In today’s fast-moving digital finance space, choosing the right app to handle your money can feel a lot like solving a puzzle. Every day, a new name promises faster transfers, easier bill payments, and smarter money management. In 2026, one such name that keeps grabbing attention is the U Money app.

Maybe you’ve seen it while trying to send money to family, pay your utility bills, or explore a digital wallet that claims to do it all.

But here’s the catch. Where convenience grows, questions follow. Online scams are becoming smarter and more convincing.

It’s natural to pause and ask: Is U Money genuinely trustworthy, or is it just another app wearing a convincing mask?

That’s exactly what we’re here to uncover. In this in-depth guide, we’ll peel back the layers of the U Money app, examine how it works, and talk honestly about the security aspects you should care about.

More importantly, we’ll help you understand how to protect yourself while navigating today’s digital economy.

U Money App Login

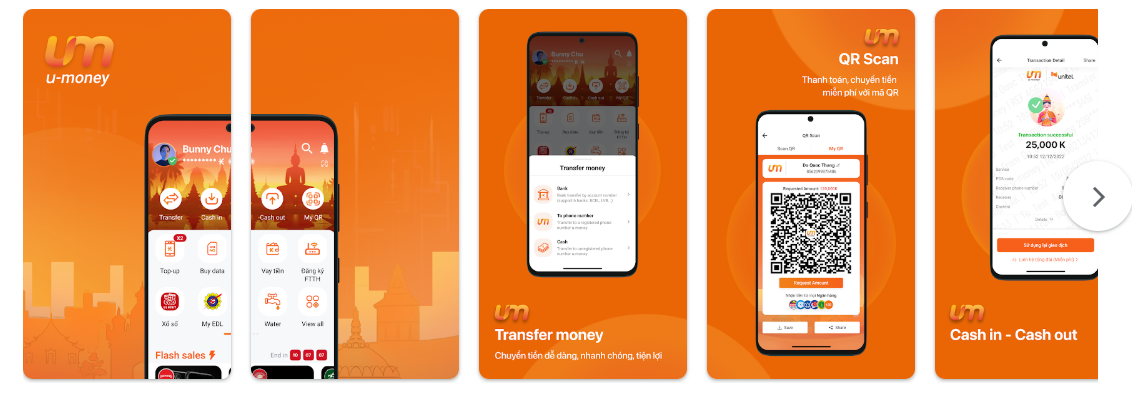

The u-money service (managed by Star FinTech Sole Co., Ltd, a subsidiary of Unitel) is a “Mobile Bank” that has revolutionised financial inclusion, particularly in the Lao PDR and surrounding regions.

It functions as a digital wallet that allows users to perform banking tasks without needing a traditional bank account.

However, the U Money App incorporates various security measures to protect user data and transactions, which generally makes the login process safe, provided users follow best practices for mobile banking security.

There are dozens of apps on third-party stores labelled “U Money Loan” or “Easy U Money.” Many of these are unregulated predatory loan apps that use the name to gain unearned trust. Additionally, there are options for downloading APK files for the U Money app, which can be unsafe.

U Money App Real or Fake?

So, is the U Money app genuine, or is it another digital trap waiting to drain your wallet? The answer isn’t a simple yes or no, and that’s where most people get confused.

Here’s the truth you need to know.

The real U Money does exist. The official version developed by Star Telecom Co., LTD is a legitimate financial app.

