When someone claims to hold a SEBI license, it naturally builds a sense of trust.

But what happens if questions start arising about how that license is being used?

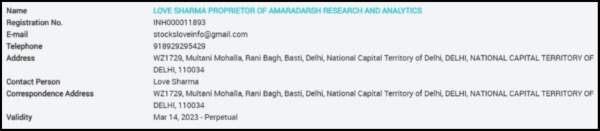

That’s exactly why we decided to take a closer look at Love Sharma and his firm, Amaradarsh Research and Analytics, a name that has recently sparked discussion within India’s trading community.

Love Sharma Trader

Love Sharma runs Amaradarsh Research and Analytics as its proprietor. He’s an SEBI-registered research analyst.

This means he’s legally allowed to give trading tips and research services in India.

But here’s the problem. A license doesn’t mean honest work. And what Love Sharma is doing raises serious red flags.

Understanding the Operations of Love Sharma and TWL

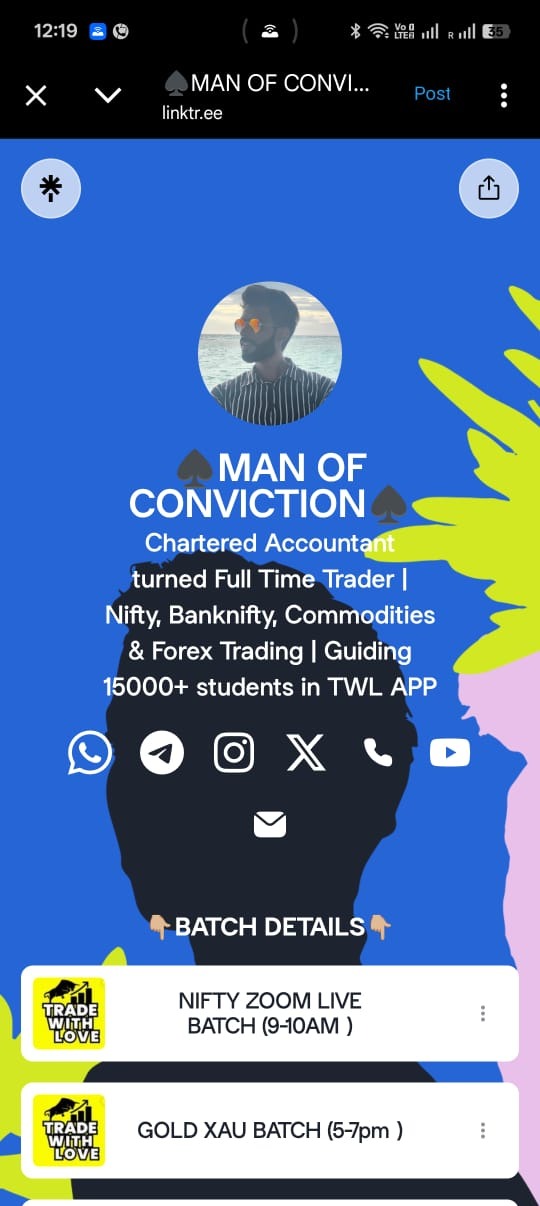

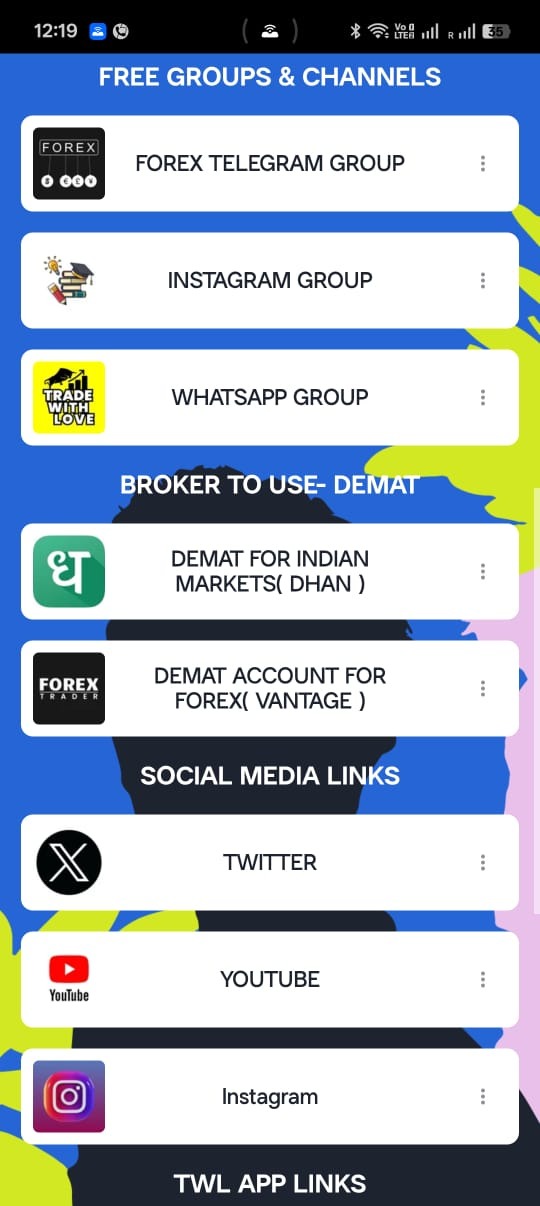

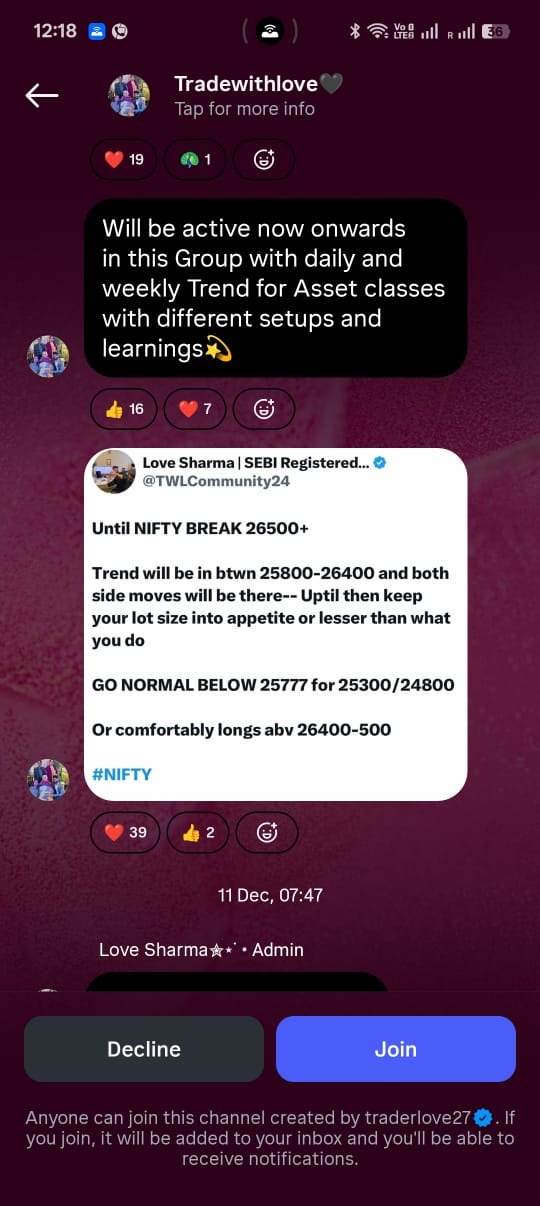

Based on the evidence from his Linktree profile and social media presence, Love Sharma operates under the brand “Trade With Love” or TWL.

Here’s his complete setup:

Social Media Presence:

- Twitter/X account for daily updates

- YouTube channel for market analysis

- Instagram for community engagement

- Multiple Telegram groups (Forex and Indian markets)

- WhatsApp groups for direct communication

His setup explicitly recommends:

- Demat for Indian Markets: Dhan

- Demat Account for Forex: Vantage (another international broker- banned)

- Live batch sessions (Nifty Zoom Live Batch 9-10 AM, Gold XAU Batch 5-7 PM)

This multi-platform presence makes it easier to spread his services.

It also makes it harder to track violations.

Smart? Maybe.

Legal? That’s questionable.

Violations Done by Love Sharma

According to SEBI (Research Analysts) Regulations, 2014, registered analysts must follow strict rules.

Let’s see how Love Sharma allegedly breaks them.

