Facing issues related to the Bombay Stock Exchange? Trades not going through? Data not updating? Investor services not responding?

You’re not alone.

Every month, investors and traders report problems linked to BSE systems, connectivity, and investor services. Some are minor. Others directly affect money, execution, or access.

The good news?

There is a proper system to handle BSE complaints if you follow the right path.

Let’s walk through it.

Common Types of BSE Complaints

The Bombay Stock Exchange (BSE) operates under SEBI’s regulatory framework. It follows strict compliance norms, regular audits, and investor protection guidelines.

On paper, that sounds reassuring.

But in real life, investors still face issues mostly due to BSE technical glitch, service delays, or system-level failures.

Here are the most common BSE-related complaints reported by investors.

1. Trading and Connectivity Issues

These are among the most serious complaints.

Investors report:

- Orders are stuck as “open” or “pending.”

- Trades not executing during live market hours.

- Sudden loss of connectivity between the broker and the BSE

Such issues typically arise from exchange-side connectivity problems or system disruptions and can affect multiple brokers simultaneously.

2. Market Data and Index Display Problems

Several investors complain about:

- Index charts not updating

- Delayed price feeds

- Inconsistent market data

These problems create confusion, especially for intraday traders who rely on real-time information.

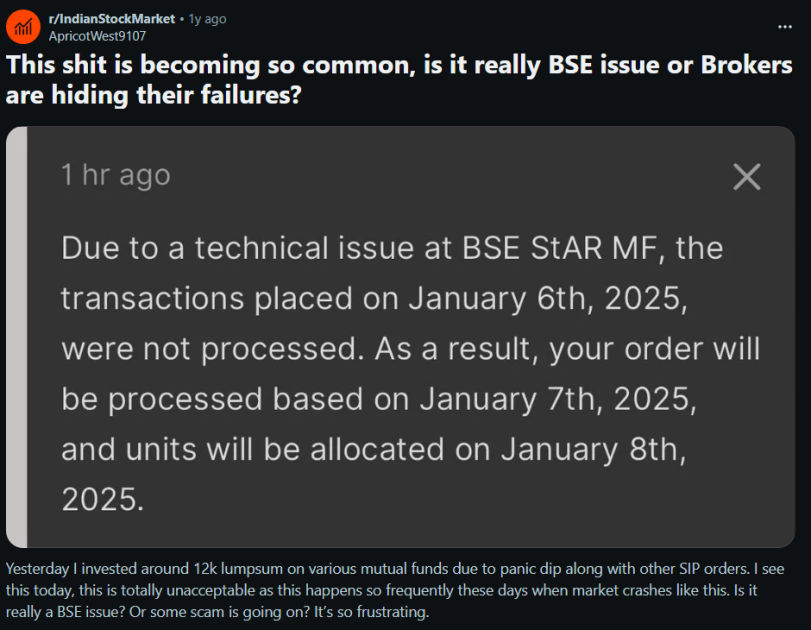

3. BSE STAR MF Transaction Failures

BSE STAR MF is widely used for mutual fund transactions.

However, investors have reported:

- Transactions are not processed despite successful submission.

- Delays during high-volatility days.

- Orders failing without clear explanations.

When MF transactions fail at the exchange level, investors are left waiting with no clarity.

4. Investor Service and Grievance Handling Delays

Some complaints aren’t about trading but about responses.

Investors report:

- No reply to grievances raised.

- Generic responses without resolution.

- Long delays beyond expected timelines.

This is where frustration usually peaks.

BSE Users Complaint

Real users have shared their experiences openly on public forums.

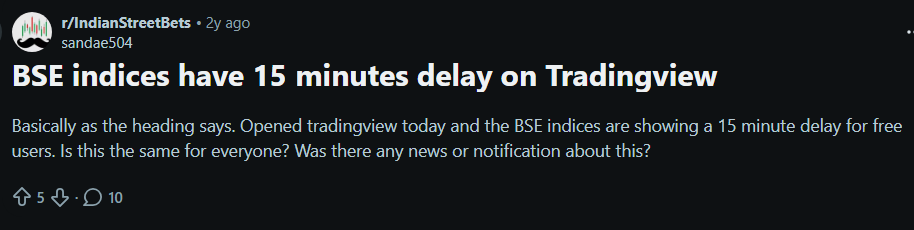

- On Reddit, one user wrote:

“Opened TradingView today, and the BSE indices are showing a 15-minute delay. Is this the same for everyone?”

This raised concerns around BSE index data visibility and timing, especially for traders relying on live charts.

- Another Reddit user shared frustration about BSE STAR MF:

“Due to a technical issue at BSE STAR MF, the transactions placed were not processed… this is totally unacceptable as this happens so frequently when the market dips.”

These are not textbook complaints. These are real investors talking about missed execution, delayed processing, and uncertainty.

Not only retail traders, but also BSE technical issues have impacted brokers’ activities too.

Multiple reports in 2024 highlighted broker outages during live market hours, where:

- Platforms loaded partially

- Market data lagged

- Index charts failed to update

In such cases, the issue wasn’t a single broker; it was exchange-level data flow and connectivity.

BSE Complaint Resolution Timeline

According to SEBI’s grievance framework and BSE’s investor service mechanism:

Official expectations:

- Acknowledgement: Within 24 hours

- Initial resolution: Within 30 days

Reality on the ground:

- Many investors report waiting 45-60 days

- Follow-ups often required

- Escalation becomes necessary

Knowing the escalation ladder is critical.

How to File a Complaint in BSE?

If you’ve faced losses or unresolved issues related to BSE, act quickly.

Here are the steps to report such problems:

Step 1: Raise the Issue with the Concerned Entity

If the issue involves trading or execution, first raise it with your broker and clearly mention the BSE-related disruption.

Keep records.

Screenshots matter.

Step 2: File a Complaint in SEBI

If the response is delayed or unsatisfactory, lodge a complaint with SCORES on the SEBI SCORES portal.

- Register on the SCORES portal.

- Select the relevant entity.

- Clearly describe the issue.

- Upload all supporting documents.

Once filed, the entity must respond within 30 days.

If 30 days have passed since you raised your complaint and there’s still no clear resolution, you don’t have to stop there. Escalation is not confrontation; it’s your right as an investor.

Here’s how to move forward, step by step.

Step 3: File a complaint in SMART ODR

In case there is a delay or unsatisfactory response from SEBI, you can escalate it and file the complaint in SMART ODR by:

- Submitting case details

- Mentioning the SCORES portal complaint number

Step 4: Arbitration in Stock Market

Still, if you don’t get a resolution, you can file for an arbitration in the share market and get it resolved legally.

Need Help?

Still stuck? Getting vague replies? Tired of chasing emails?

You’re not alone.

Register with us if you’re facing:

- Repeated rejections

- No response after 45+ days

- Confusing or contradictory replies

- Difficulty understanding escalation steps

What we help with:

- Complaint assessment and documentation

- Professional drafting using regulatory language

- Strategic escalation planning

- Follow-up and deadline tracking

- Assistance with SCORES and further escalation

The goal is simple:

Your complaint should be heard, tracked, and resolved.

Conclusion

BSE is a SEBI-regulated exchange with established systems and investor protection mechanisms.

But when systems fail or responses are delayed, investors must act.

Most BSE-related complaints can be resolved if raised correctly and escalated on time. SEBI SCORES is a powerful tool. Use it.

Silence doesn’t help. Proper complaints do.

Your money. Your rights. Your responsibility is to act.