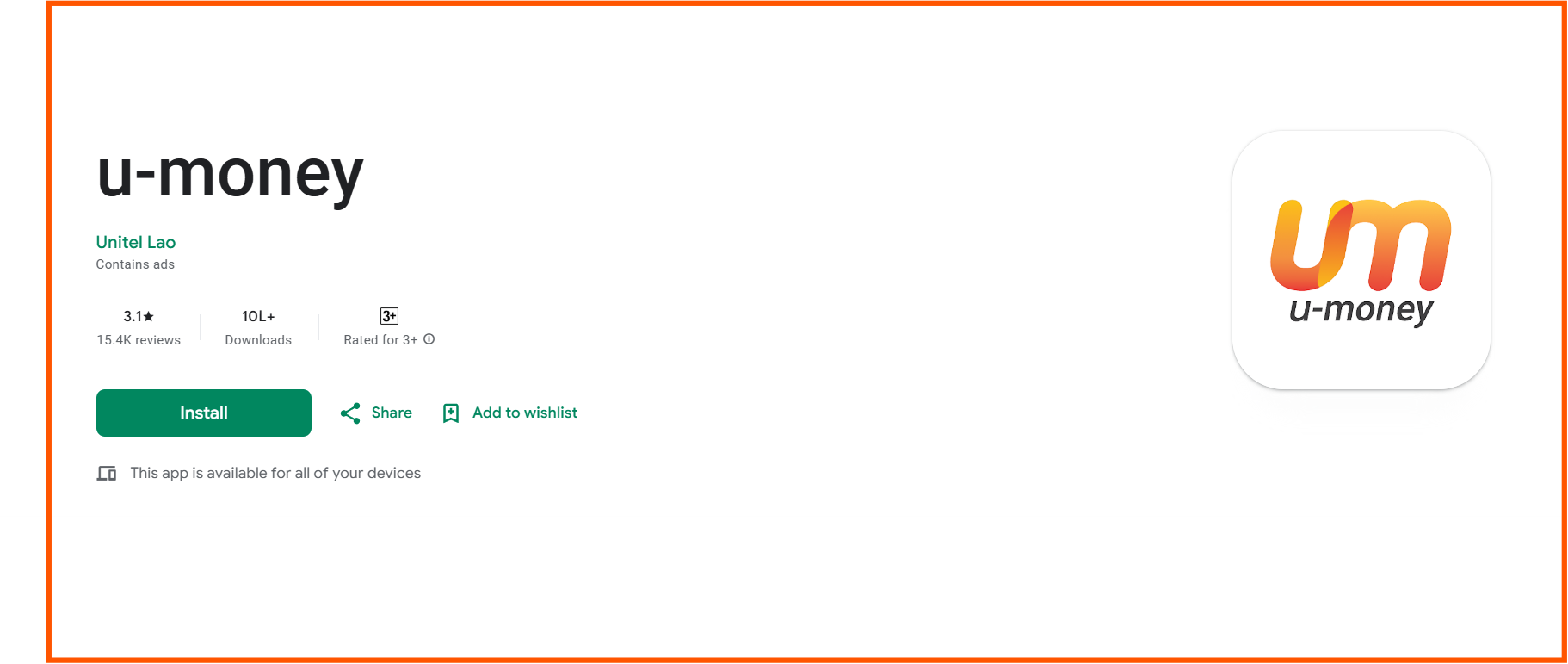

It operates under licenses issued by central banks such as the Bank of Lao PDR, has millions of downloads, and shows a solid, consistent update history on both the Google Play Store and Apple App Store. In short, this version checks all the right boxes of a regulated digital wallet.

But here’s where things take a dangerous turn.

Because the name “U Money” sounds catchy and generic, scammers have been having a field day. Dozens of fake or “clone” apps using the same name have popped up online.

These versions usually don’t appear on official app stores. Instead, they arrive via WhatsApp messages, suspicious SMS links, Telegram groups, or shady APK websites promising “instant loans” or “quick cash.”

And that’s the biggest red flag.

While the U Money app itself is legitimate, many apps claiming to be “U Money Instant Loan” are not. These fake versions often exist only to steal personal data, access contacts, or trap users in illegal lending practices.

Is U Money Safe?

When it comes to financial apps, safety isn’t a badge you slap on the homepage. It’s what’s happening behind the screen. And in 2026, the official U Money platform makes a strong case for itself.

But here’s where things get tricky, and where many users get caught off guard.

