Investment choices today need clear thinking, steady focus, and proper guidance, especially in markets that change quickly and often influence people’s emotions.

Many investors look for advice that is based on solid research, offering a balance between potential gains and risks, without overpromising or making unrealistic claims.

This demand allows firms that emphasize organized processes, openness, and following rules instead of chasing quick wins. In such a setting, advisory companies are essential in helping investors understand information and make decisions with confidence.

Fiscal Solution and Research is an investment advisory firm registered with SEBI, known for using research to guide its decisions. The company focuses on thorough analysis, a deep understanding of the market, and advisory methods that follow clear rules.

Its work aims to match investment decisions with personal financial goals, willingness to take risks, and legal guidelines. This method shows a growing trend towards making informed investment choices rather than acting on impulse.

Fiscal Solution And Research Reviews

Fiscal Solution and Research is an investment advisory and research company that operates under SEBI regulations. The firm provides paid advice and does not promote financial products for commissions.

Its main focus is on conducting structured research and following disciplined advisory methods. The advisory process helps clients make investment choices that match their financial goals and risk tolerance.

The team evaluates the current market situation before suggesting any strategy or action. This approach helps clients make decisions based on facts rather than emotions or impatience.

The firm uses market data, trends, and financial indicators to make its recommendations. Research is the basis for all the advice given to clients. This ensures that investment decisions are clear and consistent.

Fiscal Solution and Research offers guidance in areas like equities, derivatives, commodities, and IPOs. These investments are traded on platforms such as NSE, BSE, MCX, and NCDEX.

The firm keeps a broad outlook to cater to different investment needs.

Abhishek Dave is the owner of the firm and is registered with SEBI as a research analyst. The firm offers advice on stock trading, intraday strategies, derivatives, and participating in IPOs.

This section highlights the firm’s core offerings, including stock trading, intraday strategies, IPO investing, and derivatives guidance.

The pricing structure shows uniform charges across Stock Cash, Stock Futures, Stock Options, and Index Options segments.

Fiscal Solution And Research User Complaints

Whenever an investment advisor is handling real money, managing client expectations, and dealing with market ups and downs, they tend to come under close watch.

Clients often express worries when results don’t match what was expected, when communication isn’t clear enough, or when timing plays a big role in how well their money does.

These issues usually point to differences between what the advisor suggested, how the market actually behaves, and how well the client understands the risks involved.

In places where investment advice is tightly regulated, clients also pay close attention to how clear and accurate the information is, and whether there’s good follow-up.

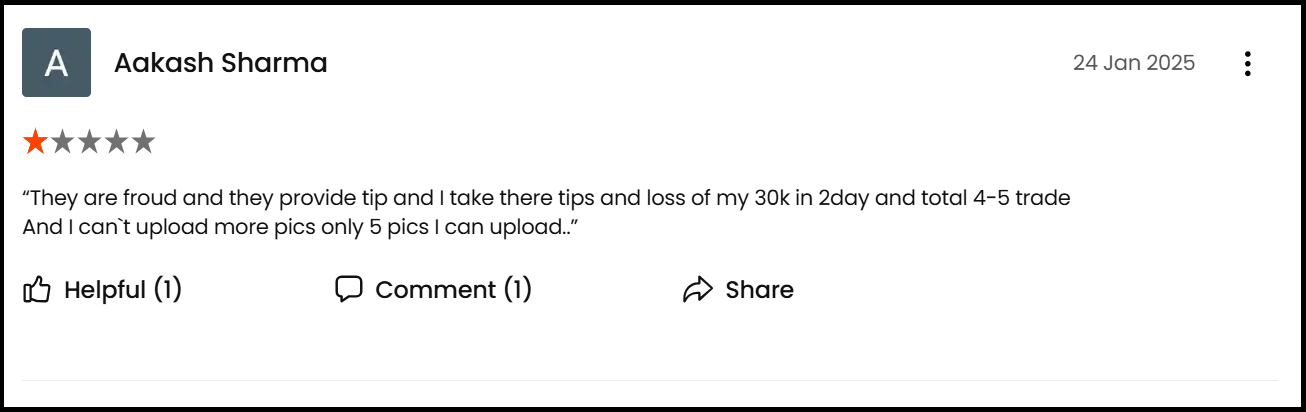

This review reflects user expressing frustration after experiencing trading losses over a short period using advisory tips.

