SEBI registration is supposed to be a safety net for investors, right? A seal of credibility that tells you an investment adviser is verified, regulated, and trustworthy. But what happens when a SEBI-registered adviser itself comes under regulatory scrutiny?

That’s exactly where the story of Ayushi Chauksey adviser begins.

At first glance, everything looks reassuring. The name sounds professional.

The website showcases matrices, portfolio reviews, and learning modules that appear well-structured and investor-friendly. For a retail investor, it ticks all the right boxes.

But dig a little deeper, and SEBI’s own enforcement orders paint a very different picture, one involving regulatory violations and compliance gaps serious enough to warrant formal action by India’s market regulator.

This raises an uncomfortable but important question: Is SEBI registration enough on its own? Or do investors need to look beyond the label and understand how an advisory actually operates before trusting it with their money?

Let’s unpack what really happened.

Who is Ayushi Chauksey?

Ayushi Chauksey Adviser Pvt. Ltd. positions itself as a SEBI‑registered Investment Adviser (RIA). It is registered with SEBI as an Investment Adviser (RIA) under registration number INA000019707.

It also lists SEBI Research Analyst (RA) registration INH000021687, indicating involvement in both research and advisory roles.

The firm offers subscription‑based products like Quant Matrix, Wealth Matrix, Portfolio Review Services, and Learning Matrix (non‑advisory) for investors.

The website also includes disclaimers emphasising market risk and advising readers that recommendations are based on research and not guarantees of profits.

Ayushi Chauksey Investor Charter

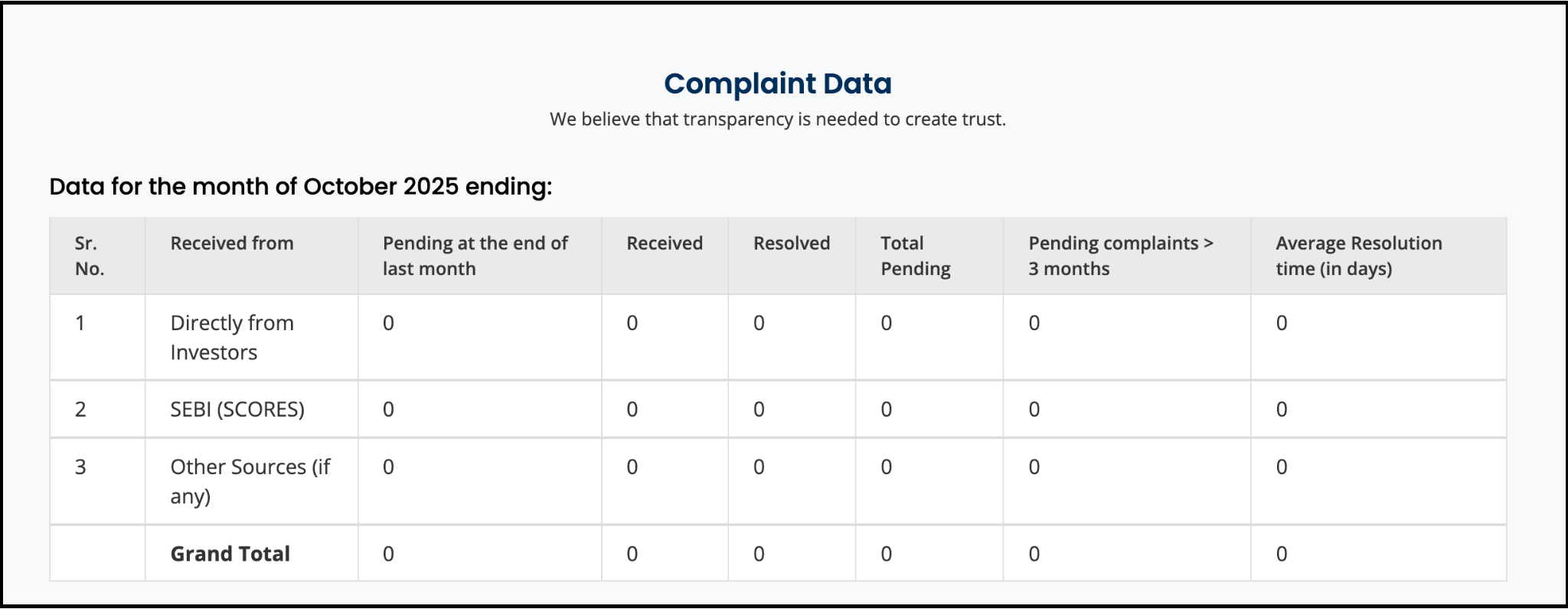

Interestingly, the grievance-handling data shared on her site for early 2025 shows zero pending complaints and quick resolution times, but this might reflect recent resets following SEBI scrutiny rather than a long track record without issues.

So, while her online presence seeks to demonstrate transparency and compliance, the regulatory record suggests fundamental gaps existed between policy statements and actual practice.

Ayushi Chauksey SEBI Order

In October 2022, SEBI issued an Adjudication Order against Ayushi Chauksey as an Investment Adviser.