Not every app with “U Money” in its name is the real deal. Several unofficial loan apps operate under lookalike names such as U Money Loan, U-Cash, or U-Loan.

These apps often lure users with “instant approval” promises, only to trap them with interest rates that can cross 100% per annum, cleverly disguised as processing or convenience fees. These aren’t just expensive, they’re dangerous.

And even if you’re using the genuine app, the risk doesn’t disappear completely. Scammers don’t always attack the platform; sometimes, they target you.

Fake customer support calls, phishing links, and social engineering tricks are still very much part of the game. When you install these apps, they often demand access to your Contacts, SMS, and Gallery.

This is the “hook” they use to harass your friends and family if you don’t comply with their demands.

So, is the U Money app safe? The safety of the app is highly questionable, as many of the user reports involve morphing photos from the gallery.

But the real challenge lies in spotting the fakes and staying alert. In today’s digital finance world, safety isn’t just about the app you download. It’s about the decisions you make after installing it.

U Money User Complaints

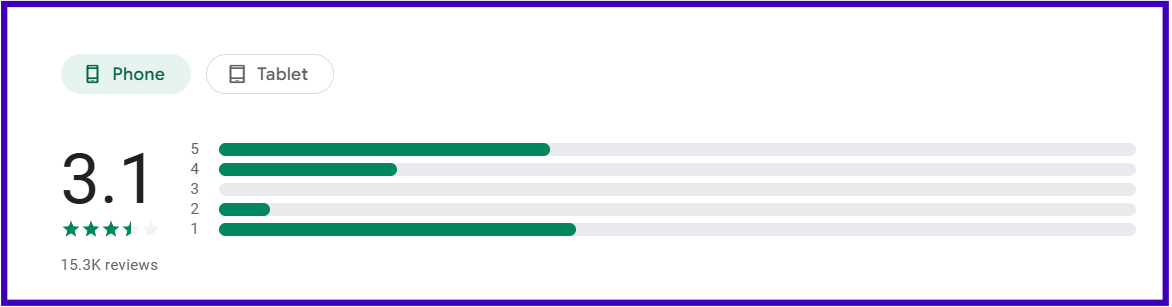

User complaints surrounding the U Money app paint a deeply troubling picture, one that goes far beyond a low app rating. With a 3.1-star rating on the Google Play Store, the reviews tell a story of frustration, fear, and alleged misconduct that many users say they never signed up for.

However, due to the same spelling and name, some of the users often confuse and give a review for one app only.

