Considering investing with Gogia Capital Services Limited?

Before making any financial commitment, it’s important to understand the firm’s background, regulatory standing, and recent developments.

As one of India’s long-standing brokerage houses, Gogia Capital has operated for decades, but recent regulatory actions and financial disclosures have prompted closer scrutiny.

This article takes a detailed look at the facts investors should be aware of.

Gogia Capital Services Limited Review

Gogia Capital Services Limited (now rebranded as Gogia Capital Growth Limited in September 2024) positions itself as a full-service stockbroker.

Founded by Mr. Satish Gogia in 1994, the firm claims to provide comprehensive market services with “world-class” standards.

Here’s what they offer:

- Stock and commodity broking services

- Equity, currency, and derivative trading

- Mutual funds and SIP investments

- Depository services through NSDL

Sounds impressive? Wait till you see what’s underneath.

Now, being a stockbroker, it is registered with SEBI and is a member of BSE & NSE, but that doesn’t mean that the entity is safe in every aspect.

Also, the entity is registered to offer research analyst services in the stock market.

According to Business Standard, the company was registered with SEBI as a Category III Merchant Banker in May 1995.

So yes, it’s registered. But there are a few cases that brought the platform in the limelight in the past.

Gogia Capital SEBI Order

SEBI issued a final order against Gogia Capital on October 6, 2025 – just months ago.

The violations reported include:

- ₹51.51 crore in receivables (money owed to them)

- ₹10.12 crore negative net worth

- Onboarding restrictions imposed by SEBI

What does negative net worth mean? Simply put, the company owes more than it owns. Their liabilities exceed their assets by over ₹10 crore.

Would you trust your money with someone who’s in the red themselves?

Concerning, right?

Alleged Violations & Regulatory Provisions

| S. No. | Alleged Violation | Regulatory Provisions |

| 1 | Shortfall in net worth & improper maintenance of books of accounts | SEBI Act, 1992; SEBI Circular (1998); Stock Brokers Regulations |

| 2 | Engaged in non-securities business involving personal financial liability | Rule 8(3)(f) of SCRR; SEBI Master Circular (2023); SEBI Circular (1997) |

| 3 | Non-settlement of clients’ funds and securities | SEBI Master Circular; SEBI Circulars (2009, 2016, 2021, 2022) |

Here is the detailed analysis of each violation

1. Net Worth Deficiency & False Accounting

Issue:

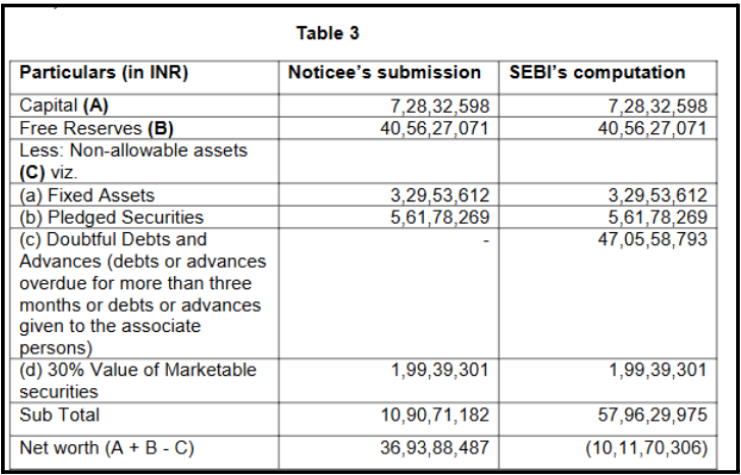

Gogia Capital misrepresented its net worth by not excluding doubtful debts and advances overdue for more than 3 months.