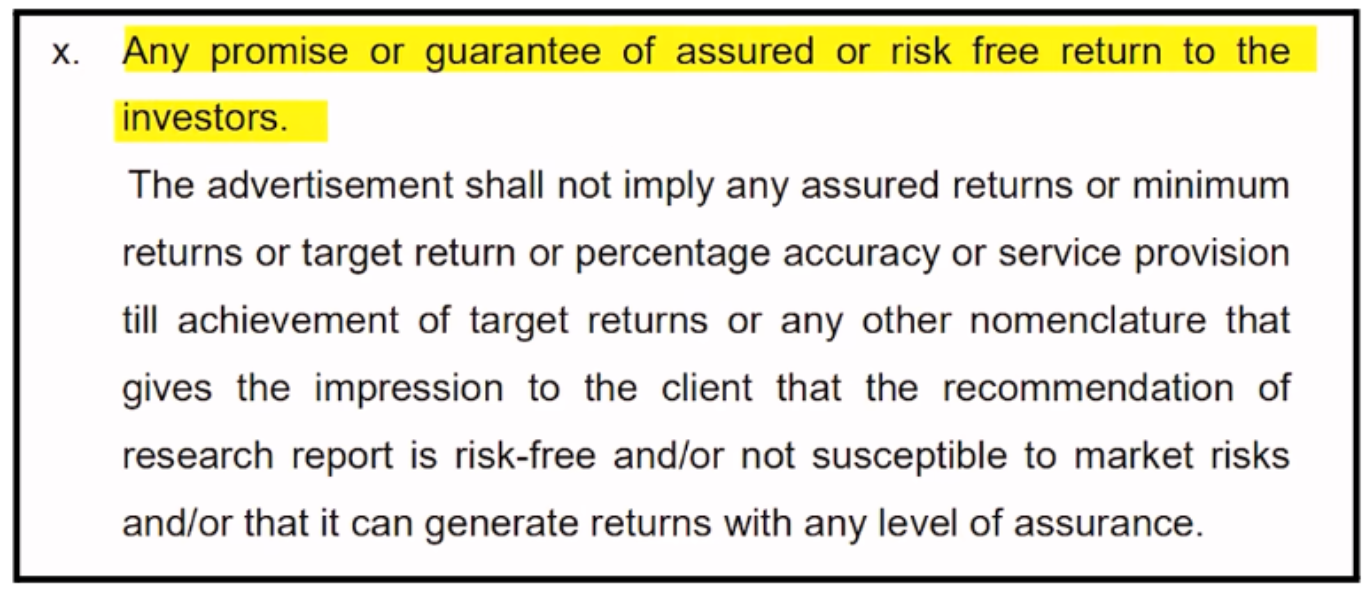

1. Giving Assurance of Guaranteed Returns

As per SEBI, no one, not even a SEBI-registered analyst, can guarantee returns in trading. Markets are unpredictable. Even the best analysts get it wrong.

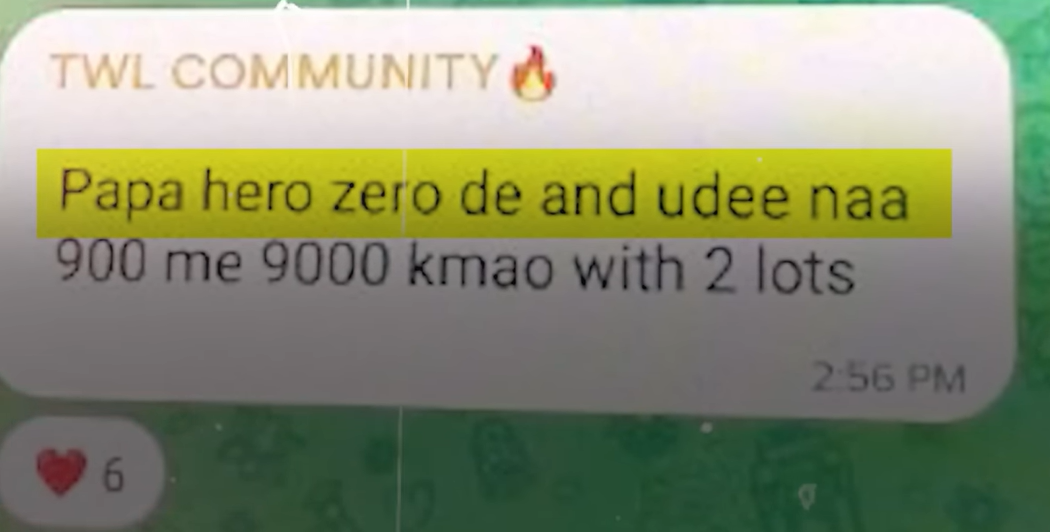

This message was shared by Love Sharma on his Telegram channel, stating,‘900 me 9000 kamao with 2 lots’: a clear case of guaranteed profit claims and specific lot advice, both prohibited under SEBI rules.

Love Sharma reportedly promises guaranteed profits to attract subscribers.

This breaks SEBI’s basic rule: research must be honest and realistic, not marketing magic.

Think about it. If someone could guarantee profits, why would they need your subscription fees? They’d just trade and become billionaires.

