Imagine this: one fine morning, you log into your Dealmoney trading account, only to see a strange debit, a delayed payout, or a trade you never placed. Your heart skips a beat.

The market is risky enough, but what happens when the risk starts coming from your broker, too?

That’s exactly why dealmoney complaints are not just statistics. They are real warning signs for real investors.

Even when a broker looks “safe” on paper, how they handle complaints, glitches, and disputes can decide whether you sleep peacefully or spend months chasing your own money.

In this blog, let’s discuss Dealmoney complaints, what arbitration really looks like, and how you can fight back if something goes wrong!

Dealmoney Commodities Private Limited Review

Dealmoney Commodities Pvt. Ltd. is a full‑service brokerage firm. It was established in 2006. It offers equity, commodity, and other investment services to retail and HNI clients across India.

As a commodities broker, Dealmoney Commodities is registered with exchanges like NSE, BSE, MCX and NCDEX.

It provides official grievance contact points and escalation contacts on its website. They have:

- Active clients: 2,257

- Complaints received against the member: 9

- Complaint percentage vs active clients: 0.399%

- Resolution percentage: 66.67%

On the surface, that looks like a low complaint ratio, but for the investor who is stuck in even one unresolved case, the pain is 100%.

There is no doubt that behind every complaint is an investor who may have trusted the wrong person, misunderstood a product, or simply felt unheard, and that emotional toll is something no statistic can measure

Numbers never show the emotional stress, the time lost, or the worry of “Will I ever get my money back?”

Dealmoney Complaints Details

Seeing the NSE data, it is clear that most of the Dealmoney complaints are grouped under:

- Type V: Service-related issues

- Type IX: Others / miscellaneous

In plain language, this usually translates into things like:

- Delay or confusion in payouts, statements, contract notes, or margin communication (service‑related).

- Platform glitches, app/terminal issues, miscommunication around charges, or other problems that don’t fit neatly into standard categories (others).

Even a small set of Dealmoney complaints in these buckets can hit investors in real ways.

Regulatory Action Against Dealmoney Complaints

There have also been a few arbitration cases filed against Dealmoney Commodities Pvt. Ltd., a reminder that even regulated brokers can face disputes when things don’t go as expected.

Let’s take a closer look at the issues raised by clients and what led them to seek arbitration in the first place.

