If you’ve spent any time on Instagram, Telegram, or YouTube looking for trading guidance, chances are you’ve come across Love Sharma.

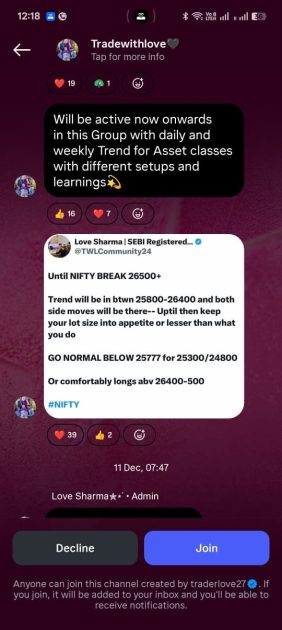

He positions himself as a SEBI-registered research analyst offering structured trading batches, live sessions, and real-time market calls.

But what does that registration really mean for traders?

And how do his services actually work in practice?

In this detailed Love Sharma trader review, we’ll examine his SEBI registration status, advisory model, platform structure, and the broader implications for retail traders in India.

Now, let’s take a closer look at Love Sharma and his trading services.

Love Sharma SEBI Registered

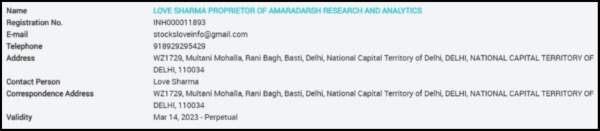

Love Sharma is registered with the Securities and Exchange Board of India (SEBI) as a Research Analyst under registration number INH000011893, operating through Amaradarsh Research and Analytics.

SEBI registration means the analyst is legally authorized to provide research-based recommendations in the Indian securities market.

Registered analysts are required to follow the SEBI (Research Analysts) Regulations, 2014, which include compliance standards such as:

- Proper risk disclosures

- Transparent fee structures

- No guaranteed return promises

- Clear segregation between research and marketing activities

- Disclosure of conflicts of interest

This registration provides regulatory oversight, but it does not automatically evaluate the quality, profitability, or ethical standards of the services being offered.

It simply confirms that the entity is officially registered and subject to SEBI regulations.

Based on publicly available information and platform activity, Love Sharma reportedly serves over 2,000 monthly subscribers through his TWL (Trader With Love) ecosystem.

His advisory structure includes:

-

- Live trading sessions (Nifty and Gold)

- Webinars and educational batches

- Real-time market updates

- Telegram and WhatsApp community alerts

- Subscription-based access via the TWL app

Social Media Presence

Love Sharma maintains an active digital footprint across multiple platforms:

- Instagram – @traderlove27 (17K+ followers)

- Twitter/X – @TWLCommunity24

- YouTube – Market analysis and trading breakdown videos

- Telegram groups – Forex and Indian equity discussions

- WhatsApp communities – Subscriber updates

His trading batches are typically time-based, such as:

- Nifty Live Batch (9:00 AM – 10:00 AM)

- Gold (XAUUSD) Batch (5:00 PM – 7:00 PM

- Bundle packages offering combined access at discounted pricing

The setup looks fairly structured, with subscription plans, live trading sessions, and active communities built around regular market updates. On the surface, it appears well-organized.

Being SEBI-registered certainly adds a layer of credibility.

But for traders, the bigger question isn’t just about registration, it’s about how those regulatory standards are actually followed in everyday operations.

That’s where taking a closer look at how the services work in practice becomes important.

Love Sharma Trader Reviews

As we went through the details surrounding the services, two situations stood out.

One came from a client who raised concerns about assured return claims.

The other became evident while closely reviewing how the advisory services were packaged and sold within the TWL ecosystem.

Let’s break down both situations clearly:

Case 1: Assurance Of Guaranteed Returns

One of the clients approached us after facing significant trading losses.

According to the client’s statement, he received a phone call from an individual named Sahil, who introduced himself as being associated with a SEBI-registered Research Analyst (RA) firm.

During the conversation, Sahil reportedly emphasized multiple times that he was operating under SEBI regulations and was authorized to provide research-based trading recommendations.

To build credibility, he shared several screenshots showing alleged profits earned by “existing clients.” These profit proofs were presented as evidence of consistent success.

Trusting the representation that the service was SEBI-regulated and professionally managed, the client proceeded to pay ₹51,498 as advisory fees.

However, no formal invoice or complete RA registration documentation was reportedly provided at the time of payment.

After enrolling, the client began following the trading calls that were shared.

According to his account, these trades were presented with strong confidence and implied profit certainty.

Over time, the trades resulted in substantial losses amounting to approximately ₹3,10,000.

