In today’s world, where a trading app is just one tap away on almost every smartphone, the promise of “financial freedom” is everywhere. But here’s the uncomfortable truth: the same tap can sometimes lead straight into a financial nightmare.

If you’re reading this, chances are you have one or the other GoPocket trading app complaints.

Maybe you’re wondering, “Is Your Trading App Real or Fake?” Or perhaps you’re already using the app and sensing that something doesn’t feel quite right.

No matter where you fall on the spectrum, whether you are a market veteran chasing smarter trades or a wide-eyed beginner hoping to ride the next bull run. You deserve clarity, not confusion.

In this blog, we cut through the hype to explore real user experiences, reported technical glitches, and the regulatory reality behind GoPocket. By the end, you’ll know exactly what questions to ask, and whether GoPocket is a stepping stone to wealth or a risk you can’t afford to ignore.

GoPocket Trading App Review

GoPocket, operated by Sky Commodities India Pvt. Ltd., loves to call itself a next-gen, lightning-fast trading platform. From smooth IPO applications to high-octane Futures & Options (FnO) trading, it promises to be your one-stop destination for everything markets.

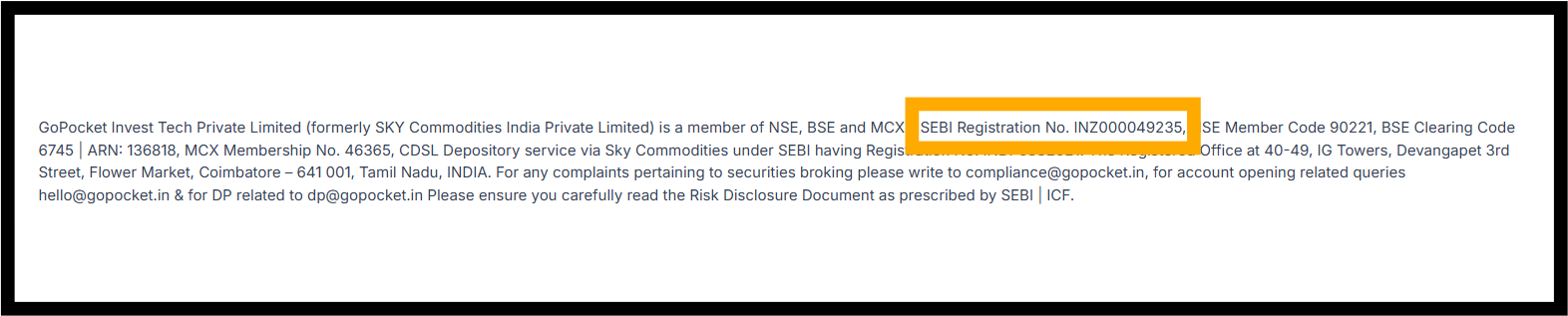

Now, here’s the important part. GoPocket isn’t just another flashy app. It is SEBI-registered, operating under the member name SKY COMMODITIES INDIA PRIVATE LIMITED, with SEBI Registration No. INZ000049235.

The platform is authorized to function as a stockbroker in NSE and MCX segments, offering trading in stocks, IPOs, mutual funds, and derivatives through a clean, user-friendly interface. On paper, it strongly highlights regulatory compliance and investor protection.

But let’s be clear, SEBI registration is not a guarantee of a problem-free experience. It doesn’t mean complaints can’t arise.

What it does mean is accountability. If something goes wrong, be it fund handling, execution issues, or service lapses, you’re not stuck shouting into the void. You have a formal and legal route to seek resolution through platforms like SEBI SCORES.

In short, GoPocket may promise speed and convenience, but as an investor, staying informed, cautious, and aware of your rights is what truly keeps you ahead in the market

GoPocket Trading App Complaint Case Study

Recently, one of the users reported a complaint against GoPocket with us. Here is the complete detail of the case.

It usually starts with a phone call.

The voice on the other end sounds confident, polite, and reassuring. The person knows market terms, speaks fluently, and introduces the company with ease. GoPocket.

They don’t just talk about trading; they talk about profits. Consistent profits. Guided profits. Profits made easier with “expert support.”

During the initial conversation, The Investor was told that while he already had a demat account, it would not work with GoPocket’s “special trading services.” According to the caller, these services required opening a new demat account specifically with GoPocket.

