Have you ever scrolled through ads promising easy cashback on everyday shopping and thought, “This sounds too good to be true”?

The SD Pay app has been popping up everywhere, luring users with dreams of daily earnings and massive discounts on bills and purchases.

But in a world full of digital traps, the big question on everyone’s mind is: Is SD Pay real or fake?

This blog dives deep into the truth, helping you spot the red flags so you can protect your hard-earned money and personal data.

Is SD Pay Real or Fake in India?

Picture this: an app that claims to be your one-stop shop for local deals, bill payments, and even a virtual wallet loaded with cashback rewards.

SD Pay, developed by S.D. HUB (OPC) PRIVATE LIMITED positions itself as India’s hyper-local platform connecting customers with nearby merchants for shopping, dining, and utilities like mobile recharges or electricity bills.

You can supposedly scan to pay vendors, add money via UPI or cards, and earn through referrals across 15 levels, with promises of daily cashbacks up to thousands on deposited funds.

Here you can earn money in the following ways:

- 0.15% to 0.30% daily, depending on your balance

- A 50% monthly bonus on top

- Referral programs where you earn by inviting friends

- Promises of 1-2% cashback on purchases.

Sounds convenient, right?

But before you rush to hit that download button on Google Play, where it has over 100K downloads, pause and think: Why does every earning app start with shiny promises but end in headaches?

User reviews hint at early wins, but deeper issues lurk, making caution your best friend here.

SD Pay exists as a downloadable app with some operational features, so in that sense, it is a real platform offering bill payments and merchant scans.

However, several red flags suggest it may not be fully legitimate. What looks like easy money after a simple SD Pay login could actually be a carefully designed system to pull in deposits and collect user data before issues begin.

In short, the convenience is real, but the risks hiding behind that login screen are very real, too.

Is SD Pay Safe or Not?

Let us break down the warning signs that should make you think twice:

1. Not Regulated

Legitimate payment apps in India must hold RBI authorization or at least in-principle approval to handle transactions safely, as per the Payment and Settlement Systems Act.

SD Pay shows no such credentials from RBI or SEBI on its site or Play Store page, leaving users vulnerable to fraud without oversight.

Without regulation, there is no guarantee your funds are protected if things go south.

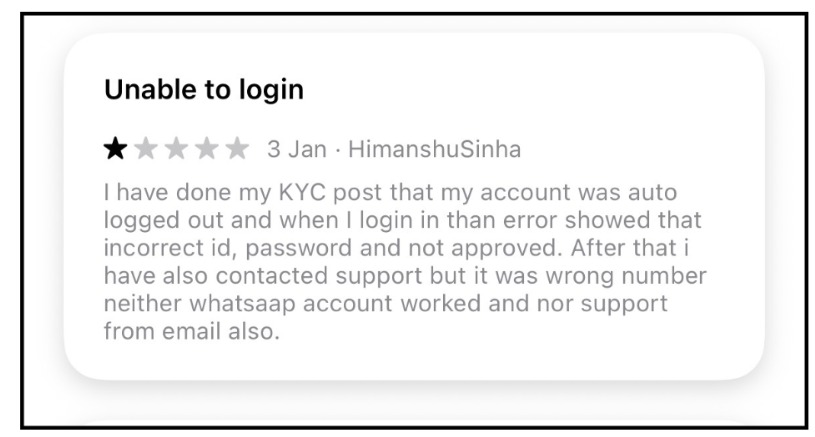

2. Unavailable Support

The app users widely report support as unresponsive or switched off during business hours.

YouTube reviews and complaints mention endless waits for replies, with no resolution for issues like stuck payments.

Imagine depositing money and then shouting into a void when problems arise. Why trust an app that ghosts you when you need help most?

3. Contradictory Information

On Google Play, SD Pay claims “No data shared with third parties” and minimal collection, but its privacy policy openly admits gathering names, addresses, phone numbers, bank details, and usage data for optimisation.

It admits on the App Store that it doesn’t collect any data. Play Store notes it collects location, photos, and videos, encrypted in transit, yet the fine print allows retention far beyond necessity. This mismatch erodes trust fast.

Does an honest app play hide-and-seek with its data habits?

4. Referral Programme

The app places major emphasis on referrals, promising 15-level income and daily team bonuses. YouTube promotions and comment sections are flooded by users flaunting codes like “b0f787e99e”.

Promotional videos focus less on core services and more on “join now, refer friends, earn big,” a classic pyramid scheme tactic.

If earnings rely heavily on recruiting others rather than genuine use, is it building value or just a house of cards?

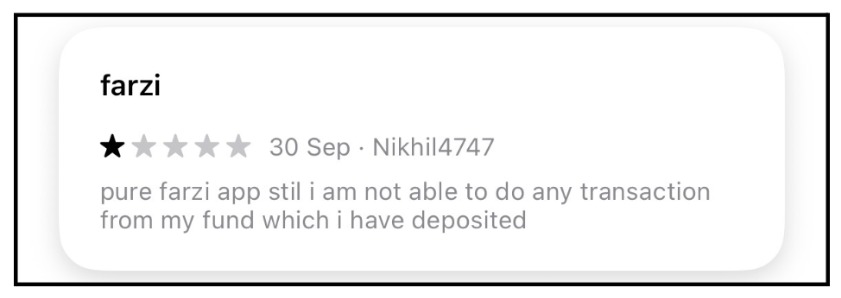

5. Major Cashback Offers

SD Pay dangles irresistible baits like 3K daily cashback on deposited money. It gives 0.15% to 0.30% returns scaling with deposits up to lakhs, boosted by 50% bonuses.

