You might have seen Aakanksha Gupta tweets about “options selling” or gotten recommendations from her free Telegram channel with thousands of followers.

She’s got the SEBI tag, the impressive trading screenshots, and the promise of consistent profits.

But here’s the thing: Aakanksha Gupta was providing trading advice to thousands of people for years without any SEBI registration, and many of those early traders lost money with zero way to complain to SEBI.

Today, she’s SEBI registered, but the violations that made her famous in the wrong circles are still happening.

Before you pay ₹5,900 for her premium channel, you need to read this.

Who Is Aakanksha Gupta?

Aakanksha Gupta is a social media financial influencer with a significant presence on Twitter (@aakankshalovely), Instagram, and Telegram.

She describes herself as someone passionate about “discretionary options selling” and works as a trainer and educator for market learners.

On the surface, she looks legit because she has a professional website, thousands of followers, and she’s positioned as an expert in trading. Her business model is simple but effective.

She runs three layers of engagement:

- A free Telegram channel with approximately 50,000+ subscribers where general market discussions happen

- A premium Telegram channel costing ₹5,900 per month with around 800 to 1,000 monthly subscribers

- A community group where members interact among themselves

The revenue from this?

If you do the math, 6,000 rupees multiplied by roughly 1,000 subscribers every month. That’s 60 lakhs monthly, or 7.2 crores annually. It’s a profitable venture, no doubt about it.

But profitability doesn’t always mean legitimacy, especially in the financial advisory space.

Is Aakanksha Gupta SEBI Registered or Not?

Aakanksha Gupta does have a current SEBI registration. Her registration number is INH000013457, and it’s listed as perpetual from March 1, 2024 onwards on the official SEBI website.

So technically, she is a SEBI-registered Research Analyst right now.

But she was providing advisory services, trading tips, and investment guidance for years before getting this registration. Before obtaining her SEBI license, she was only NISM-certified, which is different from being a registered Research Analyst.

This means she was operating in a legal grey area, or rather, outside the boundaries of what SEBI allows, while thousands of traders followed her recommendations and paid her for services.

For all those people who registered for her services and faced losses before her SEBI registration?

EBI doesn’t handle complaints against unregistered advisors. Thus, leaving early traders with no avenue for recovery or justice.

The Violations Done By Aakanksha Gupta

There have been several violations done by Aakanksha Gupta. Looking from an investor’s perspective, it is very important to understand these violations to make an informed decision.

1. The Mixing of Sales, Marketing, and Research

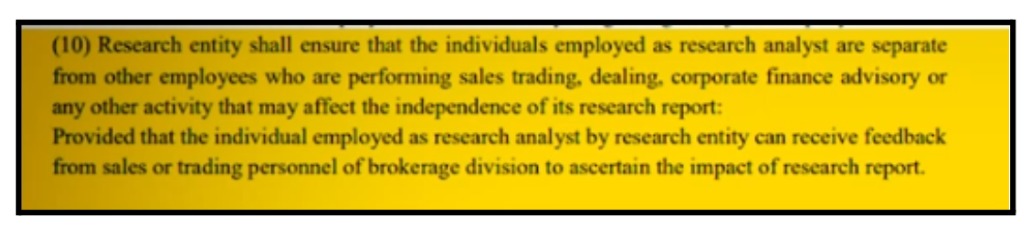

According to SEBI Research Analyst Regulations, there’s a fundamental rule: sales, marketing, and research must remain separate.

One person cannot do all three simultaneously.

But that’s exactly what Aakanksha Gupta does. She markets herself on Twitter, she actively sells subscriptions to her premium channel, and she gives research recommendations as well.

This is a direct violation of SEBI guidelines.

The concern here is that when one person handles all three functions, conflicts of interest become inevitable.

2. Explicit Trading Instructions Despite Disclaimers

In her free and premium Telegram channels, she provides very specific trading instructions that go far beyond general guidance.

Messages like “Sell 120 quantity at 19,700 call option” come complete with exact entry prices, exit prices, and specified quantities.

When questioned about this, she later adds disclaimers like “For illustration purposes only” or “This is not trading advice.”

But here’s the problem. The damage is already done by the time the disclaimer appears. New traders in the group see the specific quantities and prices first, follow them, and later realize they were supposed to treat it as an illustration.

This is a classic example of seeking forgiveness rather than permission, and it violates SEBI’s rules on explicit trading instructions.

3. Displaying Only Profit Screenshots Without Losses

After obtaining her SEBI license, something interesting happened. Profit screenshots started flooding her Telegram channels regularly.

Messages like “Half set up at 3 months subscription fee recovered” or “Almost fees covered for 3 months in one trade” became common.

She even posts screenshots from her mentees showing only their winning trades alongside testimonials like “I appreciate your point, thank you so much” paired with green profit numbers.

But where are the screenshots of losing trades? Where are the students who lost money? Where are the failed strategies?

They simply don’t exist in her public communications. This selective performance display is exactly what SEBI regulations prohibit.