Dealmoney Complaint on Unauthorised Portfolio Management Services

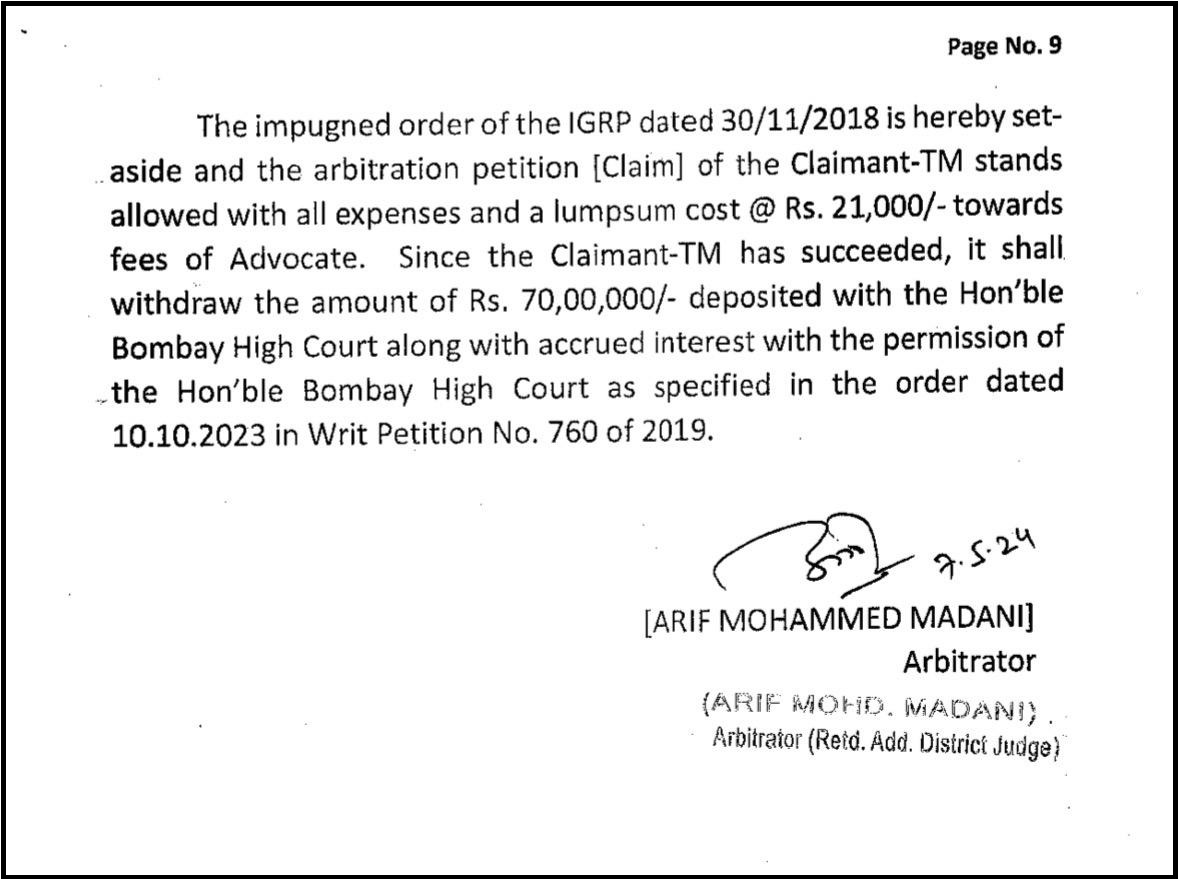

Dealmoney Securities approached the NSE arbitration panel to challenge a ₹70 lakh payout that had been awarded against them in 2018.

The issue began when an outside “helper”/sub-agent named Raah Financials made a shady arrangement with investor Abhishek Sethi.

The agent allegedly promised:

- Guaranteed profits

- Safe trading using pledged shares

- Risk-free returns

All of this is strictly illegal under SEBI regulations. No agent, dealer, or broker employee is allowed to offer assured returns or manage someone’s account without proper portfolio management licensing.

Because of these false promises and unauthorised trades, the investor suffered major losses:

- ₹17 lakh margin shortfall

- ₹50 lakh overall financial damage

Feeling cheated, Sethi filed a case against Dealmoney.

An NSE investor panel reviewed the matter and initially held the broker responsible. Dealmoney challenged the order in court, and the court allowed arbitration to proceed, but only after Dealmoney deposited the disputed amount.

In the arbitration case involving Dealmoney Securities, it’s clear that the broker was not completely at fault.

The main issue arose because an agent, Raah Financials, acted outside their authority, promising guaranteed profits and “safe” pledged shares, which is strictly illegal under SEBI rules.

The broker’s only mistake was not supervising the sub-agent closely enough, allowing these unauthorised promises to mislead the investor.

That said, it’s also the trader’s responsibility to ensure they receive fair and transparent services.

This means staying alert to red flags, like promises of assured returns, profit-sharing schemes, or unauthorised account management.

By being informed, verifying credentials, and avoiding too-good-to-be-true offers, investors can protect themselves and ensure their trades remain safe and legitimate.

In short, brokers must enforce compliance, but investors must also stay vigilant and never fall into the trap of shady side deals.