Key Numbers:

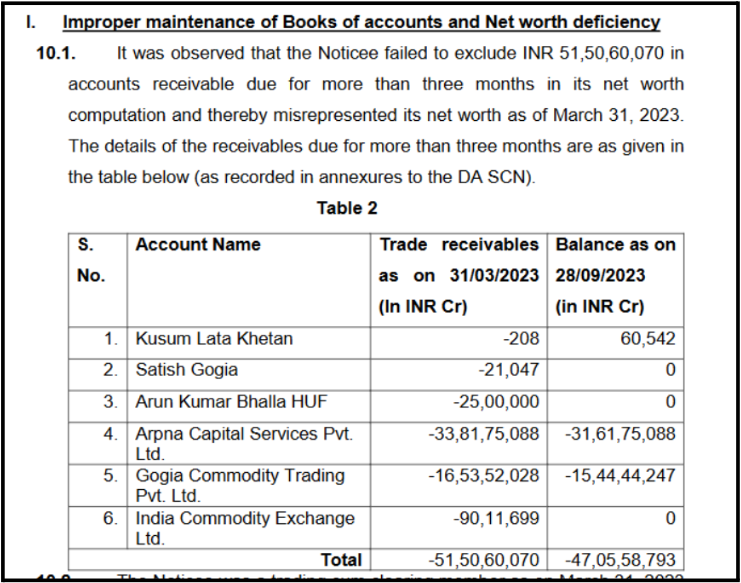

- Total questionable receivables: ₹51.50 crore

- Adjusted net worth as of March 31, 2023: Negative ₹10.11 crore

- Required net worth (as TMCM): ₹15 crore

The table below shows six debtors who owed Gogia ₹51.50 crore, with amounts overdue for more than 3 months, indicating doubtful or unrecoverable funds that should not count toward net worth.

Table 3 compares Gogia’s claimed net worth of ₹36.93 crore with SEBI’s corrected calculation of negative ₹10.11 crore, proving the firm misreported its financial health by including ineligible assets.

Accounting Manipulation:

The broker used Journal Vouchers (JVs) to adjust receivables from related parties without actual cash movement, artificially inflating its financial position.

Impact:

- Investor Risk: Brokers with low or negative net worth may fail to meet obligations, risking client funds.

- Market Trust: False reporting undermines transparency and trust in the financial system.

- Regulatory Failure: Shows weak internal controls and non-compliance with capital adequacy norms.

2. Engaging in Non-Securities Business

Issue:

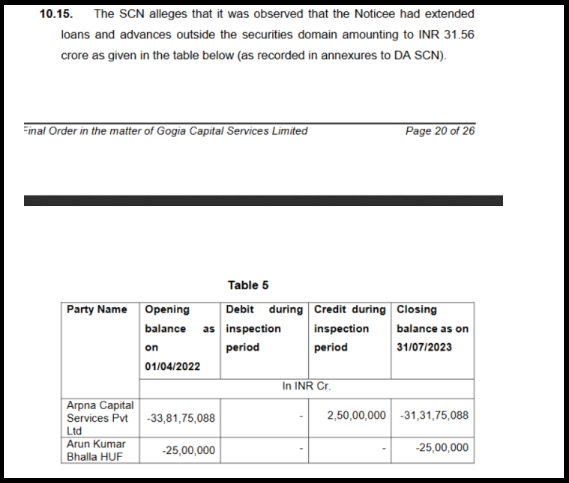

Gogia Capital provided large loans/advances to entities like Arpna Capital Services and Arun Kumar Bhalla HUF, unrelated to the securities business.

Key Transactions:

- Advance to Arpna: ₹33.81 crore (claimed as loss-sharing in proprietary trading)

- Advance to Arun Kumar Bhalla HUF: ₹25 lakh (claimed as property purchase advance)

Lack of Documentation:

No proper agreements, stamp duty, or bank statements were provided to prove that these were related to securities business.

Impact:

- Conflict of Interest: Using client funds or firm capital for unrelated activities jeopardizes investor assets.

- Liquidity Risk: Diverting funds to non-core activities affects the broker’s ability to settle client trades.

- Regulatory Breach: Violates the core principle that stockbrokers should not engage in other businesses involving financial liability.

3. Failure in Client Fund & Securities Settlement

Issue:

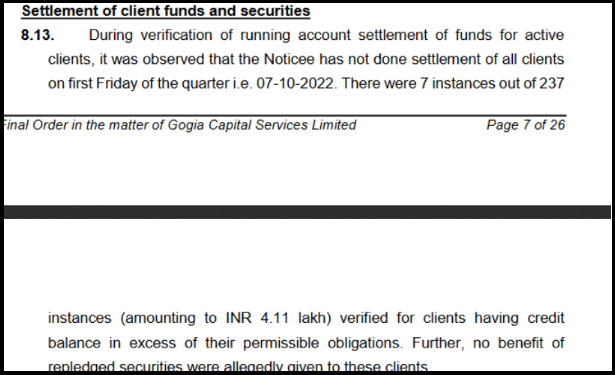

Gogia Capital failed to settle running accounts for 7 out of 237 clients on the mandated quarterly settlement date (October 7, 2022).

