In the fast-moving world of Indian stock markets, picking the right broker isn’t just a choice; it’s a decision that can shape your entire investing journey. Think of it like choosing a co-pilot for a long flight. You want someone who knows the route, follows the rules, and won’t disappear when the skies get rough.

That brings us to GoPocket, a trading platform that’s been popping up on the radar of many retail traders lately. But the big question is: Is the buzz justified? Whether you’re a market veteran tracking every tick or a first-time investor taking cautious steps, this deep dive has you covered.

We’ll break down GoPocket’s SEBI credentials, explore how the platform actually works, and, most importantly, look at what real users are saying on the ground.

So before you place your next trade, let’s put GoPocket under the microscope and see if it’s a smooth ride or a potential turbulence zone.

GoPocket Trading

GoPocket isn’t just another trading app; it’s the digital avatar of Gopocket Invest Tech Private Limited, earlier known as Sky Commodities India Pvt. Ltd.

Headquartered in Coimbatore, Tamil Nadu, the company has come a long way from being a traditional, region-focused commodity broker. Today, it has reinvented itself as a tech-first, digital trading platform built for modern investors and traders.

What started with commodities has now expanded into a full-service offering, Equities, Futures & Options (F&O), Commodities, and Mutual Funds, all under one roof. Whether you prefer trading on a browser or on the go, GoPocket has you covered with its official website and a dedicated Android app available on the Google Play Store.

GoPocket’s journey reflects a classic transformation story. From old-school broking to a digital, app-driven investment platform designed to keep pace with today’s fast-moving markets.

GoPocket Trading App Complaints

Several users have lodged serious complaints, primarily focusing on unexpected high costs and pressure from relationship managers to place large trades.

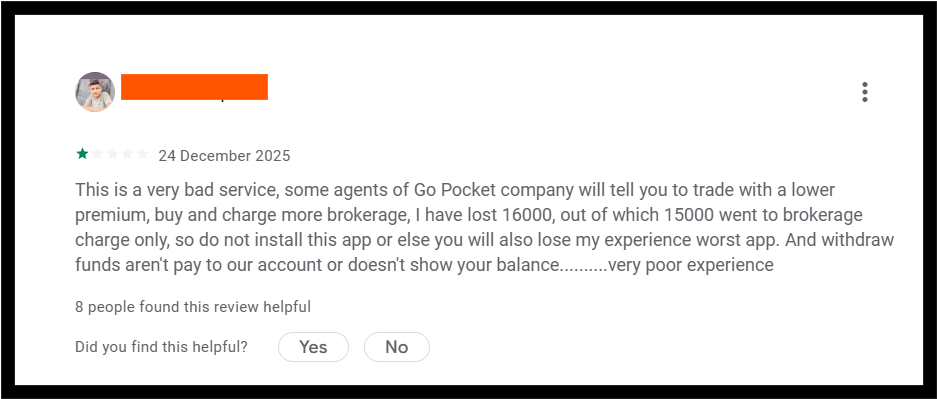

- There are several negative reviews also available on the Google Play Store. Users describe the service as “very bad” and “the worst app experience.”

The user claims that agents advise trading with a lower premium but then charge excessive brokerage fees. This suggests a potentially misleading sales practice aimed at generating commissions rather than client profits.

The user reports a significant loss of ₹16,000, with ₹15,000 specifically attributed to brokerage charges. This points to a potentially non-transparent or confusing fee structure that can quickly erode an investor’s capital. Other user complaints echo this sentiment, citing charges per lot instead of per trade, which leads to exorbitant costs.

From an investor’s perspective, this review serves as a critical warning that while GoPocket is a legitimate, SEBI-registered entity operating within a regulated framework, the client experience can be inconsistent.

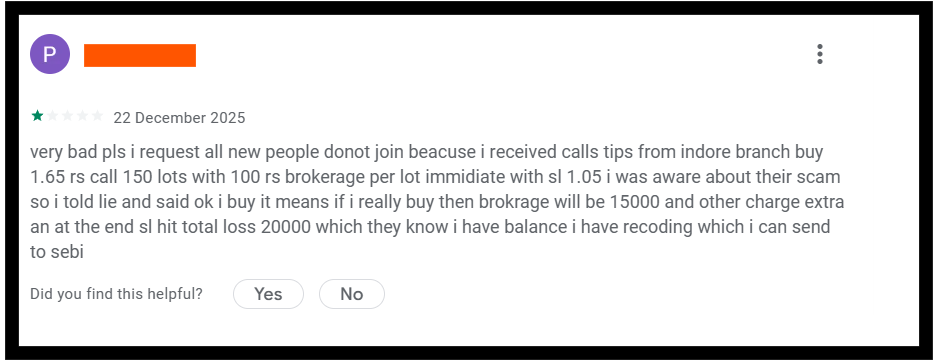

- Another user also complained of Misleading Advice against GoPocket. The user was given specific trade tips from the Indore branch and pressured into immediate action.

Trading advice and pressure to trade large amounts are red flags, since registered brokers are generally prohibited from guaranteeing returns or providing prescriptive “tips.”The core of the complaint revolves around the fee structure.

A user reported being contacted by an individual identifying herself as Aarti, who claimed to represent a company called GoPocket. According to the user, the interaction involved high-pressure sales tactics and a lack of transparency, practices that are not permitted for registered intermediaries operating in the Indian securities market.