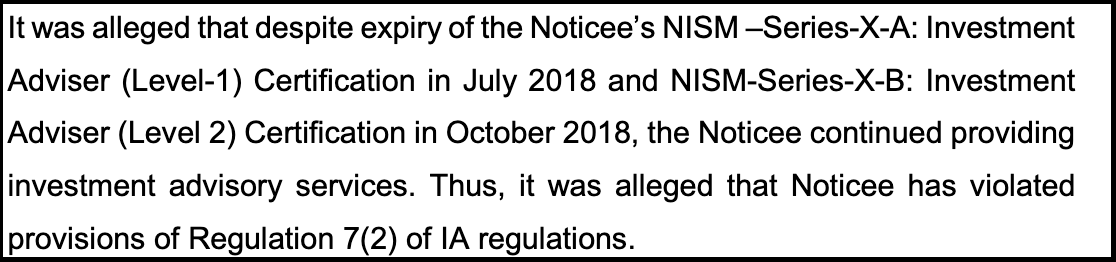

Between July 2018 and September 2021, she provided advisory services without holding the required valid NISM certifications.

This was a direct violation of SEBI’s Investment Adviser regulations, which mandate that all advisers must maintain valid certifications at all times.

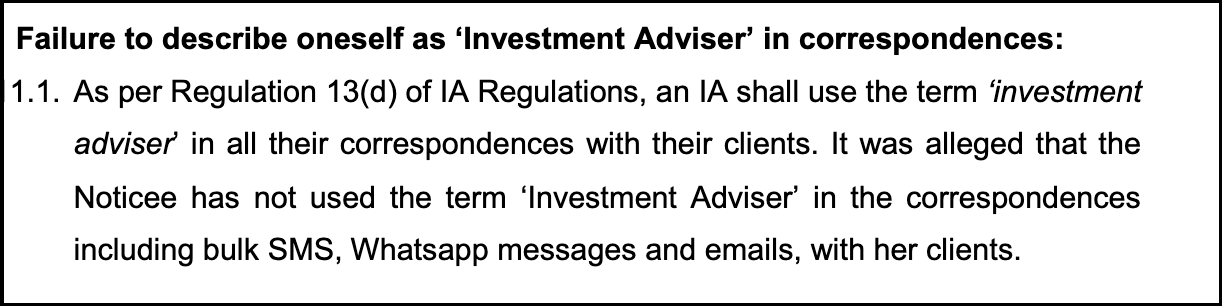

Additionally, SEBI requires advisers to use the term investment adviser in all communications. She did not do that consistently, especially in WhatsApp messages and bulk SMS.

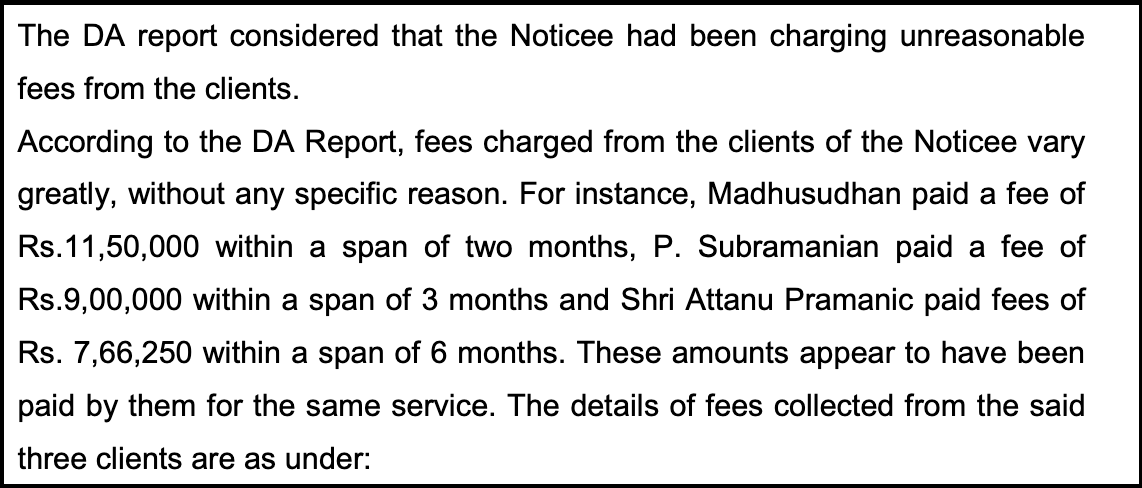

Most importantly, SEBI found that fees charged to clients varied widely, with little documented justification, suggesting that the fees were not “fair and reasonable” as required.

These lapses were severe enough that SEBI moved beyond a simple guidance letter into formal adjudication proceedings.

