Trust is one of the most important currencies in the financial world, especially when it comes to your hard-earned money. At some point, almost every investor, whether a beginner or a seasoned trader, asks the same question: Can you really trust a stock broker?

This question doesn’t come out of nowhere. Many investors have faced situations where trades appeared in their account without clear consent, fees were deducted that were never properly explained, or advice was given that seemed to benefit the broker more than the client.

Can a Stock Broker steal your money? In some cases, investors only realised something was wrong after losses had already occurred.

On the surface, everything may look reassuring. The trading app works smoothly, contract notes arrive on time, and customer support sounds confident and professional. But as real cases have shown, good technology and polished communication don’t always equal ethical conduct. Trust isn’t built on appearances; it’s built on consistent behaviour, transparency, and how a broker acts when something goes wrong.

Feeling doubtful isn’t a bad sign. In fact, it’s a sign of a responsible investor. Trusting a stockbroker should never be based on comfort or assumptions alone. It should be based on facts, records, and accountability.

Brokers play a powerful role in an investor’s journey, from executing trades and providing access to markets to offering advice and recommendations. That’s exactly why they must be held to high standards. History shows that problems often begin when investors stop asking questions, ignore small inconsistencies, or assume that “this is how it’s supposed to work.”

Issues related to unauthorised trading, misleading advice, hidden charges, or poor grievance handling are not rare—they’ve appeared in multiple real disputes and arbitration cases across the Indian securities market.

One smooth experience doesn’t guarantee long-term reliability. Real trust is built by staying informed, verifying actions, and remaining alert at every stage of your investing journey. And understanding real-world instances where things went wrong is often the best place to start.

Can You Really Trust Your Stock Broker?

SEBI Bars Prabhudas Lilladher from Taking New Clients for 7 Days

Recently, one more Stock Broker got penalized by SEBI. SEBI has taken action against Prabhudas Lilladher Private Limited, prohibiting it from accepting new clients or contracts for seven days starting December 15, 2025. This decision was made due to serious compliance issues.

The action followed a joint inspection by SEBI, along with the NSE, BSE, and Multi-Commodity Exchange, which reviewed the company’s operations from April 2021 to October 2022.

The regulator found several violations of important rules, showing that the broker had handled critical responsibilities related to weakly protecting investors.

Key violations that SEBI identified include:

- Misuse of client funds, with a shortfall of about ₹2.70 crore on certain dates, shows poor fund management.

- Delays in settling client accounts within the required time limits.

- Incorrect reporting of margins and client balances to the exchanges.

- Charging more in brokerage fees than allowed by regulations.

- Other issues, like putting paid securities into unpaid accounts and errors in reporting exposure.

SEBI dismissed the brokerage’s argument that these issues were just technical or software problems, saying they directly affected investor protection rules.

By preventing the firm from taking on new business temporarily, SEBI aims to highlight the importance of compliance and prevent similar mistakes in the future.

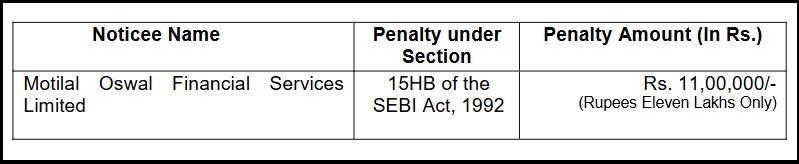

2. SEBI Imposed a Penalty of ₹11,00,000 on Motilal Oswal for Key Violations

In August 2025, SEBI penalty against Motilal Oswal Financial Services Limited after an inspection revealed multiple compliance lapses. The case focused on how the broker handled client funds, regulatory reporting, and system-related obligations.

Key violations noted by SEBI included:

- Delay in settling the funds of inactive clients within the required timeline

- Incorrect reporting of end-of-day and peak client ledger balances involving large amounts

- Gaps in technical and system safeguards required under SEBI guidelines

SEBI clarified that even if such issues are claimed to be unintentional, brokers are expected to strictly follow regulatory rules at all times.

SEBI levied a monetary penalty of ₹11 lakh on the broker under Section 15HB of the SEBI Act. This case highlights why investors should not rely only on a broker’s brand name and should regularly monitor fund settlements, statements, and compliance practices.