2. Giving Specific Lot Quantities

SEBI Rule Broken: Regulation 2(wa) (Research Services) – Crossing into Investment Advisory

Research analysts can give opinions: “Buy this stock” or “Sell that commodity.” But telling someone “Take 2 lots” is different. That’s personalised advice.

Personalised trading advice requires a separate Investment Adviser (IA) registration from SEBI, and Love Sharma lacks this, which makes it illegal.

That’s a serious problem.

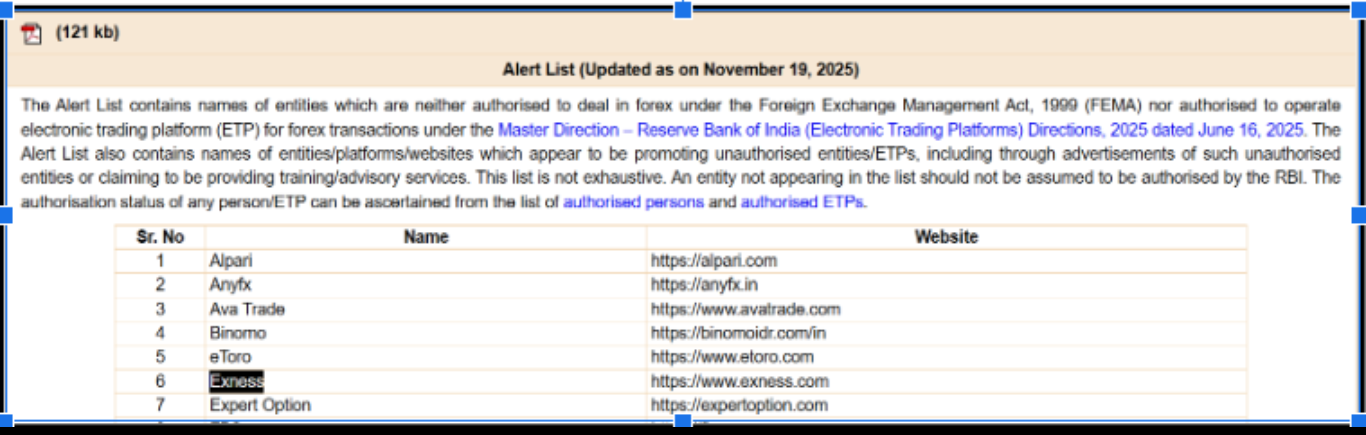

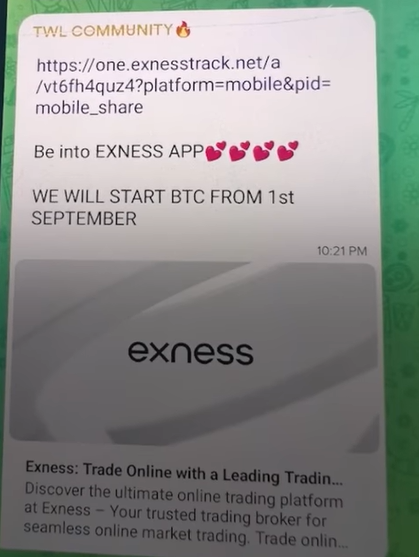

3. Promoting Banned Forex Apps (Exness)

SEBI Rule Broken: Regulation 15 (Conflict Management) and Regulation 24(1)

This is where things get really serious. Love Sharma actively promotes Exness, a forex trading platform that the RBI has not authorised for Indian traders.

