge. The sentiment isn’t mixed. It’s overwhelmingly negative.

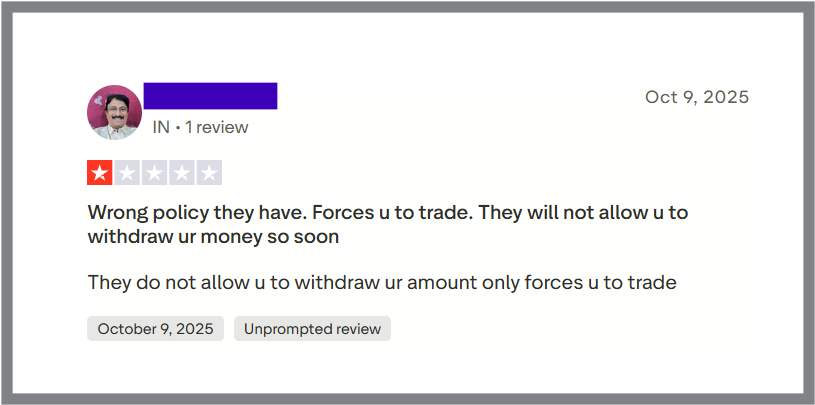

Users repeatedly share the same unsettling experience: depositing money is effortless, almost encouraged, but the moment you try to take your funds back, everything changes.

TradeNow Withdrawals suddenly become “under review,” support goes silent, and excuses begin to pile up. For many, the money simply never comes back. This isn’t just frustration; it’s one of the most common red flags associated with financial scams.

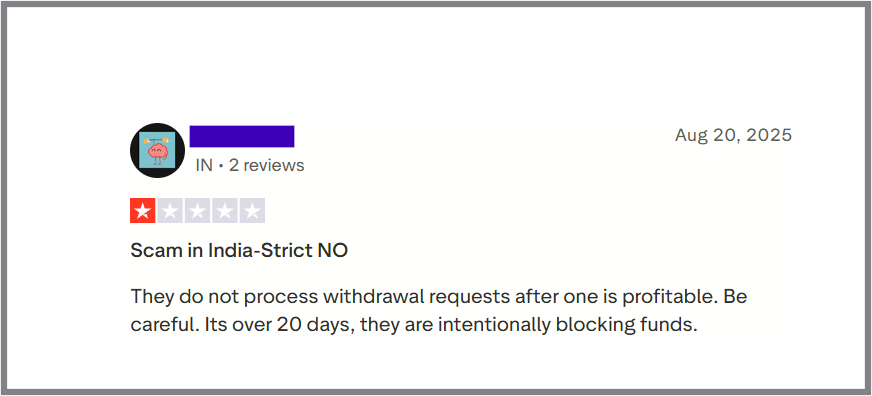

Even more alarming is what happens when users actually make a profit. Instead of processing withdrawal requests, the platform allegedly freezes accounts or delays payouts indefinitely.

Some users claim their funds have been blocked for over 20 days with no clear explanation, strongly suggesting intentional obstruction rather than a technical glitch.

The takeaway is hard to ignore.

When a platform makes it easy to put money in but nearly impossible to get it out, especially after you start winning. It’s time to step back and be extremely cautious.

These complaints paint a consistent picture of a platform that prioritizes taking money rather than providing a legitimate trading service.

TradeNow Withdrawal Issues

One of the loudest red flags raised by users of shady trading platforms is the withdrawal nightmare. Putting money in feels effortless. Just a few taps and your funds are accepted instantly.

But the moment you try to take your money out, the story changes dramatically.

Suddenly, withdrawals are “under process” for days or even weeks. Technical glitches appear out of nowhere. Support tickets vanish into silence.

Customer care, once eager and responsive, becomes unreachable. For many users, what should have been a simple withdrawal turns into an exhausting chase with no resolution.

What’s even more alarming is how TradeNow platforms keep investors hooked. Users report seeing impressive profits displayed on the app, numbers that look too good to ignore.

Encouraged by these fake gains, they’re nudged to deposit even more money. And just when confidence peaks and users attempt to withdraw larger amounts, accounts get frozen, or withdrawals are abruptly blocked.

This pattern, easy deposits, flashy profits, and impossible withdrawals, is a classic warning sign of investment fraud. If a platform celebrates your deposits but resists your exits, it’s not a trading app. It’s a trap waiting to snap shut.

How to Report Trading Scams?

If you have encountered TradeNow or a similar suspicious trading platform, it’s crucial to report it to the relevant authorities to help prevent others from falling victim.

- File a Cyber Crime complaint at the National Cybercrime Reporting Portal. Provide as much detail as possible, including any communication, transaction records, or screenshots.

- While TradeNow is not registered with SEBI, you can still inform them about unregistered entities operating in the market. They have mechanisms to investigate such reports.

- If you have transferred money to TradeNow, immediately contact your bank or the payment gateway you used to see if they can initiate a chargeback or stop the transaction.

- Share your experiences on reputable online forums, consumer protection websites, and social media to warn others. However, be cautious about sharing personal information publicly.

Need Help?

We understand the challenges and are here to help guide you.

Register with us and get help drafting a clear, detailed complaint, understand which authority to approach first, and get guidance on how to talk to your bank or card provider for trading scams recovery.

Conclusion

Based on the comprehensive analysis, it becomes clear that TradeNow does not appear to be a legitimate or safe platform for investment.

The lack of an official and verifiable website, its absence from trusted app stores, no visible SEBI registration, and repeated negative feedback from users all raise serious concerns.

These are common warning signs seen in many trading frauds in India, where platforms operate without accountability or regulatory oversight.

In today’s fast-moving online trading space, it’s easy to be tempted by promises of quick and effortless returns. Scammers rely on this urgency to pull users in before doubts surface.

That’s why the golden rule of investing still holds true: when an opportunity sounds too good to be true, it usually is.