The message was subtle but firm: If you want profits, you need to open a GoPocket demat account.

For many investors, this sounds reasonable. After all, platforms often market proprietary tools or strategies. But this is also a well-known tactic. Drawing clients into a closed ecosystem where the broker has greater control over trades, brokerage generation, and client behaviour.

A genuine SEBI-registered investment adviser can provide advice regardless of which broker an investor uses. Forcing or pressuring a client to open a demat account with a specific broker is the first major red flag.

Soon after, The Investor was contacted by a representative named Aarti, who presented herself as part of the GoPocket team. She spoke confidently about market opportunities and assured The Investor that profits could be generated through their guidance.

There was no talk of downside risk. No discussion about market volatility. Just repeated confidence that the trading support would “work.”

Under SEBI Regulations, no individual or entity is permitted to assure or guarantee returns. The stock market is inherently uncertain. Anyone promising profits is not just being misleading. They may be violating the law.

Encouraged by these assurances, The Investor deposited ₹30,000 into the newly opened demat account. This is where the situation became more concerning.

Despite committing money, The Investor received:

- No Risk Disclosure Document (RDD)

- No brokerage or fee structure

- No written agreement

- No explanation of transaction costs or charges

Everything was verbal. Every assurance was informal. Every question about risk was brushed aside with confidence.

This absence of documentation is not a minor oversight; it is a serious compliance failure. Investors are legally entitled to understand:

- How much will be charged

- What risks are they taking

- Who is responsible for the trades

- Whether the advice is discretionary or not

Without this information, the investor cannot make an informed decision.

The Realisation

Over time, The Investor began to realise that the relationship was built entirely on trust, not transparency. The promises that influenced the decision to invest were never backed by written disclosures or regulatory safeguards.

The distress that followed wasn’t just financial. It was mental. The feeling of being misled, of agreeing to something without full information, left the investor questioning every step of the process.

GoPocket App Reviews

When we look at the high-volume search terms like “GoPocket app not working” or “GoPocket withdrawal problems,” a pattern begins to emerge. Here are the most common grievances reported by the community.

- High Brokerage and Hidden in Plain Sight

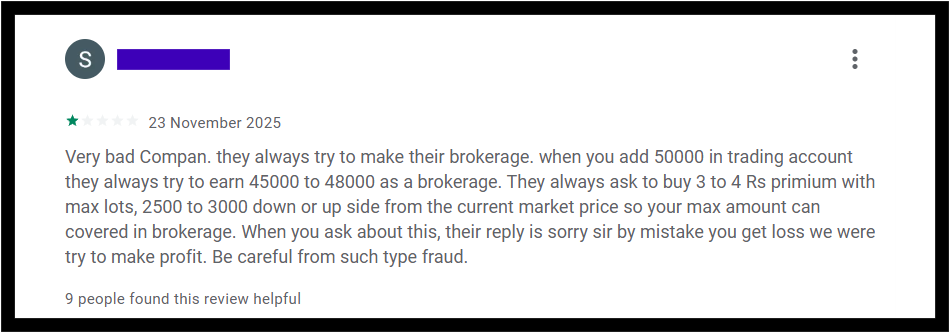

One of the most vocal complaints involves “aggressive” brokerage strategies. Some users have reported that relationship managers or brokers associated with the app encourage high-frequency trading in large quantities.

The user review presented here highlights serious allegations of predatory brokerage practices and potential fraud. The customer’s perspective is one of frustration, financial loss, and perceived deception by the company’s representatives. The user explicitly labels the company a “fraud,” a “very bad Company,” and warns others to “Be careful”.

The user feels brokers intentionally advised them to buy specific premium options with maximum lots and large price spreads to ensure maximum brokerage was collected, regardless of the user’s trading success. This suggests the company prioritized its own commissions over the client’s financial well-being. This is an unethical practice in the financial services industry.

