Many investors believe that problems only arise with unregistered or fly-by-night operators. That belief is dangerous.

Even a SEBI-registered stock broker can face serious allegations if its representatives misuse access, bypass consent, or exploit client trust.

A recent client complaint against Goodwill Wealth Management Pvt. Ltd. highlights how unauthorized trading, misuse of OTPs, and excessive brokerage can occur even within a regulated setup.

This blog explains the issue step by step, starting from what Goodwill claims on its website, moving into the client’s allegations, and then explaining why these actions matter under SEBI rules and what investors can do when this happens.

What Goodwill Wealth Management Claims on Its Website?

According to its official website, Goodwill Wealth Management:

- Started operations in 2008

- Serves over 2 lakh customers across India

- Operates through 100+ locations

- Works with 2000+ Authorized Persons (APs)

- Employs over 650 staff members

- Holds memberships with NSE, BSE, MCX, and other exchanges

- Positions itself as a “trusted stock broker” offering personalized services

Being SEBI registered allows a broker to:

- Open Demat and trading accounts

- Execute trades only on client instructions

- Charge brokerage as per disclosed slabs

However, registration does not allow:

- Trading without consent

- Sharing or using client passwords or OTPs

- Providing “account handling” or assured returns

The Client’s Allegation: Unauthorized Trading and Credential Misuse

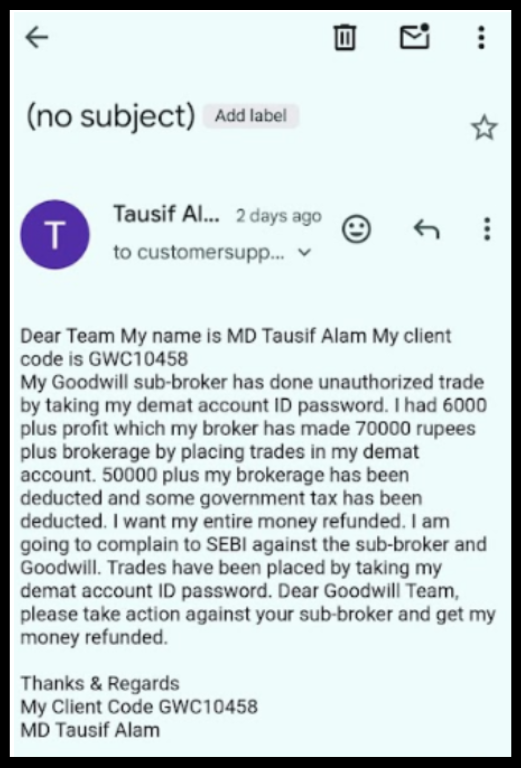

The client, MD Tausif Alam, raised a formal escalation after receiving no response from Goodwill’s compliance team.

He alleges the following:

- A Goodwill sub-broker accessed his trading account by taking his Demat ID and password

- Trades were placed without his authorization

- His account showed limited profit, but massive brokerage was generated

- Over ₹50,000 was deducted as brokerage, along with taxes

- He never approved trades in advance

- He never consented to discretionary trading

- He demanded a full refund and warned of escalation to SEBI

Unauthorized trading does not depend on whether the broker is registered. It depends on whether the client authorized the trades.

Unauthorised Trading by Goodwill Wealth Management – Findings

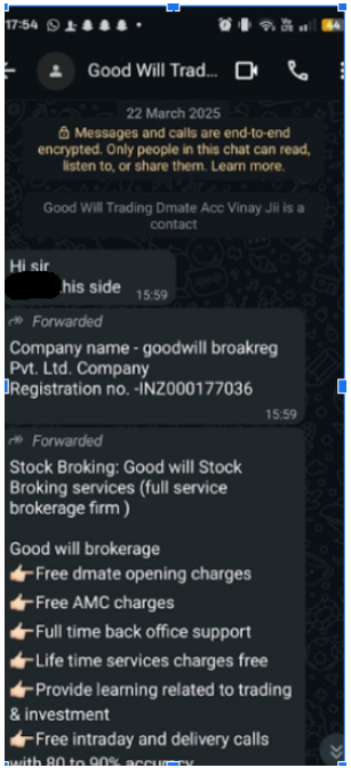

According to the escalation mail, the client was contacted in March 2024 by Mr. Ajay (name changed), who introduced himself as a representative of Goodwill Wealth Management.