When the losses accumulated, communication reportedly became inconsistent.

The client stated that responses slowed down, refund requests were not addressed, and no structured resolution was offered.

From a regulatory perspective, two key concerns were raised:

- SEBI regulations strictly prohibit any form of assured or guaranteed return representation.

- Proper disclosure, invoicing, and registration transparency are mandatory for registered Research Analysts.

The client believed the situation involved misrepresentation and unauthorized conduct under the Research Analyst framework, which led him to formally register a complaint.

This was one of the cases that contributed to the arbitration proceedings.

Case 2: Cross-Selling of His Own Products

In addition to the client complaint, we also decided to independently evaluate the advisory ecosystem.

To get a clear and unbiased understanding of how the services function, our team enrolled as regular subscribers rather than relying solely on public reviews.

On 29th August 2024, we purchased a membership through the TWL app for ₹7,200 (including GST).

From that point onward, our goal was not to test profitability or execute trades. We intentionally avoided placing any trades. Instead, we focused purely on observation, documentation, and structural analysis.

Based on our direct experience and settlement documents, the TWL platform offered:

- Daily trading calls: Live sessions for Nifty and Gold, including entry points, stop-loss levels, and trade management guidance.

- Locked Trades concept: Subscribers could pay for access to specific trade setups with predefined lot sizes and risk levels.

- Student performance posting: Users were encouraged to upload profit screenshots, which were acknowledged within the community.

- WhatsApp updates: Daily summaries and trading updates circulated through community groups reportedly managed by interns.

At first glance, the system appeared organized and professionally structured.

However, as our observation period continued, we began noticing certain structural concerns, particularly around how subscription tiers were positioned, how premium access was marketed, and how trading results were presented within the ecosystem.

The cross-selling of various internal products, bundled packages, and platform-specific incentives raised regulatory questions regarding transparency and disclosure practices under the Research Analyst Regulations.

While structured advisory services are permitted, compliance depends heavily on how products are marketed, disclosed, and executed in practice.

Following a client complaint and supported by our documentation, we decided to initiate arbitration so the concerns could be formally examined through the appropriate dispute resolution mechanism.

Love Sharma Arbitration Case

One of the clients registered a complaint against Love Sharma with us.

The concerns were supported by payment records, communication screenshots, and promotional material shared during the subscription period.

After reviewing the details and cross-checking them with our own observations, we decided to move forward with arbitration on the client’s behalf.

The objective was simple: to have the issues examined through a proper and recognized dispute resolution framework rather than relying on informal allegations.

As the arbitration progressed and documents were reviewed, several compliance-related concerns were recorded.

1. Assured Returns Advertising

According to the settlement documents presented during arbitration, certain promotional materials associated with the TWL platform referenced assured or fixed-style returns.

Under SEBI regulations, no individual, including a SEBI-registered Research Analyst, is permitted to guarantee profits in trading.

Market returns are inherently uncertain, and any assurance-based language can conflict with regulatory standards.

2. Absence of Standard Risk Disclaimers

SEBI requires registered analysts to clearly display prescribed risk disclaimers in advertisements and promotional communication.

During the review, it was observed that some promotional materials did not prominently include the standard market risk disclaimer in the format mandated by regulation.

3. Incorrect license display

The TWL app reportedly displayed an incorrect SEBI registration number.

During the arbitration proceedings, this was acknowledged as a one-digit error.

While presented as an unintentional mistake, accuracy in regulatory identification is considered a serious compliance requirement.

4. Conflict of interest with Dhan

Settlement records indicated that Love Sharma was associated with Dhan (Moneylicious Securities) as an authorized person and earned commission from client referrals.

SEBI regulations require clear disclosure of financial interests or commissions when promoting brokerage platforms.

The issue raised during arbitration was whether such disclosures were adequately communicated to subscribers.

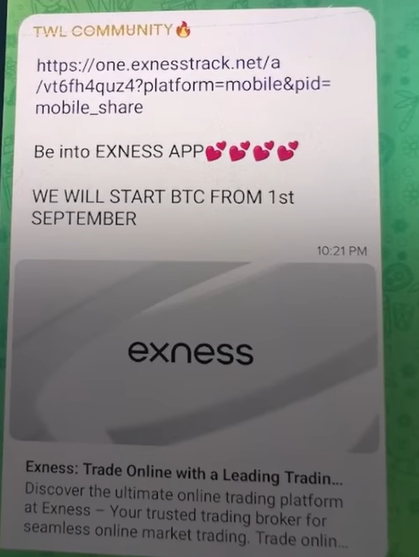

5. Exness promotion

The case documentation also referenced promotion of the Exness trading platform.

