Have you ever placed a trade and been sure it should work, only for the app to freeze or not respond? Imagine that on a busy market day, your money is on the line. That’s exactly what happened to one investor in a case that ended up in arbitration.

This is the full story of the IIFL technical issue case, as detailed in the official NSE arbitration award.

IIFL Arbitration Case Explained

This case is an arbitration dispute filed before the National Stock Exchange of India Limited (NSE). It involved an investor and IIFL Securities Limited – the broker through which she traded.

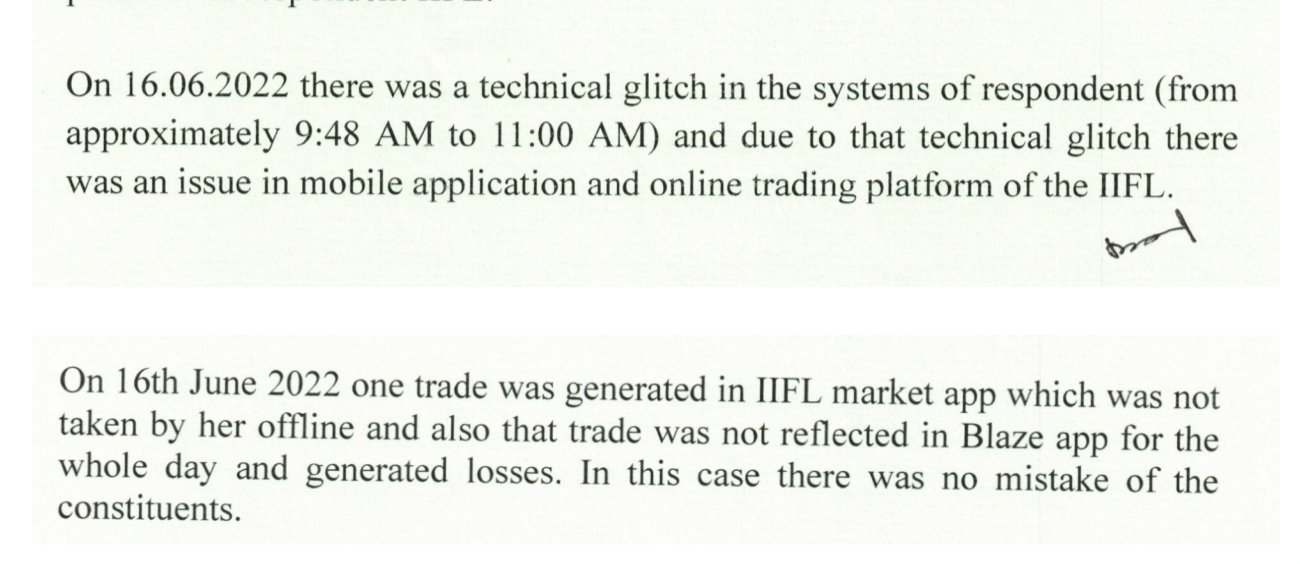

The whole matter boiled down to a technical outage in IIFL’s trading system that allegedly caused a serious financial loss to the investor on one specific trading day.

Arbitration like this happens when a client and a broker can’t settle a dispute themselves. Instead, they ask a neutral arbitrator, in this case, appointed under NSE rules, to hear both sides and decide what’s fair.

Let’s set the scene: It was June 16, 2022, a day when markets, especially F&O contracts, tend to be choppy and volatile. That means many traders are placing many orders to lock in profits or cut losses.