The client states that:

- He was persuaded to open a Demat and Trading Account

- His KYC documents were collected by the representative

- He was assured that:

- His account would be “professionally handled”

- Trading would be safe

- Returns would be guaranteed

Later, the client was introduced to another individual, Mr. Prabhas (name changed), who was presented as the account handler responsible for trading activities.

At this point, the relationship moved from simple brokerage to account handling, which SEBI rules do not permit unless the entity holds specific discretionary portfolio management approval.

Here are the violations done by Goodwill Wealth Management:

1. Account Handling

- He made an initial investment of ₹20,000

- A profit of around ₹10,000 was shown

- Based on this, he invested another ₹20,000

- By April 2024, total funds reached around ₹73,000

- Trades then resulted in substantial losses

- He was pressured to deposit an additional ₹13,000 to cover losses

Throughout this period:

- Trades happened without prior consent

- No trade-wise confirmation was taken

- No written authorization existed

SEBI rules place the burden of proof on the broker to show that the client authorized each disputed trade.

2. Misuse of OTP

The most serious allegation involves OTP misuse.

The client states that:

- Representatives repeatedly asked him to share OTPs

- He initially refused, knowing that OTPs are sensitive

- He later shared OTPs after repeated assurances of safety and guaranteed returns

- The OTPs were then used to execute unauthorized trades

Under SEBI and exchange rules:

- OTPs exist to protect the client

- Brokers and their representatives must never ask for OTPs

- Using OTPs to place trades without consent is a grave violation

Once a broker or its agent uses OTPs this way, the issue moves beyond negligence into misuse of credentials.

3. Assurance of Guaranteed Returns

The client was told that:

- Goodwill is SEBI-registered

- The firm provides “account handling services.”

- Experts would manage the account

- There was “no risk.”

- Losses would be recovered with guaranteed profits

These claims directly conflict with SEBI regulations.

SEBI treats such assurances as misrepresentation and unfair trade practice, even if the broker holds a valid registration.

The client alleges that:

- Around ₹51,000 was charged as brokerage and account handling fees

- These charges were never disclosed at account opening

- The deductions were arbitrary and disproportionate to the capital involved

If charges appear excessive and undocumented, the broker must justify them with records.

Why This Case Qualifies as Unauthorized Trading?

Based strictly on the complaint and screenshots provided, the allegations point to:

- Trades executed without prior approval

- Credential and OTP misuse

- Discretionary trading without mandate

- Misleading assurances of guaranteed returns

- Non-disclosure of charges

What Investors Should Do When Unauthorized Trading Happens?

Now, such cases are on the rise, and the major reason behind that is a lack of awareness. Retail traders consider SEBI-registered entities safe to handle their accounts and fall into the trap of guaranteed return profits, which eventually leads to losses.

In the stock market, along with trading knowledge, regulatory understanding is a must to avoid such losses.

In case you have lost a certain amount in any such case, then take immediate action and file a complaint by following steps below:

Step 1: Stop Further Damage

- Change trading and Demat passwords

- Disable dealer or sub-broker access

- Inform the broker in writing immediately

Step 2: Write to the Broker’s Compliance Officer

- Clearly mention “Unauthorized Trading.”

- List disputed trades with dates

- Demand trade-wise authorization proof

Step 3: File a Complaint in SCORES

- Use the SCORES platform

- Attach emails, chats, call logs, and statements

- Highlight OTP misuse and assured return claims

Step 4: Escalate to the Exchange

If the broker does not respond:

- File a complaint with BSE or NSE

- Use the Investor Grievance Redressal mechanism

Step 5: File Arbitration in the Stock Market

If the exchange process fails:

- File for arbitration

- SEBI and exchanges often award refunds in proven unauthorized trading cases

Need Help?

Reach out to us; unauthorized trading cases often collapse because investors:

- Panic and delay complaints

- Fail to preserve evidence

- Do not frame the issue correctly under SEBI rules

We provide practical guidance on:

- Identifying unauthorized trades

- Structuring complaints that regulators act on

- Understanding broker vs sub-broker liability

- Navigating exchange, SEBI, and arbitration processes step by step

The focus stays on facts, evidence, and regulatory accountability, not noise.

Conclusion

Goodwill Wealth Management is a SEBI-registered broker.

That status brings responsibility, not immunity.

If a client’s allegations prove true, the issues do not lie in market risk. They lie in process failure, misuse of trust, and violation of investor protection norms.

Unauthorized trading does not become acceptable because a broker is large, old, or registered.

Consent remains the foundation of every trade.