In today’s world, where financial emergencies can strike without warning, instant loan apps seem like a lifesaver. One of the names that often come up is Press Money Loan App, an app that promises quick approval, zero paperwork, and money transferred in just minutes.

Sounds convenient, right?

But then the real question hits: “Is the Press Money Loan app safe to use?”

If yes, then why does it ask for so many permissions?

How do you know who’s behind the app?

And what happens to your personal data once you upload it?

These are the kinds of questions more and more users are asking, and rightly so.

Before you trust any loan app with your financial details, it’s important to understand whether it’s legitimate, secure, and actually worth the risk.

Is Press Money Loan App Safe in India?

Well, in one word, the answer is NO!

Press Money Loan app is not safe

Although, it claims to offer personal loans in partnership with an NBFC named Storrose Vyapaar Private Limited.

However, when checked, is the press money loan app RBI approved with the RBI’s official list of registered NBFCs, the NBFC is real, but its connection with the Press Money app is not clearly proven.

Because of this missing clarity, users still face the risk of dealing with an unregulated or unauthorized loan provider, which can lead to fraud, advance-fee scams, or misuse of personal data.

Dozens of users have also complained about advance fee scams, where they were asked to pay small amounts (like a “processing fee” or “first EMI”) before receiving the loan.

Once the payment was made, the loan was never disbursed.

This single red flag asking for money before giving money is a classic sign of a fake or unsafe loan app.

Press Money Loan App Real or Fake

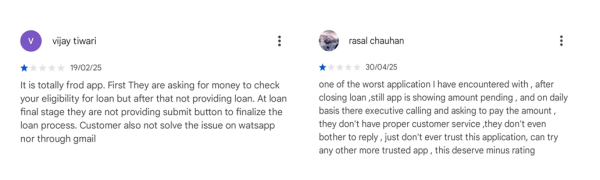

If you scroll through reviews on platforms like SafeLoan.in or the Google Play Store, you’ll notice a pattern of disturbing user experiences:

- “They asked me to pay ₹1000 for loan processing, but never gave me the loan.”

- “Fake app after payment, they stopped replying.”

- “Customer care number doesn’t work, and no refund was received.”

These aren’t isolated incidents. Multiple users have flagged the same issues, from non-disbursal of loans to fake promises and inaccessible support channels.

For a genuine loan app, this level of user dissatisfaction and lack of transparency is unacceptable and another indicator that Press Money is unsafe and unreliable.

How to Report Loan Frauds in India?

Taking these steps quickly increases your chances of recovering your money or preventing further misuse.

If you’ve been scammed or when you check fake loans and suspicious the app is fake, here’s what to do immediately:

- Collect evidence screenshots of transactions, chats, payment receipts, and app details.

- File a Cyber Crime complaint.

- Report the app on the Google Play Store

- Inform your bank or UPI provider to block further unauthorized transactions.

Need Help?

If you’ve lost money to such fake loan app scams or are being harassed for payments you never owed, don’t panic.

Our team has helped thousands of victims track scam transactions, file cybercrime reports, and even recover lost funds through proper legal channels.

Register with us today, and your recovery process can start in minutes.

Conclusion

The Press Money Loan App might look polished, but the lack of RBI approval, user complaints, and red flags make it unsafe for borrowers in India.

Always remember this golden rule:

A genuine lender gives you money first, not the other way around.

Stay alert, verify every app, and never let financial urgency push you into risky platforms.

Because when it comes to online loans, a few minutes of research can save you thousands of rupees and a lot of stress.