Imagine you’re scrolling through Telegram. A festive post pops up, bells ringing, colors bright. “Christmas Gift: BUY TRENT.” Target: ₹5,500. Looks legit, right?

But what if the person behind it was operating without valid credentials for nearly 3 years?

What if there were no research backing those recommendations?

That’s exactly what happened with Manas Jaiswal. And SEBI just handed him a ₹5 lakh penalty to prove it.

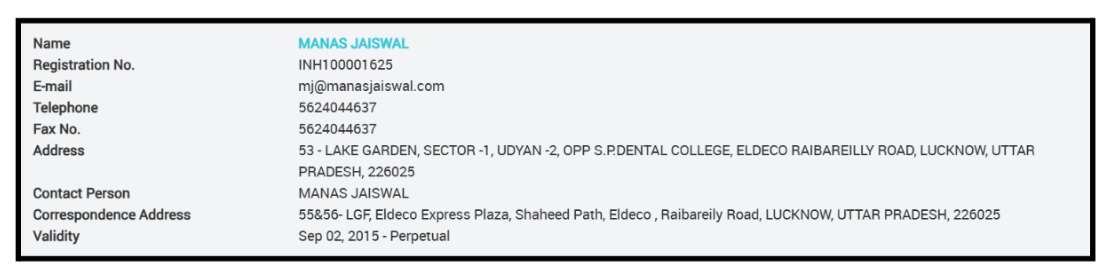

Who is Manas Jaiswal?

Manas Jaiswal is a research analyst from Lucknow with over 14 years of experience in the Indian capital markets.

His Background:

- Worked with well-known broking houses

- Regular guest on CNBC Awaaz, ET Now, Bloomberg UTV, Zee Business, NDTV Profit

- Contributed to Economic Times

- Built presence across YouTube, Twitter, Instagram, and Telegram

He positioned himself as a pure technical analyst providing “trading calls” based on technical indicators.

But behind the curtains, there was a totally different story. Let’s uncover the truth behind his services one by one.

Is Manas Jaiswal SEBI Registered?

Yes, Manas Jaiswal IS currently registered with SEBI.

SEBI Registration Number: INH100001625

Status: Active (as displayed on his website)

However, here’s the critical timeline:

The Problem Period:

- NISM Certificate expired: December 21, 2019

- Operated WITHOUT a valid certificate until December 28, 2022 (3 years!)

- Registration expired: September 9, 2020

- Renewal fee paid (late): October 18, 2022 (2-year delay!).

Now, as per SEBI guidelines, during these gaps, he should not have legally provided SEBI-regulated investment advisory services.

However, this does not automatically mean fraud, but it does mean reduced regulatory protection for clients during that time.

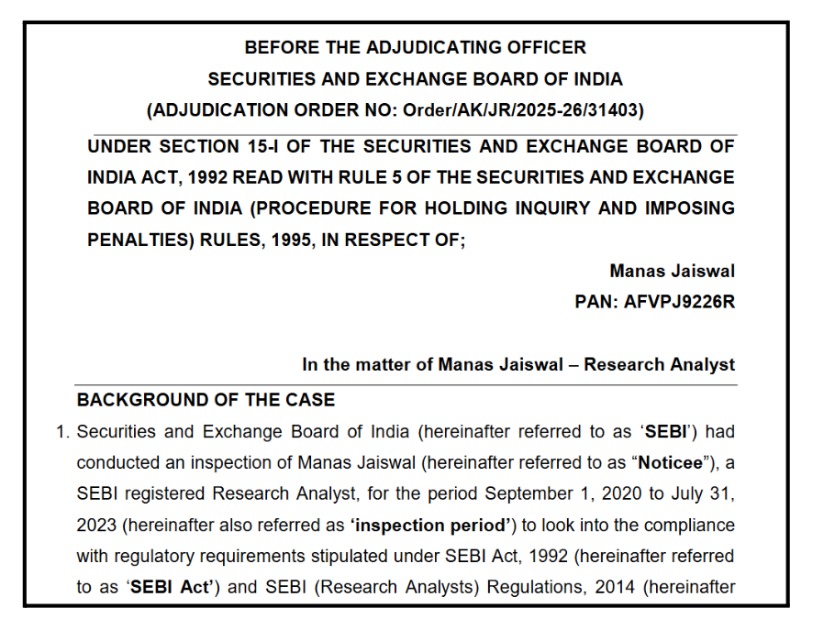

Major Regulatory Actions on Manas Jaiswal

Regulatory actions by SEBI are not issued casually; they typically follow reviews of compliance with mandatory requirements such as valid registration, certification, disclosures, and adherence to prescribed conduct standards.

For market participants and readers, understanding why a regulatory order was issued is just as important as understanding what the order states.