During the conversation, the caller allegedly encouraged the user to open a demat account specifically with GoPocket, while also suggesting the possibility of guaranteed returns.

It is important to note that no registered broker, intermediary, or trading platform is legally allowed to assure guaranteed profits to clients. Any such claim directly violates basic regulatory principles governing securities and investment services.

The caller introduced herself as someone managing trading services for GoPocket and spoke with confidence and authority. She claimed that the firm specialised in helping retail investors earn consistent profits through guided trading and “expert support,” even for individuals with limited market experience.

When the investor mentioned already having an existing demat account, the caller reportedly responded with strong persuasion. The user was told that the offered trading services would only function if a demat account was opened exclusively with GoPocket.

According to the caller, using an external or personal demat account would not provide access to their proprietary strategies or advisory support.

This insistence on opening a new demat account, combined with profit assurances, became the first significant red flag for the user.

Account Opening Under Assurances

After several follow-up calls and repeated assurances of profit-making opportunities, the investor agreed to open a demat account with Go Pocket. The process was handled by a person named Aarti, who represented herself as being associated with the firm.

The account opening was smooth and quick. At no point during this process were detailed documents explained or shared. There was no discussion around:

- Brokerage charges

- Transaction or platform fees

- Risk disclosures

- Trading authority or consent structure

Instead, the focus remained firmly on profit potential and how the firm’s guidance would help grow the invested amount.

Funding the Account

Once the demat account was activated, the investor was encouraged to fund it so trading could begin. Repeated verbal assurances were made that profits would be generated with the firm’s support and market guidance.

Acting on this confidence, the investor first deposited ₹20,000 into the demat account. Soon after, based on continued encouragement and expectations of better trading opportunities, an additional ₹10,000 was deposited.

Throughout this phase, no written agreement was provided. There was:

- No risk disclosure document

- No brokerage or cost breakup

- No explanation of how trades would be executed

- No clarity on whether the advice was discretionary or non-discretionary

Everything was communicated verbally, with one consistent message: “Don’t worry, we’ll take care of the profits.”

Over time, the investor began to notice that the confidence and clarity promised during the onboarding phase were missing when actual accountability was required. There was no formal documentation supporting the assurances that had been made.

What Was Promised vs. What Actually Happened

The promises made included:

- Assured or guided profit-making through expert trading support

- Specialised services available only through their demat account

- Confidence that risk was managed by professionals

In reality:

- No written proof of services or guarantees was provided

- No risk factors were disclosed

- No fee or brokerage structure was explained

- No regulatory documentation was shared

GoPocket SEBI Violations

This case raises serious concerns from a regulatory and compliance standpoint:

- Mis-selling of trading services: Promising or implying assured profits is strictly prohibited under Indian securities regulations.

- Lack of mandatory risk disclosure: SEBI requires brokers and intermediaries to clearly disclose risks involved in trading before onboarding a client.

- No written agreement or fee transparency: Investors must be informed of brokerage, transaction costs, and service terms in writing.

- Inducing revealing profits to influence investment decisions: Using profit assurances to encourage account opening and funding is unethical and misleading.

- Potential misuse of authority and trust: Encouraging account opening by restricting access to services unless a specific broker is used raises red flags.

What You Can Do in Such Cases?

Are you struggling with your broker and unsure of what to do? You can register with us, and we will help you throughout the entire process by providing:

- Document Assistance: We assist you in collecting, organizing, and structuring all required documents, trading statements, ledger reports, contract notes, call logs, screenshots, and emails to ensure your case has strong evidence.

- Complaint Drafting: Our team prepares clear, concise complaint drafts that meet the exact specifications of NSE, BSE, SEBI SCORES, and SMART ODR. Thus, your complaint will be properly understood and not rejected due to formatting issues.

- Platform Filing Support: Regardless of whether it is to file a complaint on SCORES or SMART ODR, we advise you at every step of the submission process. We also make sure that every fine print is correctly filled up thus no time is wasted for the delivery.

- Escalation Guidance: If you think your complaint with a broker should be taken to a higher level, we tell you the correct channel to follow. Whether it is through the exchange or getting ready for the following stage.

- Case Management from Start to Finish: After you have enlisted with us, we keep an eye on your case, notify you about the time limits, and help you give answers to the questions that may be raised by either regulators or exchanges.

- Support During Counseling & Arbitration: In the event that your complaint is referred to counseling or arbitration in the stock market, we provide you with the necessary preparation of your oral and written submissions so that you have enough self-confidence and are fully ready.

Conclusion

Technically speaking, GoPocket is a legitimate, SEBI-registered broker. So no, it’s not a shady or “fake” app hiding in the shadows. The platform itself is sleek, modern, and does what a trading app is supposed to do.

While the app passes the legitimacy test, user experiences tell a different story about the people behind the calls. Several traders have reported aggressive sales pitches, glossy profit promises, and a serious lack of transparency. These are classic signs of mis-selling.

If you are an experienced trader who can ignore sales calls and manage your own trades, the low brokerage might be attractive. Those persistent “advisors” and persuasive callers often oversell expectations, sometimes bordering on the infamous “Aarti-style” profit guarantees that seasoned investors know to stay away from.