WealthyVia Ventures, a growing player in the investment advisory space, presents Pritam Prabodh Deuskar as its research analyst.

On paper, his profile seems impressive: a SEBI-registered professional with expertise in equity research, backed by a polished website and bold claims of identifying multibagger stocks early.

For a retail investor tired of confusing noise on social media, that combination can feel like finally finding “the right guide” in a risky market.

But whenever an analyst builds a strong personal brand around stock recommendations, the real question isn’t just, “How impressive does the profile look?”

The real question is: “What do SEBI orders, public complaints, and past controversies reveal about this person’s track record and conduct?” Too often, investors skip this homework—or realize it too late, after their money is already stuck or gone.

This blog takes the slower, safer route.

Instead of blindly trusting a SEBI registration badge or a few success stories, it walks through who Pritam Deuskar is, what kind of services he offers.

We also analyse what SEBI has officially found during inspections, and how public allegations and online discussions should change the way you look at its research.

The idea is not to label him as good or bad in one line, but to show you the full picture so you can decide for yourself whether to follow his calls, avoid them completely, or only use them with strict risk controls.

Pritam Prabodh Deuskar Research Analyst

When you first read about Pritam Prabodh Deuskar, research analyst, it is easy to feel impressed.

He runs WealthyVia as a SEBI-registered research analyst (registration number INH000005397), with a background that combines engineering (BE Mechanical) and a post‑graduate qualification in portfolio management.

Over the years, he has worked in equity research and portfolio roles before building his own research brand, positioning himself as someone who looks for “early-stage winners” and potential multibaggers rather than quick intraday tips.

On the WealthyVia “About” page and his LinkedIn profile, you see a strong focus on detailed research reports, long-term wealth creation, and working with PMS clients, family offices, and serious retail investors who are willing to think beyond short-term noise.

From an investor’s point of view, Pritam Deuskar comes across as a research‑driven, idea‑oriented analyst rather than a typical tipster.

That is exactly why many people consider his services when they start exploring paid equity research.

However, being SEBI‑registered and having a polished website is just the starting point, not the final filter.

It is important to look at both the strengths in his profile and the concerns raised around his practices before relying fully on his calls.

In other words, the “about” section tells you why investors get attracted to Pritam Prabodh Deuskar research analyst; the complaints, SEBI orders, and news that follow will help you decide how much trust and risk you are comfortable attaching to that attraction.

Pritam Prabodh Deuskar Research Analyst Complaints

Imagine trusting a research analyst’s multibagger calls, then spotting whispers of complaints or orders. Does it make you pause?

For Pritam Prabodh Deuskar, research analyst at Wealthyvia, complaints aren’t flooding forums like some RAs, but key red flags emerge from regulatory probes and public callouts.

You know those moments when a cricket legend drops a bombshell on Twitter?

That’s exactly what Virender Sehwag did on February 22, 2022, firing off a “FRAUD ALERT” tweet that put Pritam Prabodh Deuskar, research analyst, under the spotlight.

The tweet exploded, racking up thousands of retweets and shares.

Why Was It Posted?

Sehwag’s post wasn’t random. It stemmed from reports of investors being allegedly duped through pump-and-dump tactics. Pritam, via WealthyVia Ventures, was accused of luring retail folks with stock tips, artificially inflating prices through a “syndicate network,” then dumping shares and ghosting complaints.

Hindi media like Aaj Tak called it “dugna log chori” (duping innocents), while News18 and Times Now highlighted Sehwag’s warning as a call for refunds or lawsuits.

No formal FIR or suit followed publicly, but it fueled investor distrust.

Although there are no massive SCORES backlogs, SEBI’s audit and Sehwag’s tweet about the 2022 fraud keep everyone’s attention.

Hooked? Let’s unpack arbitrations, orders, and facts to guide your money wisely.

