Real money apps are becoming popular side hustles for quick income. They usually promise easy rewards through simple online tasks. MoneyHi Duo is one such app that appears convenient and beginner-friendly.

Sounds easy enough, right?

However, trusting any money app without reading its terms can be risky. Hidden clauses can affect withdrawals, data privacy, and even access.

A little research often helps users avoid unpleasant surprises. If you’re short on time, these quick insights may help you decide better.

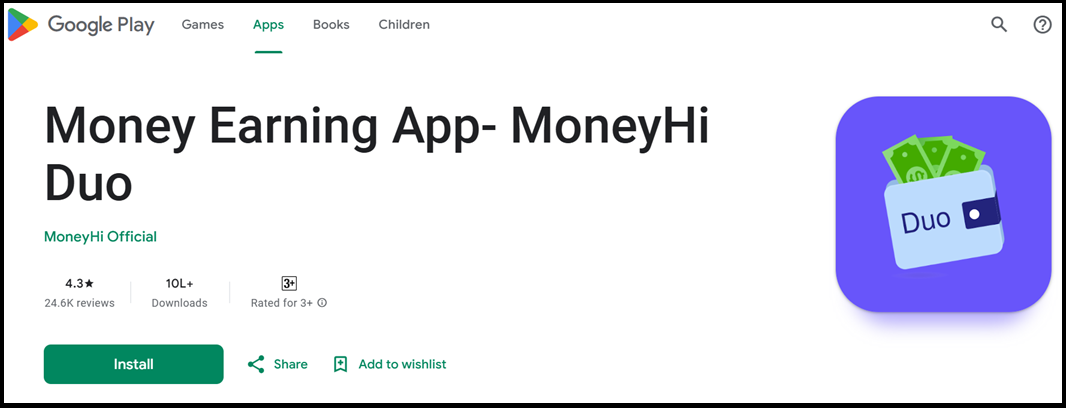

What is MoneyHi Duo?

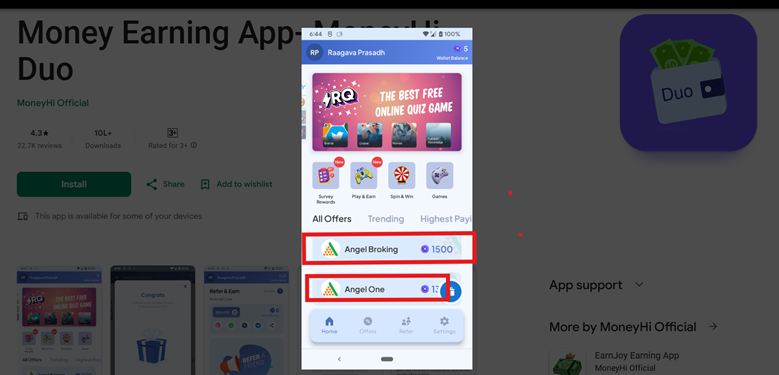

MoneyHi Duo is a real money-earning app available on the Google Play Store. It allows users to earn rewards by completing small tasks within the app.

These tasks may include making purchases, playing games, or trying partner apps. In return, users earn MoneyHi Duo coins for each completed activity.

Wondering how this earning app works?

Well, it makes it look very simple.

For every 10 coins, users receive ₹1 in value.

Simple math, right? But earnings are not permanent.

The app requires users to redeem their coins within 60 days. If not withdrawn within this period, the accumulated coins may expire.

Is MoneyHi Duo Safe?

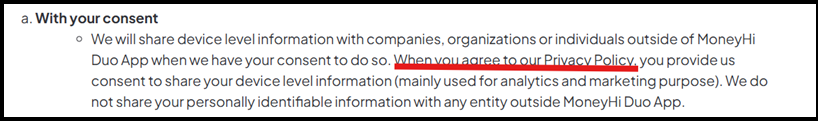

Safety is one of the first concerns users raise with real money apps. MoneyHi Duo also requires users to agree to its terms and privacy policies before using the platform.

And there comes the hidden risk.

Let’s get into the details to check:

How MoneyHi Duo Handles User Data?

Like many reward-based apps, MoneyHi Duo clearly outlines its rules on data usage, payouts, and eligibility. However, most users tend to skip reading these details during registration.

This is where caution becomes important. Certain permissions and clauses may impact how user data is collected or how earnings are processed.

Does that automatically make the app unsafe?

Not necessarily.

But it does mean users should understand what they are agreeing to.

Your experience largely depends on how comfortable you are with the platform’s policies and conditions.

What this means for users:

MoneyHi Duo’s safety depends on informed usage rather than blind trust.

Other than this, the scariest part is that the app will track other key data about your system without notifying you.

As the policy mentioned, they will collect info about device & account, logging, unique application numbers, local storage and cookies.

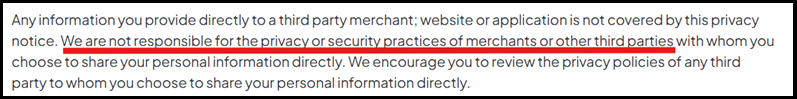

When users accept the privacy policy during registration, they also agree to how their data may be shared. This includes situations where information is provided directly to third-party merchants or partner applications.