Unauthorised Trading Practices by Dealmoney Commodities

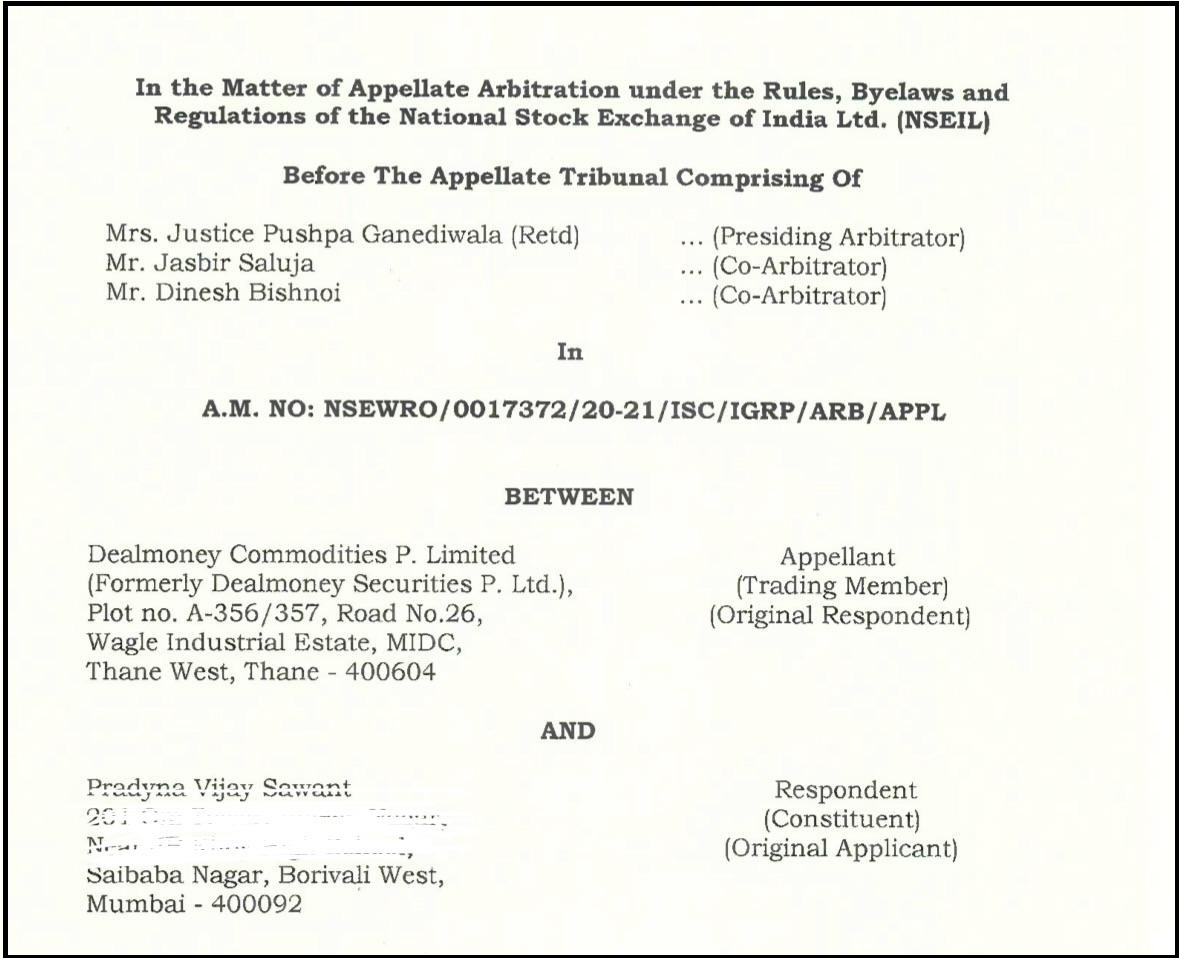

This dispute involved Dealmoney Commodities Pvt. Ltd. and a retired bank employee, Pradnya Vijay Sawant, from Mumbai.

Ms Sawant alleged that the broker’s relationship managers conducted unauthorised high-risk Futures and Options (FO) trades in her account between January and May 2020, during the COVID-19 period.

These trades reportedly wiped out her share portfolio, originally worth over ₹14 lakhs (later valued at ₹25.49 lakhs), while generating substantial brokerage fees for the broker through excessive churning.