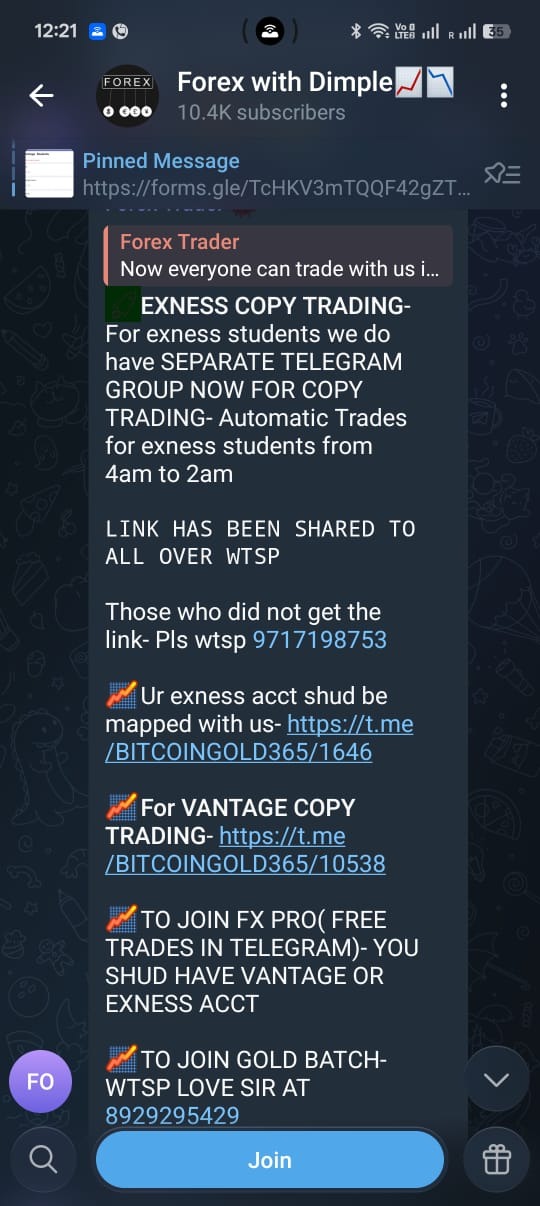

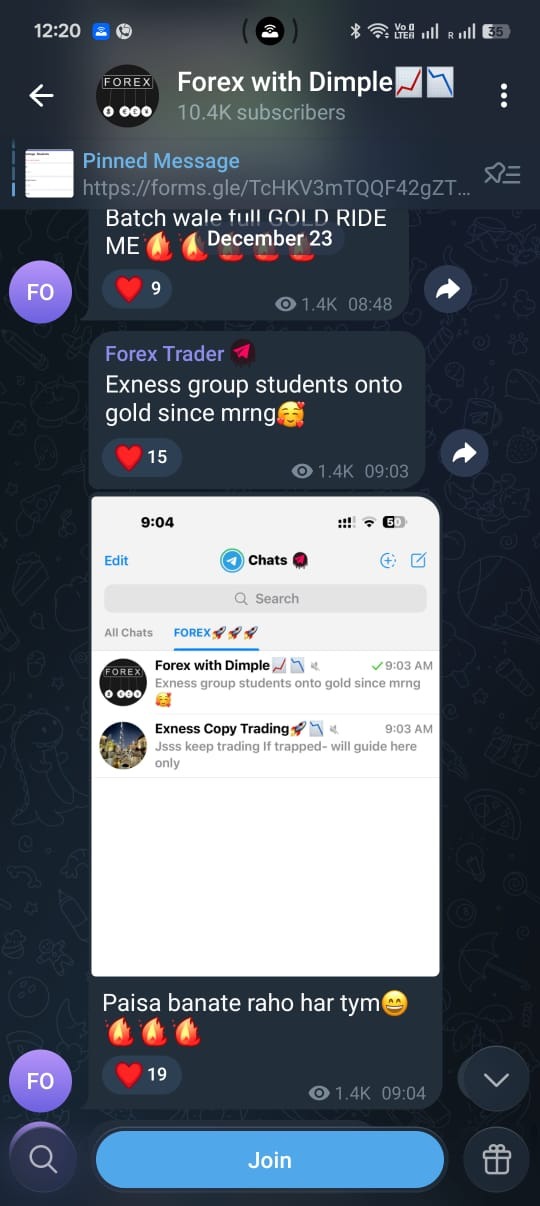

He promotes Exness across:

- His Telegram channels

- WhatsApp groups

- X (Twitter) posts

These images show Exness copy trading links and instructions being openly shared and promoted in the Telegram channel.

This message directly shares an Exness referral link and asks users to install and trade on the Exness app, clearly advertising and onboarding users to an unauthorised forex platform.

As shown in the screenshots, he also recommends “Vantage” for forex, another international broker operating without RBI approval in India.