In the case of Manas Jaiswal, while he is currently shown as registered with SEBI, a closer look at historical records reveals significant lapses in mandatory compliance over an extended period.

These lapses relate to the validity of NISM certification and continuity of SEBI registration, both of which are legal prerequisites for offering SEBI-regulated investment advisory services.

The regulatory action discussed below must therefore be read in the context of:

- Time-bound regulatory requirements, not just the present-day status

- Whether advisory activities were carried out during periods of expiry

- Investor protection implications during those non-compliant periods

The following section outlines the SEBI order, the period it relates to, and the specific regulatory concerns identified.

₹5 Lakh SEBI Order Due to Multiple Compliance Failures

SEBI conducted an inspection of Manas Jaiswal’s operations covering the period from September 1, 2020, to July 31, 2023.

The investigation uncovered serious violations of regulatory requirements that research analysts must follow to protect investors.

The Key Violations

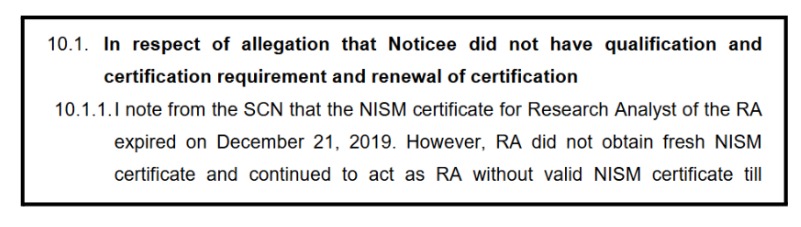

1. Operating Without Valid Certification

His NISM Research Analyst certificate expired on December 21, 2019.

- He continued working as a research analyst without a valid certificate until December 28, 2022, nearly 3 years

- His registration itself expired on September 9, 2020, but renewal fees were only paid on October 18, 2022, a 2-year delay

Despite expired credentials, he kept providing recommendations to clients throughout this period.

His Defense: Claimed ignorance and said he thought registration became permanent after regulatory amendments.

Why This Matters: This is like a doctor practicing medicine with an expired medical license. Certifications exist to ensure analysts maintain current knowledge and competency standards.

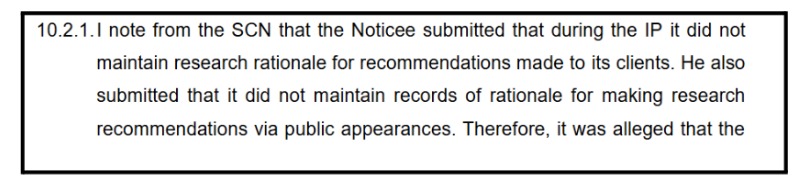

2. No Research Backing for Recommendations

Admitted, he maintained no research rationale or documentary basis for stock recommendations.

Could not justify why he recommended buying or selling specific stocks. No records of analysis or reasoning behind his calls.

His Defense: Claimed his recommendations were only for “trading,” not “investment,” so research backing wasn’t needed.

Why This Matters: Without proper research and documentation, recommendations become mere speculation.

Investors deserve to know the reasoning behind advice that affects their money. Whether called “trading” or “investment,” all stock recommendations should be backed by solid analysis.

3. Missing Critical Disclosures

Active on YouTube (@manasjaiswalTA), Twitter, Instagram, Telegram, and TV (CNBC Awaaz).

While he mentioned his registration status, he never disclosed his financial interests in companies he recommended.

Failed to inform viewers/followers whether he owned shares in stocks he was promoting.

His Defense: Said he had no financial interest in those companies, so he thought disclosure wasn’t necessary. Claimed TV channels made disclosures on his behalf.

Why This Matters: Investors have a right to know if an analyst personally benefits from the stocks they’re recommending. Even stating “no financial interest” is a required disclosure.

This prevents scenarios where analysts pump stocks they own and profit at followers’ expense.

4. Vague and Misleading Terms

The website advertised a “risk & reward ratio of 1:2” without explaining what this actually meant. Clients could interpret this ambiguous term in multiple ways.

His Defense: Said the term is self-explanatory, potential profit is double the potential loss.

Why This Matters: Financial jargon without clear definitions can mislead retail investors into taking risks they don’t fully understand. Clear communication is essential in investment advice.

SEBI’s Decision

Adjudicating Officer: Amit Kapoor ruled that Manas Jaiswal violated multiple provisions of SEBI regulations.

Penalty Imposed: ₹5,00,000 (Five Lakh Rupees)

Payment Terms:

- Must pay within 45 days

- Failure to pay will result in recovery proceedings, including property attachment and sale

Why Is It Important For Investors?

- Certification Matters: Professional credentials aren’t just paperwork; they ensure competence and accountability.

- Research is Non-Negotiable: All investment recommendations must be backed by documented analysis, whether for “trading” or “investing.”