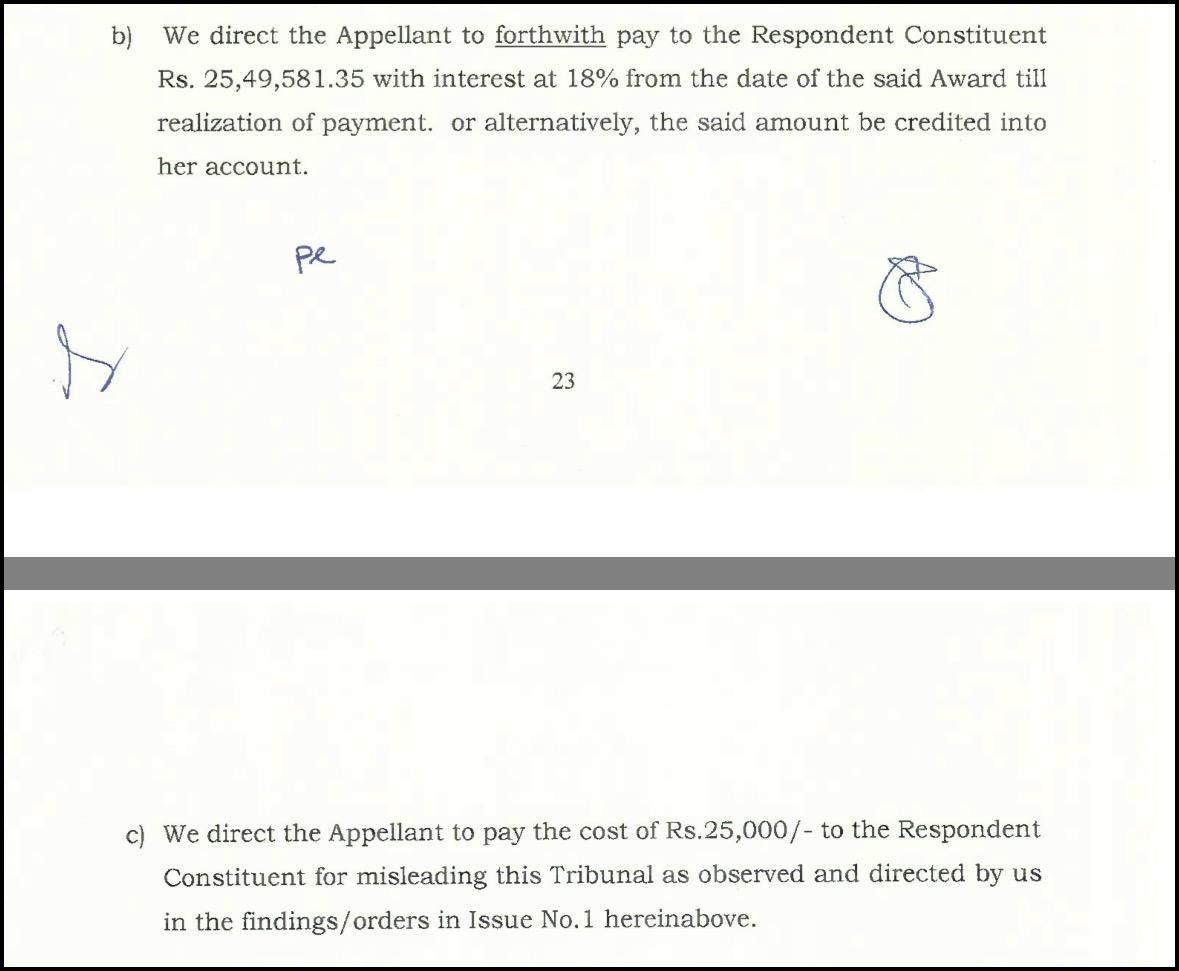

The tribunal ordered Dealmoney to compensate Ms Sawant with:

- ₹25,49,581, reflecting the current value of her lost shares (including Reliance and ICICI Bank stocks as of May 2024).

- 18% annual interest from 7 May 2024 until full payment.

- An additional ₹25,000 as costs for misleading the tribunal regarding trading rules.

This case is a strong reminder that vigilance, documentation, and timely action are essential to protect investments, especially against unauthorised or high-risk trades.