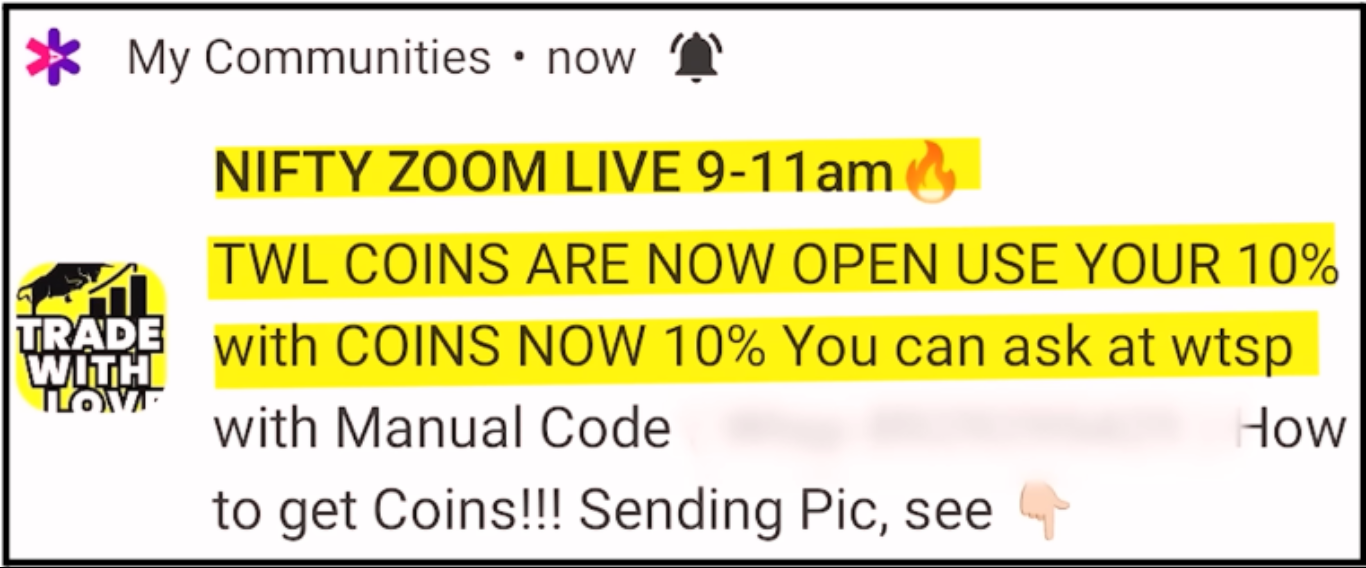

4. Creating TWL Coins for Gamification

SEBI Rule Broken: Regulation 15A (Fees) and Regulation 24(6)

Love Sharma created his own virtual currency called TWL Coins. He uses this to gamify his trading services.

But here’s the issue. SEBI says analysts can only charge transparent, regulated fees.

Creating your own coins or tokens isn’t covered. It creates confusion and can manipulate people into taking bigger risks.

5. Showing Past Performance

SEBI Rule Broken: Regulation 19 (Disclosures) and Regulation 20 (Report Contents)

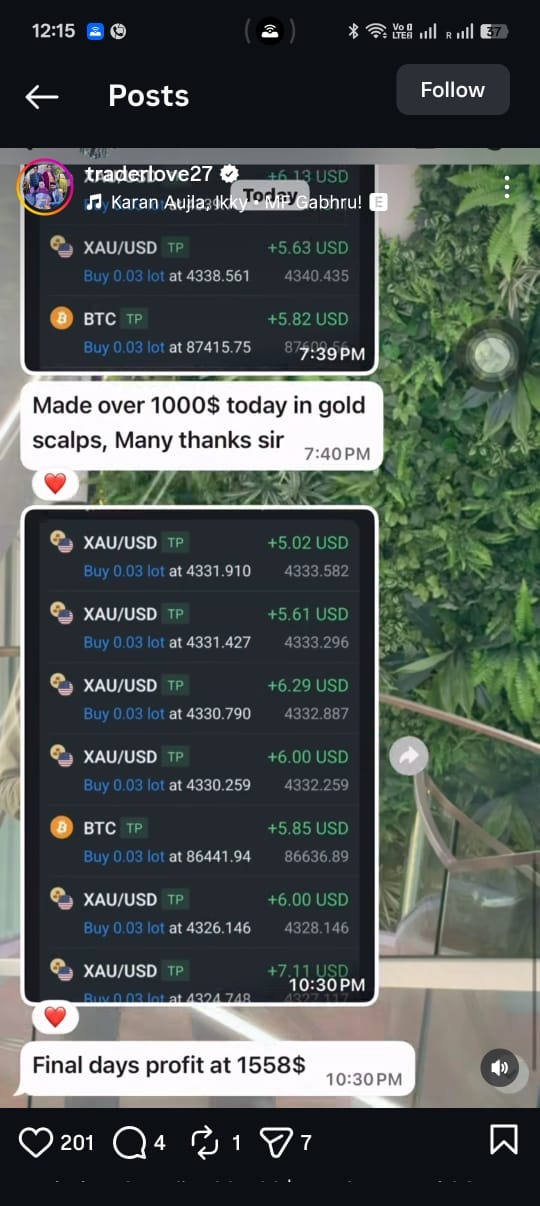

Love Sharma allegedly shows his students’ past trading results. This sounds helpful, right? Wrong.

These profit snippets are shared by Love Sharma on his Instagram to showcase selective student gains, creating a misleading impression of guaranteed or consistent success.