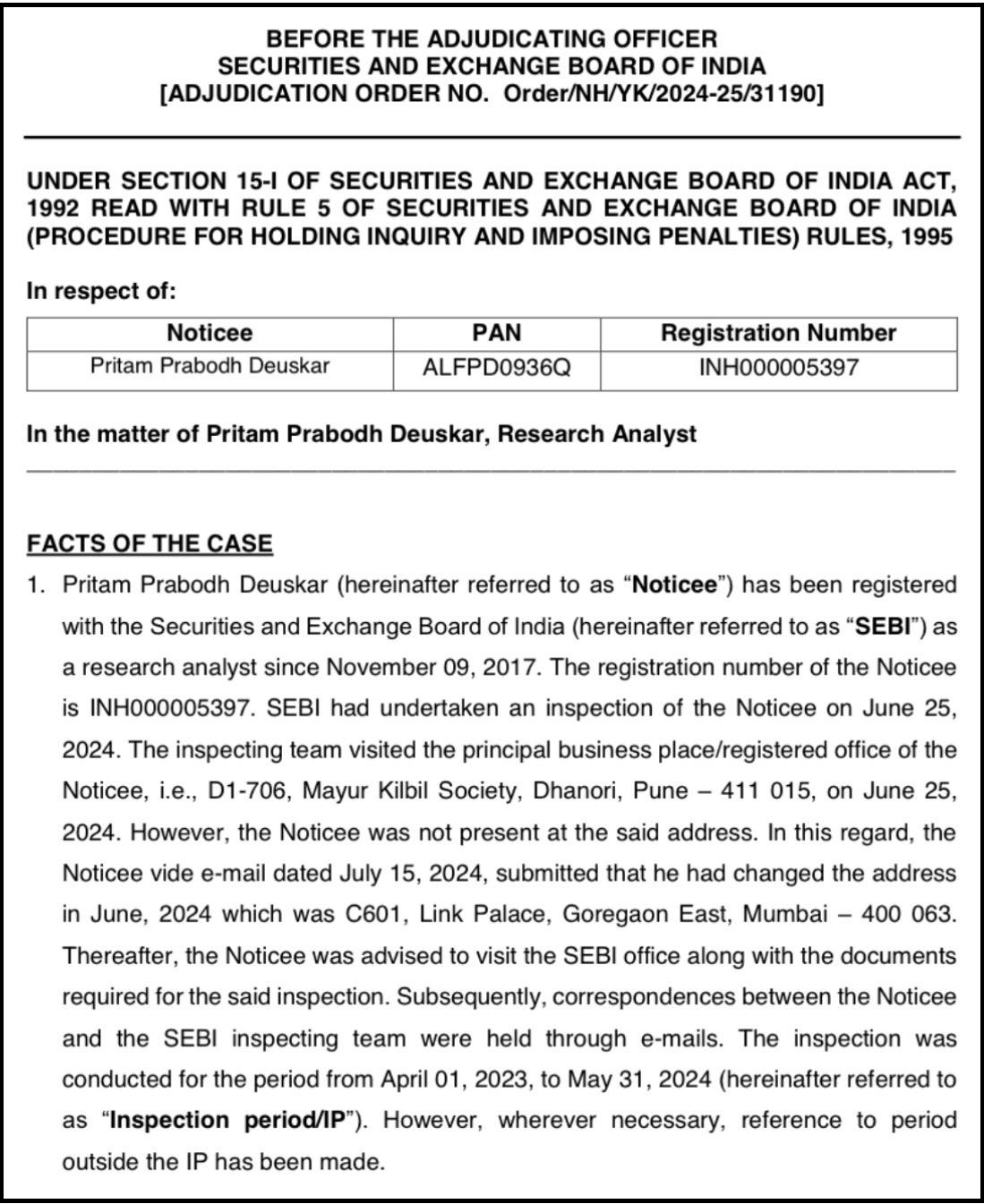

Pritam Prabodh Deuskar Fined Rs 1 Lakh by SEBI

Let’s talk about that SEBI order that caught many investors off guard.