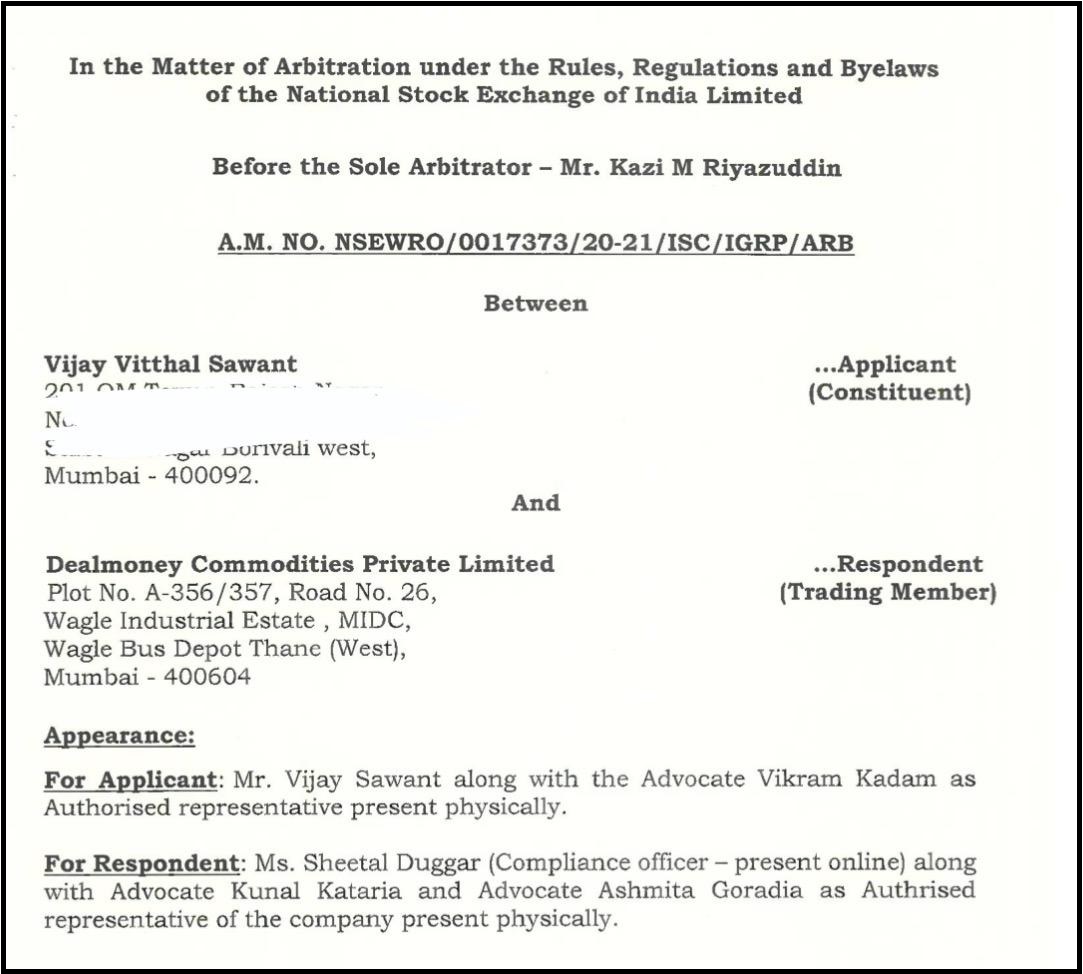

In a separate but related arbitration matter involving the same broker, Vijay Vitthal Sawant also filed a case against Dealmoney Commodities Private Limited.

He accused the broker’s relationship managers of tricking him into signing blank KYC forms, activating a high-risk Futures & Options (FO) segment without his knowledge.

He even transferred his blue-chip share portfolio worth over Rs. 22 lakh from HDFC Bank to their demat account. Over four to five months in 2020, they executed unauthorised FO trades using scripted calls and his login credentials.

It resulted in wiping out his entire portfolio to nearly zero while earning brokerage fees. This was all done during the COVID-19 period, when he lacked trading experience or computer literacy.

