Heard the hype around Moonex?

Here’s a word of caution: treat it as risky until proven otherwise.

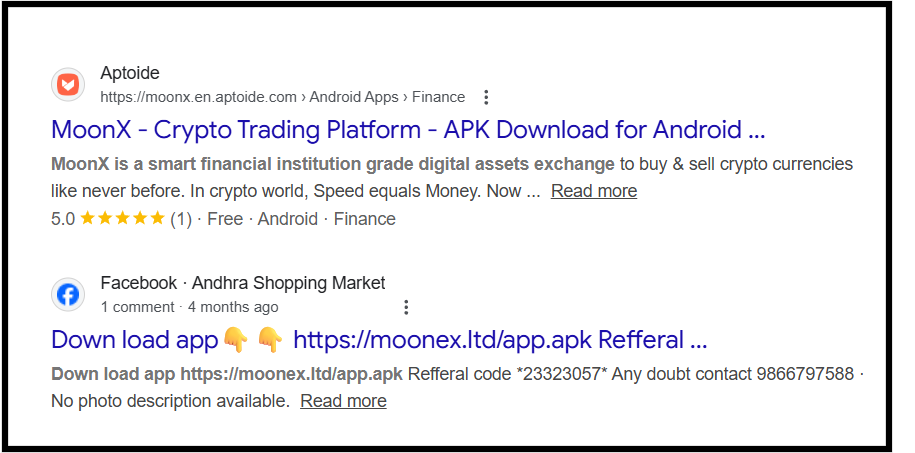

The platform is promoting APK downloads and referral schemes all over social media, but there’s no sign it’s registered with Indian regulators, hence raising concerns, whether Moonex real or fake.

In India, legitimate crypto platforms always display their FIU-IND registration, but Moonex doesn’t.

That means using it could put your money, and even your personal data, at serious risk. Before jumping in, it’s important to know what you’re really dealing with.

Is Moonex Legit?

Moonex bills itself as a “next-gen crypto exchange”, offering spot trading, contract trading, and even a built-in wallet.

Sounds impressive, right?

But before you hit download, let’s slow down and look a little closer.

Here’s the first thing that should make you pause.

Moonex asks users to download it directly from its website (moonex.ltd) as an APK, instead of trusted platforms like Google Play Store or Apple App Store.

Why does this matter?

APK sideloading bypasses app-store security checks.

The file can be tampered with, swapped, or injected with malware. If something goes wrong, you have zero protection or recourse.

In short: convenience for them, risk for you.

Crypto platforms serving Indian users are expected to register with FIU-IND, the country’s anti–money laundering authority. Recently, Indian authorities have cracked down hard on offshore and non-compliant exchanges.

In short, at first glance, the platform looks flashy and futuristic, branding itself as a “next-gen crypto exchange.”

But when you dig a little deeper, the shine quickly fades.

Based on ongoing investigations and multiple financial red flags, Moonex falls into the high-risk category, with strong signs pointing toward a possible scam.

So what’s really going on?

One of the biggest red flags? Hidden ownership.

The official website masks the identity of its founders using privacy protection tools.

In the world of finance and crypto, this is a major no-no. Genuine platforms proudly display their team and credentials; Moonex doesn’t.

Moonex User Reviews

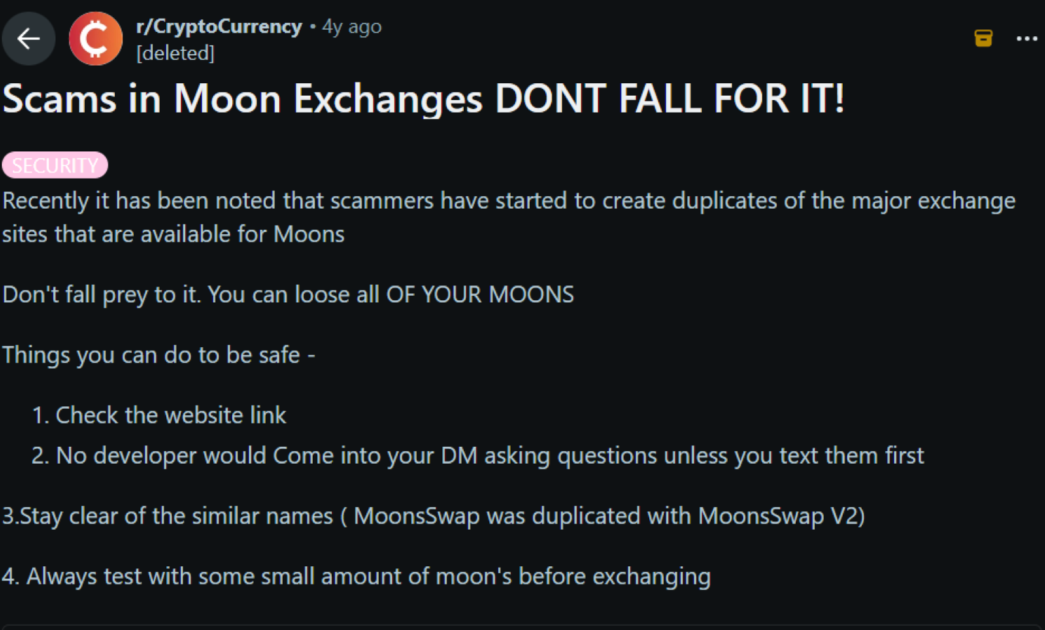

Users repeatedly report a troubling pattern: depositing money is smooth and instant, but when it’s time to withdraw?

Suddenly, there are excuses: “system upgrades,” “security checks,” “temporary maintenance.” Sound familiar?

This so-called withdrawal trap is a classic scam tactic.

Despite its polished interface and bold promises, Moonex exchange lacks essential regulatory approvals, legal transparency, and verifiable credentials, both in India and globally.

In crypto, hype without proof is dangerous.

How to File a Crypto Fraud Complaint in India?

Take these steps immediately:

- Stop and document: Save screenshots of deposits, wallet IDs, emails/chats, and any “fee to withdraw” messages.

- Revoke risk: If you sideloaded the APK, uninstall it. Change exchange, email, and bank passwords immediately.

- Raise a ticket with your bank/UPI to flag suspicious merchant handles.

- Report to Cyber Crime: Early reports help banks freeze mule accounts.

Need Help?

If you’ve already used Moonex and are looking for a way out, register with us to receive guidance on reporting the fraud and starting your recovery.

Thousands of investors have already recovered their funds.

Keep all transaction details and communications ready for a smoother process.

Conclusion

Until Moonex can clearly show a registered Indian legal entity and FIU-IND approval, it should be treated as high-risk.

Using an unverified platform isn’t just about facing potential glitches; it could mean losing your money, exposing sensitive personal information, and falling victim to scams that leave you with no legal recourse.

In the world of crypto, where regulations exist to protect users, skipping verification is a gamble you don’t want to take.

Always prioritize platforms that are transparent, regulated, and accountable; your funds and data depend on it.