But users report deposited funds not credited properly, with cashbacks failing to materialize or turning into non-withdrawable points.

High yields like these are mathematically unsustainable without Ponzi elements. Why promise the moon when sustainable apps offer modest, reliable rewards?

6. Money Usage Restriction

When you add money via a virtual account or UPI, the funds land in a holding area, not immediately available for spending or withdrawal.

Reports indicate an 8-day wait before they shift to your “Available Balance,” frustrating users who need quick access. This delay smells like a liquidity trick, letting the app use your money meanwhile.

Ever wondered why legit wallets credit instantly, while this one plays the waiting game?

7. Privacy Violations

The app demands invasive permissions like reading contacts, recording audio, taking pictures/videos, modifying storage, disabling screen locks, and accessing phone identity.

These are far beyond a payment app’s needs.

Play Store confirms location, photos, and more, creating huge risks for data theft or device compromise.

No standard bill-pay app needs to spy like this. Are you okay with handing over your entire phone for some cashback?

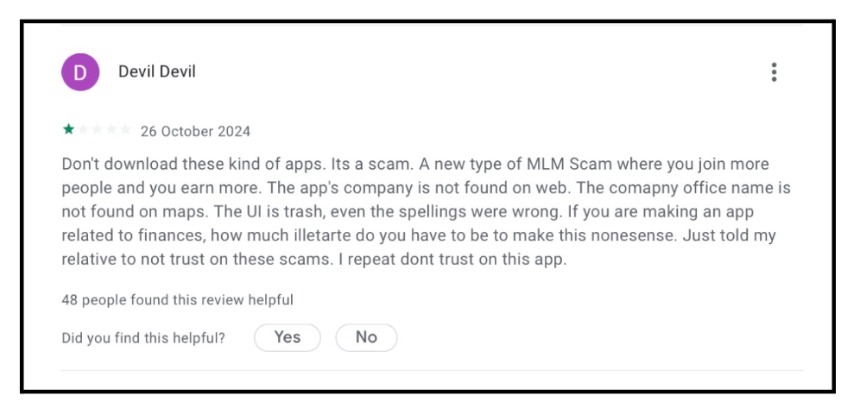

SD Pay Complaints

Countless users have voiced frustrations across YouTube and review sites, painting a picture of initial excitement turning to regret.

Common gripes include the following:

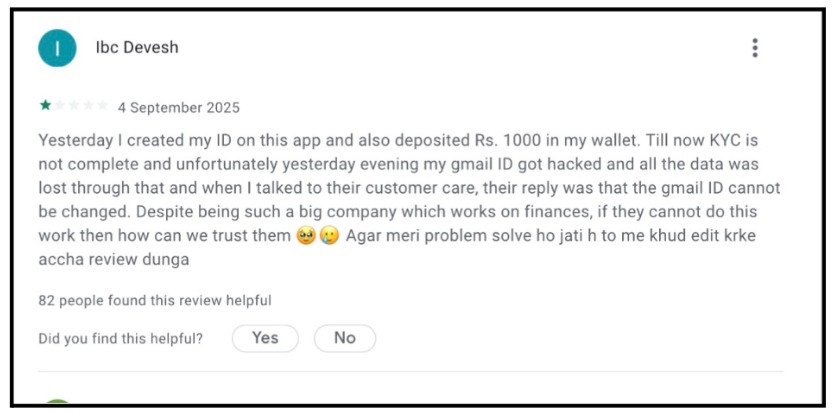

A user finished their KYC, got logged out, and now their credentials “don’t exist” while support is unreachable. What do you think a real app does this?

In another case, a user can deposit money but cannot perform any transactions or withdrawals. In legitimate finance, your money is yours to move. But here, the users money is stuck, and now they cannot make payments.

People have also noticed that this app has no web presence, no office on maps, poor grammar, and an MLM (referral) structure. This seems more like a fly-by-night scam. Real financial institutions spend millions on professional interfaces.

A user’s email was hacked, but the app refuses to change account details or help secure the funds. This reveals a Zero-Protection Policy. A real bank or fintech app has “Account Recovery” protocols. The refusal is usually done to prevent users from reclaiming compromised accounts.

These reviews collectively describe a predatory platform.

The pattern of collecting sensitive ID documents, accepting deposits, and then blocking access is a major warning of a “scam-exit” in progress.

What to do if Online Fraud Happens?

If SD Pay has burned you, do not stay silent; reporting helps protect others and might recover your funds.

Here is a step-by-step guide:

- Gather evidence like screenshots of transactions, deposit proofs, withdrawal attempts, chat logs with support, and app permissions granted.

- File a complaint in Cyber Crime.

- Contact your bank or UPI provider immediately to dispute charges and request transaction blocks or reversals.

- File an FIR at your nearest police station.

- File a formal complaint with the relevant consumer forums using your evidence for investigation.

- Share your anonymized story on public review platforms to warn fellow users.

- Keep following up persistently on all reports until you get a resolution or closure.

Need Help?

If you need help in reporting your issue, you can simply register with us.

We are a team of dedicated professionals who have helped various victims recover their money that was lost to a scam or fraud.

We help you file your complaint easily and follow each and every step so that you don’t have to take on the headache.

Conclusion

SD Pay might deliver small early wins to build hype, but the pile of red flags make it a high-risk gamble not worth your time or money.

True financial apps prioritize transparency, quick access, and ironclad security, not referral frenzy or hidden holds on your cash.

Next time an app whispers “easy earnings,” ask yourself: Does it pass the legit test, or is it just another fake dressed in promises?

Stay vigilant, verify first, and keep your wallet safe, because in the digital wild west, awareness is your strongest shield.