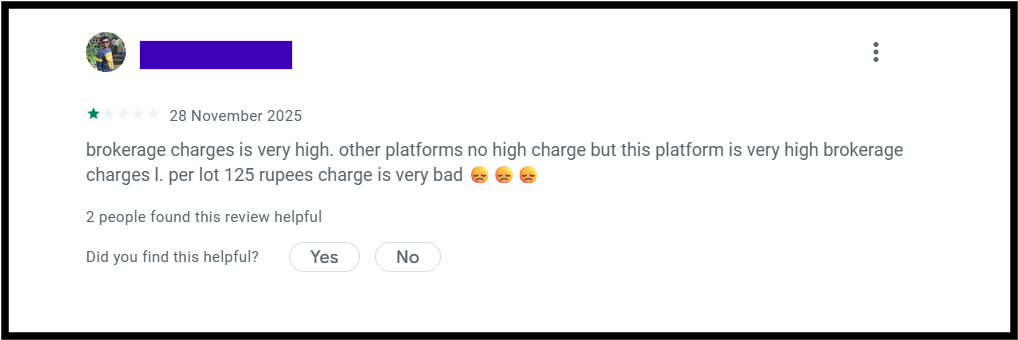

As you can see, the user’s point of view in this review is one of frustration and dissatisfaction regarding the platform’s pricing structure. They believe the company has excessive brokerage charges compared to competitors. Potential users should be highly cautious about the brokerage fees before committing to this platform, as the high costs can quickly impact profitability.

- Technical Glitches Reporting Volatile Hours

In intraday trading, even 30 seconds can feel like a lifetime. The difference between booking a neat profit and watching your stop-loss get brutally wiped out.

That’s why traders are fuming. Users have repeatedly flagged app freezing at the worst possible moments, especially during peak morning market hours. Just when the bell rings and volatility explodes, the app decides to hang or refuse to log in.

And the login experience? Don’t even get traders started. Painfully slow, frustrating, and unreliable. The so-called password-less biometric login often fails, forcing users into emergency credential resets, while their open positions are actively bleeding in the market. When speed is everything, tech failures aren’t just annoying, they’re expensive.

Where to File A Complaint Against Stock Broker?

Facing issues with your stockbroker? The complaint process can be overwhelming, especially when dealing with regulatory portals and legal procedures.

Our legal team simplifies the entire process.

Step 1: Register with Us

We will set up a meeting between you and the Case Manager devoted to your case. They will gather every detail about your situation.

Step 2: Lodge a Complaint in SCORES

The first time you use SEBI portal, you might find it a bit complicated.

We can:

- Help you register on SEBI SCORES

- Guide you through the filing process step, by, step

- Ensure all documents are properly uploaded. Verify the complaint categorisation is correct

- Track your SEBI complaint status. Help you respond to the broker’s replies.

Step 3: Lodge a grievance with Smart ODR

If your dispute referral is through Smart ODR, we dont leave you alone. Help you understand the conciliation process. Prepare yourself for discussions. Review settlement offers with you.

Step 4: Post, ODR Counselling

We will thoroughly scrutinize their response, find out the loopholes in their points, and, based on the analysis, provide you with the best possible solution. Lets work together to figure out whether you want to approve the settlement or take it further.

Step 5: Arbitration in Stock Market

Filing with the National Stock Exchange, our team will assist you with that. Preparing your case documentation. You will understand the arbitration process clearly with our explanations. We will be with you until the decision is made.

Conclusion

Imagine stepping into the markets, ready to take on volatility, global headlines, and lightning-fast algorithms, only to realize you’re also fighting your own trading platform. That’s exactly why navigating the GoPocket ecosystem demands a healthy dose of Investor Skepticism.

On the surface, GoPocket looks reassuring: a sleek app interface and a registered entity behind it (Sky Commodities). But dig a little deeper, and the picture gets murkier. A growing number of GoPocket trading app complaints point toward aggressive brokerage practices and recurring technical glitches, red flags that no serious trader can afford to ignore.

Let’s be honest: trading is hard enough already. You’re risking capital every day against unpredictable markets. The last thing you should worry about is whether your broker is working against you. The case of an investor losing peace of mind over a ₹30,000 deposit isn’t just an isolated story, it’s a warning. When transparency disappears, trust collapses.

And here’s where it gets serious. When platforms, or people claiming to represent them, focus more on pushing account openings than on educating investors about risk, the relationship is broken before the first trade is placed. In this case, the absence of a Risk Disclosure Document (RDD) isn’t a minor oversight; it’s a clear technical violation and a powerful point of leverage if you decide to file a formal complaint.

So pause. Take a breath. Protect your capital.

The markets will always present new opportunities, but only if you still have money (and confidence) left to trade them.