Penalty Imposed

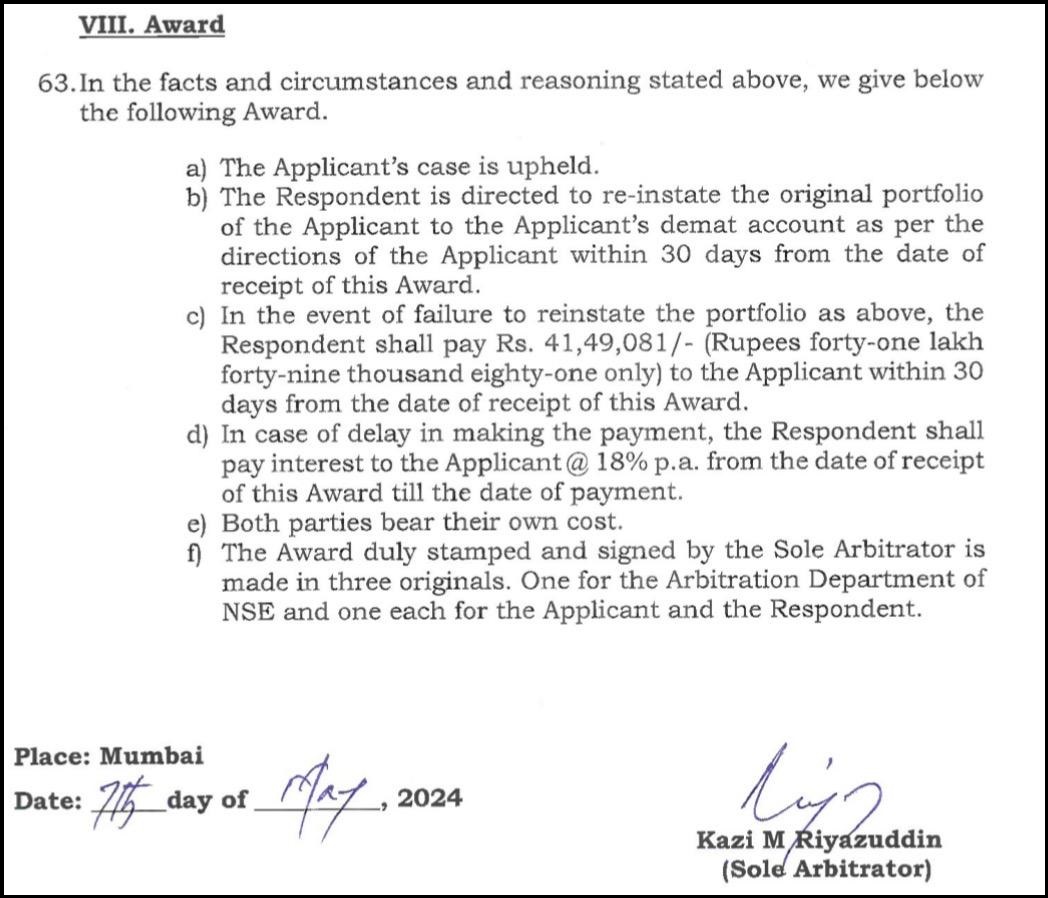

The arbitrator ruled fully in favour of Sawant on May 7, 2024, rejecting the broker’s limitation and authorisation defences.

Dealmoney was asked to reinstate the exact original portfolio of Rs. 22,33,243 to Sawant’s demat account within 30 days or pay Rs. 41,49,081. Failure incurs a further 18% interest.

What Investors Can Learn from these Cases?

Even though Dealmoney Commodities Pvt. Ltd. has a relatively small client base, the complaints and arbitration cases we discussed show that no investor is immune to risk.

A smaller client base does not automatically mean safer investments; issues like unauthorised trades, staff misconduct, or miscommunication can still occur.

These cases serve as real-world lessons in vigilance, documentation, and proactive account management.

They show how investors can protect their portfolios, avoid common traps, and ensure their investments are handled responsibly.

- Never sign blank forms or authorise trades blindly. Always read and verify every document before signing.

- Monitor your accounts regularly, even if a relationship manager handles your trades. Daily statements and transaction alerts can help detect unauthorised activity early.

- Avoid giving login credentials or access to anyone, including staff or agents. Your account is your responsibility.

- Verify all FO or high-risk trade activations with written confirmation and risk disclosures.

- Check broker complaints and regulatory records on NSE/SEBI portals before trusting any advisory or trade recommendations.

- Act quickly and file complaints or arbitration within regulatory timelines to protect your investments.

Investors must remain vigilant and proactive because even reputable brokers can face staff misconduct. Protecting your portfolio requires both broker accountability and investor diligence.

How to Report Stock Broker Complaints?

If you face issues with your broker, there are clear steps you can take to protect your investments and seek a resolution:

1. Gather Evidence

- Collect all relevant documents, screenshots, emails, call recordings, account statements, and trade confirmations. Solid evidence is essential for a strong case.

- Our team can guide you through the complaint process, ensuring every detail is captured accurately.

3. Case Documentation and Drafting

- We help you prepare a complete, professionally drafted complaint, tailored to your situation.

4. Escalation to Regulatory Portals

- File a complaint in SCORES: We assist in filing your complaint online, ensuring it reaches SEBI with all supporting documentation.

- Lodge a complaint in SMART ODR: For unresolved issues, we escalate the case to the SMART Online Dispute Resolution portal for faster resolution.

5. Representation in Counselling and Arbitration

- We also represent you during counselling sessions and arbitration proceedings in the share market, helping you navigate the process and improve your chances of a successful outcome.

By following these steps and leveraging professional support, you can ensure that your complaint is handled efficiently and your rights as an investor are protected.

Conclusion

Dealmoney is an established and trusted broker that many people rely on for their investments. But sometimes big names can also make mistakes.

Those slip-ups hurt badly when you’ve saved up for a better life.

The good news?

Real cases show people get their cash back. It starts with filing a complaint right away.

If Dealmoney or any broker lets you down, don’t wait.

Fix it fast while it’s fresh.