SEBI Verdict

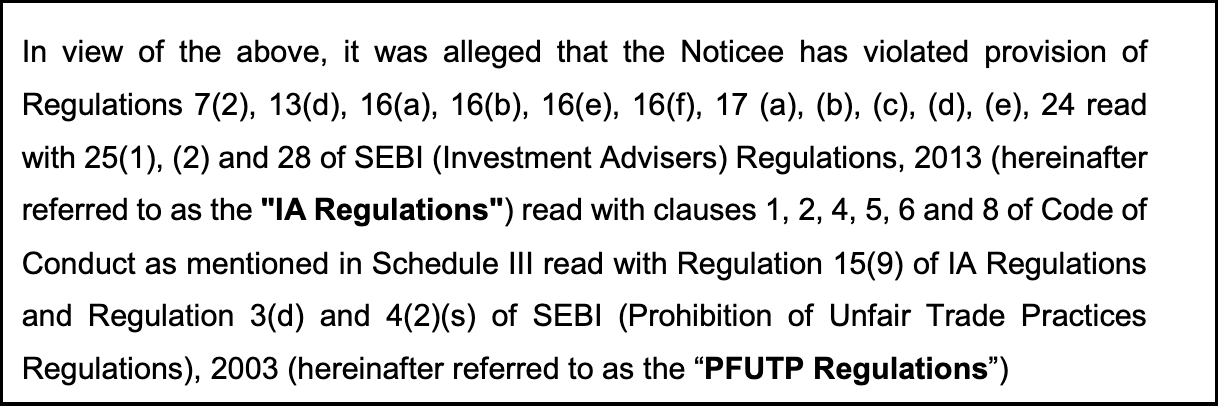

In September 2023, SEBI finalised its view in the matter with a Final Order against Ayushi Chauksey. SEBI ultimately found violations of multiple detailed technical provisions of the SEBI (Investment Advisers) Regulations, 2013, such as:

- Regulation 7(2): Certification requirement not met for the whole period.

- Regulation 13(d): Failed to use “Investment Adviser” consistently in all client communications.

- Regulation 16–17: Inadequate risk profiling and mismatches with advice suitability.

- Code of Conduct standards: Improper fee charging and lapses in customer due diligence.

The regulator also confirmed that some of these violations went beyond mere technical non‑compliance and reflected material lapses in advisory behaviour and documentation.

Based on the facts and circumstances of the case, SEBI chose not to impose a monetary penalty.

Instead, it took a regulatory action by temporarily suspending certain business activities.

Under the powers granted by the SEBI Act and the Intermediaries Regulations, SEBI restrained Ayushi Chauksey from taking up any new assignments or onboarding new clients for a period of one month from the date of the order.

This measure was intended as a corrective step, allowing the regulator to address compliance lapses while allowing the adviser to rectify issues, rather than resorting to harsher actions such as cancellation of registration.

Why is this case important for Investors?

This case highlights an important reality for retail investors: SEBI registration alone is not a guarantee of flawless conduct or risk-free advice.

While regulatory registration is a crucial first filter, it does not eliminate the need for investors to stay vigilant.

The action taken by SEBI shows that even registered investment advisers can face compliance lapses, ranging from certification issues to shortcomings in documentation and advisory practices.

For investors, this underscores the importance of not relying solely on labels or marketing material but actively checking an adviser’s regulatory history, enforcement records, and adherence to suitability and risk-profiling norms.

Most importantly, the case serves as a reminder that informed decision-making is an investor’s strongest protection.

Understanding how an adviser operates, how fees are charged, and whether recommendations are properly documented can help investors avoid potential risks and make more confident financial choices.

How to Report if You’ve Dealt with Similar Advisors?

If you or your family have already paid for stock tips from a Research Analyst or “multibagger” advisor, or joined WhatsApp / Telegram groups that look like this case, you have options.

You can register with us, and we’ll guide you through every step of the process. Here’s what we specifically help you with:

- Documentation Assistance

We help you gather, organise, and structure all the necessary documents, ledger reports, contract notes, call logs, screenshots, and emails, so your case is backed with solid evidence.

- Drafting Your Complaint

Our team prepares clear, well-formatted complaint drafts that fit the exact requirements of NSE, BSE, SEBI SCORES, and SMART ODR.

- Platform Filing Support

Whether it’s SCORES or SMART ODR, we guide you through the submission process and ensure every detail is filled in correctly to avoid delays.

- Escalation Guidance

If your complaint needs to be escalated beyond the broker, we show you the right path, whether it’s going to the exchange or preparing for the next stage.

- Case Management from Start to Finish

Once you register with us, we track your case, remind you of deadlines, and help you respond to any queries asked by regulators or exchanges.

- Support During Counselling & Arbitration

If your case moves to counselling or arbitration, we assist you in preparing your statements and documents so you feel confident and ready.

We make the process smoother, more precise, and faster, so you can focus on recovery while we handle the technical work.

Conclusion

In the world of investment advisory, SEBI registration should be your starting point, not your end-all guarantee. While Ayushi Chauksey holds a valid SEBI registration, her case clearly shows that even registered advisors can face significant regulatory issues.

Always verify an advisor’s regulatory history, demand transparency, and be cautious of promises that seem too good to be true. Your money deserves diligence, integrity, and above all, transparency.