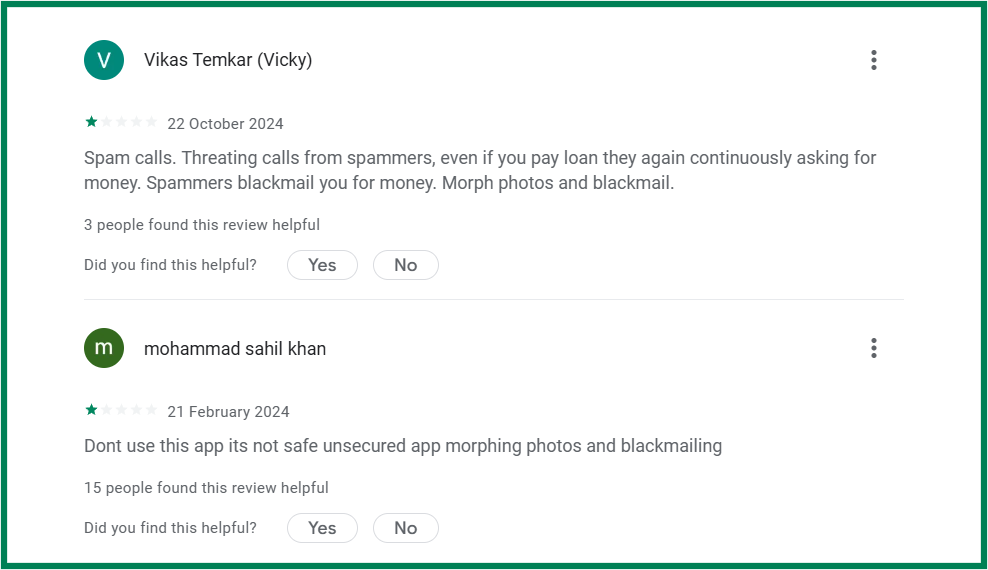

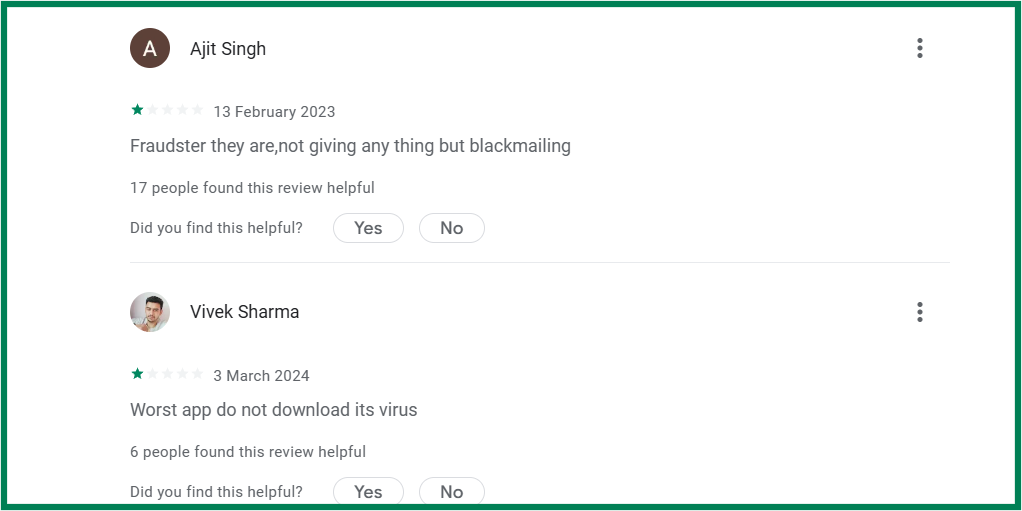

Several users claim that once they install the app, they are bombarded with relentless spam calls, often from unknown numbers. What’s more alarming is that even after repaying the loan, the calls allegedly don’t stop.

Instead of closure, users report being repeatedly pressured to pay again, as if the repayment never happened.

The situation takes an even darker turn in some reviews. Users allege that threatening and abusive calls are made by spammers who resort to intimidation tactics. There are disturbing claims of blackmail, including the misuse and morphing of personal photos, allegedly to extort more money. For many, this turns a short-term loan into a long-term nightmare.

Taken together, these complaints raise serious red flags.

For anyone considering the U Money app, these experiences serve as a stark reminder to proceed with extreme caution and to thoroughly research before sharing personal data or financial details.

How To Report U Money App?

If you have fallen victim to harassment or fraudulent charges from a U Money app, you must act immediately. Do not suffer in silence.

- Go to the Google Play Store or Apple App Store, find the app page, and click “Flag as Inappropriate.” Select “Harmful to users” or “Fraud.” This helps get the app removed for everyone.

- File a complaint at Cyber Crime or call the National Helpline.

- If the app is a fake lender, report it to the RBI Sachet Portal.

Need Help?

Navigating the world of digital wallets shouldn’t be terrifying. If you are looking for assurance, we can help you find the right path.

You can register with us.

Conclusion

U Money app is a classic example of why we must look beyond the name.

While a legitimate version exists for mobile payments, the marketplace is currently flooded with predatory “U Money” loan clones that use harassment, blackmail, and data theft to exploit users.

Based on the evidence of photo morphing and relentless extortion reported by users, extreme caution is advised.

Always verify the developer, check for a valid NBFC license, and never, under any circumstances, give an app access to your personal photos or contacts for a loan.