Somewhere between the ticket raised and us looking into it, many investors realise something uncomfortable.

The real test of a broker is not the app design or the pricing. It is what happens when something goes wrong with money, trades, or timelines.

When people search for Finvasia Securities Private Limited in the context of complaints, it is usually not for curiosity.

It is because something feels unresolved, unclear, or repeatedly delayed, and they want a proper route that creates accountability.

This blog breaks down the official identity on record, the escalation options available for investors, and where arbitration and SEBI orders fit into the larger resolution system.

Finvasia Review

Finvasia Securities Private Limited is a global financial platform that operates on four key niches such as financial services, healthcare, real estate, and technology.

In India, the company has gained popularity through its zero brokerage trading platform, Shoonya.

In 2025, the company has 1,18,198 active clients. However, among them, 73 people raised complaints against the company on various issues.

It represents 0.062% Finvasia complaints against the active numbers.

However, 83.56% of the total number of complaints have been resolved.

The data also shows a ray of hope.

The business has successfully reduced the service and the Finvasia unauthorised trading-related complaints by 93.82% and 95.74% respectively, from 2023 to 2025.

In 2025, the other significant complaints were related to non-payment or payment delay, and unauthorized trades were also reduced.

However, do you think you are in a safe zone?

If yes, you must know that the reduced complaints do not mean zero complaints. You still can face a similar scenario of other victims.

Therefore, in case you are unsure about the challenges and repercussions, learn here through various consumer cases and established procedures to seek justice.

Types of Complaints against Finvasia

The key consumer complaints against Finvasia are segmented into seven different categories.

These are as mentioned below:

Type I-Non-receipt / delay in Payment: In 2025, out of 73 Finvasia complaints, 11 were due to non-receipt or delay in receiving payments. In 2023, around 136 out of 1110 complaints were of the type-I category.

The company has been successful in significantly reducing the number of payment-related issues from 2023 to 2025. Therefore, taking a cautious approach is necessary as per the numbers.

Type II-Non-receipt / delay in Securities: The number of complaints due to non-receipt or delay in receiving securities is very less. It sums up to only 2 and 3 people faced such an issue in 2025 and 2024, respectively.

Type III- Non-receipt of Documents: It is another type of complaint that is not prevalent among Finvasia consumers.

Although in 2023, the number of Type III complaints reported was 22, it significantly reduced to 3 in 2025 and 2024, respectively.

Type IV-Unauthorized trades/misappropriation: In 2023, out of 1110 Finvasia complaints, 235 were reported regarding unauthorized trades or misappropriation.

However, due to various effective initiatives taken by the company, the number of Type IV complaints reduced to 40 in 2024 and 10 in 2025.

Type V-Service related: Data reveals that Finvasia had the maximum number of service-related complaints in 2023. It amounted to 632 among all the 1110 complaints in 2023. In 2024, the Type V complaints amounted to 239, which is significantly high.

However, in 2025, this category of complaints reduced to 39 out of the total 73 complaints received. Thus, the service-related risks still exist in the platform.

Type VI- Closing out / Squaring up: Finvasia consumers don’t face many issues related to closing out or squaring up positions. In 2024 and 2025, the number of such issues was reported by only 10 and 2 users, respectively.

Therefore, chances are less that you will face such an issue with the broker in the future. Type IX-Others: The number of Type IX complaints decreased from 84 in 2023 to 59 in 2024. It was further reduced to only 12 complaints out of a total of 73 Finvasia complaints in 2025.

Finvasia Securities Private Limited has had some arbitration cases despite its good reputation. Let’s take a look at that.

Finvasia Arbitration

This is the part most people never plan for, but end up needing.

When calls, emails, and tickets start going in circles, arbitration is where the issue finally gets a proper hearing and a clear outcome, instead of another “we’ll check and revert” reply.

Think of it as the complaints stage with a backbone. You bring your timeline, your proofs, and your exact loss.

The broker brings their version and their records. Then the matter is decided on facts, not frustration.

Finvasia Securities Private Limited V/s Mr. Bhasi Chellappan Nelpurail

In the case of Finvasia (Appellant) V/s Mr. Bhasi Chellappan Nelpurail (Respondent), Mrs. Ramanjeet Kaur represented the appellant, and Mr. Girish Gopi Acharya represented the respondent.

Here is the snapshot of the case file showing the arbitration number and the names of the appellant and respondent.

On 13.04.2023, the respondent was not able to log in to the Shoonya platform of Finvasia even after several attempts. He communicated with the broker for assistance.