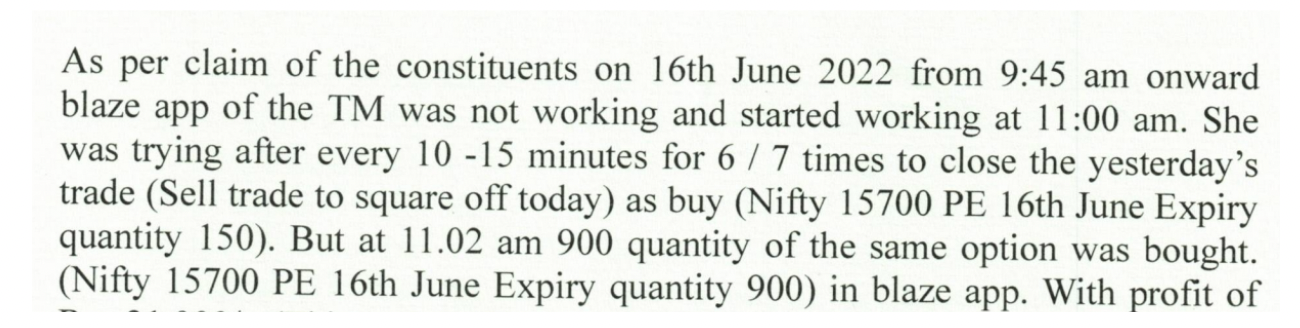

The investor claimed that at about 9:48 AM, she found that her IIFL app not working. She could see prices, but the platform wouldn’t execute her trade to square off a position. She kept trying, but the application kept rejecting her orders. That went on until around 11:00 AM – about 72 minutes of stressful waiting while the market kept moving.

Here’s the real punch: At one point during that malfunction, her position showed a profit of over ₹30,000, but because she couldn’t exit the trade, it later turned into a significant loss. This was the core of her complaint.

What Did the Investor Say in Her Claim?

When the investor filed her arbitration claim, she laid out a few key points:

- She had a legitimate open trade that she wanted to square off.

- The Blaze app was broken during the critical time window.

- She repeatedly tried to place closing orders.

- Despite screenshots and trading logs, her orders were never executed.

- She lost about ₹2,01,600 because of the glitch.

- She asked IIFL to compensate her for the losses.

She also shared screenshots of her order book and chat logs to show that she was actively managing her risk, but the platform kept failing her.

What Was IIFL’s Defense?

IIFL didn’t deny that a technical glitch happened. They agreed the Blaze app malfunctioned. But their defense had a few points.

1) The technical issue was beyond their control and lasted only from 9:48 AM to around 11:00 AM. They reported the glitch to NSE the next day and filed a Root Cause Analysis (RCA), as required by exchange rules.

2) The investor could have used other channels. like calling customer support, to check her orders or place trades.

3) The investor did not cancel the multiple orders she placed, and those orders were eventually executed. Market volatility on that particular day, owing to F&O expiry, contributed to losses, not just the technical glitch alone.

The investor understood trading risks, especially in derivatives, because she agreed to detailed risk disclosures when opening her account.

So, while they admitted the outage, IIFL argued that the loss wasn’t entirely their fault.

IIFL Arbitration Award

The Sole Arbitrator appointed in this matter closely reviewed screenshots, order logs, communications, and reports from both sides. The arbitrator made decisions based on how brokers are required to behave under NSE rules and industry standards.

Here’s what came out clearly from the findings.

The IIFL technical glitch did occur and was not denied by either side. The investor repeatedly tried to square off her trade, but the trading platform repeatedly failed. IIFL’s support system did not provide an effective backup mechanism for the investor during the outage.

Brokers are expected to show reasonable skill, care, and diligence toward clients, especially when outages hurt their ability to trade. IIFL’s performance fell short here.

The arbitrator noted that it isn’t enough to show that a glitch occurred. The question was whether IIFL reasonably assisted the client during the outage, which damaged her ability to manage risk.