Key Lapses:

Impact of the Violations on Retail Investors:

Imagine you invest with Gogia Capital as your broker.

They transferred ₹33 crore of the firm’s money to a company called Arpna Capital, a move outside the securities business, without telling you.

This weakens their financial position.

Meanwhile, because of net worth manipulation, Gogia shows a healthy balance sheet when in reality it’s negative ₹10 crore.

Then, on settlement day, due to poor systems and oversight, your ₹50,000 credit balance isn’t paid out. Because they failed to settle 7 clients’ accounts, including possibly yours.

When you complain, they blame a software error, but the truth is they misused funds and fudged accounts. It also failed basic client obligations, putting your money at risk without your knowledge.

That’s how SEBI-proven violations translate into real investor loss and lead to:

- Financial Risk: Clients’ funds and securities were not promptly settled, affecting their access and liquidity.

- Loss of Confidence: Investors may doubt the safety of their assets with non-compliant brokers.

- Potential Losses: If the broker’s net worth is inadequate, investors could face losses in the case of broker default.

SEBI’s Verdict

Action Taken: Gogia Capital is prohibited from onboarding new clients for one month from the order date.

Reasoning: SEBI found the violations serious but considered the DA’s recommendation proportionate, given no prior enforcement history for these breaches.

Order Enforcement: The order is effective immediately and has been communicated to all stock exchanges for compliance.

What Can You Do in Such Cases?

Are you facing similar issues with Gogia Capital or any other SEBI-registered broker?

You are not alone.

Our dedicated team specialises in assisting investors like you. We provide end-to-end support to ensure your grievance is documented effectively and reaches the right authorities.

Our Step-by-Step Support Process

1. Initial Consultation & Case Assessment: We arrange a confidential call with a dedicated case manager. They’ll listen to your complete experience and evaluate your case.

2. Professional Case Documentation: We help you draft a structured, legally coherent complaint letter. It clearly outlines the misconduct, financial loss, and specific regulatory breaches.

3. Direct Engagement & Escalation:

- Reaching the Broker: We guide you in formally communicating your complaint to Gogia Capital—a necessary step for the grievance trail.

- Filing on SEBI SCORES: We provide detailed guidance on filing through the SEBI SCORES portal. We help track status and respond to SEBI queries.

- Smart ODR: For eligible disputes, we guide you through SEBI’s Smart ODR (Online Dispute Resolution) platform—a faster mechanism for resolving conflicts.

4. Advisory & Strategic Counselling: Our experts counsel you on realistic outcomes, recovery avenues, and typical timelines in the regulatory process.

5. Guidance on Advanced Recourse:

If initial regulatory action is unsatisfactory, we guide you on the next steps:

- Pursuing Arbitration: If your agreement has an arbitration clause, we connect you with legal experts specializing in securities arbitration.

Your money matters. Your complaint matters.

By taking this step, you’re not just seeking accountability. You’re becoming part of a cleaner, more transparent financial market.

Ready to take action?

Register with us today, and let’s fight for your rights.

Conclusion

Gogia Capital has been SEBI registered for decades and is listed on the BSE. The firm has operated for over 30 years with a presence across 380 branches. However, these traditional markers of stability don’t tell the complete story.

The concerning aspects far outweigh the positives. The company is dealing with a negative net worth of ₹10.12 crore, meaning it owes more than it owns.

SEBI has imposed onboarding restrictions following violations discovered in October 2025.

Moreover, the sales growth has declined by 19.2% over the past five years, and the return on equity stands at a troubling negative 24.9% over the last three years.

This means the company is struggling to collect money owed to it, which raises serious questions about its operational efficiency and financial management.

With such concerning financial indicators and recent regulatory action, investors should proceed with extreme caution.

Stay informed. Stay safe. Invest wisely.