However, he did not receive any help. But, on the next day, he was able to access the platform by changing the password with the help of Finvasia.

Due to this technical glitch in Finvasia, he incurred a loss of 85,539.

Finvasia complains that on 13.04.2023, they were preoccupied with resolving aFinvista technical glitch. The unknown technical problem was rejecting the orders placed by the investors.

The company agreed to compensate all the investors for that, including the respondent. However, the appellant emphasized that there was no login issue.

The above snapshot reveals that the broker did not instantly respond to the complaint of the respondent. It caused him a delay and loss in placing the order.

Moreover, the respondent was trading on 5 stocks. Finvasia agreed to compensate for the loss incurred on 4 of the 5 trades due to a technical glitch. It amounts to INR 29,975.

But the respondent could not trade on the 5th one due to a login issue. This trade alone cost him a loss of INR 55,563.75.

Analysis of the Case

Since, in this case, other investors also faced technical issues, the ground of conflict was in favor of the respondent.

However, Finvasia’s complaints against the respondent took shape as the company repeatedly claimed that there was no login error message generated in the back end of the system.

However, the respondent has successfully presented all the information regarding the interaction with the company over the phone and SMS to raise the complaint. He was also able to show the emails sent and error messages generated during the login problem.

All this data bolstered the respondent’s claim that due to the login issue, he could not square up the position and incurred a loss.

Award

Therefore, the arbitrator gave a verdict in favor of the respondent and awarded him INR 85,539, including INR 29,975 already agreed by the appellant.

What can Go Wrong for you?

In this case, resolving the login issue took one day. It gave enough time to the respondent to carefully document all the error messages and communication information.

However, if the problem were solved within a few minutes, he would have lost the best square-up position.

This time also he might have incurred the same loss. But, had he forgotten to take note of all the key information, he would have never been able to prove his ground.

Many investors fall into this trap of minor technical glitches and put themselves far away from getting justice.

Apart from this, there are SEBI orders against the broker. Find the details of the order below.

Finvasia SEBI Orders

If arbitrations are where a dispute gets heard, SEBI is where the market gets watched. SEBI works like the securities market’s watchdog, not for one investor or one broker, but for the system as a whole.

It steps in when something looks like it crosses compliance lines or puts investors at risk.

That’s why SEBI orders matter in a complaints-focused blog. They don’t read like customer support conversations; they read like accountability documents.

This section highlights any publicly available SEBI orders linked to the broker and explains, in plain language, what the regulator observed, what action was taken, and what it can mean for investors going forward.