4. Poor Documentation and Backdating Concerns

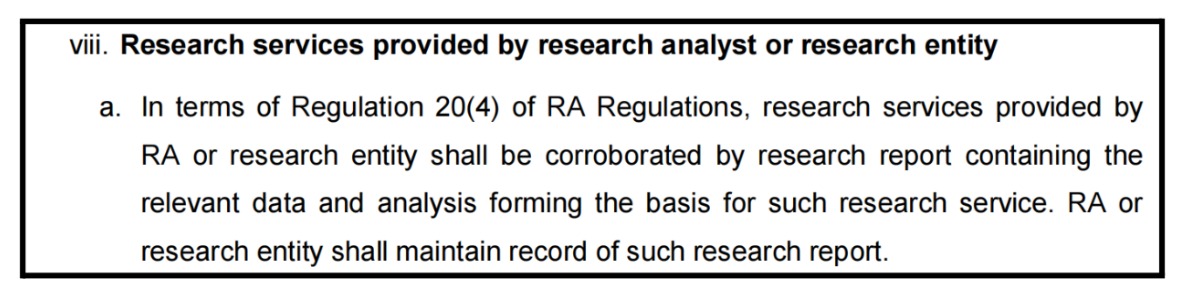

SEBI regulations demand that research analysts maintain proper documentation for every recommendation they make.

This documentation must include when the research was done, what the basis of the recommendation was, and timestamped records of the entire process.

If documentation wasn’t created at the time the recommendation was made, it cannot be backdated. SEBI audits specifically check document creation dates to verify compliance.

In a Telegram-based operation like Aakanksha’s, where recommendations are flying in as quick messages without formal documentation, this requirement becomes problematic.

How do you prove the research was done before the recommendation?

The timestamps would tell the story, and that’s where many influencers slip up.

5. No Risk Profiling or Risk Assessment

Here’s something crucial that most people overlook: SEBI regulations require advisors to understand the risk capacity and risk appetite of every client before giving recommendations.

This is called “Know Your Client” or KYC in the investment world. But Aakanksha operates by broadcasting the same recommendations to 50,000+ people in her free channel without knowing anything about them.

A retired person living on a pension has a completely different risk capacity than a young IT professional with a stable income.

One aggressive trade recommendation can wipe out someone’s life savings while being just a learning opportunity for someone else. By not doing individual risk profiling, she’s treating all her followers as if they’re the same.

6. Running Operations Under Another Research Analyst’s Name

According to investigation documents, there are allegations that Aakanksha had been operating advisory services in the name of another registered research analyst named “Chaitanya.” This was being done before she herself registered as a research analyst.

This is where things get legally murky. If Chaitanya is registered and Aakanksha is giving the research, who bears the responsibility for those customers who lost their money? If there’s a complaint, who does SEBI take action against?

The customer base comes from Aakanksha’s Twitter followers; the free channel has her branding, the premium channel is marketed by her, but the research advice might have been attributed to Chaitanya.

This might have created a situation where accountability becomes unclear, and potentially, Aakanksha could hide behind another’s registration to avoid consequences.

Why Past Behavior Matters for Your Decision Today?

Here’s what worries seasoned investors and compliance experts: Aakanksha got her SEBI license in 2024, but the violations that raised concerns before her registration are still happening now.

Getting a SEBI license didn’t change her operating practices. It just gave her an official stamp of approval that she now uses to legitimize those same practices.

Past behavior is often the best predictor of future behavior. If someone was mixing sales and research illegally before getting licensed, what’s stopping them from doing it now?

The only difference is that now, they have a SEBI registration number to hide behind.

Many of the early traders who paid her before her SEBI registration and faced losses couldn’t file complaints because SEBI doesn’t handle cases against unregistered advisors. They were essentially left out in the cold.

The traders who joined after her SEBI registration might have more legal recourse, but they’re still following a person with a documented history of regulatory violations.

What You Should Do If You’ve Already Lost Money?

If you’ve been a client of Aakanksha Gupta or any research analyst and experienced losses due to what you believe are violations of SEBI regulations, you’re not alone, and you have options.

Here’s what you can do:

1. Document Everything

Keep records of all communications, screenshots of trading recommendations, bank transfers you made, and records of your losses. Dates matter, so note when you joined, when you paid, and when losses occurred.

2. File a Complaint on SEBI SCORES

Go to the official SEBI website and file a formal complaint through the SCORES (SEBI Complaint Redressal System) portal. Be specific about what violations you’re reporting (mixing of functions, misleading performance claims, lack of risk profiling, etc.).

3. File a Complaint SEBI Smart ODR

If your case is eligible, SEBI offers an Online Dispute Resolution mechanism that can sometimes resolve cases faster than traditional complaints.

4. Consider Legal Help

If you’ve lost significant amounts, consult with lawyers who specialize in securities law. They can guide you on whether arbitration or further legal action is viable.

Need Help?

If you have been a victim of any kind of fraud, don’t worry. All you need to do is connect with us.

We can help you in the complex process of filing your complaint and represent you in arbitrations in stock market and counselling. Our expert team handles your complaint with care and makes sure all the steps of recovery are followed properly.

Conclusion

Aakanksha Gupta is SEBI registered today. But SEBI registration is not a guarantee of quality, ethical behaviour, or that you won’t lose money. It’s a baseline compliance requirement and nothing more.

The fact that she was operating without registration for years, giving specific trading tips to thousands, and then only obtained her license recently, should make you pause.

Why did she finally get registered? Was it because she wanted to be compliant, or because the regulatory heat was building?

Before you hit “subscribe” on her premium channel, remember this: the traders who followed her before her SEBI registration and lost money have no way to recover those losses through SEBI because she wasn’t registered at the time. Are you willing to take that same risk?

If an advisor can’t handle tough questions about their track record, documentation, and past behavior, that’s your answer right there.

Stay informed, stay cautious, and always verify before you invest.