Showing selective student performance creates problems:

- Only winners get shown (cherry-picking)

- Past success doesn’t mean future success

- It misleads people into thinking “everyone wins.”

According to Regulation 20(4), recommendations must be backed by proper data and analysis, not feel-good testimonials. This violates that principle.

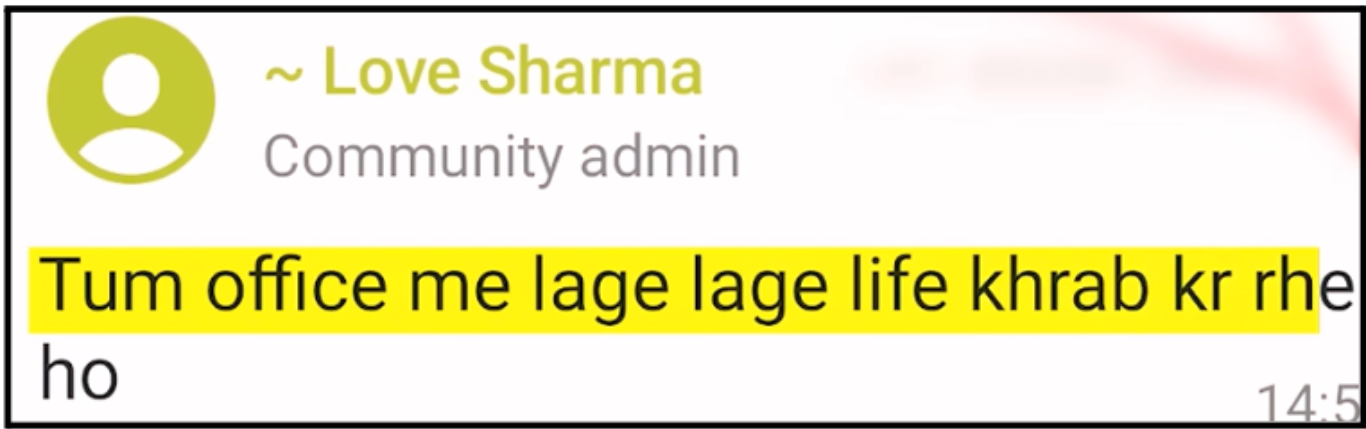

6. Telling People Jobs Are a Waste of Life

SEBI Rule Broken: Professional Ethics and Regulation 24(2) (Code of Conduct)

Multiple reports say Love Sharma tells followers that doing regular jobs wastes their lives. Instead, he pushes them to buy his trading subscription.

This is deeply irresponsible. Trading is risky. Not everyone succeeds. Telling people to quit jobs for subscriptions preys on their dreams and insecurities.