In such cases, the responsibility for data handling shifts to those third parties. MoneyHi Duo states that it is not accountable for the privacy or security practices of external platforms.

This is fairly common in reward-based apps. However, it becomes important when tasks require users to interact with or grant access to other apps.

So what does this mean for users?

You should review third-party privacy policies carefully before sharing personal information or permissions.

The company is not liable for any misuse of your crucial information by third parties, as you are allowing them to do that by accepting the privacy policy.

Why MoneyHi Duo Tasks May Not Suit Everyone?

MoneyHi Duo rewards users for completing different in-app tasks. However, the app provides limited upfront clarity on what all these tasks may include.

Based on available information, tasks can range from simple actions.

These may include downloading apps, visiting platforms regularly, or watching advertisements.

In some cases, tasks may also involve third-party financial platforms. This can include signing up with stockbroking or investment apps.

That’s where some users may feel uncertain.

Financial-related tasks are not suitable for everyone, especially beginners.

MoneyHi Duo Complaints

Obviously, there are many positive reviews about the app on the Play Store.

That can be helpful for you. But understanding the negative reviews will give you a glimpse of what can go wrong.

So, we begin with this one.

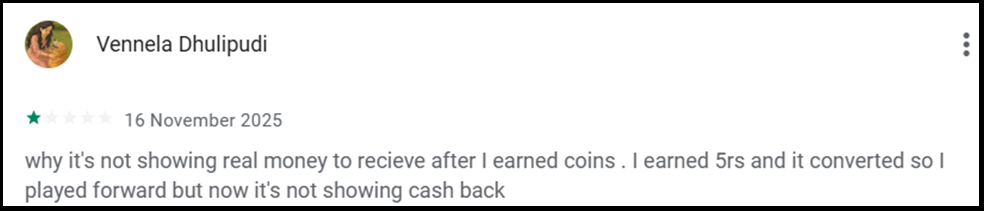

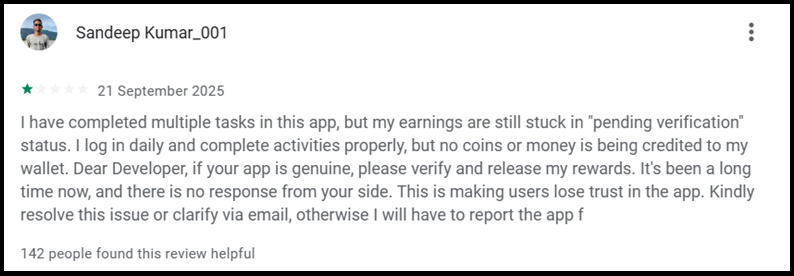

1. MoneyHi Duo Withdrawal Issues

Now, if there is no cashback or withdrawal, then what’s the objective of the app?

Well, most likely to steal data or later to trap you in prepaid tasks where the app most likely asks you to add funds to unlock high return tasks or maybe just to add more funds to withdraw your own funds.

Here is another one

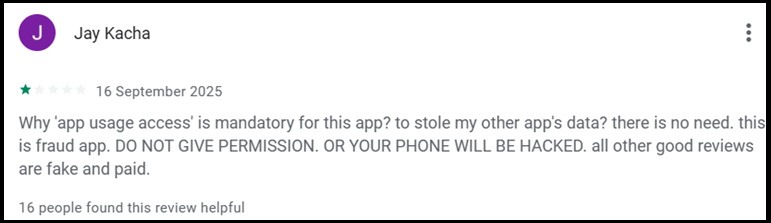

2. Steals Personal Information

The next complaint raised the concern on safety and privacy of information.

The review raises concerns about mandatory app usage access permissions. While such access can be required to verify tasks, it also makes some users uncomfortable.

Claims about hacking appear to be personal opinion, not verified evidence. However, the feedback shows that unclear permission requirements can affect user trust.

What this indicates: Users should understand why access is required before granting permissions.

What to Do if the MoneyHi Duo App Blocks You?

You are not helpless, even if the app prohibits your access. You can claim the invested amount and take legal help. For that, you have to follow the steps below.

- Document all the transactions, call recordings, images, videos and chat transcripts as proofs.

- Contact your bank to inform them about fraud and stop any unauthorised transactions.

- Report to the nearest cybercrime cell to lodge an FIR.

- File a cyber crime complaint at the National Cyber Crime Reporting Portal.

Need Help?

In cases where it becomes difficult to understand the basic legal purview under which the crime falls, register with us, and we will help to

- Analyse the criminal context.

- Do the paperwork.

- File a legal complaint.

- Trace back the fraudster.

- Claim the guaranteed money the victim deserves.

Conclusion

A little caution can go a long way when using real money apps.

Before granting permissions or sharing personal data, it’s worth pausing and reviewing what you’re agreeing to.

If an app’s requirements feel unclear or excessive, stepping back is often the safer choice.

And if you believe you’ve already faced issues or possible misuse, understanding your options becomes important.

Need guidance on what to do next? You can reach out to us to learn about the appropriate steps and available reporting options.