On this point, the award sided with the investor

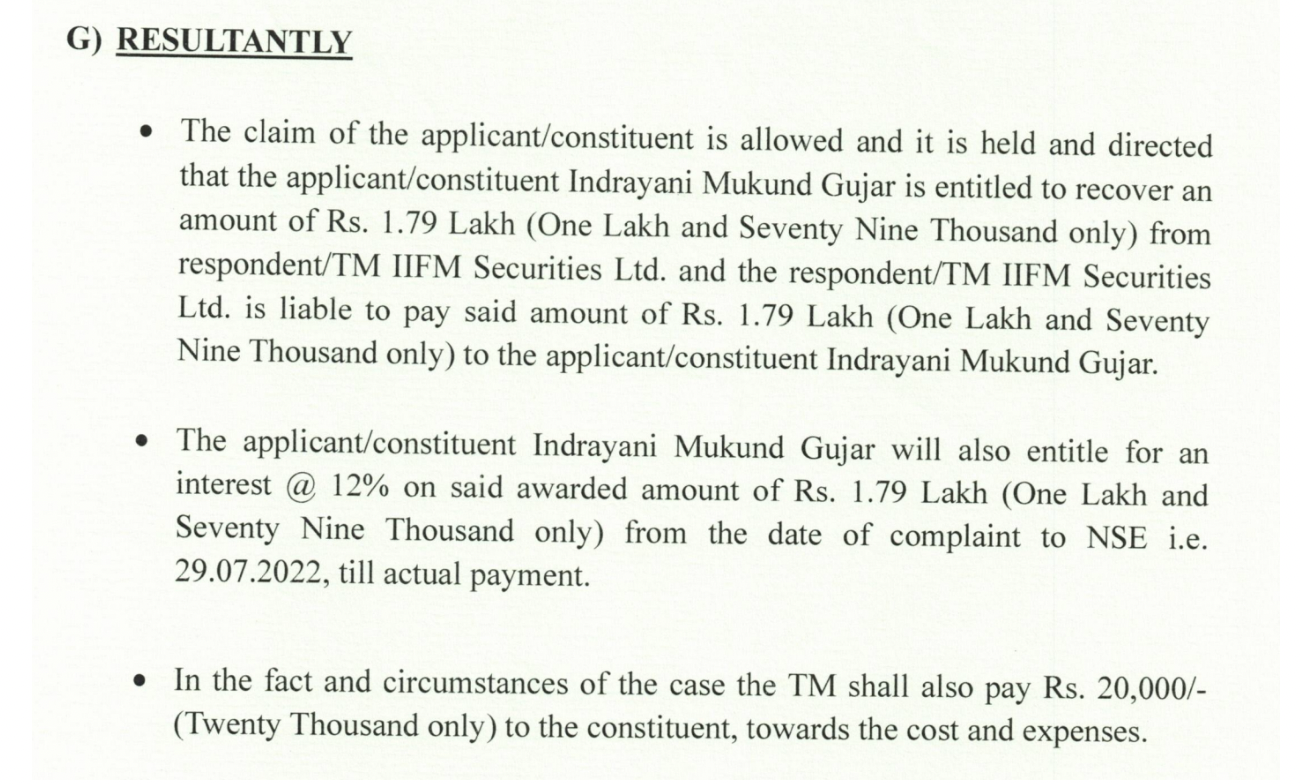

After weighing everything, the arbitrator issued a clear outcome:

- Compensation: The investor was awarded ₹1,79,000 as the principal compensation for her actual financial loss.

- Interest: IIFL had to pay 12% interest per year on that amount from the date the complaint was filed until the payment was made.

- Expenses: IIFL was also directed to cover ₹20,000 toward the investor’s legal and arbitration costs.

So in effect, the broker was held liable not only for the direct loss but also for compensating the investor for procedural costs and interest on the amount due.

What Other Traders Can Learn From This Arbitration Case?

This award sets an important example for retail investors who rely heavily on broker platforms for fast execution.

Technical outages are not always excusable excuses for brokers. Brokers must show they provided adequate alternatives or assistance during outages.

Clients have recourse, including arbitration, when service failures cause real financial harm. Screenshots and trade logs can be powerful evidence in disputes.

It also highlights how volatile market conditions, like those during F&O expiries, can magnify losses when a platform fails at exactly the wrong moment.

How to Report If You’ve Dealt with Technical Glitch in Stock Market

If you have ever faced losses due to a technical glitch reporting in the stock market, then you should register with us. We will guide you with the complaint process and guide you with the complaint process

- Document Assistance

We help you gather all necessary documents, such as ledger reports, contract notes, screenshots, and emails, to build a strong case. - Drafting Your Complaint

Our team will create a clear, well-structured complaint that fits the requirements of NSE, BSE, SEBI SCORES, and SMART ODR. - Platform Filing Support

We guide you through submitting your complaint to the relevant platforms, ensuring accuracy and completeness. - Escalation Guidance

If needed, we’ll help you escalate the matter to the exchange or move to the next stage of resolution. - Complete Case Management

From filing to resolution, we’ll track deadlines, handle queries, and ensure your case stays on course. - Support During Counselling & Arbitration in Stock Market

If your case reaches counselling or arbitration, we assist in preparing statements and documents to ensure you’re confident and ready.

Register with us; we make the process smoother and faster, so you can focus on recovering while we handle the details.

Conclusion

Trading on mobile apps feels easy most of the time, right? But when a platform crashes and the market keeps moving, every minute counts.

That’s exactly the high‑stakes scenario this investor faced with IIFL’s Blaze app. The arbitration award shows that simply blaming market volatility or a temporary technical issue isn’t enough. Brokers must show real, hands‑on support when clients need it most

If you’ve ever worried a trade might not go through, you’re not alone. And if you believe a broker’s failure has hurt your investment, there are structured legal paths to pursue answers and compensation.