It is relevant to note that the Reserve Bank of India (RBI) has issued cautionary communications regarding certain offshore forex platforms for Indian residents.

Promotion of such platforms, particularly to retail traders, may invite regulatory scrutiny.

6. Section 24.1 violation

Using the TWL app to sell subscription plans allegedly breached the SEBI RA Regulations Act 2014.

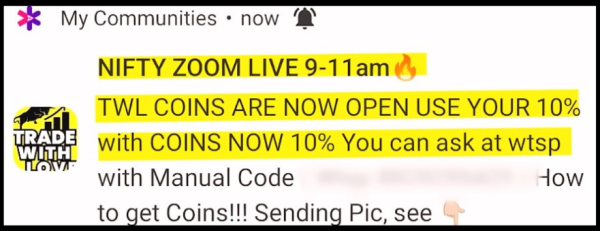

7. TWL Coins System

The platform introduced a virtual internal credit mechanism referred to as “TWL Coins.”

SEBI regulations emphasize transparent and clearly defined fee structures. The use of a virtual credit system raised questions regarding pricing clarity and regulatory transparency.

8. Past performance displays

The platform allowed users to share profit screenshots and highlighted successful trades.

While sharing performance examples is not prohibited, presenting selective results without balanced representation can create unrealistic expectations for new subscribers.

Regulatory standards require fair and non-misleading communication.

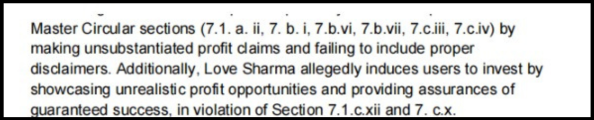

9. Multiple Master Circular violations

The complaint documented breaches of sections 7.1.a.ii, 7.b.i, 7.b.vi, 7.b.vii, 7.c.iii, 7.c.iv, 7.1.c.xii, and 7.c.x.

We collected evidence through screenshots, audio recordings, and video documentation.

Key Outcomes

According to the settlement agreement, Love Sharma admitted his faults. He acknowledged the violations we documented.

His commitments: Follow SEBI guidelines going forward

The matter was resolved amicably. Love Sharma agreed to correct his practices.

However, one question remains: Will these changes actually happen?

And the answer is no.

The same practices are still going on through his new Instagram and Telegram groups. Sounds concerning enough.

Be aware.

What Can Investors Do in Such Situations?

If you ever find yourself in a similar situation with any trading advisor, not just Love Sharma, the first step is to stay calm and act methodically.

Emotional decisions often make matters worse.

Start by documenting everything. Save payment receipts, subscription confirmations, WhatsApp chats, Telegram messages, promotional screenshots, and any promises or claims made before enrollment.

These records become crucial if the matter needs to be escalated.

Next, try resolving the issue directly with the advisor or their support team. In many cases, written communication itself creates accountability.

If concerns remain unresolved, investors in India have formal channels available.

SEBI has established structured mechanisms for grievance redressal and dispute resolution, including online complaint systems and arbitration frameworks.

The key is not to ignore the issue or assume nothing can be done. Regulatory systems exist to protect investors, but they only work when individuals choose to use them.

How to File a Complaint Against RIA?

Facing issues with how to complain in SEBI about any trading advisor?

Here’s where to report:

- Central complaint redressal system

- Track complaint status online

- 30-day resolution timeline

Lodge a complaint in SEBI Smart ODR

- Online Dispute Resolution

- Faster alternative resolution

- For eligible cases

Before reporting:

- Document all communications

- Save payment receipts

- Screenshot promises made

- Note specific violations

Need Help?

Facing problems with Love Sharma or any other trading advisor?

Our team specializes in resolving investor grievances.

We provide:

- Complaint documentation assistance

- SEBI SCORES filing support

- Escalation guidance

- Legal consultation referrals

- End-to-end complaint tracking

- Arbitration Help

Don’t suffer in silence. Every complaint strengthens regulatory oversight. Your experience matters for protecting future investors.

Register with us today if you’re facing trading advisory issues. We’ll guide you through the complete resolution process.

Conclusion

Love Sharma’s TWL Community presents a mixed picture. The SEBI registration is legitimate. Some users report positive experiences.

However, serious concerns exist. Promoting unauthorized foreign exchange platforms violates regulations. Alleged guaranteed return promises break SEBI rules.

Platform-shifting after complaints suggests awareness of violations.

For Indian traders, the message is clear: Registration isn’t enough. Verify practices. Question promises. Protect your capital.

Stay informed. Stay cautious. And always prioritize regulatory compliance over profit promises.

Your financial security depends on it.