The concern highlights expectations around accuracy, outcome timing, and limitations in sharing complete supporting evidence publicly.

A user on Justdial, identified as Aakash Sharma, posted a complaint on 24 January 2025, alleging losses after acting on trading tips provided by the entity.

According to the complaint, the user claims that he followed the stock tips given and incurred a loss of approximately ₹30,000 within two days, across 4–5 trades.

He has described the service as fraudulent and expressed frustration over limitations in uploading supporting evidence, stating that he was only able to upload a limited number of screenshots despite having more proof.

The complaint highlights concerns regarding:

- Tip-based trading recommendations

- Rapid losses in a short time frame

- Allegations of misleading or unreliable advisory practices

Such user feedback raises red flags about the quality, transparency, and risk disclosures associated with the advisory services being offered.

When to File a Complaint Against an Investment Advisory Firm?

Investors should take action if advisory services aren’t meeting the standards they promised, aren’t ethical, or aren’t following the rules. Acting early helps protect your money, gives a formal record of your concerns, and holds the advisory system accountable.

- If a firm promises guaranteed returns, gives false tips, or offers advice without proper registration, you should file a complaint. This behavior breaks the rules and puts your money at risk.

- If an advisor pushes complicated products without checking your risk tolerance or explaining possible losses clearly, you should raise your concerns.

- If you see trades made without your approval or without written consent, act immediately. Unauthorized trading is serious and can lead to legal problems.

- If reports, research, or promised services don’t arrive after you’ve paid, file a complaint.

- Poor communication and repeated delays are signs that the service isn’t up to standard.

- If a firm charges hidden fees, takes money without permission, or refuses a legitimate refund, take action.

- If the firm doesn’t respond to your complaint or takes more than ten working days to reply, escalate the issue. No response means the company isn’t handling complaints properly.

How to Report a Complaint Against an Investment Advisory Firm?

Reporting a complaint is most effective when investors follow a clear process rather than going straight to regulators.

This method allows the advisory firm a fair opportunity to address the issue while also creating proper records for any further steps.

A structured process also helps in maintaining clarity, setting clear timelines, and ensuring accountability throughout.

Steps to Report:

- Contact the advisory firm: Reach out to them through official email or their support channels. Keep a record of all messages and responses you receive in writing.

- Wait for a reasonable response period: Allow the firm up to ten working days to resolve the issue. Carefully note any delays, unclear replies, or lack of response.

- Prepare supporting documents: Gather proof of payments, invoices, chat logs, emails, and advisory reports. Make sure the documents are organized to clearly explain what happened and when.

- File a complaint in SEBI: Lodge a complaint with SCORES against the registered advisory firm. Be clear and factual in your description, avoiding exaggerated or emotional language.

- Track and follow up regularly: After filing SEBI complaint against advisory company, you should check the SEBI complaint status of your case on the SCORES dashboard. Respond quickly if SEBI requests more information or clarification.

Need Help?

If you’re feeling confused or uncertain about what to do next, our team is here to help you through the whole complaint process in a calm and clear way. You can register with us.

We’ll help you understand your situation, make sure your concerns are clear, and organize your documents without making things harder or more stressful.

We’ll be with you during all follow-ups and help you respond accurately to any questions from the regulators. You don’t need any prior knowledge or experience because we take care of every step with clear explanations and patience.

From the first concern to the final resolution, we focus on keeping things structured, transparent, and easy to follow at every stage.

Conclusion

Fiscal Solution and Research operates in a regulated advisory environment that emphasizes research, organization, and compliance with rules.

Investors should understand how these advisory firms work, what services they offer, and the limits of their responsibilities.

Being informed helps investors set realistic goals, assess advice fairly, and stay focused on their financial plans. Making thoughtful decisions helps avoid hasty choices and encourages a disciplined way of investing.

When issues or concerns arise, it’s important to deal with them promptly rather than putting them off or ignoring them. Taking action early, keeping accurate records, and using clear reports help protect investors’ interests and increase transparency.

Knowing how to handle complaints gives investors the confidence to address problems calmly and effectively.

Having clear information and staying informed helps investors feel in control and assured in their relationship with their advisors.