- Disclosure is Mandatory: Transparency about conflicts of interest protects investors from biased advice.

- Records Create Accountability: Proper documentation isn’t bureaucracy, it’s investor protection.

- Ignorance is No Excuse: Registered professionals are responsible for knowing and following regulations.

Manas Jaiswal Social Handles

These screenshots from his Telegram channel and other handles provide concrete proof of exactly what SEBI caught him doing wrong.

Let us connect the dots:

What do These Images Show?

- TV appearances on CNBC Awaaz

IOC stock: BUY recommendation with Stop Loss (SL) at 166, Target (TGT) at 175

REC stock: HOLD recommendation with SL at 335, TGT at 380

WhatsApp contact number prominently displayed: 7045220000

- Telegram post

TRENT stock: Christmas-themed “gift” recommendation to BUY

How does this connect to SEBI’s Charges?

1. The Missing Disclosures Problem

What SEBI Found: He never disclosed financial interests in companies he recommended on social media and TV.

What We See Here:

- These posts show specific stock recommendations (IOC, REC, TRENT)

- No disclosure anywhere about:

- Whether he owns these stocks

- Any financial interest in these companies

2. The “Trading vs Investment” Excuse Exposed

His Defense to SEBI: “I only gave trading recommendations, not investment advice, so research wasn’t needed.”

What We See Here:

- IOC: Target 175, Current around 166 = ~5% gain

- TRENT: Target 5500, SL 3500 = 57% potential gain

Reality Check: The TRENT recommendation especially suggests a long-term investment position, not a quick trade.

His own posts contradict his defense that he only provided short-term trading calls.

3. The Marketing Approach

Using terms like:

- “Christmas GIFT”

- Decorative bells, celebratory framing

This can be interpreted as inducement or promotional assurance, even without explicit guarantees.

SEBI Position: Research Analysts must not present recommendations as gifts, rewards, or incentives. Advice must be neutral, professional, and non-promissory.

What Can You Do In Such Cases?

If you’re a client or investor who faced issues with Manas Jaiswal or similar research analysts providing questionable recommendations without proper compliance, you are not alone.

Our dedicated team specializes in supporting investors in situations exactly like these.

We provide end-to-end guidance to ensure your grievance is clearly documented and effectively escalated to the right authorities.

Our Step-by-Step Support Process:

1. Initial Consultation & Case Assessment

We arrange a confidential discussion with a dedicated Case Manager to understand your specific situation.

2. Professional Case Documentation & Drafting

We help you prepare a structured, persuasive, and legally sound complaint that outlines:

- The specific misconduct you experienced

- Any financial losses you incurred

- Specific SEBI rule violations, such as:

- Operating without a valid certification

- No research backing for recommendations

- Missing financial interest disclosures

- Vague or misleading terminology

- Poor record-keeping practices

3. Direct Engagement & Escalation

- Reaching out to the Research Analyst: We guide you in formally communicating your complaint to the analyst, which is often a required first step before approaching SEBI.

- Filing on SEBI SCORES: We assist you in filing a complaint on the SEBI SCORES portal and help you track its status and respond to any SEBI queries.

- Exploring SEBI Smart ODR: If your case is eligible, we can guide you through the SEBI Online Dispute Resolution platform for potentially faster resolution.

4. Arbitration & Further Legal Options

If responses from the analyst or initial SEBI actions are unsatisfactory, we help you explore further options, including:

- Arbitration in Stock Market: If your service agreement includes an arbitration clause, we can connect you with legal experts specializing in securities arbitration.

- Legal Action: We can refer you to lawyers experienced in securities law and investor protection cases.

Your Money Matters. Your Complaint Matters.

Don’t let non-compliance go unreported. Every complaint helps SEBI take stronger action. Every voice matters in cleaning up India’s financial advisory space.

Take the First Step Today.

Register with us today, and let our experienced team guide you toward a fair resolution.

Conclusion

The ₹5 lakh SEBI penalty against Manas Jaiswal isn’t just about one analyst; it’s a wake-up call for all investors.

Professional certifications aren’t bureaucratic paperwork. They ensure competence and accountability. Manas operated for 3 years without valid credentials while reaching thousands daily.

Whether called “trading tips” or “investment advice,” all stock recommendations must have documented research backing. “Trust me” isn’t enough.

Financial interest disclosures aren’t optional details; they’re your right. Without them, you can’t assess if advice is biased.

Festive graphics, professional TV appearances, and large followings don’t guarantee compliance or quality. Always verify registration and check for disclosures.

While Manas Jaiswal now holds a valid registration and has paid his penalty, the case exposes how easily retail investors can be influenced by attractive packaging without substance.

His defense that recommendations were “just for trading” shows a fundamental misunderstanding, or deliberate evasion, of why regulations exist to protect investors.