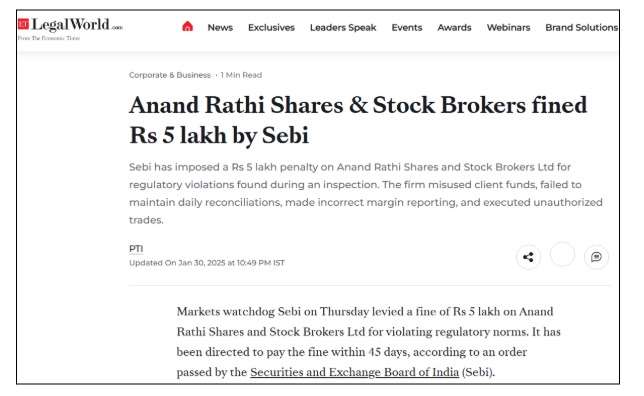

3. Penalty of ₹5 Lakh Imposed on Anand Rathi for Unauthorised Trading

SEBI imposed a ₹5 lakh penalty on Anand Rathi following a cybersecurity-focused inspection that revealed multiple compliance lapses. The order highlighted serious concerns around unauthorised trading and improper client order recording, both of which directly affect investor trust.

During the proceedings, the broker acknowledged three instances of unauthorised trades, attributing them to dealer “punching errors.” SEBI, however, emphasised that such explanations do not absolve brokers of responsibility, as accurate order recording and client authorisation are core regulatory requirements.

The inspection also pointed out additional shortcomings, including:

- Missing or incomplete order placement confirmations in certain cases

- Delays in submitting client complaint-related documents to the inspection team

Penalty imposed:

SEBI levied a monetary penalty of ₹5,00,000 for these violations.

This case reinforces SEBI’s stance that operational lapses—whether technical or human—can still amount to regulatory breaches when investor interests are compromised.

Where to Complaint Against a Stock Broker?

If a stock broker doesn’t fix your problem, it’s important to report it.

Not dealing with issues like unauthorized trades or bad replies can cause more harm. Making a formal complaint helps create a record and makes the broker take responsibility.

How to file a complaint aginst stock broker?

You should file a complaint if the broker doesn’t solve your issue in a reasonable time, usually between 7 and 30 days. You should also report right away if there’s any fraud, money misuse, or misleading behaviour.

- Contact the broker first – Talk to the broker through their official support channels. Keep copies of emails, tickets, and any responses you get as proof.

- Prepare your complaint details – Gather your account statements, contract notes, screenshots, and any written messages. Having clear evidence helps your case.

- Visit the SCORES portal – Go to the SCORES platform run by the Securities and Exchange Board of India. Use your PAN and contact information to create a login.

- Submit the complaint online – Choose the broker’s name, clearly explain the problem, and upload all supporting documents. Send the complaint for review.

- Track and close the complaint – Check SEBI complaint status regularly. Carefully read the broker’s response. Only close the complaint if you’re happy with the solution.

Need Help?

Dealing with a problem involving a stock broker can be really tough, especially when it comes to money and trust. You don’t have to deal with this on your own or feel lost about what to do next.

We’re here to listen, understand your situation, and help you step by step with care and clear guidance. Whether your issue seems minor or major, your perspective is important, and getting in touch early can actually make a big difference.

If you’re feeling confused, stressed, or not sure what to do next, reach out to us as soon as you can.

We take the time to hear your story, explain your choices in an easy-to-understand way, and support you throughout the whole process.

Reach out to us for help. Asking for help isn’t a sign of weakness; it’s a smart and responsible choice. You deserve clear information, fairness, and support at every stage.

Conclusion

Building wealth is something many people hope for, but it’s important to stay aware to keep it safe. Trusting a stock broker shouldn’t be based on hope or promises of fast money; it should come from understanding.

Rules, systems, and tools can help, but they work best when investors stay informed and watchful. By asking questions, checking details, and keeping track of what’s happening, trust becomes a choice you make with your eyes open.

Awareness helps keep your financial goals realistic and solid. Being watchful doesn’t mean being scared; it means taking responsibility for your money.

A trustworthy broker builds confidence through honesty, good behavior, and steady actions over time.

When investors mix ambition with care, they protect both their money and their peace of mind. The path to growing wealth works best when trust is built, checked, and kept up with regularly.