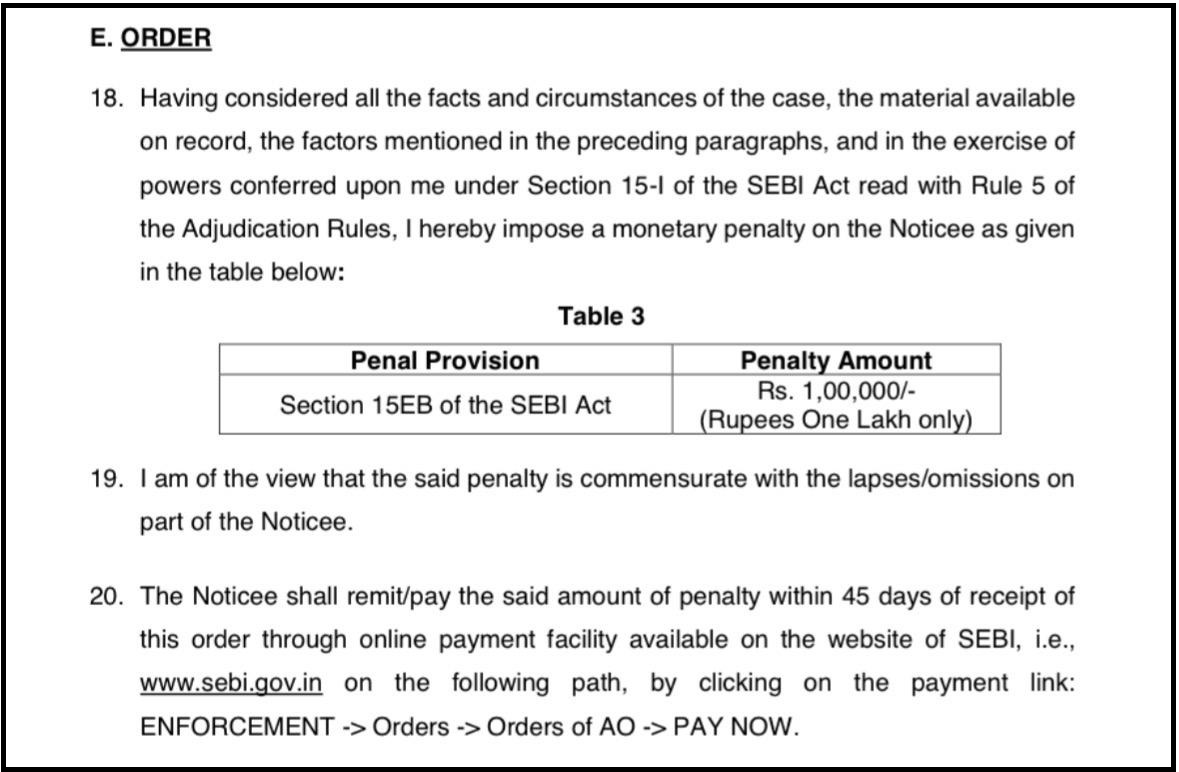

On February 11, 2025, SEBI slapped a heavy penalty on Pritam Prabodh Deuskar, a research analyst under Section 15EB of the SEBI Act.

The order wasn’t about fake tips or investor losses. It was about annual audits.

What This Order Was Regarding

SEBI inspected Pritam’s operations in June 2024 and found he had skipped annual compliance audits for three straight years (FY 2021-22, 2022-23, and 2023-24).

When SEBI asked for audit reports in July 2024, Pritam scrambled. Then, he submitted the FY 2023-24 audit dated July 15, 2024, and the older audits dated August 14, 2024.

The audits were done only after SEBI knocked on his door, not proactively as rules demand.

Why Was It Done?

Annual audits aren’t paperwork. They’re your safety net. They check if the analyst is maintaining proper records, disclosing risks, and following SEBI’s Code of Conduct.

By skipping them, Pritam left a blind spot: no one verified his compliance during those years. SEBI argued this wasn’t a minor slip as it broke Regulation 25(3) and Code of Conduct clauses 2 and 7, which require diligence and transparency.

The Penalty Imposed

SEBI imposed a clean ₹1 lakh penalty. The amount was set low because there was no proven investor loss or repeat offense, but it still stings. Pritam had 45 days to pay via SEBI’s online portal.

What You Should Learn From This Order?

Here’s the real takeaway! Even SEBI-registered analysts can cut corners. Always ask for their latest annual audit report before subscribing.

If they hesitate, walk away.

This order proves that compliance lapses happen, and SEBI does catch them, but your money could be at risk during those gap years. Test small, verify everything, and remember that registration is a license, not a guarantee.

What to Do If You Have a Complaint Against a Research Analyst?

If you encounter problems with Pritam Prabodh Deuskar research analyst, or any other research analyst, follow these straightforward steps to seek a resolution.

Step 1: Register Your Complaint With Us

Contact us right away and provide all the details of your issue with the research analyst. We take care of documenting your case thoroughly and accurately from the start.

Step 2: Consult Our Case Manager

We set up a dedicated call with one of our experienced case managers. They review your unique circumstances, assess the strength of your complaint, and walk you through the full path to resolution.

Step 3: Draft a Strong Complaint

Our experts assist in preparing a detailed and well-structured complaint letter. Every key fact, evidence, and supporting document gets included to make your case compelling.

Step 4: Engage the Research Analyst

We support you in reaching out to the research analyst directly. This ensures clear communication and opens the door for an amicable solution.

Step 5: File a SEBI SCORES Complaint

We provide hands-on guidance for filing on the SEBI SCORES platform. All details are verified for accuracy, with proper attachments and submission protocols followed.

Step 6: Access SMART ODR Assistance

Should SCORES not yield results, we step in for SMART ODR support. This includes helping you sign up on the ODR portal, gathering required documents, aiding in conciliation sessions, and advocating strongly on your behalf.

Step 7: Navigate Arbitration if Needed

For cases requiring arbitration, we offer complete support. This covers preparing the application, assembling solid evidence, and accompanying you through every phase until closure.

To date, we have represented victims in more than 300 arbitrations and helped them to get recovery for their losses.

So, if you are facing issues with any registered entity, then register with us without any further delay.

Conclusion

When you put it all together, Pritam Prabodh Deuskar, research analyst, offers strengths like SEBI registration since 201,7 and a portfolio management background focused on multibaggers via Wealthyvia.

However, the February 2025 SEBI order for skipping annual audits over three years reveals operational lapses, even with just a one-lakh-rupee penalty and no direct investor harm.

Virender Sehwag’s 2022 tweet accusing pump-dump syndicates and ghosting adds caution, making blind trust risky. Approach with eyes wide open rather than jumping in.

No public arbitrations or complaint floods are reassuring, but always document recommendations, payments, and chats for SCORES or ODR escalation.

Pritam teaches that SEBI badges are basics. Always verify audits, backtest calls, test small packages, and diversify sources.

Red flags early? Report fast and walk. Your capital deserves better than promised gems. Stay informed, trade smart, and build wealth safely.