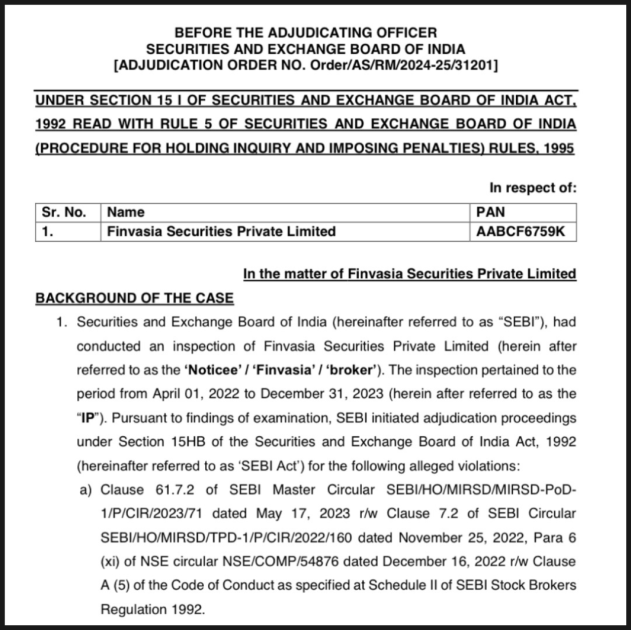

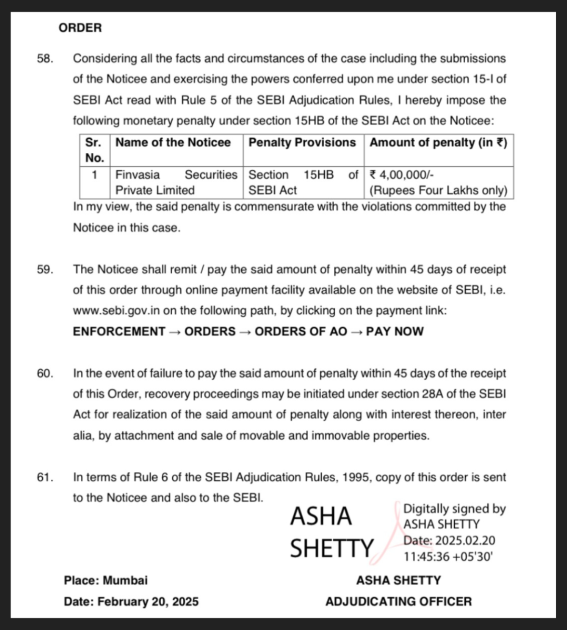

SEBI inspected Finvasia Securities Pvt. Ltd. from 1st April, 2022 to 31st December, 2023 and initiated adjudication proceedings for alleged compliance failures.

The violations relate to SEBI and NSE requirements on Business Continuity Planning & Disaster Recovery (BCP-DR) and system monitoring, including:

- No review of BCP-DR implementation for three quarters in 2023.

- Not having a properly set-up DR site within the required timelines.

- Failure to conduct DR live-trading drills as mandated.

- Failure to connect all critical systems to the SEBI-mandated monitoring mechanism, LAMA.

Finvasia argued that delays were caused by technical challenges, dependency on vendors and exchanges, and that setting up a compliant DR infrastructure in the given timeframe was not feasible.

Penalty Imposed

SEBI imposed a penalty of INR 4,00,000 for not complying with the SEBI guidelines within the set timeframe. Finvasia was asked to pay the amount within 45 days, or recovery methods would be imposed by SEBI.

Impact of the SEBI Order on other Traders

The aforesaid SEBI order will benefit many traders as well as the investors.

Apart from ensuring fewer losses, the traders will achieve the following benefits:

- Adhering to the BCP-DR framework will ensure better reliability of trading systems.

- SEBI’s action reinforces that brokers must have strong backup systems. Traders should see fewer outages, system glitches, and order-execution issues during volatility.

- The focus of SEBI to make live trading drill compulsory for brokers will help them to ensure optimal functionality of trading platforms even while recovering from a disaster.

- Due to the imposed penalty, other traders will be more eager to implement the LAMA system to help stock exchanges monitor key parameters of critical systems. Thus, chances of technical failure will be reduced.

Therefore, this SEBI order will reduce Finvasia complaints while improving the overall trading ecosystem directly and indirectly.

How To Register A Finvasia Complaint?

If you’re facing issues with your broker and don’t know where to begin, you can register with us, and we’ll guide you through every step of the process.

Here’s what we specifically help you with:

- Documentation Assistance: We help you gather, organize, and structure all the necessary documents, trade statements, ledger reports, contract notes, call logs, screenshots, and emails, so your case is backed with solid evidence.

- Drafting Your Complaint: Our team prepares clear, well-formatted complaint drafts that fit the exact requirements of NSE, BSE, SEBI SCORES, and SMART ODR. This ensures your complaint is understood properly and not rejected due to formatting issues.

- Platform Filing Support: Whether it’s SCORES or SMART ODR, we guide you through the submission process and ensure every detail is filled in correctly to avoid delays.

- Escalation Guidance: If your complaint needs to be escalated beyond the broker, we show you the right path, whether it’s going to the exchange or preparing for the next stage.

- Case Management from Start to Finish: Once you’re registered with us, we track your case, remind you of deadlines, and help you respond to any queries asked by regulators or exchanges.

- Support During Counseling & Arbitration: If your case moves to counseling or arbitration in stock market, we assist you in preparing your statements and documents so you feel confident and ready.

Need Help?

You can register with us for any complaints related to Finvasia Securities.

We will arrange a call with our case manager, who will help in drafting the complaints, reaching out to the stock broker, lodging complaints at SEBI SCORES, and initiating smart ODR.

After the smart ODR complaint counselling will take place, based on the action, our team will guide you for the arbitration at NSE. We represent clients in front of the arbitrators to fight against the odds tactfully, technically, and authoritatively.

The responsibility to achieve the reward on behalf of clients lies solely on us.

Conclusion

The legal processes become much complicated as you move higher in the ladder. With every little effort you put into paperwork, you create another chance of rejection.

When you have genuine complaints with all the necessary proof, losing ground to the opponent due to poor strategy and less accountability is unacceptable.

In case you need an expert who has achieved wins in similar cases, discuss your concern with us. After all, it’s not only end justifies the means, but the means also justify the end.