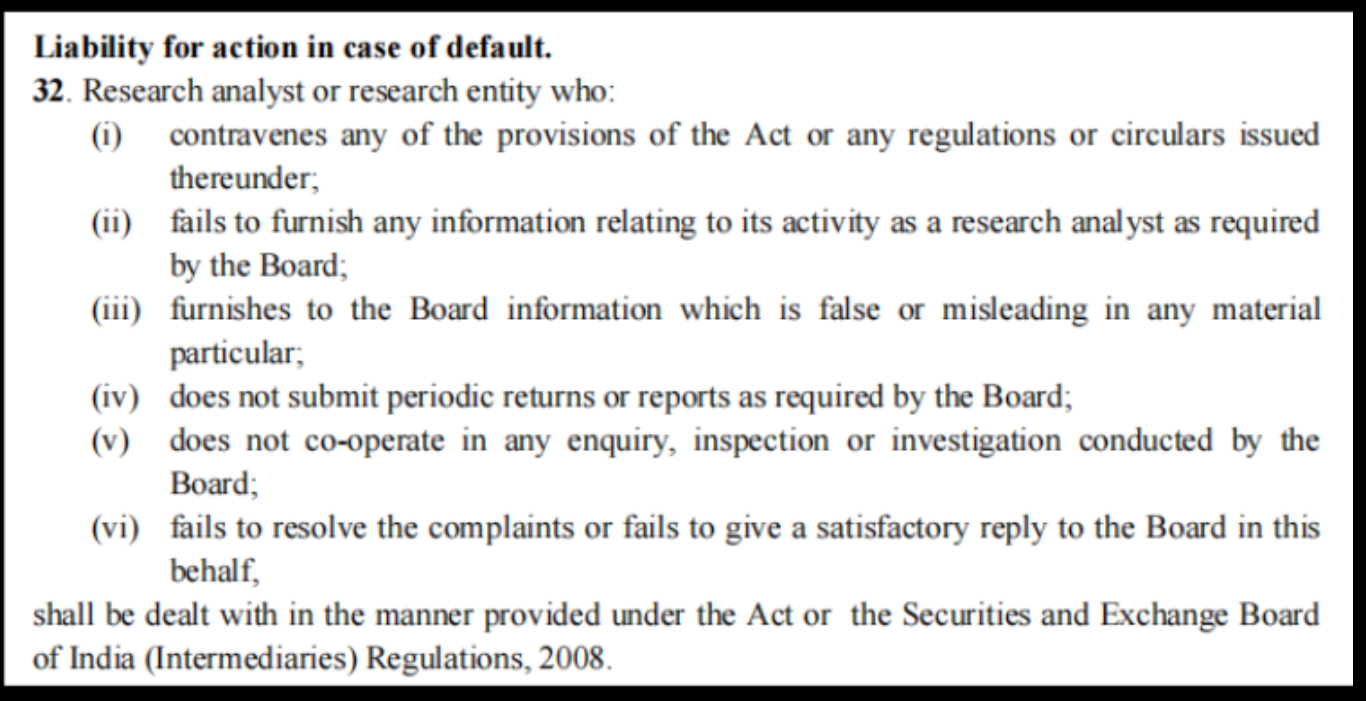

7. Continuing After Complaints, Just Shifting Platforms

SEBI Rule Broken: Regulation 32 (Default Liability) and Regulation 24(4)

Love Sharma accepted all the allegations and promised never to repeat them.

But this might be the worst part. Love Sharma allegedly continued his practices even after receiving complaints.

According to reports:

- He shifted operations to Instagram groups

- Created new Telegram channels

- Kept doing the same prohibited activities

The screenshots (dated 10 Dec 2025) confirm he runs both “FOREX TELEGRAM GROUP” and “INSTAGRAM GROUP”, likely to avoid scrutiny on any single platform.

Regulation 32 says analysts who don’t cooperate with enquiries or keep violating rules face serious action: suspension, license cancellation, and bans from capital markets.

What Can You Do In Such Cases?

If you’re a client or investor who faced issues with Love Sharma, Amaradarsh Research and Analytics, or similar questionable trading advisory services, you are not alone.

Our dedicated team specialises in supporting investors in situations exactly like these.

We provide end-to-end guidance to ensure your grievance is clearly documented and effectively escalated to the right authorities.

How do We Help Investors at Every Step?

1. Initial Consultation & Case Assessment

We arrange a confidential discussion with a dedicated Case Manager.

2. Professional Case Documentation & Drafting

We help you prepare a structured, persuasive, and legally sound complaint that outlines:

- The specific misconduct you experienced

- Any financial losses you incurred

- Specific SEBI rule violations (such as guaranteed return promises, promoting banned apps like Exness, providing lot quantities without IA registration, or misleading gamification practices)

3. Direct Engagement & Escalation

- Reaching out to Love Sharma: We guide you in formally communicating your complaint to the advisor, which is often a required first step before approaching SEBI.

- Filing on SEBI SCORES: We assist you in how to lodge a complaint in the SCORES portal and help you track its SEBI complaint status and respond to any SEBI queries.

- Exploring SEBI Smart ODR: If your case is eligible, we can guide you through the SEBI Online Dispute Resolution platform for potentially faster resolution.

4. Arbitration & Further Legal Options

If responses from Love Sharma or initial SEBI actions are unsatisfactory, we will help you explore further options, including:

- Arbitration in the Stock Market: If your service agreement includes an arbitration clause, we can connect you with legal experts specialising in securities arbitration.

- Legal Action: We can refer you to lawyers experienced in securities law and investor protection cases.

Your Money Matters. Your Complaint Matters.

Don’t let unethical practices go unreported. Every complaint helps SEBI take stronger action. Every voice matters in cleaning up India’s financial advisory space.

Take the First Step Today

Reach out to us today, and let our experienced team guide you toward a fair resolution.

Conclusion

Love Sharma’s Amaradarsh Research and Analytics case shows why a SEBI license isn’t enough. You need to check if the analyst actually follows SEBI rules.

The alleged violations are serious, including guaranteed returns, promoting banned apps like Exness, creating TWL Coins, discouraging jobs, and giving large quantities without proper registration.

And continuing these practices after complaints by just shifting to Instagram? That shows potential intent to avoid accountability.

For Indian investors and traders: Always do your homework. Verify registrations on SEBI’s website. Check for complaints. Never trust guaranteed returns.

SEBI’s regulations exist to protect your hard-earned money. When analysts violate them, they’re not just breaking rules; they’re breaking your trust.

Stay informed. Stay protected.